| High | $45.00 |

|---|---|

| Median | $37.00 |

| Low | $25.00 |

| Average | $35.63 |

| Current Price | $28.97 |

What are analysts'target prices for Cohu stock?

4 brokerages have issued 12-month target prices for Cohu's shares. Their forecasts range from $20.00 to $28.00. On average, they expect Cohu's stock price to reach $23.50 in the next twelve months.

Is Cohu a buy or sell?

Cohu has received a consensus rating of Buy. The company's average rating score is 2.71, and is based on 6 buy ratings, no hold ratings, and 1 sell rating. According to analysts' consensus price target of $46.71, Cohu has a forecasted upside of 30.1% from its current price of $35.92.

Is there an upside for Cohu stock?

According to analysts' consensus price target of $46.71, Cohu has a forecasted upside of 30.1% from its current price of $35.92. Cohu has only been the subject of 4 research reports in the past 90 days. Cohu has received 429 “outperform” votes. (Add your “outperform” vote.) Cohu has received 186 “underperform” votes. (Add your “underperform” vote.)

What was the 52-week low for Cohu stock?

The low in the last 52 weeks of Cohu stock was 25.15. According to the current price, Cohu is 116.42% away from the 52-week low. What was the 52-week high for Cohu stock? The high in the last 52 weeks of Cohu stock was 39.85. According to the current price, Cohu is 73.48% away from the 52-week high.

What is Cohu's consensus rating and price target?

According to the issued ratings of 6 analysts in the last year, the consensus rating for Cohu stock is Buy based on the current 1 sell rating, 1 ho...

Do Wall Street analysts like Cohu more than its competitors?

Analysts like Cohu stock less than the stock of other Computer and Technology companies. The consensus rating score for Cohu is 2.50 while the aver...

Do MarketBeat users like Cohu more than its competitors?

MarketBeat users like Cohu stock more than the stock of other Computer and Technology companies. 68.64% of MarketBeat users gave Cohu an outperform...

Is Cohu being downgraded by Wall Street analysts?

Over the previous 90 days, Cohu's stock had 1 downgrade by analysts.

Does Cohu's stock price have much upside?

According to analysts, Cohu's stock has a predicted upside of 27.31% based on their 12-month price targets.

What analysts cover Cohu?

Cohu has been rated by B. Riley , and The Goldman Sachs Group in the past 90 days.

Should I buy or sell Cohu stock right now?

6 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Cohu in the last twelve months. There are currently 1 sell rating, 1 hold...

What is Cohu's stock price forecast for 2022?

6 Wall Street research analysts have issued 12 month target prices for Cohu's shares. Their forecasts range from $28.00 to $50.00. On average, they...

How has Cohu's stock performed in 2022?

Cohu's stock was trading at $38.09 at the beginning of 2022. Since then, COHU stock has decreased by 26.0% and is now trading at $28.18. View the...

When is Cohu's next earnings date?

Cohu is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for Cohu .

How were Cohu's earnings last quarter?

Cohu, Inc. (NASDAQ:COHU) posted its quarterly earnings data on Thursday, April, 28th. The semiconductor company reported $0.61 earnings per share (...

What guidance has Cohu issued on next quarter's earnings?

Cohu updated its second quarter 2022 earnings guidance on Monday, May, 9th. The company provided earnings per share (EPS) guidance of for the perio...

Who are Cohu's key executives?

Cohu's management team includes the following people: Dr. Luis Antonio Muller , Pres, CEO & Director (Age 52, Pay $1.69M) Mr. Jeffrey D. Jones ,...

Who are some of Cohu's key competitors?

Some companies that are related to Cohu include Applied Materials (AMAT) , Lam Research (LRCX) , KLA (KLAC) , Entegris (ENTG) , MKS Instrument...

What other stocks do shareholders of Cohu own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Cohu investors own include Energy Transfer (ET) , AT&T (T...

