| High | $310.00 |

|---|---|

| Median | $200.00 |

| Low | $150.00 |

| Average | $203.46 |

| Current Price | $153.06 |

Is Zscaler (ZS) stock a buy or sell?

According to the issued ratings of 27 analysts in the last year, the consensus rating for Zscaler stock is Buy based on the current 2 sell ratings, 6 hold ratings and 19 buy ratings for ZS. The average twelve-month price target for Zscaler is $366.19 with a high price target of $439.00 and a low price target of $235.00.

What is the price target for Zs Inc (ZS)?

The high price target for ZS is $89.00 and the low price target for ZS is $40.00. There are currently 2 sell ratings, 8 hold ratings and 10 buy ratings for the stock, resulting in a consensus rating of "Hold.".

Will Zscaler (ZS) outperform or underperform the S&P 500?

MarketBeat's community ratings are surveys of what our community members think about Zscaler and other stocks. Vote “Outperform” if you believe ZS will outperform the S&P 500 over the long term. Vote “Underperform” if you believe ZS will underperform the S&P 500 over the long term.

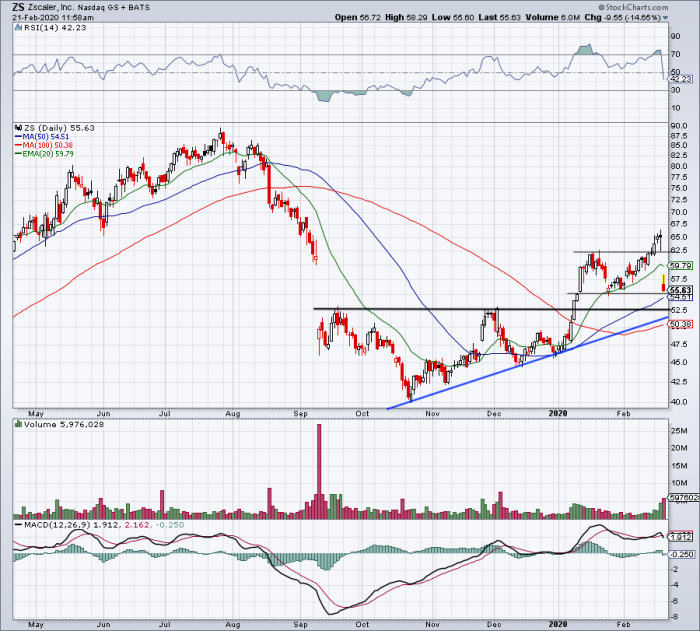

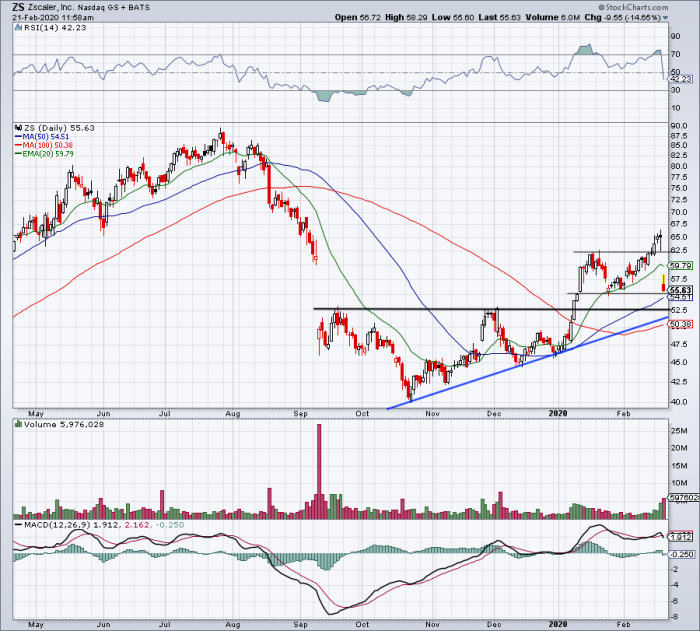

Is ZS likely to bottom on its long-term chart?

We observed that ZS had held its May lows resiliently over the past two months. Therefore, we believe its price action is constructive and looks increasingly likely to bottom on its long-term chart, which is potent.

See more

Is zscaler a buy now?

