What are analysts' forecasts for exlservice's (ExLS) stock?

Their forecasts range from $92.00 to $134.00. On average, they anticipate ExlService's stock price to reach $109.33 in the next twelve months. This suggests that the stock has a possible downside of 10.3%.

Where can I buy exlservice shares?

Shares of EXLS can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here. What is ExlService's stock price today?

Should you hold exlservice (ExLS) stock?

The consensus among Wall Street research analysts is that investors should "hold" ExlService stock. A hold rating indicates that analysts believe investors should maintain any existing positions they have in EXLS, but not buy additional shares or sell existing shares. View analyst ratings for ExlService or view top-rated stocks.

Who is exlservice holdings?

Click here for more on how to use these ratings. ExlService Holdings Inc. is a business process management company that provides operations management and analytical services to clients.

Is EXL a publicly traded company?

In August 2001, Conseco acquired EXL and operated it as a wholly owned subsidiary....EXL Service.TypePublicTraded asNasdaq: EXLS S&P 600 componentFoundedApril 1999FounderVikram Talwar Rohit KapoorHeadquarters320 Park Avenue, New York , United States6 more rows

Is Exls a buy?

Consensus Rating. ExlService has received a consensus rating of Hold. The company's average rating score is 2.40, and is based on 2 buy ratings, 3 hold ratings, and no sell ratings.

What is EXL healthcare?

EXL Health combines deep domain expertise with analytic insights and technology-enabled services to transform how care is delivered, managed, and paid. Leveraging Human Ingenuity, we collaborate with our clients to solve complex problems and enhance their performance with nimble, scalable solutions.

How is EXL as a company?

Exl is good company to start up or experienced both. Culture is also good. Only freshers salary is not good about 10 to 12k but if you are experienced so they offer good depends on your experience also it's mnc or not.

What is the full form of EXL?

EXLAcronymDefinitionEXLExtended LearningEXLEthernet AcceleratorEXLExtradition Limitation (NCIC form datum)EXLExpiration Notice (insurance)2 more rows

What kind of company is EXL Service?

EXL Service, also known as EXL Services (NASDAQ: EXLS), is a company that provides business process outsourcing services to global corporations. The company provides outsourcing services in the following areas: finance and accounting, legal processes, transactions, bill collections and customer services.

Why do you want to join EXL Services?

You would be working in most contemporary environments and not only will you grow at EXL because EXL is growing, you will add so much market value to yourself that you become a professional that is truly valued in today's world. We are a global organization and we are very proud of the impact we make in this world.

Who is the CEO of EXL?

Rohit Kapoor (Apr 2012–)EXL Service / CEO

Should I buy or sell ExlService stock right now?

5 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for ExlService in the last twelve months. There are currentl...

What is ExlService's stock price forecast for 2022?

5 Wall Street analysts have issued 1 year price objectives for ExlService's shares. Their forecasts range from $134.00 to $160.00. On average, they...

How has ExlService's stock performed in 2022?

ExlService's stock was trading at $144.77 at the start of the year. Since then, EXLS shares have increased by 0.3% and is now trading at $145.16....

When is ExlService's next earnings date?

ExlService is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for ExlService .

How were ExlService's earnings last quarter?

ExlService Holdings, Inc. (NASDAQ:EXLS) issued its quarterly earnings data on Thursday, April, 28th. The business services provider reported $1.18...

What guidance has ExlService issued on next quarter's earnings?

ExlService updated its FY 2022 earnings guidance on Monday, May, 9th. The company provided earnings per share (EPS) guidance of $5.40-$5.65 for the...

Who are ExlService's key executives?

ExlService's management team includes the following people: Mr. Rohit Kapoor , Co-Founder, Vice Chairman & CEO (Age 57, Pay $2.82M) ( LinkedIn P...

What is Rohit Kapoor's approval rating as ExlService's CEO?

1,344 employees have rated ExlService CEO Rohit Kapoor on Glassdoor.com . Rohit Kapoor has an approval rating of 85% among ExlService's employees.

Who are some of ExlService's key competitors?

