Is affirm a good investment?

Revenue was up 55% in the most recent quarter, and the company increased its annual revenue estimates for 2022. Affirm remains a good long-term stock in a growing industry. You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Why is everyone talking about affirm Holdings stock?

They're a technology company, they develop an artificial intelligence platform that aims to do a better job of predicting loan losses than the traditional methods, specifically the FICO score. They provide the system that will underwrite and approve loans and try to give people the credit that they should have.

Should you buy affirm holdings on the dip?

Affirm Holdings ... stock to buy on the dip? Let's start by looking at some of the good news. Image source: Getty Images. Buy now, pay later (BNPL) isn't the end of the world for credit cards, but it is becoming a lot more popular than you might expect.

Is affirm Holdings stock a buy now?

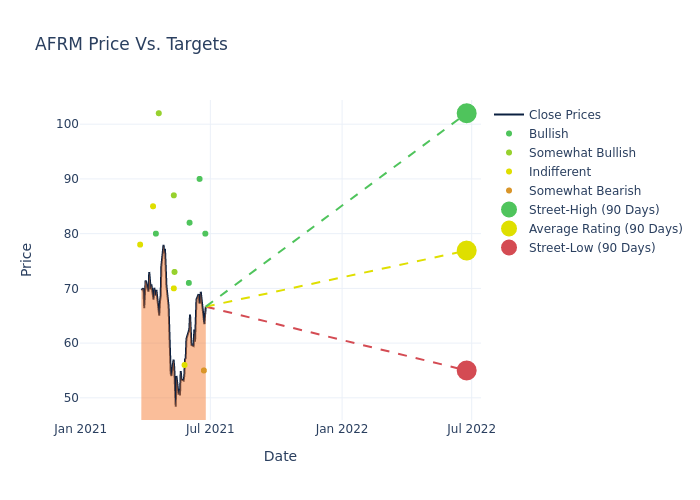

Affirm ... stock is rated as a Hold by 5 analyst(s), 8 recommend it as a Buy and 0 called the AFRM stock Overweight. In the meantime, 0 analyst(s) believe the stock as Underweight and 1 think it is a Sell. Thus, investors eager to increase their holdings ...

What is the target price for affirm stock?

Stock Price TargetsHigh$80.00Median$35.00Low$15.00Average$37.37Current Price$23.10

Is affirm buy or sell?

Affirm has received a consensus rating of Hold. The company's average rating score is 2.19, and is based on 6 buy ratings, 7 hold ratings, and 3 sell ratings.

Is affirm overvalued?

Valuation metrics show that Affirm Holdings, Inc. may be overvalued. Its Value Score of F indicates it would be a bad pick for value investors. The financial health and growth prospects of AFRM, demonstrate its potential to underperform the market.

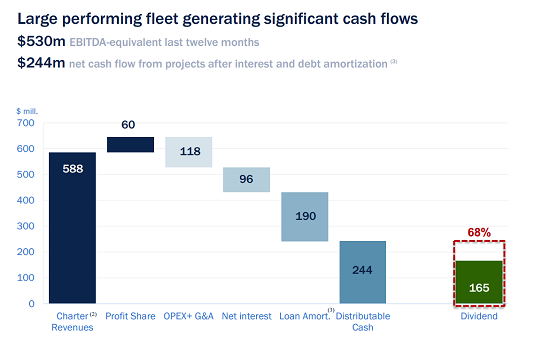

Does affirm pay a dividend?

Does Affirm pay a dividend on its stock? We do not currently pay dividends on our stock.

Is Affirm a profitable company?

In the Barclays 2022 Virtual Emerging Payments and FinTech Forum, Linford reiterated Affirm's target of achieving sustained profitability by mid-2023. This might be ahead of some analysts' estimates.

Is AFRM a buy today?

The consensus among 17 Wall Street analysts covering (NASDAQ: AFRM) stock is to Buy AFRM stock.

Why is Affirm so low?

Affirm is posting high growth and expanding partnerships and services. Market volatility and losses have led to a declining stock price.

Why does Affirm lose so much money?

Revenue was up 77% from a year ago, but marketing and administrative costs sent losses up six-fold. Without Putin's War, those numbers would not have crashed the stock. But wars are unhealthy for economies and other living things.

Why is Affirm stock falling?

Chiaverini initiated coverage of Affirm (ticker: AFRM) at Underperform on Wednesday, citing concerns over rising competition in the Buy Now, Pay Later (BNPL) space, as well as the company's path to profitability and slowing e-commerce sales. Affirm stock has fallen 4.6% to $23.26 on Wednesday.

Who owns affirm credit?

Max LevchinAffirm HoldingsTypePublic companyFoundersMax Levchin Nathan Gettings Jeffrey Kaditz Alex RampellHeadquarters650 California Street, San Francisco, California , U.S.Key peopleMax LevchinProductsConsumer loans Installment loan12 more rows

How does affirm financing make money?

Affirm is a fintech startup that provides point-of-sale (POS) loans and buy now pay later financing for consumers via e-commerce retailers. It makes money in two main ways, through the interest it charges consumers and from merchant fees. Learn more about Affirm's business model.

Where is affirm traded?

Affirm's founder and CEO is Max Levchin, who is also a PayPal co-founder. Affirm has raised a total of $1.5 billion in funding. In 2020, the company was privately valued at $5–10 billion. Affirm will trade on the Nasdaq Exchange under the ticker symbol “AFRM.”

Who is the insider of affirm?

What is fair value in accounting?

Jeremy Liew, Insider at Affirm Holdings (NASDAQ:AFRM), made a large insider sell on November 15, according to a new SEC filing. What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Liew sold 4,785,491 shares of Affirm Holdings at prices ranging from ($0.00) to $149.94. The total transaction amounted to $10,051,756. Following the transaction, Liew still owns 116,186 shares of Affirm Holdings worth $16,582,472.00. Affirm Holdings shares are trading

What is the Vickers top buyer and seller report?

Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected.

What is MQ in IPO?

Daily – Vickers Top Buyers & Sellers for 11/18/2021 The Vickers Top Buyers & Sellers is a daily report that identifies the five companies the largest insider purchase transactions based on the dollar value of the transactions as well as the five companies the largest insider sales transactions based on the dollar value of the transactions.

Is affirm stock trading lower?

Marqeta (MQ), which is a payments processing operator, pulled off its IPO last week. On the first day of trading, the shares rose by 13% to $30.50, putting the market capitalization over $16 billion. The performance may seem unimpressive, but it's actually strong, considering that the company initially set a range for the offering at $20 to $24. (See Marqeta Stock Stats and Charts on TipRanks) The underwriters on the offering included Goldman Sachs (GS), J.P. Morgan (JPM), Citi (C), Barclays (BC

What is affirm holdings?

Affirm Holdings Inc (NASDAQ: AFRM) shares are trading lower as the stock pulls back from recent strength, which was driven by strong first-quarter results. Affirm on Wednesday reported quarterly losses of $1.13 per share which missed the analyst consensus estimate of a loss of 30 cents per share. Affirm reported quarterly sales of $269.40 million which beat the analyst consensus estimate of $248.23 million by 9%. The company announced that it has expanded its relationship with Amazon (NASDAQ: AM

What is the target for affirm?

Affirm Holdings, Inc. operates a platform for digital and mobile-first commerce. It offers integrated checkout, virtual cards, split pay, Affirm app and marketplace, and savings accounts. The company was incorporated as a holding company on June 18, 2019.

Is affirm trading at 200?

Affirm starting a pattern of lower lows and lower highs. Was able to draw a nice downtrending channel on it. Short the resistance. Target is about 110.

What is affirm holdings?

Affirm has been trading in a strong uptrend and recently touched its all time high and has been trading at higher levels. It has potential to touch 200-220 with in a few days in this rally before any significant profit booking happens. Disclaimer: For educational purpose only. All disclaimers apply.

What is the P/E ratio of affirm?

Affirm Holdings, Inc. operates a platform for digital and mobile-first commerce in the United States and Canada. The company's platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its payments network and partnership with an originating bank, enables consumers to pay for a purchase over time with terms ranging from one to forty-eight months. As of September 30, 2020, the company had approximately 6,500 merchants integrated on its platform covering small businesses, large enterprises, direct-to-consumer brands, brick-and-mortar stores, and companies. Its merchants represent a range of industries, including sporting goods and outdoors, furniture and homewares, travel, apparel, accessories, consumer electronics, and jewelry. The company was founded in 2012 and is headquartered in San Francisco, California.

What is the AFRM symbol?

The P/E ratio of Affirm is -42.36, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

Where is affirm mail?

Affirm trades on the NASDAQ under the ticker symbol "AFRM."

Does affirm pay dividends?

Affirm's mailing address is 650 CALIFORNIA STREET, SAN FRANCISCO CA , 94108. The company can be reached via phone at 415-984-0490 or via email at ir@affirm.com.

What is affirm holdings?

Affirm does not currently pay a dividend.

What is affirm payment?

Affirm Holdings, Inc. (NASDAQ: AFRM) (“Affirm” or the "Company”), the payment network that empowers consumers and helps merchants drive growth, today reported financial results for its fiscal 2022 ...

Why are fintech stocks so high?

Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth, today unveiled “Holiday Smart,” a new campaign that calls out the stupid mistakes people make during...

Is Realtime sourced from all markets?

Fintech stocks have been trending higher since the onset of the pandemic last year due to the widespread adoption of remote financial transactions and an increase in digital sales. However, all fintech...