The stock-to-flow model uses a simple formula where you divide the current supply (stock) of an asset by its yearly production (flow). S2F = Stock (existing stock pile) / Flow (annual production) When you divide Bitcoin’s current circulating supply by the annual rate of new coins entering the supply, you get the Bitcoin stock-to-flow rate.

Should I invest in Bitcoin or the stock market?

There are so many reasons to invest in Bitcoin. This unique financial instrument changed the world forever and ushered in the digitization of the economy. Bitcoin is much more than just a protocol. It represents a fundamental shift in global monetary policy. For the first time, government and monetary policy are separate. Nobody knows exactly ]

Is it profitable to invest in Bitcoin?

The Pros of Bitcoin Investing. The main benefit to Bitcoin investing is that you may be able to generate a huge return on profit, perhaps as high as 200% or more. Of course, that’s a challenging thing to accomplish, but it’s possible.

How to trade stocks with Bitcoin?

Bitcoin’s latest price rally has bucked its trend of following traditional financial markets, with crypto market analysts saying it has finally “decoupled” from stock markets. It has also managed to outperform gold, which is typically the go-to safe ...

Is it better to invest in Bitcoin or Altcoins?

It is fair to say that Bitcoin has better investing fundamentals than the vast majority of altcoins. Bitcoin is the most purchased, held and traded cryptocurrency on the market. It has a market capitalization of about $1.2 trillion, or more than 60% of the total market cap of cryptocurrencies. Bitcoin’s daily trading volume accounts for more ...

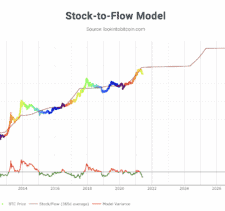

Is Bitcoin stock-to-flow model accurate?

All in all, the stock-to-flow model has been fairly accurate if you zoom out far enough when looking at the chart overlay. However, investors cannot use S2F to accurately predict where the price will head in the coming months.

Is there a correlation between Bitcoin and the stock market?

Correlations between stocks and Bitcoin have been strong, and the relationship is even more pronounced between the coin and tech stocks, which can sometimes be thought of as more speculative plays in the market.

How is the stock-to-flow model calculated?

What is the Stock to Flow model? In simple terms, the Stock to Flow (SF or S2F) model is a way to measure the abundance of a particular resource. The Stock to Flow ratio is the amount of a resource held in reserves divided by the amount it is produced annually.

Is BTC correlated to S&P?

Both the CoinDesk report and data from Blockchain Center show that Bitcoin started to become correlated to the S&P 500 in the last quarter of 2021. The 90-day correlation between them grew from 0.2 (no significant correlation) to just about 0.6 (fairly strong correlation).

Which crypto will boom in 2021?

Binance Coin (BNB) Binance is the most successful cryptocurrency exchange in terms of trading volumes. Like bitcoin, binance coin keeps a hard limit on the number of tokens in circulation — in its case, 165,116,760 tokens. This helped the token price increase exponentially in 2021.

Is Bitcoin rainbow chart reliable?

Does the accuracy of this chart prove that the Bitcoin price is likely to always follow the shape of a rainbow? Probably not. Similarly, S2F being accurate, does not provide any real evidence that Bitcoin's price trajectory must follow the diminishing supply, as we progress through each future halving schedule.

What is gold's stock-to-flow?

The ratio of stock to flow is stock-to-flow (S2F). The higher this value, the more scarce something is. Gold, for example, has (as of 2019) a S2F ratio of 62. That means at current rates, it will take 62 years of production to create the current supply of all gold in existence.

What is a stock flow model?

What Is the Stock-to-Flow Model? The stock-to-flow model takes a simpler approach to predicting value changes. It measures the current stock of an asset against the flow of new production or how much is mined in a year. A higher ratio indicates more scarcity, which in turn indicates a higher value.

How is Bitcoin doing in the stock market?

Volume: 1,83,005 Cr....Bitcoin Price Update.Bitcoin PriceValueToday/Current/Last17,05,1451 Day Return4.83%7 Day Return9.52%

What is negatively correlated to Bitcoin?

In recent weeks, Bitcoin has been trading increasingly negatively correlated with Asian market indices such as the Shanghai Composite or the Nikkei 225.

Is stocks or Bitcoin better?

The owner of a cryptocurrency holds his or her assets in a virtual wallet or on a storage device, such as a USB drive. So, while stocks provide stability; cryptocurrencies are riskier investments that while they offer the potential for great rewards, they also represent greater risk.

Is Bitcoin a non correlated asset?

Firstly, Bitcoin is historically an uncorrelated asset. Though the high correlation to U.S. equities of the past year and a half worried some Bitcoiners, the recent decoupling shows that Bitcoin still moves according to its four-year cycles.

Dataset

We are going to use a dataset that’s downloaded directly from the Bitcoin blockchain. The data file is about 400MB in size. You can learn how to download it from this tutorial. Do not download the blockchain from a single source if you want authentic data as I suggested in the blog post. Therefore I also don’t be providing the original data here.

