Full Answer

What happened to Tupperware's stock price?

The Orlando-based company (NYSE: TUP) lost 59.3% of its stock price during the trading period from $5.95 per share on Feb. 21 to $2.42 on March 3. Tupperware's stock price drop came during a generally tough period for public companies in Orlando and beyond.

How many insiders own Tupperware Brands (Tup)?

Only 2.19% of the stock of Tupperware Brands is held by insiders. 87.86% of the stock of Tupperware Brands is held by institutions. High institutional ownership can be a signal of strong market trust in this company. Earnings for Tupperware Brands are expected to decrease by -9.14% in the coming year, from $3.50 to $3.18 per share.

Is Tupperware Brands's PE ratio good or bad?

The P/E ratio of Tupperware Brands is 48.33, which means that it is trading at a more expensive P/E ratio than the market average P/E ratio of about 14.49. The P/E ratio of Tupperware Brands is 48.33, which means that it is trading at a more expensive P/E ratio than the Consumer Staples sector average P/E ratio of about 38.07.

Is there a class action lawsuit against Tupperware?

On Feb. 25, a class-action lawsuit on behalf of shareholders in California was filed against Tupperware, as well as current and former executives. The suit claims the company failed to disclosed it lacked internal controls and claimed members of the suit and the lead plaintiff suffered significant losses and damages.

Why did Tupperware stock drop today?

Tupperware's FridgeSmart Shares of Tupperware Brands plummeted Wednesday after the company posted an earnings miss and withdrew guidance for the year. Tupperware's (ticker: TUP ) net sales for the quarter decreased 16% year over year to $348.1 million, below estimates calling for $357 million, according to FactSet.

What is happening to Tupperware?

Tupperware reported first-quarter 2022 revenue of $348.1 million, down 16% from the same quarter of 2021. That number also missed the Wall Street consensus, which was just short of $357 million. On the bottom line Tupperware reported adjusted earnings per share of $0.12, down from $0.81 in the first quarter of 2021.

Will Tupperware stock go back up?

The 4 analysts offering 12-month price forecasts for Tupperware Brands Corp have a median target of 12.75, with a high estimate of 25.00 and a low estimate of 8.00. The median estimate represents a +101.26% increase from the last price of 6.34.

Is Tupperware a good investment?

Valuation metrics show that Tupperware Brands Corporation may be undervalued. Its Value Score of A indicates it would be a good pick for value investors. The financial health and growth prospects of TUP, demonstrate its potential to outperform the market. It currently has a Growth Score of C.

Does anyone sell Tupperware anymore?

Tupperware is still sold mostly through a party plan, with rewards for hosts and hostesses.

Did Tupperware go out of business?

Back in March, Tupperware — the iconic kitchenware brand that has sold plastic food containers since the 1950s — was facing down a dire future. In 2019, the company's sales slid by 13% — a particularly bleak number after a rocky few decades for the company. Then came the coronavirus, and everything changed.

Is Tupperware publicly traded?

Tupperware Brands is traded on the New York Stock Exchange under the symbol: TUP.

Is Tupperware undervalued?

Analysts give the company a range of $25-$43/share, with an average of $31.5, indicating an undervaluation of 60%.

How do I buy stock in Tupperware?

How to buy shares in Tupperware Brands CorporationCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. ... Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Is Tupperware still made in the USA?

Tupperware Home Parties Inc. of Orlando, Fla., confirmed that its items sold in the United States are made in the United States at three manufacturing facilities.

Who owns Tupperware now?

Tupperware Brands is not owned by hedge funds. BlackRock, Inc. is currently the company's largest shareholder with 15% of shares outstanding. FMR LLC is the second largest shareholder owning 15% of common stock, and The Vanguard Group, Inc. holds about 7.1% of the company stock.

Is Tupperware still sold in the UK?

Buy Direct with Tupperware® Select Tupperware® items are now available to buy direct online in the UK delivered right to your door. It's as simple as that.

Is Tupperware safe to use?

Most Tupperware products are made of LDPE or PP, and as such are considered safe for repeated use storing food items and cycling through the dishwasher. Most food storage products from Glad, Hefty, Ziploc and Saran also pass The Green Guide's muster for health safety.

Is Tupperware Brands a buy right now?

2 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Tupperware Brands in the last year. There are currently 2 hold ratings for...

When is Tupperware Brands' next earnings date?

Tupperware Brands is scheduled to release its next quarterly earnings announcement on Wednesday, August 3rd 2022. View our earnings forecast for T...

How were Tupperware Brands' earnings last quarter?

Tupperware Brands Co. (NYSE:TUP) announced its earnings results on Wednesday, May, 4th. The company reported $0.12 earnings per share (EPS) for the...

