Which fintech stock to buy?

Without further ado, the three fintech stocks to buy are:

- Block (NYSE: SQ)

- PayPal (NASDAQ: PYPL)

- SoFi (NASDAQ: SOFI)

Who are the fintech stocks?

What is a fintech stock? A fintech stock is a company that provides technology service in the financial industry, and that is publicly traded on a stock exchange. Fintech stocks can range from payment processing companies like Visa to banking-as-a-service (BaaS) companies like Green Dot.

Which are fintech stocks?

Fintech stocks are typically high-growth companies that are investing heavily in disruptive technologies, and, as a whole, they aren't the safest places to put your money. That said, just as with ...

What are fintech stocks?

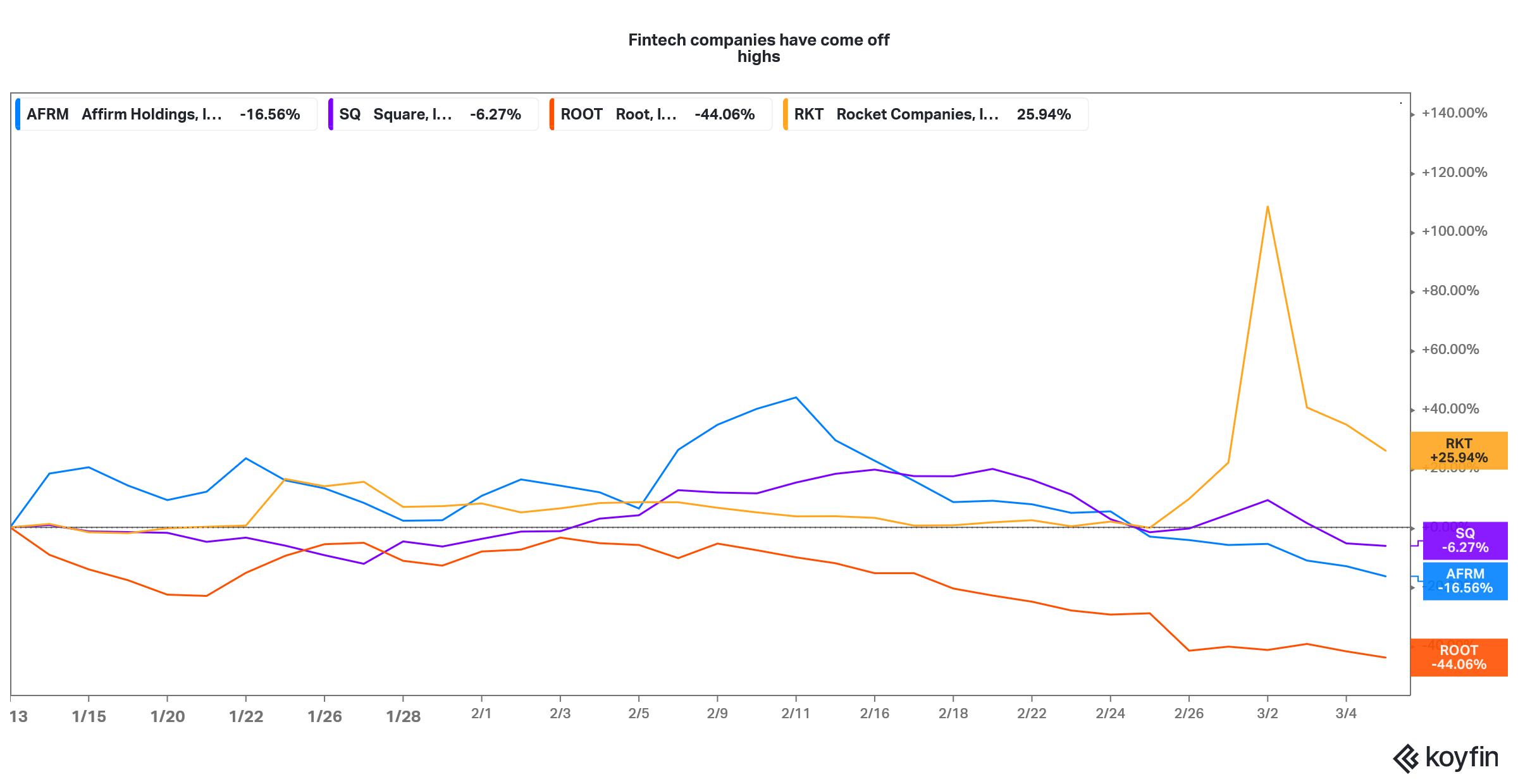

The rate increase becomes increasingly concerning with FinTech companies and buy now pay later stocks such as UPST, AFRM, and SQ. While the loans these companies issue carry higher interest rates, one may think that this is good for investors – higher interest rates equal more cash for the company.

