Low-volume stock trading can also be a result of local or global macroeconomic factors. A country may be going through a slowdown or recession with higher interest rates and inflation. Such periods often see overall low stock trading activity.

What does it mean when a stock starts trading at low volumes?

When a stock begins irregularly trading at low volumes, it's usually a warning sign: proceed with caution. Low-volume stocks may express trading volatility, market uncertainty or a liquidity risk.

What are the potential risks of low trading volume?

Potential for increased volatility: Lower trading volume can make stock share prices more sensitive to volatility. In other words, you’re more likely to see substantial price swings with a stock that’s traded less frequently versus one that’s regularly trading hundreds of thousands of shares per day.

What is trading volume and how does it affect your trading?

There are a few ways that trading volume can help with evaluating stocks and broader market trends as a whole. For example, tracking volume can help you get a sense of where the market is going collectively. If the volume is on the increase overall, you can go deeper to analyze what’s driving higher trading activity.

What is the difference between high volume and low volume stocks?

Meanwhile, low volume stocks are more thinly traded. There’s no specific dividing line between the two. Howerver, high volume stocks typically trade at a volume of 500,000 or more shares per day. Low volume stocks would be below that mark.

What does it mean when a stock trades low volume?

Low volume means there are fewer shares trading, and fewer shares means less liquidity across the broad market. Stock price volatility rises in a low volume market. Trading huge blocks of stock in an illiquid market can cause significant changes in the prices of those stocks.

Can you trade low volume stocks?

Trading in low-volume stocks can be very risky. Low-volume stocks typically have a daily average trading volume of 1,000 shares or fewer. They may belong to small, little-known companies that trade over-the-counter (OTC). But they can also be traded on major stock exchanges.

Is it bad if a stock has low volume?

Stocks with low volumes can be difficult to sell because there may be little buying interest. Additionally, low-volume stocks can be quite volatile because the spread between the ask and bid price tends to be wider. Stocks with a high volume and a rising price are generally easier to sell at a desirable price.

Is low volume bullish?

Down volume indicates bearish trading, while up volume indicates bullish trading.

How important is volume in trading?

This is the importance of “volume”. Traders do not buy the stock unless it breaks a critical level and unless the volume is high. If the stock goes down with little then it also means the same thing.

Should you buy stocks with low volume?

The reality is that low-volume stocks are usually not trading for a very good reason—few people want them. Their lack of liquidity makes them hard to sell even if the stock appreciates. They are also susceptible to price manipulation and attractive to scammers.

Does low volume mean high volatility?

Low Volatility Stocks Also, stocks that trade at very low volumes, which are far less liquid than those with higher average volumes, can have higher volatility than their higher-volume counterparts.

Is high or low volume good for stocks?

If you see a stock that's appreciating on high volume, it's more likely to be a sustainable move. If you see a stock that's appreciating on low volume, it could be a dead cat bounce. Logically, when more money is moving a stock price, it means there is more demand for that stock.

Why is low volume stock trading difficult?

1. Low Liquidity Makes Trading Difficult. One risk of low-volume stocks is that they lack liquidity, which is a crucial consideration for stock traders. Liquidity is the ability to quickly buy or sell a security in the market without a change in price. That means traders should be able to buy and sell a stock that is trading at $25 per share in ...

Why do traders lose money?

As a general rule, frequent traders often lose money when liquidity is low. 2. Challenges in Profit Taking. Lack of trading volume indicates interest from only a few market participants, who can then command a premium for trading such stocks.

What is manipulative market maker?

Manipulative Market Makers. Market makers active in low-volume stocks can use low liquidity to profit. They are aware that the stock's low liquidity means they can take advantage of buyers who are eager to get in and out of the market.

Who is Shobhit Seth?

Follow Twitter. Shobhit Seth is a freelance writer and an expert on commodities, stocks, alternative investments, cryptocurrency, as well as market and company news. In addition to being a derivatives trader and consultant, Shobhit has over 17 years of experience as a product manager and is the owner of FuturesOptionsETC.com.

