Why has Pfizer stock floundered?

Pfizer chief corporate affairs chief Sally Sussman shares lessons from how the company responded to the global pandemic. INC. TODAY'S MUST READS: New Research: Status Reports Can Make Teams Less Effective INC. TODAY'S MUST READS: How to Stay Innovative ...

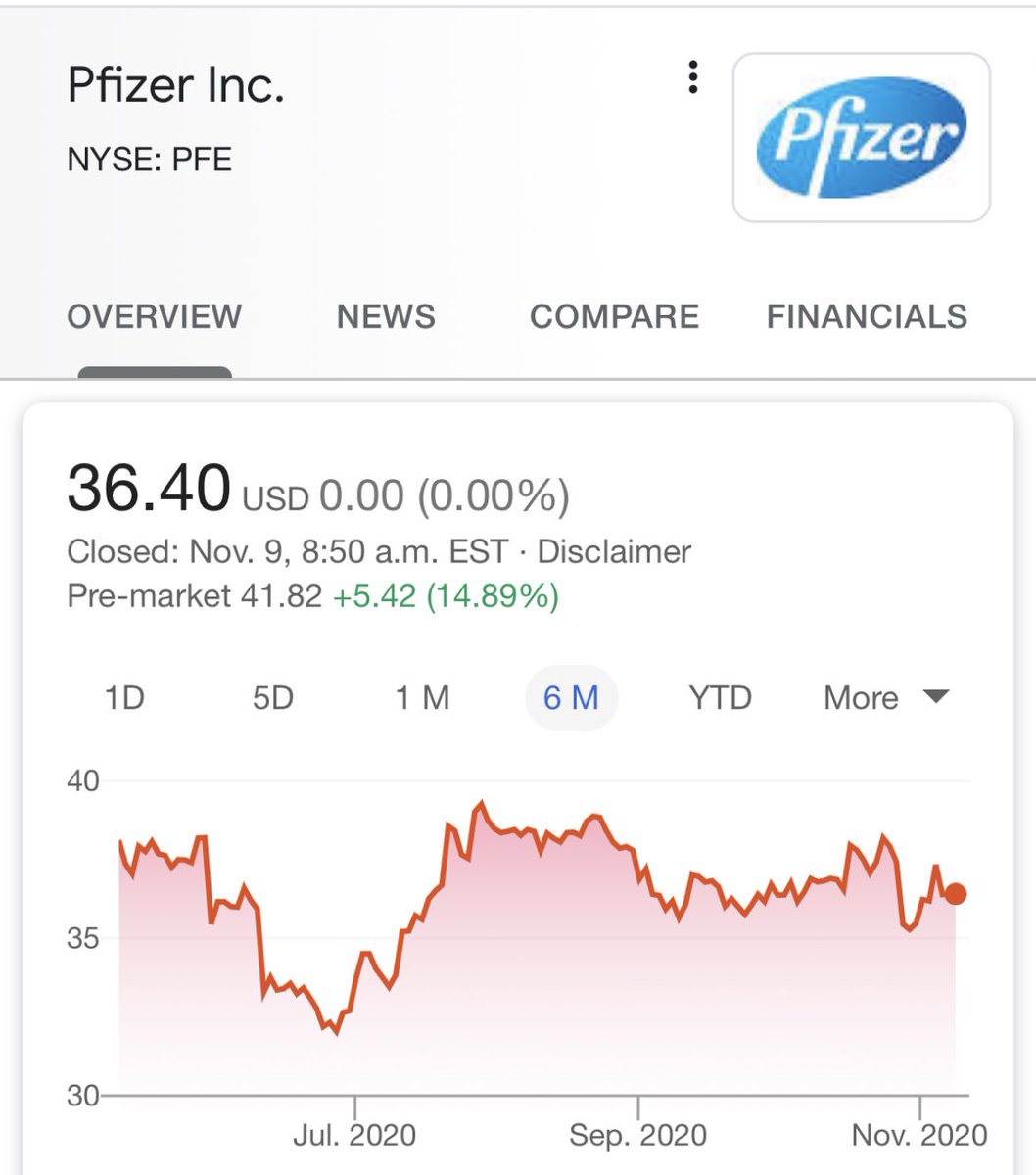

Is Pfizer stock going up?

REUTERS/Stephane Mahe PARIS, Sept 28 (Reuters) - French vaccine company Valneva (VLS.PA) and U.S. drugmaker Pfizer (PFE.N) announced on Tuesday more positive Phase 2 results, including on the booster response, for their Lyme disease vaccine candidate VLA15.

Should I buy Pfizer Inc. (PFE)?

Pfizer Inc. (NYSE:PFE) released its full-year results, but the market seems to be already pricing-in a decline. Shares are down 4.4% to US$51.5 in the past week, and the stock is currently in the red. Markets are forward-looking, and the price decline ...

Why did Pfizer acquire Hospira?

Pfizer and Hospira have entered into a definitive merger agreement under which Pfizer will acquire Hospira, a leading provider of injectable drugs and infusion technologies and a global leader in biosimilars, for approximately US$17bn. The Boards of Directors of both companies have unanimously approved the merger. 'Hospira’s business aligns well with our new commercial structure and is an excellent strategic fit for our Global Established Pharmaceutical (GEP) business, which will benefit ...

Is this a good time to buy Pfizer stock?

Based on CAN SLIM rules of investing, PFE stock isn't a buy right now. It's consolidating, but shares have yet to break out. Investors are encouraged to buy a stock when it rises above and is within 5% of its entry.

Why is Pfizer stock down today 2019?