Is future Fintech a good stock to buy?

Future Fintech Group Inc (NASDAQ:FTFT) The 1 analysts offering 12-month price forecasts for Future Fintech Group Inc have a median target of 14.30, with a high estimate of 14.30 and a low estimate of 14.30. The median estimate represents a +3,258.38% increase from the last price of 0.43.

Is future Fintech a real company?

Future FinTech Group General Information Future FinTech Group Inc is engaged in the financial technology business. The company engages in the operation of a blockchain-based online shared shopping mall platform and also operates an incubator for application projects using blockchain technology.

What Sector is FTFT?

TechnologyCommon Stock (FTFT) Stock Price, Quote, News & History | Nasdaq....Key Data.LabelValueSectorTechnologyIndustryEDP Services1 Year TargetN/AToday's High/Low$0.43/$0.4015 more rows

What is Fintech group?

What is a Fintech Company? A Fintech company is the one that integrates technologies (such as AI, blockchain, and data science) with conventional financial domains in order to make them protected, swift and more efficient.

What does future Fintech group do?

Future FinTech Group Inc. is a holding company. The Company is engaged in providing blockchain based e-commerce platform, supply chain financing services and trading business and financial technology business.

What is Fintech stock symbol?

FTFTFTFT Stock Price | Future FinTech Group Inc. Stock Quote (U.S.: Nasdaq) | MarketWatch.

Is Bitcoin a Fintech?

Fintech now includes different sectors and industries such as education, retail banking, fundraising and nonprofit, and investment management, to name a few. Fintech also includes the development and use of cryptocurrencies, such as Bitcoin.

Is FTFT a buy or sell?

This name already in use....Barchart Opinion.Composite IndicatorTrendSpotterSell20 - Day Average Volume: 291,150Average: 50% SellMedium Term Indicators50 Day Moving AverageSell15 more rows

What makes a company fintech?

The term “fintech company” describes any business that uses technology to modify, enhance, or automate financial services for businesses or consumers.

Is fintech the future of banking?

Fintech Report 2019 As Fintech has transformed the banking business by providing smart services, better customer connectivity, and value-added services; Fintech is ruling the world and financial sector and it is important to adopt the technologies which are transforming the financial sector.

How does fintech make money?

The most common and simple way to generate revenue from Fintech apps is by displaying commercials in the app. The app owners get paid by the third-party ad networks for running their advertisements. You can also earn bucks for each time users clicked.

Why every company is a fintech company?

Customer retention, easy payments, and innovative products and services. In the financial sector, this role was played by fintechs, technology startups linked to the financial sector.

What are fintech companies?

Fintech companies are companies that use technology in the financial services industry. Large payment processing companies including Mastercard are...

What is a fintech stock?

A fintech stock is a company that provides technology service in the financial industry, and that is publicly traded on a stock exchange. Fintech s...

What are the best fintech stocks?

There are many publicly traded companies benefiting from the fast-growing fintech market. Some of the best-performing fintech stocks have been Squa...

What is fintech stock?

What is fintech company?

A fintech stock is a company that provides technology service in the financial industry, and that is publicly traded on a stock exchange. Fintech stocks can range from payment processing companies like Visa to banking-as-a-service (BaaS) companies like Green Dot.

What is Global X FinTech ETF?

Fintech companies are companies that use technology in the financial services industry. Large payment processing companies including Mastercard are considered fintech companies, and so are cryptocurrency exchanges like Coinbase. Traditional fintech companies, like PayPal Holdings and Square, may offer peer-to-peer ...

How much did PayPal invest in MercadoLibre?

The Global X FinTech ETF (NASDAQ: FINX) is invested in 39 fintech companies comprising insurance, mobile payments, investing, fundraising, and lending. Over the past five years, the ETF has gained more than 200%, compared to about 120% for the S&P 500.