Getting Blockchain Data

If you followed my previous tutorial, now you should have all the blockchain data stored in a local SQLite database, we’ll read the entire blockchain into Python. Note that for efficiency reasons, we could have selected just the columns required instead of everything. Limiting the data columns also helps if your computer is slow.

Historical Bitcoin Price And Market Cap

Moving on to get historical prices for Bitcoin. The source with the most complete data I could find is https://ca.investing.com/indices/investing.com-btc-usd-historical-data. The historical price data starts from July 2010. So we’ll have to do some manual adjustments for the missing data. Below is a quote from PlanB’s article:

Bitcoin Price Prediction Model With Python

We’ll need matplotlib for some simple visualization, and sklearn for the linear regression model.

Conclustion

If this has been confusing to you, don’t worry. Let me put this in plain English: Stock to flow Ratio is a driving factor for the Bitcoin market cap. The larger the Stock-To-Flow Ratio, the higher the Bitcoin market cap.

Why does the stock to flow model fail?

The stock-to-flow model fails if Bitcoin doesn’t have any other useful qualities other than the supply scarcity. In the case of gold, it’s scarcity, predictable flow, and global liquidity have made it a relatively stable store of value compared to fiat currencies, which are prone to devaluation. Bitcoin is volatile in nature. If this volatility was predictable to some extent, then the valuation model may be more reliable.

What is stock flow?

The Stock-to-Flow model analyzes the relationship between the currently available stock of resources and its production rate. This model is mainly applied to precious metals and other commodities. But, it can also be applied to Bitcoin as well. According to this model, Bitcoin is an asset that retains its value for the long-term.

What does it mean when Bitcoin is halved?

There is a Bitcoin halvings concept in which the amount of new supply entering the system is halved every 210,000 blocks. It means the Bitcoin scarcity will also increase. Hence, Bitcoin has characteristics to retain its value for the long-term. As the Stock-to-flow ratio decreases, the Bitcoin price will gradually increase.

How much is Bitcoin worth in 2024?

The S2F model predicts that Bitcoin Will likely be worth $288,000 each coin by 2024. This prediction comes after the Bitcoin halvings in 2012 and 2016. The S2F model creator Plan B tweeted the 2019 time series model on historical BTC data only.

What is the digital asset that Satoshi Nakamoto created?

To solve this problem, Satoshi Nakamoto designed a scarce digital asset called Bitcoin. The scarcity of this digital asset is the primary essence behind the stock-to-flow S2F model.

How many coins are in Bitcoin?

Similar to gold and silver, Bitcoin is also scarce, costly to produce, and has a maximum supply of 21 million coins. Bitcoin’s supply issuance makes the flow completely predictable.

Why do commodities have a low stock to flow ratio?

Consumable goods and industrial commodities have a low stock-to-flow ratio. It is because their value comes down due to being destroyed or consumed. The stock is there to cover the demand. As they do not have high value, they tend to work poorly as investment assets.

Why are the two decomposed DS2F models bent in the opposite direction?

This is due to the fact that the “aggressive” input variable is given a negative weight in the DS2F models, whereas it has a positive weight in the S2F and AS2F models.

Does bitcoin grow faster?

These experiments indicate that bitcoin’s price growth diminishes faster than indicated by the time-based power model and much faster than indicated by the stock-to-flow ratio based power model. This is in line with other findings of diminishing returns, which have been observed in all of bitcoin’s history.

How does S2F work?

S2F is elegant in its simplicity. You simply divide the current supply (stock) of a commodity or asset by its annual production (flow). When PlanB debuted the bitcoin S2F model in 2019, he included a chart that compared its value with that of other commodities and precious metals with varying degrees of scarcity.

Is S2F accurate for bitcoin?

The results have been very compelling. In fact, S2F has probably been the most accurate tool that we have for predicting bitcoin’s price. See for yourself.

Should You Invest In Bitcoin ? What The Stock To Flow Model Tells Us

Disclaimer: The material in this article is purely educational and should not be taken as professional investment advice. Invest at your own discretion.

What Is The Stock To Flow Model ?

Stock to Flow Model showing for 463 day and 10 day time period. Image source: https://stats.buybitcoinworldwide.com/stock-to-flow/

How To Calculate The Stock To Flow Ratio

To calculate the stock to flow ratio, we just need to calculate the scarcity. Note the formula below comes from https://stats.buybitcoinworldwide.com/stock-to-flow/.

What Is Stock to Flow (S2f)?

Stock-To-Flow Ratio of Gold

Stock-To-Flow and Bitcoin

Bitcoin Total Supply

S2F Bitcoin Price Prediction

- Due to the scarcity of Bitcoin, the S2F model depicts that Bitcoin has value. Prices will increase if the demand rises, but the supply will drop. The S2F model predicts that Bitcoin Will likely be worth $288,000 each coin by 2024. This prediction comes after the Bitcoin halvings in 2012 and 2016. The S2F model creator Plan B tweeted the 2019 time s...

Limitations of Stock-To-Flow

Final Word