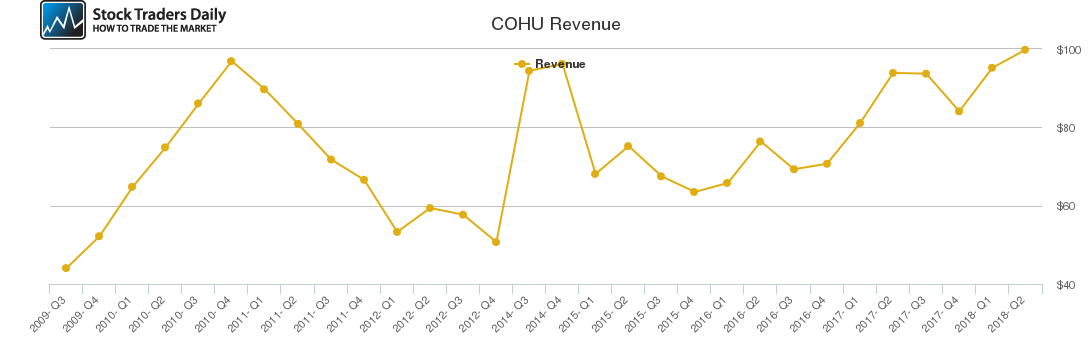

How much does Cohu make?

What is the average rating of Cohu?

How much money does Cohu make? Cohu has a market capitalization of $1.76 billion and generates $636.01 million in revenue each year. The semiconductor company earns $-13,800,000.00 in net income (profit) each year or $0.93 on an earnings per share basis.

What is the symbol for Cohu?

Cohu has received a consensus rating of Buy. The company's average rating score is 2.75, and is based on 7 buy ratings, no hold ratings, and 1 sell rating.

What is the P/E ratio of Cohu?

Cohu trades on the NASDAQ under the ticker symbol "COHU."

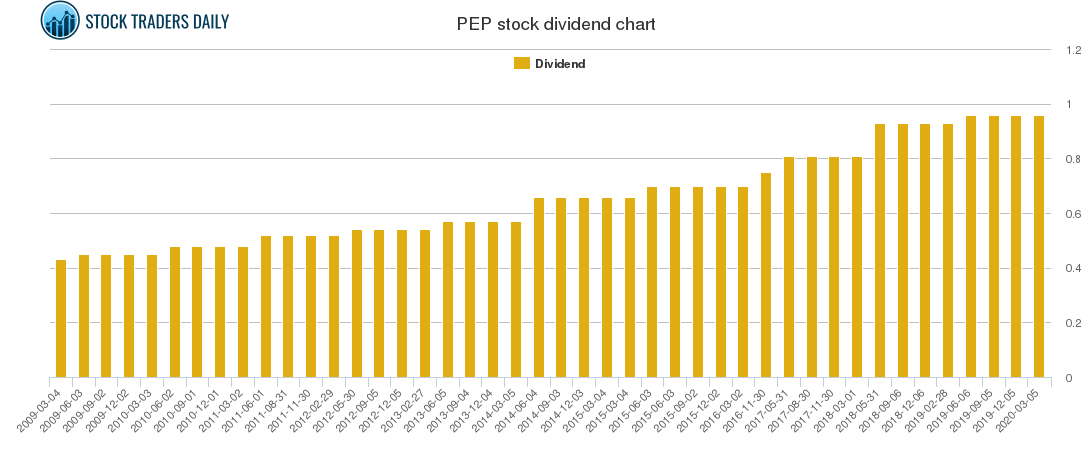

Does Cohu pay dividends?

The P/E ratio of Cohu is 10.59, which means that it is trading at a less expensive P/E ratio than the Computer and Technology sector average P/E ratio of about 80.58.

Component Grades

Cohu does not currently pay a dividend.

The Trend in the Analyst Price Target

We have 9 different ratings for every stock to help you appreciate its future potential. You can unlock it all now.

The Trend in the Broker Recommendations

COHU's average price target has moved down $2.39 over the prior 27 weeks.

Who is Cohu selling to?