Is the fintech market going to triple?

MercadoLibre got a vote of confidence in 2019 when PayPal invested $750 million in the company. With the fintech company’s stock up nearly 200% in 2020, it’s clear that investors view MercadoLibre as a rising star in this industry as well.

What is Future FinTech?

The fintech market is expected to nearly triple in size over the next 10 years and it’s creating a massive opportunity for publicly traded companies and investors alike. That’s why we’re highlighting 10 of the best fintech companies that should be on your investment radar.

What is the technology sector?

(NASDAQ: FTFT) ("hereinafter referred to as "Future FinTech", "FTFT" or "the Company"), a leading blockchain-based e-commerce business and a fintech service provider , announced today that on April 13, 2021, the Company signed a preliminary term sheet (the "Term Sheet") to acquire 100% of the equity ...

What is FTFT in 2021?

The technology sector consists of businesses that develop, build, and market consumer electronics, electronic components, and software. Companies in the tech sector may also provide information technology (IT) services such as cloud computing. While the best-known companies are giants like Apple Inc. (AAPL) and Microsoft Inc. (MSFT), there also are tech businesses that are classified as penny stocks.

What makes PayPal stand out from other fintech companies?

(NASDAQ: FTFT) ("hereinafter referred to as Future FinTech", "FTFT" or "the Company"), a leading blockchain-based e-commerce business and a fintech service provider, announced today that on August 6, 2021, the Company closed its acquisition of 90% of the issued and outstanding shares of Nice Talent Asset Management Limited ("NTAM"), a Hong Kong-based asset management company, from Joy Rich Enterprises Limited ("Joy Rich").

Where is Futu based?

One of the things that makes PayPal stand out from other fintech companies is their portfolio of acquisitions. Over the years, they have acquired more than 20 relevant companies that offer financial services. Most notably, PayPal acquired Venmo in 2013.

What is green dot stock?

Futu Holdings is an online brokerage based in Hong Kong, with operations in China and the United States.

Where is Fiserv located?

Green Dot is a fintech stock with a long history.

Is the stock dork reader supported?

The company is based in Brookfield, Wisconsin and has been in business since 1984. Many of Fiserv’s products have become business essentials over the years, especially for both digital and brick-and-mortar retailers. One of their most popular products is their Clover bundle for small businesses.

Is Fiserv stock going up in 2021?

The Stock Dork is reader supported. We may earn a commission, at no additional cost to you if you buy products or signup for services through links on our site.

HCR Wealth Advisors Buys NVIDIA Corp, Vanguard Information Technology ETF, Palo Alto Networks ..

While they struggled in 2020 due to lower transaction volume, their earnings will likely pick back up again moving into 2021. Prior to the pandemic, they had several years in a row of strong financial results. While Fiserv stock has been up and down over the past year, it will likely improve as the economy rebounds.

Hills Bank & Trust Co Buys Vanguard FTSE Developed Markets ETF, WillScot Mobile Mini ..

Investment company HCR Wealth Advisors (Current Portfolio) buys NVIDIA Corp, Vanguard Information Technology ETF, Palo Alto Networks Inc, PayPal Holdings Inc, ETFMG Prime Cyber Security ETF, sells The Energy Select Sector SPDR Fund, Vanguard Health Care ETF, Bausch Health Inc, , Rio Tinto PLC during the 3-months ended 2021Q4, according to the most recent filings of the investment company, HCR Wealth Advisors..

Evolution Wealth Advisors, LLC Buys Blink Charging Co, Robinhood Markets Inc, iShares ..

North Liberty, IA, based Investment company Hills Bank & Trust Co (Current Portfolio) buys Vanguard FTSE Developed Markets ETF, WillScot Mobile Mini Holdings Corp, SPDR Dow Jones Global Real Estate ETF, General Electric Co, Vanguard S&P 500 ETF, sells Automatic Data Processing Inc, Activision Blizzard Inc, Aon PLC, iShares Core S&P Mid-Cap ETF, Starbucks Corp during the 3-months ended 2021Q4, according to the most recent filings of the investment company, Hills Bank & Trust Co..

What is Ark Fintech Innovation ETF?