What does a manipulator do?

All a manipulator needs to do is execute a few carefully timed trades to create the illusion that a stock is moving so he can get others to buy or sell. The goal is to raise the price if he wants to sell and to lower the price if he wants to buy.

What does it mean when a stock starts trading at low volumes?

When a stock begins irregularly trading at low volumes, it's usually a warning sign: proceed with caution. Low-volume stocks may express trading volatility, market uncertainty or a liquidity risk.

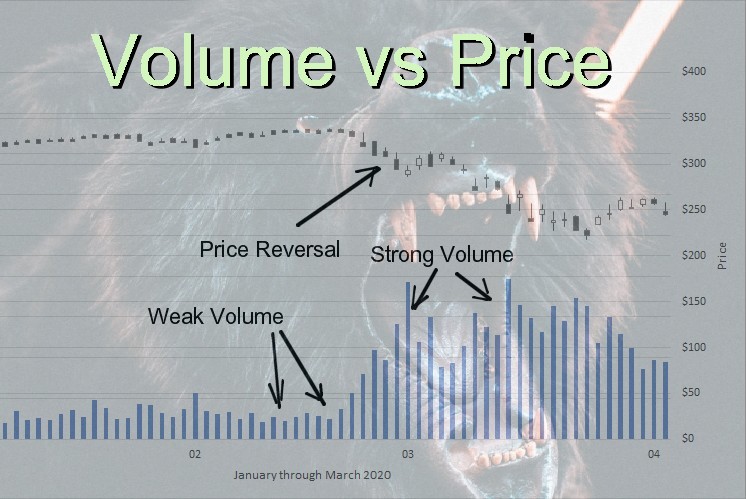

What does price action mean?

Price action reflects investor sentiment. If a stock is rising, investors are eager to buy; if it is falling, investors are eager to sell. But for a move to be valid, the stock price action must be confirmed by volume. As technicians say, volume goes with the trend. Volume shows how much conviction investors have in a trend.

What does volume mean in stock trading?

What Does Volume Mean When Trading Stocks? A stock's trade volume represents the total number of shares or contracts that are traded for a specific security during a specific time period. A stock's volume is high when its securities are more actively trading and, conversely, a stock's volume is low when its securities are less actively trading.

Who is Slav Fedorov?

He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. Now working as a professional trader, Fedorov is also the founder of a stock-picking company.

What is trading volume?

Trading volume is a simple indicator that can have a big impact on helping you choose potential trades. By taking the time to consider the trading volume of a stock as part of your research, you’ll be better able to narrow down your choices and choose the investments that are best suited to your trading style.

Why is a stock with high volume more likely to be a stable investment?

A stock with higher volume is far more likely to provide a stable investment. A stock that is appreciating value but has low volume could be a sign that the trend won’t continue or that demand isn’t as high as the price might make it seem at the moment.

What does it mean when a stock is gaining volume?

So, if a stock appears to be gaining in volume, this can be a sign that it’s poised to increase in price as well. This works in the opposite direction, too: If the volume is decreasing, the price often follows suit.

Is it safe to trade high volume stocks?

The thing is, the volume of a stock will give you an indication of the ease of entry and exit in a trade. With a high-volume stock, you can feel fairly safe in that you’ll be able to get out of your position without too much trouble. A low-volume stock, on the other hand, can provide more resistance in this regard.

What does it mean when a stock is rising?

When a stock is rising, it indicates strength. Investors can make an assessment of how convicted traders are about a particular stock, or the market in general. High volumes indicate a strong conviction with the direction in which the stock or market is moving.

Why does the price of a stock fall when everyone buys it?

However, when everyone has bought a stock, the price stagnates and then falls because the market has exhausted all buyers interested in the stock. On the other hand, when a stock has bottomed out, many investors have been forced out by the falling price, causing high volumes and increased volatility.