Zscaler has received a consensus rating of Buy. The company's average rating score is 2.73, and is based on 23 buy ratings, 6 hold ratings, and 1 sell rating.

Is zscaler stock overvalued?

An overvalued stock has a current price that is not justified by its earnings outlook, typically assessed by its P/E ratio. A company is considered overvalued if it trades at a rate that is unjustifiably and significantly in excess of its peers.

Is zscaler a buy Zacks?

The Zacks database contains over 10,000 stocks. All of those stocks are classified into three groups: Sector, M Industry and X Industry....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

What is the target price for Okta stock?

Stock Price Target OKTAHigh$174.00Median$140.00Low$94.00Average$141.32Current Price$98.40

What is the most shorted stock?

Most Shorted StocksSymbol SymbolCompany NameFloat Shorted (%)BBBY BBBYBed Bath & Beyond Inc.35.01%BGFV BGFVBig 5 Sporting Goods Corp.34.13%SRG SRGSeritage Growth Properties Cl A33.83%MGI MGIMoneyGram International Inc.33.25%42 more rows

What are the best stocks to short?

Stocks with the most short sell positions as of June 2022, by share of float shortedStock exchange: tickerShare of float shortedHeron Theraoeutics Inc. (NASDAQ: HRTX)47%Cryptyde Inc. (NASDAQ: TYDE)42.8%Beyond Meat Inc. (NASDAQ: BYND)42.36%MicroVision Inc. (NASDAQ: MVIS)41.67%9 more rows•Jul 14, 2022

Is Paypal a buy Zacks?

How good is it? See rankings and related performance below. The VGM Score are a complementary set of indicators to use alongside the Zacks Rank....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return2Buy18.15%3Hold9.70%4Sell5.35%5Strong Sell2.45%2 more rows

Is Google stock a buy Zacks?

Zacks' proprietary data indicates that Alphabet Inc. is currently rated as a Zacks Rank 3 and we are expecting an inline return from the GOOGL shares relative to the market in the next few months.

What is PE in zscaler?

About PE Ratio (TTM) Zscaler, Inc. has a trailing-twelve-months P/E of 282.33X compared to the Internet - Services industry's P/E of 17.18X. Price to Earnings Ratio or P/E is price / earnings. It is the most commonly used metric for determining a company's value relative to its earnings.

Is OKTA a Buy Sell or Hold?

Okta has received a consensus rating of Buy. The company's average rating score is 2.74, and is based on 20 buy ratings, 7 hold ratings, and no sell ratings.

Is Okta undervalued?

Is Okta Stock Undervalued? The current Okta [OKTA] share price is $99.14. The Score for OKTA is 42, which is 16% below its historic median score of 50, and infers higher risk than normal. OKTA is currently trading in the 40-50% percentile range relative to its historical Stock Score levels.

What is the price target for Docusign?

Stock Price TargetsHigh$151.00Median$70.00Low$50.00Average$75.77Current Price$60.23

Is zscaler a good stock to buy?

Zscaler has generated resilient growth rates at high octane levels. The stock is priced for strong returns over the next few years.

Who are zscaler competitors?

Top Zscaler AlternativesCisco.Broadcom (Symantec)Palo Alto Networks.Forcepoint.Netskope.Microsoft.Akamai.Barracuda.

Is zscaler a good company to work for?

Zscaler Softech is rated 4.1 out of 5, based on 110 reviews by employees on AmbitionBox. Zscaler Softech is known for Job Security which is rated at the top and given a rating of 4.2.

Is SentinelOne a public company?

It went public at $35 per share, and its initial valuation of $8.9 billion topped CrowdStrike's $6.7 billion market debut in 2019. Its stock started trading at $46 a share and eventually hit an all-time high of $78.53 last November. But today, SentinelOne's stock trades right around its IPO price.

What is Zscaler's consensus rating and price target?

According to the issued ratings of 31 analysts in the last year, the consensus rating for Zscaler stock is Buy based on the current 1 sell rating,...

Do Wall Street analysts like Zscaler more than its competitors?

Analysts like Zscaler stock more than the stock of other Computer and Technology companies. The consensus rating score for Zscaler is 2.77 while th...

Do MarketBeat users like Zscaler more than its competitors?

