Where can I buy Trivago shares?

Shares of TRVG can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here. What is trivago's stock price today?

Can Trivago stock make a comeback in 2022?

While the market has mostly forgotten Trivago -- the stock barely moved on the report on Wednesday -- 2022 could mark a comeback for the banged-up travel stock. Here are three reasons why. Image source: Getty Images. 1.

What are analysts'price targets for Trivago's stock?

3 analysts have issued 12 month price objectives for Trivago's shares. Their predictions range from $5.00 to $6.00. On average, they expect Trivago's stock price to reach $5.50 in the next year.

Is Trivago a penny stock?

Trivago has been trading in penny stock range for several years now and has missed out on some of the recovery tailwinds that other travel stocks have gotten.

See more

Why is trivago stock so cheap?

Trivago significantly reduced its cost base over the last two years, laying off staff and slashing its office space. It's also made its marketing more efficient, and those steps should lead to wider profit margins as the travel sector bounces back.

Is Trivago a good stock to buy right now?

Trivago N.V. ADS is currently rated as a Zacks Rank 3 and we are expecting an inline return from the TRVG shares relative to the market in the next few months.

Is Trivago undervalued?

An Intrinsic Calculation For trivago N.V. (NASDAQ:TRVG) Suggests It's 35% Undervalued.

Is TRVG stock a buy?

The 8 analysts offering 12-month price forecasts for Trivago NV have a median target of 2.67, with a high estimate of 3.06 and a low estimate of 1.78. The median estimate represents a +51.98% increase from the last price of 1.76.

Will trivago go up?

Earnings for trivago are expected to grow by 83.33% in the coming year, from $0.06 to $0.11 per share.

What is trivago highest stock price?

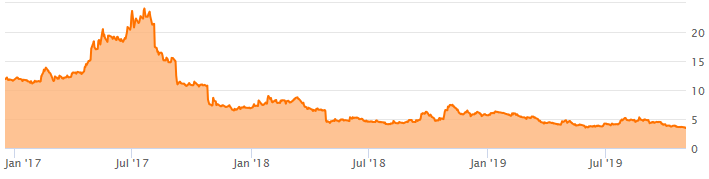

The all-time high Trivago ADS stock closing price was 24.07 on July 19, 2017. The Trivago ADS 52-week high stock price is 3.20, which is 110.5% above the current share price. The Trivago ADS 52-week low stock price is 1.45, which is 4.6% below the current share price.

3 Reasons Why Trivago Could Bounce Back in 2022

trivago N.V.'s (NASDAQ:TRVG) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Like most of the travel sector, Trivago (NASDAQ: TRVG) has been hit hard by the pandemic, as revenue has fallen sharply from pre-pandemic levels.

Shares of the hotel-booking specialist got hammered after revenue tumbled in its first-quarter earnings report

Most readers would already be aware that trivago's (NASDAQ:TRVG) stock increased significantly by 20% over the past...

What happened

Fool since 2011. I write about consumer goods, the big picture, and whatever else piques my interest. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. Follow @tmfbowman

So what

Shares of Trivago ( NASDAQ:TRVG) were taking a dive today after the hotel meta-search company said in its first-quarter earnings report that revenue fell sharply. Though a decline in revenue had been foreseen, as the company has scaled back marketing spending, the sales slide was greater than expected.

Now what

Trivago said revenue fell 19.5% in the quarter to 208.8 million euros, or $234.8 million, badly missing estimates at $266.8 million. That decline came as the company slashed selling and marketing spending by 36.5% to $183 million, which helped drive overall profitability and efficiency.

NASDAQ: TRVG

In its guidance, Trivago said that revenue and advertising expenses would continue to decline in the second quarter, but increase in the second half of the year as the company laps the beginning of its marketing optimization strategy a year ago.

The struggling travel stock may finally be turning the corner

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

1. The pandemic may finally end

Like most of the travel sector, Trivago ( TRVG -5.24% ) has been hit hard by the pandemic, as revenue has fallen sharply from pre-pandemic levels.

2. Costs have been significantly reduced

There are some signs that 2022 could be the year in which the COVID-19 pandemic comes to a close, or at least becomes endemic, meaning it's treated as a part of normal everyday life.

3. New business lines are emerging

The record EBITDA margins in the fourth quarter are a promising sign for the company as the travel market recovers. Trivago significantly reduced its cost base over the last two years, laying off staff and slashing its office space.

Premium Investing Services

While Trivago will always primarily be an accommodations-booking service, the company has begun B2B services that monetize the data it generates from travel searches.

What happened

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

So what

Shares of online hotel-search platform Trivago (NASDAQ: TRVG) rose as much as 20.7% on Thursday. The stock is up about 17% at the time of this writing.

Now what

Trivago stock is down 59% in the past six months, spurred recently by a plummeting stock price after the company lowered its guidance for full-year revenue significantly. The company's guidance earlier this year for revenue growth of 50% in 2017 has since been lowered twice. Current guidance calls for revenue growth between 36% and 39%.