How will Tupperware Brands' stock buyback program work?

Tupperware Brands announced that its Board of Directors has approved a share buyback plan on Monday, June 21st 2021, which allows the company to re...

What guidance has Tupperware Brands issued on next quarter's earnings?

Tupperware Brands updated its FY 2022 earnings guidance on Wednesday, March, 16th. The company provided EPS guidance of $2.600-$3.200 for the perio...

What price target forecast have analysts set for TUP?

2 analysts have issued 12 month price targets for Tupperware Brands' stock. Their forecasts range from $13.00 to $13.00. On average, they expect Tu...

Who are Tupperware Brands' key executives?

Tupperware Brands' management team includes the following people: Mr. Miguel Angel Fernandez , Pres, CEO & Director (Age 50, Pay $2.43M) Mr. Ric...

What is Miguel Fernandez's approval rating as Tupperware Brands' CEO?

5 employees have rated Tupperware Brands CEO Miguel Fernandez on Glassdoor.com . Miguel Fernandez has an approval rating of 72% among Tupperware B...

Who are some of Tupperware Brands' key competitors?

Some companies that are related to Tupperware Brands include Latham Group (SWIM) , Myers Industries (MYE) , Karat Packaging (KRT) , Core Moldin...

When will Tupperware release its earnings?

Tupperware Brands is scheduled to release its next quarterly earnings announcement on Wednesday, August 4th 2021. View our earnings forecast for Tupperware Brands.

When is Tupperware earnings call?

Tupperware Brands will be holding an earnings conference call on Wednesday, August 4th at 8:30 AM Eastern. Interested parties can register for or listen to the call using this link.

How much does Tupperware make?

Tupperware Brands has a market capitalization of $1.02 billion and generates $1.74 billion in revenue each year. The company earns $112.20 million in net income (profit) each year or $2.24 on an earnings per share basis.

Shares of consumer products maker Tupperware got hit hard despite a year-over-year sales improvement. Here's why

Reuben Gregg Brewer believes dividends are a window into a company's soul. He tries to invest in good souls.

What happened

Shares of Tupperware Brands ( NYSE:TUP) fell dramatically in the first hour of trading on March 10, losing as much as 28% at one point. The driving force here was the company's earnings announcement.

So what

Tupperware, which makes the iconic plasticware of the same name, posted a revenue increase of 17% year over year in the fourth quarter of 2020. Adjusted earnings came in at $0.14 versus a loss of $0.63 in the same quarter of 2019. That's pretty positive, but investors were still not pleased.

Now what

Tupperware's fourth quarter wasn't terrible, but Wall Street doesn't like to be disappointed. So the stock sold off sharply. Still, there are reasons to be positive here, given the improved sales results. With stock volatility high, however, conservative investors might want to sit on the sidelines until the share action is less... exhilarating.

Who is the CEO of Tupperware?

Tupperware's struggles come as the company is looking for permanent executive leadership. The company’s board last fall appointed independent director O’Leary as interim CEO. Tupperware's future strategy is going to depend on the appointment of the new CEO, Lane said.

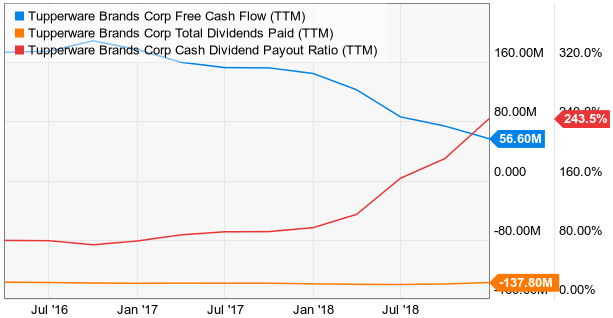

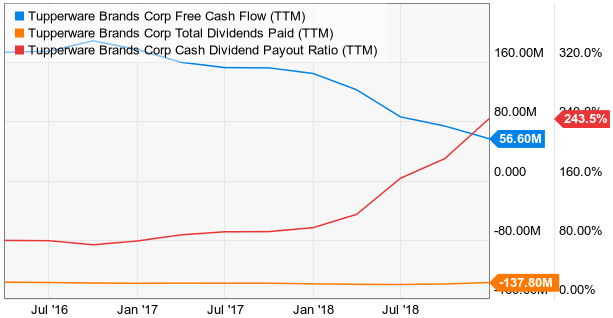

Does Tupperware pay dividends?

Tupperware previously had been known to pay dividends to shareholders “through thick and thin” in the past — but that changed after last year’s first quarter. The Orlando-based manufacturer and direct seller of food storage and other home products had shown several signs of shakiness in 2018, including falling revenue.