What happened to my DryShips stock?

DryShips (NASDAQ:DRYS) announces that the acquisition of the company by SPII Holdings has been completed. The company is now effectively owned by Chairman/CEO George Economou.Oct 11, 2019

What happened to $drys?

DryShips Inc. DryShips Inc is a dry bulk shipping company based in Athens, Greece. It is a Marshall Islands corporation, formed in 2004. On October 11, 2019, it was taken private by CEO and Chairman George Economou.

What is DryShips stock?

Key Turning Points52-Week High7.22Last Price5.24Fibonacci 50%5.15Fibonacci 38.2%4.6652-Week Low3.081 more row•Oct 10, 2019

Is drys publicly traded?

DryShips trades on the NASDAQ under the ticker symbol "DRYS."

What happened

Shipping stocks are going haywire. Yesterday, shares of dry bulk shipper DryShips ( NASDAQ:DRYS) jumped 70%. They're still locked as of 11 a.m. EST (but expected to jump as soon as trading resumes).

So what

At first glance, all of this kind of makes sense. After all, ever since Donald Trump became president-elect, the Baltic Dry Index (BDI) -- which reflects relative pricing strength that dry bulk shippers are able to charge for shipping goods across the ocean -- has been climbing. At today's new high of 1,084, it's up 19% from pre-election levels.

Now what

All this being said, there's more than just excitement over good news going on here. In fact, I'd venture to say that some investors may be veering into irrational-exuberance territory. Case in point: One of the strongest gainers today was Diana Containerships ( NASDAQ:DCIX), up 250%.

An insurmountable wave of dilution washed over this shipping stock last year

Matthew is a senior energy and materials specialist with The Motley Fool. He graduated from Liberty University with a degree in Biblical Studies and a Masters of Business Administration. You can follow him on Twitter for the latest news and analysis of the energy and materials industries: Follow @matthewdilallo

What happened

Last year was an absolute disaster for investors in DryShips Inc. ( NASDAQ:DRYS). While the dry bulk shipping company staved off bankruptcy, that still didn't stop the stock from shedding nearly its entire value last year. Here's a look back at why shares plunged so deeply in 2017.

So what

DryShips entered 2017 with a sense of optimism after securing a comprehensive strategic repositioning transaction with its founder at the end of 2016.

Now what

DryShips made one thing clear last year: It cared more about growing its fleet than creating value for investors. Thus, investors should steer clear of this stock even if it has since ended its dilutive ways.

Series E-1 Convertible Preferred Shares

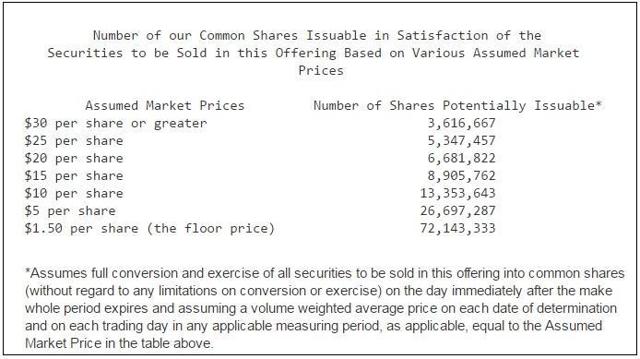

DryShips intends to sell Kalani 20,000 of these shares, for which DryShips admits "there is no established public trading market" and which the company says "will not be listed on any national securities exchange." In exchange, the company will receive "approximately $20 million."

Series E-1 Preferred Warrants

It gets worse. In tandem with its purchase of the convertible preferred stock, Kalani will acquire the right to buy an additional 30,000 Series E-1 preferred shares at the same price it paid for the initial tranche -- $1,000 apiece -- then convert them to common stock as described above, adding to the dilution.

Series E-2 Convertible Preferred Shares

Likewise, Kalani gets warrants to buy 50,000 Series E-2 preferred shares at $1,000 each. Like the Series E-1s, these are also convertible into common stock, but according to a slightly different formula.

Common warrants

Finally, Kalani can exercise warrants to buy 372,874 common shares, paying "no consideration" for the privilege.

Complexity for its own sake

If you do, too, there's probably a reason for that. When a company's management "explains" a stock issuance plan in a manner as convoluted as the one DryShips has just settled upon, historically, they may have been counting on people getting confused. But here's the upshot:

What it means to investors

So what's the upshot? I could be wrong, but it looks to me like we're seeing a wholesale transfer of DryShips' equity to Kalani -- a company so mysterious that even S&P Global Market Intelligence has almost no data on it other than the fact of its existence.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

What happened

Shares of shipping company DryShips (NASDAQ: DRYS) fell roughly 11% in the first month of the new year, according to data provided by S&P Global Market Intelligence. That, however, doesn't actually capture the full drop the stock experienced, because DryShips started January 2019 off with a nearly 20% rally.

So what

There is some less-than-compelling history behind DryShips that includes massive shareholder dilution and an almost complete loss of the stock's value over the trailing-three-year period. To get it out of the way pretty quickly, most investors should probably avoid the stock. That said, the shares gained a huge 60% in 2018.

Now what

At the end of the day, the January decline shouldn't come as any surprise given the volatile industry in which DryShips operates. However, the story here is so much bigger. DryShips has far more worrisome problems (like the massive shareholder dilution noted above) than just a price drop in January.