How to Calculate Future Expected Stock Price

- First Things First. Contact your investment broker, or go online, and find out the current stock price, dividend payout...

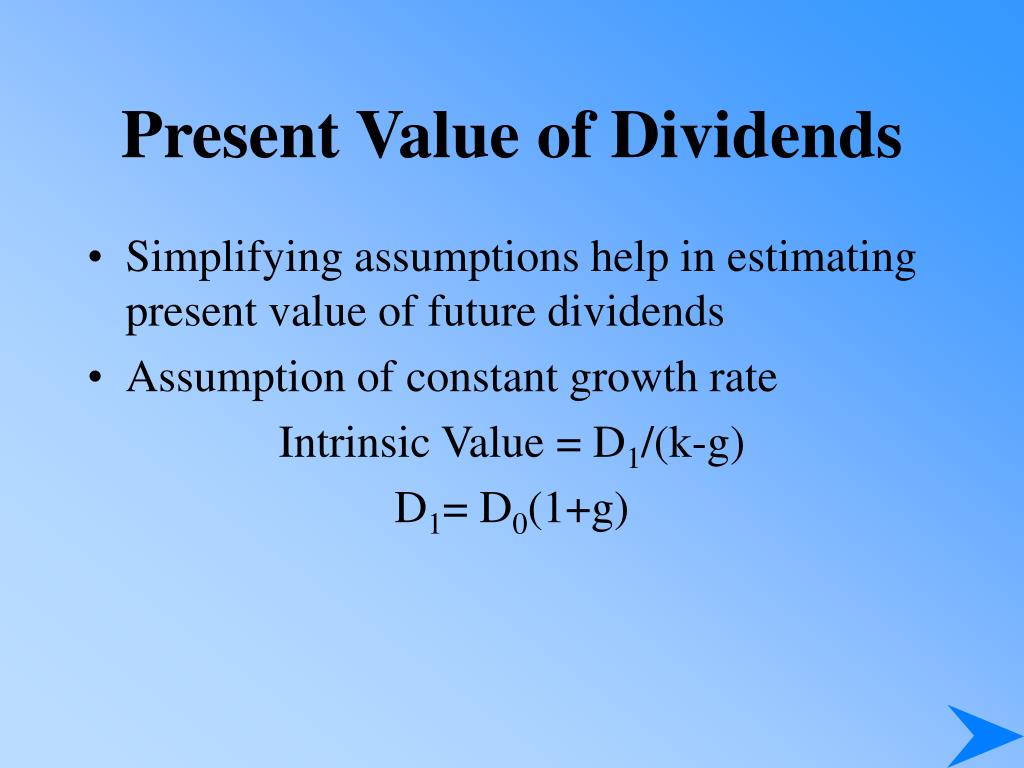

- Exploring The Calculation. In order to determine the future expected price of a stock, you start off by dividing the...

- Identifying Next Steps. Raise this figure to the N power, where N is the number of...

How do you calculate current stock price?

The Heromoto Corp’s financial data is listed below:

- Current Stock Price: INR 2,465

- Last 12-months earnings per share: 148.39

- Annual Sales: 30800.62

- Annual Dividends per share: 105

- Historical P/E ratio: 18.53

- Book Value per Share: 1840.79

How to calculate future expected stock price?

- Dividend per share now (DPS).

- Stock growth rate which (SGR) is the percentage of the increase on the dividends received year per year.

- Desired stock rate of return (DRR) which is a percent you specify you would like to earn from holding the stock.

- No. of share you want to buy (NSB).

How do you calculate futures price?

How do you calculate Eurodollar futures? Eurodollar futures contract as synthetic loan. Consider an investor who agreed to lend US$1,000,000 on a particular date for three months at 5.00% per annum (months are calculated on a 30/360 basis). Interest received in 3 months' time would be US$1,000,000 × 5.00% × 90 / 360 = US$12,500.

What is the formula to calculate price per share?