What is a bullish indicator?

A key bullish indicator is when a stock price is falling but volume is increasing, ahead of a share price rebound, followed by another decline. If the stock price doesn't fall below the previous low when it declines the second time, and volume is down during that second decline, it is usually a bullish indicator.

What is volume price trend indicator?

The volume price trend indicator helps investors figure out the direction of a stock and the strength of changes in the price.

What does it mean when a stock has a high volume?

When a stock has an unusually high volume, it means something is going on with the company that investors should probably know about.

Why do investors use volume information?

Investors can use volume information to assist in their determination of whether a stock would be good for their portfolio.

What is volume in stock?

Volume is the number of shares of a stock that have changed hands over a certain period of time. Stocks with higher volumes have more investors interested in buying or selling them.

How does volume help in trading?

There are a few ways that trading volume can help with evaluating stocks and broader market trends as a whole. For example, tracking volume can help you get a sense of where the market is going collectively. If the volume is on the increase overall, you can go deeper to analyze what’s driving higher trading activity.

How much volume do high volume stocks trade?

Howerver, high volume stocks typically trade at a volume of 500,000 or more shares per day. Low volume stocks would be below that mark. Pros and cons of trading high volume stocks. Minimize volatility: By nature, a stock that’s trading at a higher volume may be less volatile.

Why does volume pick up?

For example, trading volume may pick up if political or economic fears trigger a sell-off. On the other hand, if volume increases along with prices then that may signal a strong market. High Volume Stocks and Low Volume Stocks. Stocks can be categorized as high volume or low volume, based on their trading activity.

What is trading volume?

Trading volume is a way to measure how often a security trades over a set period of time. Traders often measure volume on a daily basis. But they also measure trading volume over shorter or longer time frames. For example, you might analyze trading volume over the previous 30 days or year to date.

Does trading volume help with false breakouts?

If the higher price holds, a breakout may follow. Trading volume can also help you pinpoint potentially false breakouts when a stock is signaling that it’ s share price is about to increase but it actually isn’t. The Bottom Line. Trading volume is just one way to evaluate stocks when deciding whether to buy or sell.

What is a put/call ratio?

A volume indicator that uses options volume is called the put/call ratio. The ratio is an indicator that shows put volume relative to call volume. Puts are generally used to hedge adverse changes to the price of a stock. Calls are used to mitigate the risk of advancing stocks. The put/call ratio is often used as a market sentiment indicator.

What does high volume mean?

High levels of volume generally reflect stronger levels of liquidity. When volume declines substantially liquidity also falls. You can formulate certain studies that will describe the momentum of volume and use that in conjunction with price to determine future price changes.

What does it mean when volume declines?

Trade volume and liquidity are considered interrelated. When volume declines it indicates a low overall market interest in that particular security.

How to calculate relative volume?

The relative volume ratio is calculated by taking today’s volume and dividing by a prior day’s volume or the average of a few days.

What does volume mean in trading?

Volume can describe pieces of information that cannot be relayed by price. Since trading volume is the number of shares traded during a given period it indicates the overall activity of a stock. What is important to determine is whether the volume is average volume, low volume, or heavy volume relative to previous trading periods.

What does it mean when prices rise on low volume?

Generally, when prices rise or fall on heavy volume, it’s a telltale sign that prices are poised to move in the direction of the trend.

What is volume used for?

Volume when used along with price can help you determine the future direction of a stock. Several indicators incorporate volume as a trading indicator. One of the most popular is the Relative Volume ratio.

Why is tracking volume important?

For example, tracking volume can help you get a sense of where the market is going collectively. If the volume is on the increase overall , you can go deeper to analyze what’s driving higher trading activity. Specifically, you’d want to look at how prices are moving in connection with trading volume.

When determining which stocks to invest in consider trading volum among your criteria?

