Why is CIBC stock so expensive?

CIBC has a large Canadian residential mortgage portfolio, so a major slowdown in the housing market or a crash in house prices would likely hit the bank harder than its peers. This is why CIBC stock often trades at a discount to the other Canadian banks.

Should you buy CIBC stock on the TSX today?

It rebounds quickly after market crashes and has continued to make improvements that drive share growth. On top of that, Motley Fool investors can pick up CIBC stock on the TSX today with a P/E ratio of 11.2. That’s incredible value considering the past and future growth of this company.

What is the ticker symbol for Canadian Imperial Bank of Commerce?

Canadian Imperial Bank of Commerce trades on the Toronto Stock Exchange (TSX) under the ticker symbol "CM." How do I buy shares of Canadian Imperial Bank of Commerce? Shares of CM and other Canadian stocks can be purchased through an online brokerage account.

Is CIBC TSX at a decisive point around $104?

Taking a look at the daily chart CIBC TSX:CM to see that it could be at a very decisive point around the $104 area. Price hit a major horizontal that acted as a strong resistance turned strong support with price hitting that level on multiple occasions with subsequently massive price movement to follow.

See more

Why are CIBC shares dropping?

CIBC shares drop after earnings. Canadian Imperial Bank of Commerce (CM.TO) shares fell the most in almost three months after the bank posted fiscal second-quarter results that missed analysts' expectations as domestic mortgages and net interest income shrank.

What is CIBC dividend percentage?

Historical dividend payout and yield for Canadian Imperial Bank Of Commerce (CM) since 1999. The current TTM dividend payout for Canadian Imperial Bank Of Commerce (CM) as of July 21, 2022 is $2.62. The current dividend yield for Canadian Imperial Bank Of Commerce as of July 21, 2022 is 5.42%.

What is CIBC payout ratio?

According to CIBC's 2021 earnings release, the bank paid $5.84 in dividends last year on $13.97 in earnings. That gives us a payout ratio of 41.8% — extremely low. With that kind of payout ratio, a company can keep paying, or even raising, its dividend for a long time.

Can Imperial Bk Of Commerce?

About Canadian Imperial Bank of Commerce Its Canadian Commercial Banking and Wealth Management provides high-touch, relationship-oriented banking and wealth management services to middle market companies, entrepreneurs, high-net-worth individuals and families across Canada.

Is CIBC a good buy?

In 2021, CIBC had one of the higher payout ratios among its peers in the 60% range. However, this has come down considerably, and the company is now paying out only 40% of trailing twelve-month earnings towards the dividend in 2022. The company's average payout ratio over the last 5 years has been around 45%.

What is the best Canadian dividend stock?

Top Canadian Dividend StocksNameTickerForward Dividend Yield %Enbridge IncENB6.33%Great-West Lifeco IncGWO6.26%AGF Management LtdAGF.B6.14%Manulife Financial CorpMFC5.96%6 more rows•Jul 11, 2022

Will CIBC stock split 2022?

The shares of CIBC will begin trading on a two-for-one split basis on the Toronto Stock Exchange at the opening of business on May 16, 2022. The Shares will commence trading on a “due bill” basis at the opening on May 5, 2022. Due Bill Trading will end at the close of business on May 13, 2022.

How much profit did CIBC make in 2021?

$6.4 billionFor the year ended October 31, 2021, CIBC reported net income of $6.4 billion and adjusted net income(1) of $6.7 billion, compared with reported net income of $3.8 billion and adjusted net income(1) of $4.4 billion for 2020.

Will CIBC raise dividend?

TORONTO, May 26, 2022 /CNW/ - CIBC (TSX: CM) (NYSE: CM) announced today that its Board of Directors declared a dividend of $0.83 per share on common shares(1) for the quarter ending July 31, 2022, payable on July 28, 2022 to shareholders of record at the close of business on June 28, 2022.

Why is CIBC a good bank?

Today, CIBC is one of Canada's most reputable banking institutions and offers an exceptional direct-to-consumer digital bank known as Simplii Financial, which touts a no-frills, cost-free banking experience. Today, CIBC has over 10 million clients.

What's the best bank in Alberta?

Servus Credit Union has over 100 branches in 59 different communities in Alberta and employs 2,200 people. Toronto-based EQ Bank garnered the number one spot on Forbes' Best Banks rankings for Canada. Tangerine, Manulife, and Simplii Financial rounded off the top five.