MarketBeat users like Zscaler stock less than the stock of other Computer and Technology companies. 66.49% of MarketBeat users gave Zscaler an outp...

Does Zscaler's stock price have much upside?

According to analysts, Zscaler's stock has a predicted upside of 24.27% based on their 12-month price targets.

What analysts cover Zscaler?

Zscaler has been rated by Barclays , BMO Capital Markets , BTIG Research , Canaccord Genuity Group , Citigroup , Cowen , Cowen , Credit Sui...

Zscaler (NASDAQ:ZS) Price Target and Consensus Rating

MarketBeat calculates consensus analyst ratings for stocks using the most recent rating from each Wall Street analyst that has rated a stock within the last twelve months. Each analyst's rating is normalized to a standardized rating score of 1 (sell), 2 (hold), 3 (buy) or 4 (strong buy).

Analyst Price Target Consensus

Sign-up to receive the latest news and ratings for ZS and its competitors with MarketBeat's FREE daily newsletter.

Analyst Ratings By Month

The chart below shows how a company's ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green.

Average Share Price and Price Target by Month

The chart below shows how a company's share price and consensus price target have changed over time. The dark blue line represents the company's actual price. The lighter blue line represents the stock's consensus price target.

Zscaler (NASDAQ:ZS) Analyst Ratings Frequently Asked Questions

According to the issued ratings of 28 analysts in the last year, the consensus rating for Zscaler stock is Buy based on the current 2 sell ratings, 4 hold ratings and 22 buy ratings for ZS. The average twelve-month price target for Zscaler is $356.33 with a high price target of $439.00 and a low price target of $235.00.

Stock Price Forecast

The 32 analysts offering 12-month price forecasts for Zscaler Inc have a median target of 363.00, with a high estimate of 500.00 and a low estimate of 286.00. The median estimate represents a +42.30% increase from the last price of 255.09.

Analyst Recommendations

The current consensus among 35 polled investment analysts is to Buy stock in Zscaler Inc. This rating has held steady since February, when it was unchanged from a Buy rating. Move your mouse over past months for detail

Release

- Zscaler is scheduled to release their next quarterly earnings announcement on Thursday, May 30th 2019. View Earnings Estimates for Zscaler.

Sales

- Zscaler updated its FY 2019 earnings guidance on Thursday, February, 28th. The company provided earnings per share guidance of $0.11-0.13 for the period, compared to the Thomson Reuters consensus earnings per share estimate of $-0.02. The company issued revenue guidance of $289-291 million, compared to the consensus revenue estimate of $271.87 million.Zscaler al…

Ratings

- 12 Wall Street analysts have issued \"buy,\" \"hold,\" and \"sell\" ratings for Zscaler in the last year. There are currently 1 sell rating, 6 hold ratings, 4 buy ratings and 1 strong buy rating for the stock, resulting in a consensus recommendation of \"Hold.\" View Analyst Ratings for Zscaler. News articles about ZS stock have been trending positive on Monday, according to InfoTrie Sentiment…

Funding

- (ZS) raised $110 million in an IPO on Friday, March 16th 2018. The company issued 10,000,000 shares at a price of $10.00-$12.00 per share. Morgan Stanley and Goldman Sachs acted as the underwriters for the IPO and BofA Merrill Lynch, Barclays, Deutsche, Credit Suisse, UBS Securities, Baird, BTIG and Needham, Stephens were co-managers.

Ownership

- Zscaler's stock is owned by many different of retail and institutional investors. Top institutional shareholders include BlackRock Inc. (2.98%), JPMorgan Chase & Co. (0.87%), First Trust Advisors LP (0.47%), First Republic Investment Management Inc. (0.36%), Artisan Partners Limited Partnership (0.33%) and Spark Investment Management LLC (0.25%). Company insiders that ow…

Business

- Zscaler has a market capitalization of $8.60 billion and generates $190.17 million in revenue each year. The company earns $-33,640,000.00 in net income (profit) each year or ($0.31) on an earnings per share basis. Zscaler employs 1,050 workers across the globe.

Location

- Zscaler's mailing address is 110 ROSE ORCHARD WAY, SAN JOSE CA, 95134. The company can be reached via phone at 408-533-0288 or via email at [email protected].