What happened. Shares of Pfizer (PFE -0.15%) were sliding 3.1% lower as of 12:54 p.m. ET on Monday. The decline came after the big drugmaker announced that it is discontinuing the clinical development of vupanorsen. Pfizer licensed the experimental drug from Ionis Pharmaceuticals (IONS 2.67%) in November 2019.

Is Pfizer Buy Sell or Hold?

Pfizer has received a consensus rating of Hold. The company's average rating score is 2.47, and is based on 9 buy ratings, 10 hold ratings, and no sell ratings.

Did Pfizer split their stock?

PFE's 6th split took place on November 17, 2020. This was a 1054 for 1000 split, meaning for each 1000 shares of PFE owned pre-split, the shareholder now owned 1054 shares. For example, a 48000 share position pre-split, became a 50592 share position following the split.

What is the target price for Pfizer?

The 20 analysts offering 12-month price forecasts for Pfizer Inc have a median target of 55.00, with a high estimate of 75.00 and a low estimate of 49.00.

Who owns Pfizer stock?

The top shareholders of Pfizer are Frank A. D'amelio, John Douglas Young, Mikael Dolsten, Vanguard Group Inc., BlackRock Inc. (BLK), and State Street Corp.

Is PFE oversold?

The resulting PFE RSI is a value that measures momentum, oscillating between "oversold" and "overbought" on a scale of zero to 100....SymbolPFELow51.13Prev. Close50.65Shares Out5.61BMarket Cap294.40B8 more rows

Is BioNTech stock a buy?

BioNTech has had an excellent 2021. 2022 and beyond will most likely not be this good, however. The company is very reliant on its COVID vax business today, but BNTX has some attractive pipeline candidates. For risk-hungry investors, BNTX might have value today.

Is Pfizer a buy Zacks?

This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. The VGM Score are a complementary set of indicators to use alongside the Zacks Rank....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return4Sell5.79%5Strong Sell2.83%S&P50011.24%3 more rows

Can I invest in Pfizer?

To buy Pfizer stock, you need to open a brokerage account. A broker serves as an intermediary between you and the stock market, facilitating the purchase and sales of securities like stocks and bonds. If you don't have a brokerage account yet, look for ones that have no trading fees and low investment minimums.

Why is Moderna stock dropping?

Moderna Inc.'s shares have dropped 50% this year as investors pulled back from Covid-19 healthcare stocks and staged a broader rotation out of growth names. The biotech firm fell 7.3% on Monday amid a broader market selloff and has erased $52 billion in value this year.

How often Pfizer pays dividends?

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 2.0. Our premium tools have predicted Pfizer Inc.

The pharma stock is moving in the opposite direction of the overall market

Keith began writing for the Fool in 2012 and focuses primarily on healthcare investing topics. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. Follow @keithspeights

Key Points

Pfizer's shares fell as the overall market rose after a pullback in recent days related to omicron concerns.

What happened

Shares of Pfizer ( NYSE:PFE) were sinking 4.4% as of 11:18 a.m. ET on Tuesday. The big drugmaker didn't report any new developments. Today's decline appears to be a by-product of the overall market rising after a pullback in recent days due to concerns about the spread of the coronavirus omicron variant.

So what

The reality is that little has changed in the expectations about the impact of the omicron variant since Monday when Pfizer's shares rose while many stocks were dropping. As such, little has changed about Pfizer's prospects. Today's move is probably more noise than anything else.

Now what

Investors will definitely want to monitor how the efficacy of Pfizer's vaccine with a booster dose fares against the omicron variant. If the efficacy wanes, it could lead to new orders for the omicron-specific vaccine version that Pfizer and BioNTech are developing.

What happened

Shares of several top COVID-19 vaccine makers were sinking on Tuesday. Pfizer (NYSE: PFE) stock was down 2.7% as of 11:09 a.m. EDT. Shares of Pfizer's partner, BioNTech (NASDAQ: BNTX), were falling 7%. Moderna (NASDAQ: MRNA) stock was tumbling 5.4%. Novavax (NASDAQ: NVAX) was the biggest loser with its shares declining 8.1%.

So what

It's really not all that surprising that these stocks would give up much of the gains from Monday. FDA approval for the Pfizer-BioNTech vaccine was fully expected.

Now what

Pfizer, BioNTech, and Moderna hope to win EUAs for their vaccines in younger children within the next few months. The companies also will pursue full FDA approvals in these age groups. Novavax plans to file for EUA of its COVID-19 vaccine in the fourth quarter, with submissions in the U.K. and Europe coming even sooner.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

What happened

Shares of several leading COVID-19 vaccine makers were falling as of 11:38 a.m. ET on Monday. Pfizer (NYSE: PFE) stock was down 3.5%. Shares of BioNTech (NASDAQ: BNTX) and Moderna (NASDAQ: MRNA) were sinking 7.6% and 8.2%, respectively.

So what

Investors should always look forward. And the number of COVID-19 vaccine doses sold by Pfizer, BioNTech, and Moderna could very well decline significantly after 2022 (or perhaps 2023).

Now what

Cuba Gooding, Jr.'s character in the movie Jerry Maguire had a famous line that seems applicable for Pfizer, BioNTech, and Moderna: "Show me the money." The main thing for investors to watch with all three companies is the money -- in particular, supply deals for COVID-19 vaccines for beyond 2022.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

NYSE: PFE

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

So what

Are today's declines warranted? It's hard to know for sure. What we can know with certainty, though, is that each of these companies is in a unique position relative to the others.

Now what

Investors seem to be betting that the omicron variant could signal the beginning of the end of the COVID-19 pandemic. That may or may not be a good bet at this point.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.