Investment company Evolution Wealth Advisors, LLC (Current Portfolio) buys Blink Charging Co, Robinhood Markets Inc, iShares Commodities Select Strategy ETF, BTC iShares MSCI China A ETF, Direxion Moonshot Innovators ETF, sells Invesco Optimum Yield Diversified Commodity, ARK Innovation ETF, iShares MSCI China ETF, Enovix Corp, iShares MSCI All Country Asia ex Japan Index Fund during the 3-months ended 2021Q4, according to the most recent filings of the investment company, Evolution Wealth Advis.

What is the first trust indxx?

Our first choice is an exchange-traded fund (ETF). The ARK Fintech Innovation ETF is an actively managed fund run by Cathie Wood’s Ark Invest. It invests in businesses that focus on the fintech sector.

How many holdings does ArkF have?

The First Trust Indxx Innovative Transaction & Process ETF provides exposure to companies that are either actively using, investing in, developing or have products that could benefit from blockchain technology.

Is JPMorgan Chase stock up in 2021?

ARKF, which typically invests in 35-55 companies, currently has 43 holdings. The fund began trading in February 2019. The leading ten names account for more than 47% of net assets of $4 billion.

Is JPMorgan Chase's balance sheet strong?

So far in 2021, JPM stock is up a bit over 20%. Forward price-to-earnings (P/E), price-to-sales (P/S) and price-to-book (P/B) ratios are 10.77, 3.67 and 1.75, respectively. The bank is a large-cap, high-quality dividend name that is also at the forefront of innovation. Thus JPMorgan Chase is likely to create significant shareholder value well into the future. A potential decline toward the $145 level would improve the margin of safety for long-term investors.

Is JPMorgan Chase an ETF?

CEO Jamie Dimon stated, “JPMorgan Chase delivered solid performance across our businesses… Consumer and wholesale balance sheets remain exceptionally strong as the economic outlook continues to improve. In particular, net charge-offs, down 53%, were better than expected, reflecting the increasingly healthy condition of our customers and clients.”

Is fintech a market?

Our first non-ETF stock, JPMorgan Chase, is one of the leading banking and asset management firms worldwide. Its business segments that contribute to revenue and profits include Consumer & Community Banking, Corporate & Investment Bank (CIB), Commercial Banking and Asset Management. In other words, this well-managed, diversified bank operates in all major banking areas.

What is SOFI technology?

Fintech stocks represent an enormous market. “Financial markets in the United States are the largest and most liquid in the world. In 2018, finance and insurance represented 7.4 percent (or $1.5 trillion) of U.S. gross domestic product.” In this high-growth sector, fintech is gaining traction as “the US fintech market’s transactional value’s CAGR is 8.6% over the forecast period of 2019-2024.”

What is SOFI platform?

SoFi Technologies is an emerging consumer and business-facing fintech disruptor. The company aims to be the first complete one-stop-shop for all things finance through its app. On the SoFi platform, it helps you “ save, spend, earn, borrow, invest, and protect ” your money all in one app. Considering most consumers use more than one financial institution to do all these, it’s becoming apparent to many that how SoFi could be a lucrative investment should the execution be done correctly.

Is Square a good stock?

On the SoFi platform, it helps you “ save, spend, earn, borrow, invest, and protect ” your money all in one app. Considering most consumers use more than one financial institution to do all these, it’s becoming apparent to many that how SoFi could be a lucrative investment should the execution be done correctly.

Is fintech a stock?

Square is no doubt one of the best fintech stocks in the stock market today. It is a company that builds tools to empower businesses and individuals all across the globe. It does so via a combination of software and hardware that turn mobile and computing devices into powerful payment and point-of-sale solutions. Moreover, Square’s analytical tools empower sellers to make more informed business decisions overall. Namely, sellers can manage several aspects of their respective businesses through Square. This includes but is not limited to inventory, locations and employees, customer engagement, and sales growth.

What is market cap?

Fintech stocks are growing in popularity in the stock market today. This should not come as a surprise as we are shifting towards a cashless society. Some fintech services allow customers more convenient banking and financial services. Other fintech tools simply allow banks and other traditional financial institutions to streamline their overall operations.

Does market cap include convertible securities?

Market Cap (Capitalization) is a measure of the estimated value of the common equity securities of the company or their equivalent. It does not include securities convertible into the common equity securities. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable). NASDAQ does not use this value to determine compliance with the listing requirements.