How many clients does CIBC serve across North America?

eleven million clientsIt has international operations in the United States, the Caribbean, Asia, and United Kingdom; Globally. CIBC serves more than eleven million clients, and has over 40,000 employees....Canadian Imperial Bank of Commerce.Headquarters at CIBC SquareTotal equityC$45.83 billion (2021)Number of employees45,282 (FTE, 2021)15 more rows

Is Canadian bank stock safe?

Canadian big bank stocks are safe investments and pay quality dividends. However, the top-performing Canadian Imperial Bank of Commerce stock stands out if you want to earn more cash. The post Canadians: Be Flush With Cash From 1 Big Bank Stock appeared first on The Motley Fool Canada.

Is CIBC a cloud?

Today CIBC and Microsoft announced a strategic relationship through a multi-year agreement formalizing Microsoft Azure as CIBC's primary cloud platform. CIBC's cloud-first approach will be enabled by Microsoft Azure's vast on-demand computing power, enabling it to scale and modernize its banking platforms, while building in additional resiliency, efficiency and agility.

Is CIBC a Dow Jones Sustainability Index?

CIBC (TSX: CM) (NYSE: CM) has been included in the Dow Jones Sustainability Index (DJSI) North America for the 17th consecutive year, as a result of its responsible and sustainable business practices, and transparency in disclosure. The DJSI measures the performance of companies based on economic, environmental and social criteria.

What is the CIBC Foundation?

CIBC announced today the launch of the CIBC Foundation, which will serve to advance social and economic equity by creating greater access to opportunities for underserved communities in Canada. To support this goal, the bank has made donations totalling $70 million in fiscal 2021 to launch the foundation, with plans to grow to $155 million over time. As part of a North American approach, the bank is also announcing plans to launch the foundation in the US in the coming year.

How much money does CIBC donate to Haiti?

CIBC donates $100,000 to support earthquake relief efforts in Haiti. CIBC announced today it is donating $100,000 to the Canadian Red Cross to assist with immediate relief efforts in Haiti, following the recent catastrophic earthquake and subsequent tropical storm that struck the country. First Came an Earthquake.

Is CIBC a cloud?

Today CIBC and Microsoft announced a strategic relationship through a multi-year agreement formalizing Microsoft Azure as CIBC's primary cloud platform. CIBC's cloud-first approach will be enabled by Microsoft Azure's vast on-demand computing power, enabling it to scale and modernize its banking platforms, while building in additional resiliency, efficiency and agility.

Is CIBC a Dow Jones Sustainability Index?

CIBC (TSX: CM) (NYSE: CM) has been included in the Dow Jones Sustainability Index (DJSI) North America for the 17th consecutive year, as a result of its responsible and sustainable business practices, and transparency in disclosure. The DJSI measures the performance of companies based on economic, environmental and social criteria.

Earnings

Corporate earnings are provided from Morningstar, including Income Statements,Balance Sheets, Cash Flow Statements, and Statement of Retained Earnings.

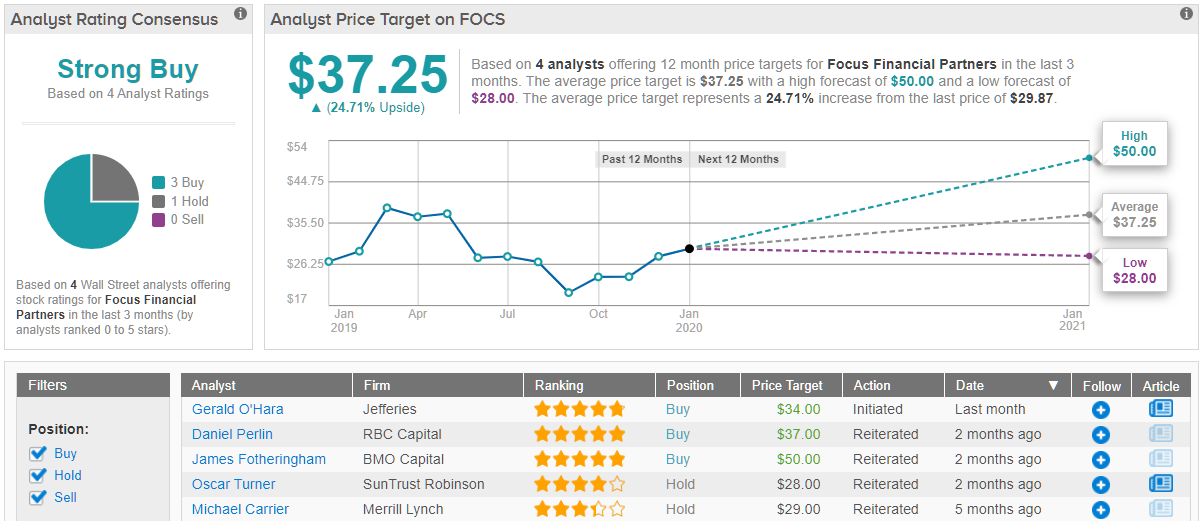

Analyst Research

Analyst Ratings and Earnings Estimates are provided by Zacks Investment Research.

