Is GameStop a good stock?

1 day ago · GameStop’s stock is on the rise again – but why? At the beginning of 2022, the controversy surrounding the artificial rise of the GameStop stock value seemed to …

Should you Buy GameStop stock?

The result of this major market event was a sudden increase in stock prices for GameStop, which benefited from a short squeeze on various major hedge funds that …

Why did the price of GameStop stocks jump so suddenly?

Apr 05, 2022 · The second, and arguably more important statement in the filing, is that GameStop will also ask shareholders to approve a new equity incentive plan for executives. ... Why GameStop Stock Dropped ...

Why is GameStop losing money?

Mar 10, 2021 · 10 stocks we like better than GameStop When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool ...

Is it good to invest in GameStop stock?

Despite the recent uptick in sales, GameStop stock remains a high-risk bet. Launching an NFT marketplace might seem ground-breaking, but it might also be a virtual craze that fizzles out quickly.Jan 20, 2022

Why did everyone buy GameStop stock?

WallStreetBets members wound up being right about the squeeze, and GameStop bulls notched incredible gains as short-sellers were forced to buy back the stock at elevated levels in hopes of avoiding massive losses.Mar 19, 2021

Why is GameStop stock growing?

On December 30, 2020, the price was valued at 18.84 U.S. dollars per share. The cause of this dramatic increase is a concerted effort via social media to raise the value of the company's stock, intended to negatively affect professional investors planning to 'short sell' GameStop shares.Jan 31, 2022

How overvalued is GameStop?

GameStop's stock is substantially overvalued at current trading levels based on any reasonable assessment of business value. There have been many successful miracle turnarounds in U.S. corporate history, but to base your investment premise on a hope and a prayer does not seem prudent at this time.Mar 18, 2022

Is GameStop a meme stock?

Meme stocks are back on the menu. Shares of AMC Entertainment Holdings , GameStop , and Bed Bath & Beyond leapt Monday in a resurgence of the frenzied buying that took them through the roof early last year.Mar 28, 2022

Who owns GameStop stock?

Top 10 Owners of GameStop CorpStockholderStakeShares ownedThe Vanguard Group, Inc.7.65%5,837,633BlackRock Fund Advisors6.28%4,794,611SSgA Funds Management, Inc.2.17%1,653,929Geode Capital Management LLC1.01%773,8806 more rows

Why is GameStop stock going down?

The decline added to significant short-term losses for investors. GameStop's shares are down over 20% so far this year compared to an 8% drop for the market. Thursday's decline came after a rival retailer announced its own holiday season results.Mar 3, 2022

So what happened?