When determining which stocks to invest in consider trading volum among your criteria. For example, you might decide to focus on high volume stocks. You may prefer lower volume when making investment decisions. Tracking stock volumes can help you choose what to buy (or sell) in your portfolio.

What is high volume stock?

Meanwhile, low volume stocks are more thinly traded. There’s no specific dividing line between the two. Howerver, high volume stocks typically trade at a volume of 500,000 or more shares per day.

What is trading volume?

Trading volume is a way to measure how often a security trades over a set period of time. Traders often measure volume on a daily basis. But they also measure trading volume over shorter or longer time frames. For example, you might analyze trading volume over the previous 30 days or year to date. There are two sides to trading volume transactions: ...

What is a narrow spread in stocks?

Narrow spreads: High volume stocks tend to have a much closer gap between the bid price and ask price. A buyer prepares to pay a bid price, while the seller sets an ask price. Smaller spreads can translate to more buying and selling opportunities for investors.

Can value investors capitalize on undervalued stocks?

Value investors, for example, may capitalize on undervalued stocks . Those stocks may increase in value over the long-term. Growth investors could similarly find an opportunity to purchase an inexpensive stock that’s on its way up.

Does volume affect stock price?

Volume has a correlation to a stock’s price: Trading activity can fluctuate as share prices increase or decrease. For example, trading volume may pick up if political or economic fears trigger a sell-off. On the other hand, if volume increases along with prices then that may signal a strong market.

What's Your Approach?

- Before venturing into low-volume stocks, decide on an approach. Are you in it for short-term trading gains or are you investing long-term in a little-known company that you believe in? Short-term traders can quickly reap profits from the sporadic price movements of low-volume stocks. …

Individual Profile

- Consider assuming the market-maker role with thinly tradedstocks where there are few or none at all. Remember that a market-maker selects one (or two) stocks and offers to buy and sell them by quoting bid and ask price. As such, this individual facilitates both buying and selling to maintain liquidity. In this role, the trader can take advantage of low liquidity by offering wide bid-ask sprea…

Multibagger Potential

- Microsoft (MSFT), Infosys (INFY) may be huge names today. But at one point, their stocks weren't that well-known and traded at very low volumes. Investors who managed to pick them young either through luck or robust stock analysis were able to multiply their investments many times. In other words, they picked what some in the financial industry call multibaggers. The term multiba…

Benefits from Corporate Actions

- Not all stocks have a low trading volume because of their popularity. In fact, some stocks may trade this way because of their very high stock price. For instance, Berkshire Hathaway’s Class A stocks (BRK-A) trade at the astounding price of $214,675 per share. The average trading volume is only 320 shares per day. Seaboard (SEB) trades at $3,750 per share with an average daily volu…

Temporary Events and Phases

- The uncertainty around major events such as political upsets, strife, or extreme weather can be an opportunity to benefit from low-volume stocks. In 2004, India’s general election results were accompanied by a major drop in stock prices when a coalition backed by Communist parties was the only available option for government formation.2 Investorswho picked up stocks on doomsd…

Benefit from Overall Market Rise

- As the saying goes, "when markets rise, everyone makes money." The overall marketrise may be a result of stable government, easing oil prices, and other local or global developments. In cases of such an overall market rise, low-volume stocks often stand to benefit the most.

Exchange-Driven Changes

- Exchange-imposed changes or initiatives have the potential to shoot up the returns from thinly traded stocks, offering substantial profit opportunities to risk-favoring investors. For instance, Bats Global Market, one of the largest stock exchanges in the United States, put forth a proposal to concentrate low-volume stocks on fewer exchanges.3A move like this could possibly increas…

The Bottom Line

- Trading low-volume stocks is a risky game. Potential benefits are subject to many factors outside the investor’s control. The best bet for an investor is to take a long-term perspective—invest with excess money that you may not need and select stocks that have good business potential.