Some companies that are related to ExlService include Visa (V) , Mastercard (MA) , Automatic Data Processing (ADP) , Fiserv (FISV) , Fidelity...

Recently Viewed Tickers

ExlService Holdings Inc

Visit a quote page and your recently viewed tickers will be displayed here.

About ExlService

ExlService Holdings, Inc. is an operations management and analytics company, which engages in providing business process management. It operates through the following segments: Insurance, Healthcare, Travel, Transportation, and Logistics, Finance and Accounting, Analytic, and All Other.

Headlines

ExlService Holdings, Inc. is an operations management and analytics company, which engages in providing business process management. It operates through the following segments: Insurance, Healthcare, Travel, Transportation, and Logistics, Finance and Accounting, Analytic, and All Other.

ExlService (NASDAQ:EXLS) Frequently Asked Questions

Should You Think About Buying ExlService Holdings, Inc. (NASDAQ:EXLS) Now?

What time do you trade in the pre market?

6 Wall Street analysts have issued "buy," "hold," and "sell" ratings for ExlService in the last year. There are currently 5 hold ratings and 1 buy rating for the stock. The consensus among Wall Street analysts is that investors should "hold" ExlService stock.

Does market cap include convertible securities?

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment.

Who is the CEO of Exl?

It does not include securities convertible into the common equity securities. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable).

What is an exl service?

EXL was co-founded in 1999 by Vikram Talwar and Rohit Kapoor. After formation in 1999, Vikram Talwar served as chief executive officer and vice-chairman. Currently, Rohit Kapoor is serving as the company's CEO and Vice-Chairman. Previously, Kapoor had held the position of president in the company.

When did Exl start trading?

EXL Service is an American multinational professional services company mainly involved in the operations management and analytics. EXL offers insurance, banking, financial services, utilities, healthcare, travel, ...

Who are some of (EXL)'s key competitors?

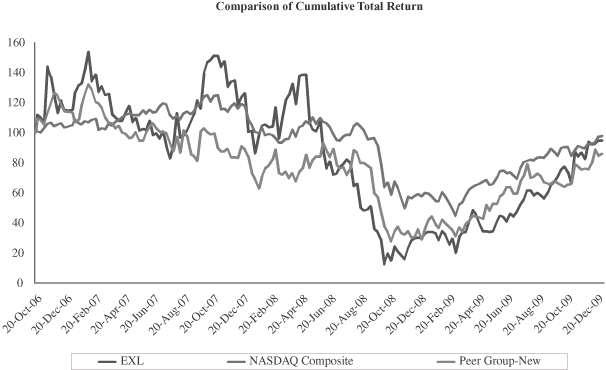

The company's stock started trading on the NASDAQ exchange on October 20, 2006 under the symbol EXLS. Shortly before EXL's debut on NASDAQ, it started down the path of growth through acquisitions with the purchase of the peer company Inductis.

What other stocks do shareholders of (EXL) own?

Some companies that are related to (EXL) include Simon Property Group (SPG), Realty Income (O), Kimco Realty (KIM), Federal Realty Investment Trust (FRT), National Retail Properties (NNN), Kite Realty Group Trust (KRG), Agree Realty (ADC), Macerich (MAC), Retail Opportunity Investments (ROIC), Acadia Realty Trust (AKR), Tanger Factory Outlet Centers (SKT), Alexander's (ALX), Getty Realty (GTY), Saul Centers (BFS) and RPT Realty (RPT). View all of EXL's competitors..

How to calculate P/E?

Based on aggregate information from My MarketBeat watchlists, some companies that other (EXL) investors own include AT&T (T), Whitestone REIT (WSR), AES (AES), Bank of America (BAC), BP (BP), General Electric (GE), GrowGeneration (GRWG), KushCo (KSHB), Lumen Technologies (LUMN) and Medtronic (MDT).

How to calculate restricted stock?

The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period.

How long are futures trading delayed?

To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded. A company's dividend expressed as a percentage of its current stock price.

Transparency is our policy. Learn how it impacts everything we do

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle.

How we make money

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we use your personal data

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we approach editorial content

How we use your information depends on the product and service that you use and your relationship with us. We may use it to: