Who owns vertex energy stock?

Company insiders that own Vertex Energy stock include Christopher Allen Stratton, David L Phillips, John Noel Strickland, Michael A Mussallem and Timothy C Harvey. View institutional ownership trends for Vertex Energy. Which institutional investors are selling Vertex Energy stock?

What drove vertex Energy’s 31% rise in early trading on Tuesday?

Shares of Vertex Energy ( VTNR 9.47% ), a refiner that uses waste products like used motor oil as a feedstock, rose a huge 31% in early trading on Tuesday. Roughly two hours into the day, the stock was still near its highs, up approximately 28%.

What are analysts'price targets for vertex energy's shares?

3 Wall Street analysts have issued 12-month price objectives for Vertex Energy's shares. Their forecasts range from $13.00 to $18.00. On average, they anticipate Vertex Energy's share price to reach $15.00 in the next twelve months.

What does vertex energy's recovery segment include?

The Recovery segment includes a generator solutions company for the proper recovery and management of hydrocarbon streams as well as metals. The company was founded by Benjamin P. Cowart in 2001 and is headquartered in Houston, TX. Is Vertex Energy, Inc.'s (NASDAQ:VTNR) Shareholder Ownership Skewed Towards Insiders?

Will Vertex Energy stock go up?

The 4 analysts offering 12-month price forecasts for Vertex Energy Inc have a median target of 22.50, with a high estimate of 25.00 and a low estimate of 20.00. The median estimate represents a +89.39% increase from the last price of 11.88.

Is Vertex Energy a good buy?

Vertex Energy has received a consensus rating of Buy. The company's average rating score is 3.00, and is based on 3 buy ratings, no hold ratings, and no sell ratings.

Should I sell VTNR stock?

The consensus among 2 Wall Street analysts covering (NASDAQ: VTNR) stock is to Strong Buy VTNR stock.

Does Vertex Energy pay dividends?

VERTEX ENERGY (NASDAQ: VTNR) does not pay a dividend.

Is Vertex Energy undervalued?

PB vs Industry: VTNR is overvalued based on its Price-To-Book Ratio (8.6x) compared to the US Oil and Gas industry average (1.8x).

What does Vertex Energy do?

(NASDAQ: VTNR) is an energy transition company focused on the production and distribution of conventional and alternative fuels. Vertex owns a 91,000 barrel-per-day refinery in Mobile (AL) and more than 3.2 million barrels of product storage, positioning it as a leading supplier of fuels in the region.

Who owns VTNR stock?

Top 10 Owners of Vertex Energy IncStockholderStakeShares ownedAventail Capital Group LP3.72%2,402,902Trellus Management Co. LLC3.29%2,126,076The Vanguard Group, Inc.3.06%1,979,062D. E. Shaw & Co. LP2.83%1,830,4616 more rows

Should I buy or sell Vertex Energy stock right now?

3 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Vertex Energy in the last twelve months. There are curre...

What is Vertex Energy's stock price forecast for 2022?

3 brokers have issued 1-year price objectives for Vertex Energy's stock. Their forecasts range from $18.00 to $21.50. On average, they predict Vert...

How has Vertex Energy's stock performed in 2022?

Vertex Energy's stock was trading at $4.53 on January 1st, 2022. Since then, VTNR stock has increased by 254.3% and is now trading at $16.05. View...

When is Vertex Energy's next earnings date?

Vertex Energy is scheduled to release its next quarterly earnings announcement on Tuesday, August 9th 2022. View our earnings forecast for Vertex...

How were Vertex Energy's earnings last quarter?

Vertex Energy, Inc. (NASDAQ:VTNR) issued its quarterly earnings data on Tuesday, May, 10th. The industrial products company reported $0.11 earnings...

Who are Vertex Energy's key executives?

Vertex Energy's management team includes the following people: Mr. Benjamin P. Cowart , Founder, Chairman, CEO & Pres (Age 53, Pay $610.86k) Mr....

Who are some of Vertex Energy's key competitors?

Some companies that are related to Vertex Energy include Sunoco (SUN) , Delek US (DK) , YPF Sociedad Anónima (YPF) , Calumet Specialty Products...

What other stocks do shareholders of Vertex Energy own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Vertex Energy investors own include Immunomedics (IMMU) ,...

What is Vertex Energy's stock symbol?

Vertex Energy trades on the NASDAQ under the ticker symbol "VTNR."

About Vertex Energy

Headlines

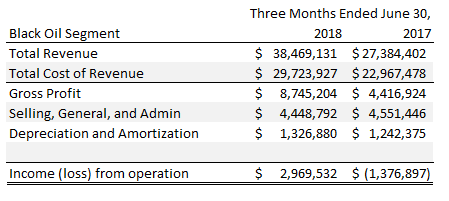

Vertex Energy, Inc. engages in the recycle of industrial waste streams and off-specification commercial chemical products. The firm focuses on the recycle of used motor oil and other petroleum by-products. It operates through the following segments: Black Oil, Refining and Marketing and Recovery.

Vertex Energy (NASDAQ:VTNR) Frequently Asked Questions

Thinking about buying stock in Palantir Technologies, Matterport, Fastly, Kinross Gold, or Vertex Energy?

What happened

3 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Vertex Energy in the last year. There are currently 3 buy ratings for the stock. The consensus among Wall Street research analysts is that investors should "buy" Vertex Energy stock. View analyst ratings for Vertex Energy or view top-rated stocks.

So what

Shares of Vertex Energy ( VTNR 5.20% ) rose in dramatic fashion on Tuesday, gaining as much as 34% in early trading. Although the stock quickly gave back some of that gain, by 10:46 a.m. EDT, it was still up by 22% or so.

NASDAQ: VTNR

On May 26, Vertex -- one of the largest processors of used motor oil in the United States -- agreed to buy a refinery in Mobile, Alabama, from Royal Dutch Shell. The following day, the stock rallied on that news, as it represents a material growth opportunity for Vertex. Two days later, an H.C.

Now what

The big story is that converting this refinery to produce renewable fuels will likely be cheaper than building a new refinery from the ground up. And that will position Vertex to prosper as the world shifts toward cleaner energy alternatives. It's worth noting that the upgrade at the end of last week from H.C.

Premium Investing Services

Clearly, investors' emotions are running high with regard to Vertex, though it should be noted that the energy sector has broadly benefited Tuesday from rising oil prices. Still, after such a large run-up in the share price over the last few days, long-term investors should probably tread with caution here.

Vertex Energy Announces Fourth Quarter And Full-year 2021 Results Conference Call Date

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Vertex Energy Announces 5-year Renewable Diesel Supply Agreement With Idemitsu Apollo Renewable Corporation

HOUSTON, TX / ACCESSWIRE / February 22, 2022 / Vertex Energy, Inc. (NASDAQ:VTNR) ("Vertex" or the "Company"), a leading specialty refiner and marketer of high-purity refined products, today announced that it will issue fourth quarter and full-year 2021 financial results before the market opens on Tuesday, March 8, 2022.

What is an X industry?

HOUSTON, TX / ACCESSWIRE / February 17, 2022/ Vertex Energy, Inc.

What is value scorecard?

The X Industry (aka Expanded Industry) is a subset of the M (Medium Sized) Industry, which is a subset of the larger Sector category, which is used to classify all of the stocks in the Zacks Universe. The Zacks database contains over 10,000 stocks.

What is a strong weekly advance?

The Value Scorecard identifies the stocks most likely to outperform based on its valuation metrics. This list of both classic and unconventional valuation items helps separate which stocks are overvalued, rightly lowly valued, and temporarily undervalued which are poised to move higher.

Is a B better than a C?

A strong weekly advance (especially when accompanied by increased volume) is a sought after metric for putting potential momentum stocks onto one's radar. Others will look for a pullback on the week as a good entry point, assuming the longer-term price changes (4 week, 12 weeks, etc.) are strong.

Does Zackstrade endorse or recommend investment strategies?

An A is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F. Value Score A. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B.