COHU's average broker recommendation rating improved by 0.66 over the prior 39 weeks.

What does Argus have to say about Cohu?

(COHU) has agreed to sell its Printed Circuit Board Test Group (PTG) business to Swedish production equipment provider Mycronic AB for a total consideration of $125 million. The PTG business includes atg Luther & Maezler GmbH and other associated units. The transaction is expected to close by the end of June. Cohu expects after-tax proceeds of $95 to $100 million from this transaction. It plans to use these funds to repay outstanding principal on its term loan facility. The divested PTG unit had sales of $52.9 million over the past year. (See Cohu stock analysis on TipRanks) Cohu President and Chief Executive Officer Luis A. Muller said, “PTG has been a valued part of our business since joining Cohu with the Xcerra acquisition in 2018, and I want to thank all employees for their contributions to the company.” Muller added, “Combining forces with Mycronic creates additional scale in the PCB market segment and greater opportunities for PTG’s success in the future, while enabling Cohu to focus on semiconductor equipment and services businesses.” On April 30, Needham analyst Quinn Bolton reiterated a Buy rating on the stock and maintained a $55 price target (41.5% upside potential). Commenting on Cohu’s Q1 results, Bolton said, “Cohu reported solid results for 1Q21 that slightly beat our estimates, and guided 2Q21 revenue up sequentially and in line with our estimate. However, the company guided net gain gross margin down sequentially by 310 basis points.” Bolton explained, “Investors should not interpret the lower GM guidance as weakness of the company but as strength of the market. Looking ahead to 2022, we expect gross margin will recover as mix shifts back to a more normalized range.” Based on 6 unanimous Buys, consensus on the Street is that Cohu is a Strong Buy. The average analyst price target of $62.40 implies 60.6% upside potential. Shares have seen about 162.6% gain over the past year. Related News: Fastly Reports Disappointing 1Q Results, Light Outlook, CFO Exit; Shares Fall 17.5% Roku Reports Profit In 1Q As Results Beat Estimates; Shares Pop 9% Verizon To Sell Media Business To Apollo Management For $5B But Will Retain 10% Stake More recent articles from Smarter Analyst: BioNTech To Set Up Manufacturing Plant In Singapore RenaissanceRe Declares $0.36 Dividend; Increases Stock Buyback to $500M KKR To Invest In Charter Next Generation Park Hotels To Sell 2 Hotels For $149M To Pare Down Debt

When did Cohu divest?

COHU: What does Argus have to say about COHU? COHU INC has an Investment Rating of HOLD; a target price of $37.000000; an Industry Subrating of High; a Management Subrating of Medium; a Safety Subrating of Medium; a Financial Strength Subrating of Medium; a Growth Subrating of Medium; and a Value Subrating of Medium.

Who is Cohu in 2021?

On June 24, 2021 Cohu completed the divestment of its Printed Circuit Board Test ("PCB Test") business which resulted in a gain of $75.8 million. Net sales for the first six months of 2021 were $470.3 million and GAAP income was $122.7 million or $2.58 p. Zacks • 29 days ago.

Do hedge funds have to report at the end of every quarter?

POWAY, Calif., June 24, 2021--Cohu, Inc. (NASDAQ: COHU), a global leader in back-end semiconductor equipment and services, today announced that it has completed the sale of its Printed Circuit Board Test Group business to Mycronic AB (MYCR.ST).

Is Cohu prepaid in 2021?

The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors.

Stock Price Forecast

POWAY, Calif., June 30, 2021-- Cohu, Inc. (NASDAQ: COHU), a global leader in back-end semiconductor equipment and services, today announced that it has prepaid an additional $100 million of its term loan B (TLB) facility. As a result of this prepayment, Cohu has reduced the outstanding principal of its TLB to approximately $104 million.

Analyst Recommendations

The 9 analysts offering 12-month price forecasts for Cohu Inc have a median target of 42.00, with a high estimate of 55.00 and a low estimate of 32.00. The median estimate represents a +35.27% increase from the last price of 31.05.