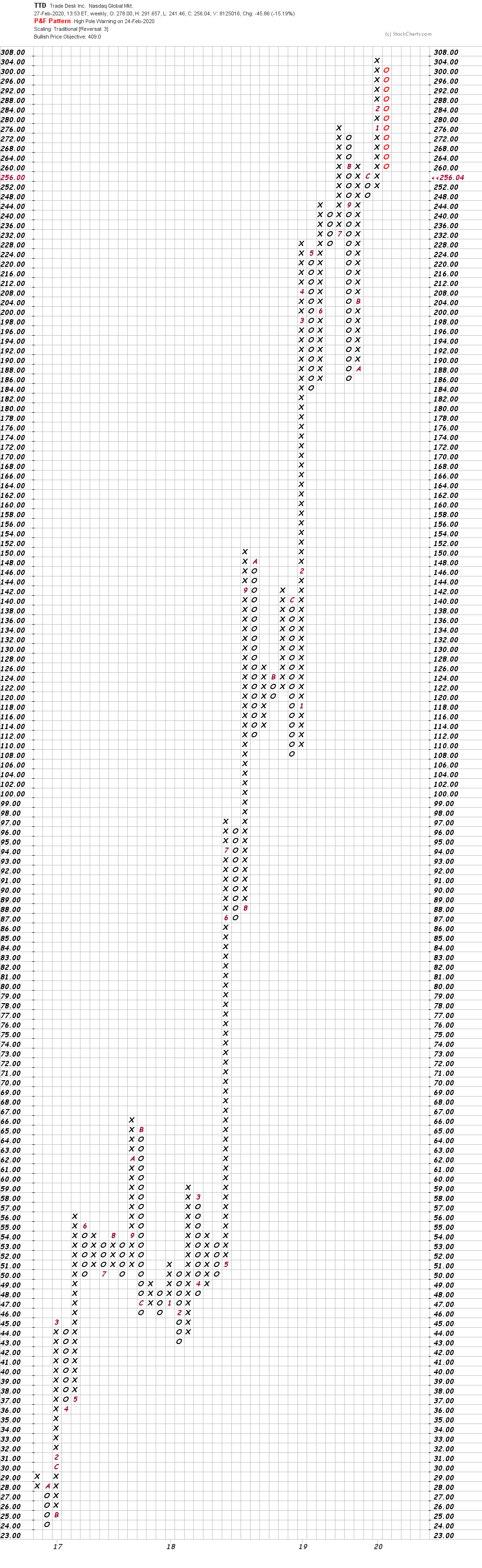

Ad tech company The Trade Desk stock dropped more than 20% between Tuesday and Thursday after Google issued its latest guidance Wednesday on its promise to not use technologies that track people individually across the internet.

Full Answer

Why did trade desk stock drop 20% Thursday?

4 hours ago · Shares of The Trade Desk ( TTD -8.03%) were sliding with the broad market last month, even as there was little news out on the ad tech …

Should you buy the trade desk (TTD) stock in today's market?

Oct 03, 2021 · What happened. Shares of The Trade Desk ( TTD -5.12% ) had a tough time this week. The digital advertising stock slumped as much as 10.1% this week, though shares ended down roughly 7.9% over the ...

What is the trade desk stock?

Mar 04, 2021 · The Trade Desk's shares fell 8% Thursday, building off of a drop Wednesday to a total of 20.4% lower than Tuesday's close. The Trade Desk's technology helps brands and agencies reach targeted ...

Why did ad tech stock drop on Monday?

Apr 20, 2022 · The Trade Desk reported revenues of $395.6 million in the last reported quarter, representing a year-over-year change of +23.7%. EPS of $0.42 for the same period compares with $0.37 a year ago ...

Will Google stop selling ads?

Google will stop selling ads based on web browsing history. The News with Shepard Smith. Google said its post was about how its own ad products will work, and that it won’t restrict what third parties do within Chrome for now. But Google could theoretically restrict that activity on Chrome in the future.

When will Google stop supporting cookies?

The Trade Desk has painted the identifier as a superior alternative to cookies, which Google plans to stop supporting in its Chrome browser by 2022. But Google’s post Wednesday warned against solutions “like PII graphs based on people’s email addresses.”.

What happened

Shares of The Trade Desk ( NASDAQ:TTD) took a hit on Monday, falling as much as 10.9%. As of 3:15 p.m. EST, however, the stock was down only 8.6%.

So what

A quick look at the bullish gain for popular market indexes like the S&P 500 and the Nasdaq Composite implies it's an upbeat day in the market. The two indexes are each up about 1% as of this writing.

Now what

It's never clear how the market will treat growth stocks (or any stock for that matter) in the short term. Investors, therefore, should try to stay focused on the underlying businesses of the stocks in their portfolio rather than their prices.

Is cordless TV going to be the dominant TV in 2021?

NEW YORK, June 29, 2021-- (BUSINESS WIRE)--Cordless TV consumers are on track to become the predominant TV consumer in the next year, according to the fourth Future of TV survey of more than 4,000 U.S. adults by The Trade Desk (Nasdaq: TTD). The data shows that nearly half of American TV viewers are already cordless (47 percent), while 44 percent of Americans with cable TV anticipate pulling back or cutting service in the coming year.

When was the fourth Future of TV survey conducted?

The fourth Future of TV consumer survey was conducted for The Trade Desk by YouGov. Fieldwork for this survey was conducted from April 27 to May 5, 2021. It’s a representative survey with a total sample size of 4,019 adults in the U.S. The survey was carried out online.

Is Google a privacy sandbox?

Back in 2019, Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) Google started developing a "privacy sandbox" to keep users' data private while browsing the web. Google planned to implement those changes in 2022, but recently postponed the push to 2023, citing a "need to move at a responsible pace" to accommodate publishers, advertisers, and regulators. Let's examine two ad-tech stocks that could benefit from that delay: Magnite (NASDAQ: MGNI) and The Trade Desk (NASDAQ: TTD).

Is everyone streaming in 2020?

While streaming services saw a huge uptick in viewers during 2020, it seems not everyone is streaming video to their television sets. A new study from media and entertainment analyst Interpret found half of consumers planning to buy a smart TV or streaming device over the next three months will be making their first such purchase. Here's what it means for some of the biggest companies in connected TV.

Advertising spending might be dropping, which is a problem for the demand-side digital advertising platform

After spending more than a decade travelling the world exploring different cultures and languages, I'm happy to now be contributing to the Motley Fool's mission to make the world smarter, happier, and richer. What's great about exploring business and the economy is the insight it gives you into how things are in the world.

What happened

Shares of The Trade Desk ( NASDAQ:TTD) plummeted 32.8% in March, according to data provided by S&P Global Market Intelligence. With a drop like that, you'd expect there to be some big news bombshell, but the company didn't announce any negative news during March.

So what

The Trade Desk operates a demand-side digital advertising platform, getting advertisers the best deal for their budgets on the most appropriate channels. As our world becomes increasingly digital, this has created a high-growth business opportunity for The Trade Desk. Both revenue and net income have surged higher over the years.

Now what

It's possible The Trade Desk could see its revenue disrupted by decreased ad spending in coming quarters. While this is a legitimate concern, there are two other big-picture items for investors to keep in mind.