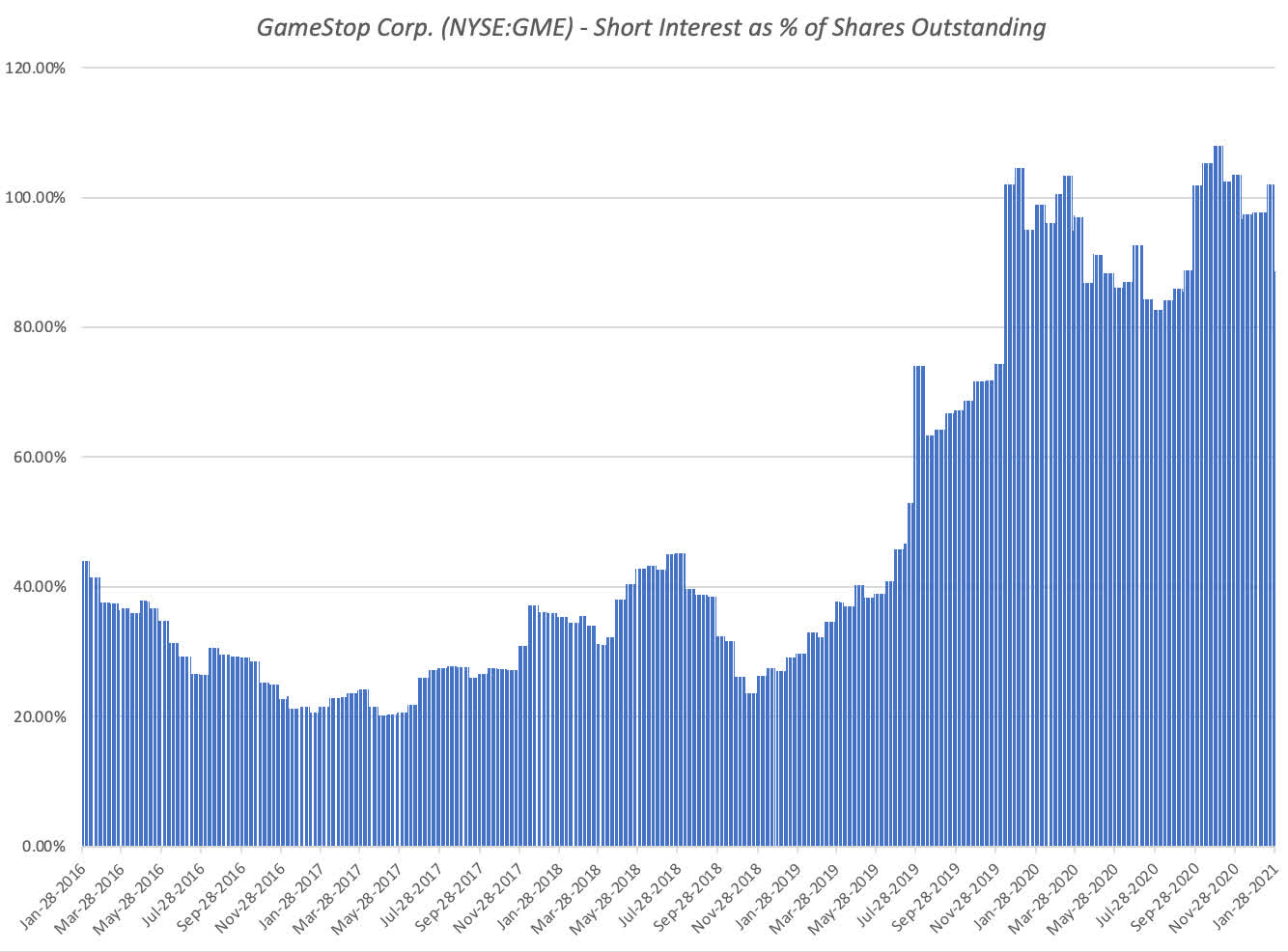

In a nutshell, it started out as a niche trading opportunity in failing US computer games retailer GameStop (GME.N) but spiraled into an unprecedented trading frenzy fueled by social media. An army of retail investors piled into a range of heavily shorted stocks, sending prices skyrocketing, which has cost hedge funds billions of dollars.

How did the GameStop trade work?

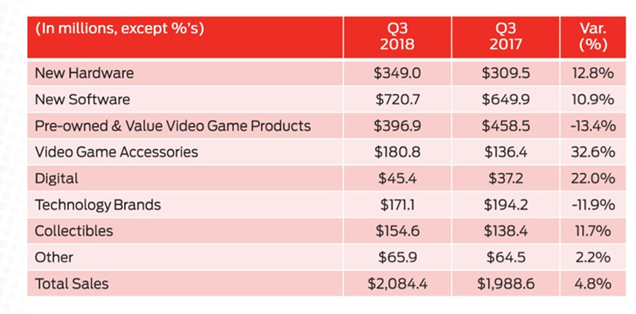

Some shrewd investors on Reddit subforum WallStreetBets noted that so many hedge funds were betting the company’s shares would fall, their short positions accounted for more than the firm was worth at 140% of market value.

Why did it go wrong yesterday?

The GameStop saga had gone from online message boards to headline news, being framed as retail investors taking on Wall Street. The money men fought back yesterday, with Robinhood and other popular retail brokers restricting trading in these stocks, sending the prices of the trending stocks plummeting.

Does this show power of private investors?

Not entirely, but the impact of retail investors on the share prices shouldn’t be underestimated. There was undoubtedly opportunistic institutional money happy to play in the background as well.

What will happen next?

It’s anyone guess what price GameStop will close at today. AMC shares are also up 60%. But, as yesterday showed, when the crash does eventually come around again, it will bite hard.

1. There Are No Gains or Losses Until You Sell

Whether the stock market increases by 20% or drops by 40%, these gains and losses don’t matter until it’s time to sell your holdings. That means as a long-term investor, you shouldn’t worry about the daily battles of the stock market. The GameStop situation and other volatile stock patterns will pass by as short-term blips.

2. Invest in Index Funds and Know Them

Investing long term in index funds allows you to buy a spread of the entire market or index you’re after. For example, you can invest in the top 500 U.S. companies, all at once. By buying into a large spread, you buy into a little bit of everything and offset potential risks that occur with these volatile manipulations or any one stock.

3. Stay Diversified

Though it’s good to be a long- term investor in the stock market, it’s also important to diversify your passive income in other wealth building streams such as real estate.

How much did GameStop stock drop in 2019?

In early 2019, GameStop's stock value fell off a cliff: It dropped under $4 a share from about $16, and it stayed in that range for just shy of two years.

Why did Wall Street traders gamble on GameStop?

Citron Research. The reason Wall Street Bets traders gambled on GameStop, however, had less to do with the company's business model and more with seeking to embarrass institutional short-sellers — including the Citron Research managing partner Andrew Left. Short-sellers make money by betting on stock prices to fall.

Why is GameStop on the moon?

Here are the four reasons Redditors are sending GameStop to the moon: 1. GameStop's stock price hit historic lows, at one point trading under $4 a share, for much of 2019 and 2020. But things began to look up recently. Ben Gilbert/Business Insider.