You'll need to follow these steps:

- Calculate the book value of the company.

- Count up all of the company's outstanding shares.

- Divide the company's book value by the total number of shares.

What is the best way to predict stock prices?

Price to Earnings ratio is one of the traditional methods to analyse the company performance and predict the prices of the stock of the company. This ratio considers the market price of the shares of the company and the earnings per share (EPS) of the company.

What is the most accurate stock predictor?

The MACD is the best way to predict the movement of a stock.

How do you calculate future stock profit?

To calculate your profit or loss, subtract the current price from the original price. The percentage change takes the result from above, divides it by the original purchase price, and multiplies that by 100.

How do you calculate the future price of a stock without dividends?

The P/E Ratio. The price-to-earnings ratio or P/E ratio is a popular metric for valuing stocks that works even when they have no dividends. Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued.

How accurate is Google stock prediction?

In this paper, we have used Kaggle data of google stock price from the year 2012 to 2016. To predict the stock price of the first two months of 2017 based on the last two months of 2016. For this purpose, we used the Recurrent Neural Network (RNN) as a deep learning model and obtained an accuracy of 87.32%.

How do we calculate future value?

The future value formula is FV=PV(1+i)n, where the present value PV increases for each period into the future by a factor of 1 + i. The future value calculator uses multiple variables in the FV calculation: The present value sum. Number of time periods, typically years.

How do you use futures on a calculator?

0:068:35Binance Futures Calculator... Complete Tutorial On How To Use ...YouTubeStart of suggested clipEnd of suggested clipSelect long and if it's going to be a short position. Select short consider we want to calculate theMoreSelect long and if it's going to be a short position. Select short consider we want to calculate the results for a long position here we set the leverage by the help of this slider.

How do you calculate future value example?

Calculate the future value of an investment worth $1,000 today in 100 years using both 1% simple annual interest and 1% compounded annually. Using the simple interest rate future value formula, the future value of the investment is equal to: $1000 * (1+(0.01*100)), or $2,000.

Is Walletinvestor accurate?

Not always 100% accurate predictions but much better than competitors. Overall great tool to monitor coins, NFT and market. I would recommend to get Vip if you can.

What is a watch list for stocks?

A watch list is a list of securities you want to track. You can include stocks, mutual funds, money markets, options, annuities and indexes in a watch list. You can create up to 15 watch lists of up to 50 securities each.

How to calculate future expected price of stock?

In order to determine the future expected price of a stock, you start off by dividing the annual dividend payment by the current stock price. For example, if a stock is currently priced at $80 and offers a $3 annual dividend, you would then divide $3 by $80 to get 0.0375.

Is it 100 percent certain to invest in stocks?

While nothing is 100 percent certain when it comes to investing, your calculations should give you a good enough idea of where a stock's price is heading, so you can make a sound investment decision. It is also worth noting, that the price of some stocks simply cannot be valued with a calculation.

Why are futures prices trending downward?

More fundamentally, why indeed are the upcoming futures prices trending downward rather than trending upward? Or even just staying neutral? The usual suspects are to blame – economic uncertainty, unimpressive growth, a base level of political agitation. Throw in other negatives, no matter how incidental they are to the stock market (e.g. ISIS, Ebola) and here we are.

What is the stock market index?

A stock market index is, at its essence, just a number that represents a collection of stock prices manipulated arithmetically. The index is a quantity, but not really “of” anything you can taste or touch. Yet we can add another level of abstraction and create a futures contract for a stock index, the result of which is speculators taking positions on what direction the market at large will move in. In other words, buying and/or selling a number. A number of great cultural and perceived significance, but still, ultimately a number.

What is the difference between index futures and index funds?

But one huge difference between stock index futures and such index funds is that the former don’t take dividends into account. An index fund, by virtue of actually holding positions in the various stocks that comprise the index, is eligible for whatever dividends those stocks’ companies’ managers decide to pay out to shareholders.