StockCalc

What is this stock worth in intrinsic value? View this premium StockCalc report to see this stock's valuation and how it was calculated using fundamental analysis. For subscribers only.

ValuEngine

A stock valuation and forecasting report include rating, fair value assessment, return forecasts, market ratio-based valuations and comparable analysis. Available for free with registration.

Latest Press Releases

Today announced the completion of a new affordable housing project, Broadview Senior Apartments, for ...

CIBC plans to bring Canadian employees back to office in March

Canadian Imperial Bank of Commerce , the country's fifth largest lender, said on Tuesday it plans to bring its local staff back to office starting March 21 as omicron-related infections ebb.

CIBC Innovation Banking Provides Financing Solutions to Graphite Ventures

TORONTO, February 22, 2022--CIBC Innovation Banking is pleased to announce it has provided financing solutions, including a capital call line of credit, to Graphite Ventures (Graphite), a $100-million fund focused on seed-stage investments and extensions, through to the rights for Series A rounds.

Where is the Canadian Imperial Bank of Commerce?

Canadian Imperial Bank of Commerce's mailing address is 199 Bay Street, Commerce Court, TORONTO, ON M5L 1A2, Canada. The company can be reached via phone at +1-416-9802211.

What is Canadian Imperial Bank?

Canadian Imperial Bank of Commerce, a diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. The company operates through four strategic business units: Canadian Personal and Business Banking; Canadian Commercial Banking and Wealth Management; U.S. Commercial Banking and Wealth Management; and Capital Markets. The company offers chequing, savings, and business accounts; mortgages; loans, lines of credit, student lines of credit, and business and agriculture loans; investment and insurance services; and credit cards, as well as overdraft protection services. It also provides day-to-day banking, borrowing and credit, investing and wealth, specialty, and international services; correspondent banking and online foreign exchange services; and cash management services. The company serves its customers through its banking centers, as well as direct, mobile, and remote channels. Canadian Imperial Bank of Commerce was founded in 1867 and is headquartered in Toronto, Canada.

What is the CM symbol?

Canadian Imperial Bank of Commerce trades on the Toronto Stock Exchange (TSX) under the ticker symbol "CM."

What is Canadian Imperial Bank?

Canadian Imperial Bank of Commerce is a financial institution, which engages in the provision of banking and wealth management services. It operates through the following segments: Canadian Personal and Small Business Banking, Canadian Commercial Banking and Wealth Management, U.S. Commercial Banking and Wealth Management, Capital Markets, and Corporate and Other. The Canadian Personal and Small Business Banking segment provides personal and business clients with financial advice, products, and services. The Canadian Commercial Banking and Wealth Management segment offers banking and wealth management services to middle-market companies, entrepreneurs, high-net-worth individuals, and families, as well as asset management services to institutional investors. The U.S. Commercial Banking and Wealth Management segment includes commercial, personal and small business banking, and wealth management services. The Capital Markets segment consists of integrated global markets products and services, investment banking advisory and execution, corporate banking and top ranked research to corporate, government and, institutional clients. The Corporate and Other segment refers to the functional groups such as administration, client connectivity and innovation, finance, human resources and communications, internal audit, risk management, technology and operations, and other support groups. The company was founded on June 1, 1961 and is headquartered in Toronto, Canada.

Is Boc increasing money supply?

Boc is increasing money supply and exploding their balance sheet. Banks benefit the most from this money supply. They filled the gap Friday and most likely to rally to 115. Going to Buy some cm calls 115 expiration in September.

What happened?

CIBC stock announced a strong earnings report yet again for the quarter. The company announced adjusted earnings per share (EPS) of $3.93 — 45% higher than the year before. Net income was also on the rise — up 48% year over year to $1.73 billion — and total revenue was up 7% to $5.06 billion.

So what?

The combination of having to continue to be competitive while also modernizing and adjusting for low interest rates put a lot of pressure on CIBC stock. Instead of rising as some of its peers have, there was a pullback in the stock after reaching all-time highs. That’s despite excellent news for the company.

Now what?

Motley Fool investors may want to seize this opportunity to buy some CIBC stock while it’s down. Analysts continue to put the average share price in the next year at $158. That’s a potential upside of 8% as of writing.

Stock Advisor Canada Returns

Returns since inception, October 2013. Current as of February 22, 2022.