Why Is Berkshire Hathaway So Expensive? Berkshire Hathaway is so expensive because the stock has never been split. Warren Buffett

Warren Buffett

Warren Edward Buffett is an American business magnate, investor, speaker and philanthropist who serves as the chairman and CEO of Berkshire Hathaway. He is considered one of the most successful investors in the world and has a net worth of US$82 billion as of July 18, 2019, makin…

Should I buy stock in Berkshire Hathaway?

Mar 01, 2022 · The main reason why Berkshire Hathaway Class A stock is priced so high is that the company didn’t decide to split its stock. As a result, the price of each share has risen along with the immense growth of the holding company over the past decades and is now the most ‘expensive’ publicly trading stock.

Should I buy Berkshire Hathaway?

Jan 03, 2020 · Buffett has always viewed Berkshire’s shareholders as partners in the business, rather than just investors in a large public company. He wants them to stick around and to stay invested. Because Berkshire Hathaway stock is so expensive, buying and selling a share are big decisions to make (like buying a house or choosing a college to attend ...

Why Berkshire Hathaway can be great for income investors?

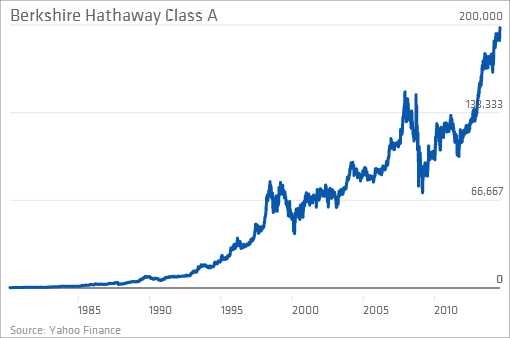

Apr 13, 2016 · In 1980, one share of Berkshire Hathaway stock cost less than $300. In 1990, it cost about $7,000. In 2000, it cost about $50,000. And today, as you know, it costs over $200,000. 5 Stocks to Buy ...

Is Berkshire Hathaway a good buy?

Apr 13, 2016 · WHY IS BERKSHIRE HATHAWAY STOCK SO EXPENSIVE - THERE ARE ALWAYS CLASS B SHARES. If you don’t have $211,000 sitting around, there’s no need to be sad – you can still be a Berkshire Hathaway shareholder. In 1996, Berkshire issued much cheaper Class B shares. Nicknamed “Baby Bs,” the shares were issued to prevent fund managers who wanted to …

See more

Over the past two decades, Buffett has done reasonably well against the index, actually beating the S&P 500 in 12 calendar years between 1999 and 2020. In 2020, Berkshire Hathaway shares were up, but not by much (2%), against an S&P 500 that gained over 18%, with dividends reinvested, according to S&P Global.

Is Berkshire Hathaway a good investment?

Who owns the most Berkshire Hathaway stock?

| Stockholder | Stake | Shares owned |

|---|---|---|

| The Vanguard Group, Inc. | 9.77% | 125,775,833 |

| SSgA Funds Management, Inc. | 6.03% | 77,687,316 |

| BlackRock Fund Advisors | 5.67% | 73,055,898 |

| Bill & Melinda Gates Foundation T... | 2.62% | 33,686,679 |

Is it worth buying Berkshire Hathaway shares?

What's the most expensive stock in the world?

Was Warren Buffett born rich?

Why is Berkshire Hathaway p/e ratio so low?

Does Berkshire Hathaway pay a dividend?

Can I buy Berkshire Hathaway stock directly?

There Are Always Class B Shares

If you don’t have hundreds of thousands of dollars sitting around, never fear – you can still be a Berkshire Hathaway shareholder!

Too Pricey?

Is Berkshire Hathaway (or even class B for that matter) too expensive? That’s up to you to decide. An intelligent investor knows how to calculate the intrinsic value of a stock. If you don’t know how to do that, you can learn right here.

Berkshire's Shareholders are Buffett's Partners

In The Snowball: Warren Buffett and the Business of Life , Buffett explains his reasoning for not splitting Berkshire's stock:

There are Always Class "B" Shares

If you don't have $211,000 sitting around, there's no need to be sad - you can still be a Berkshire Hathaway shareholder.

Is Berkshire Hathaway a good investment?

While investors can also get broad exposure to the economy with an S&P 500 index fund, Berkshire offers advantages over funds and ETFs, such as a highly selective portfolio built by one of the greatest investors of all time.

Is Berkshire Hathaway the most expensive stock?

A) Berkshire Hathaway has the highest -priced shares of any U.S. company, and is also one of the largest companies in the world, consistently ranking in the top 10 by market value.

Can I buy Berkshire Hathaway stock?

Berkshire Hathaway stocks trade on the New York Stock Exchange. The company offers two types of shares: Class A and Class B.

Does Berkshire Hathaway beat the S&P 500?

Over the past two decades, Buffett has done reasonably well against the index, actually beating the S&P 500 in 12 calendar years between 1999 and 2020. In 2020, Berkshire Hathaway shares were up, but not by much (2%), against an S&P 500 that gained over 18%, with dividends reinvested, according to S&P Global.

Can I buy 1 share of Amazon stock?

At the time of writing, a single share of Amazon costs north of $3,000. Thankfully, we can use what are called fractional shares to invest in Amazon with much less than that. Fractional shares allow you to use M1’s account minimum deposit ($100) to buy roughly 1 /33 of a share of Amazon stock.

What state is Warren Buffett from?

Located in a quiet neighborhood of Omaha, Nebraska lies the home of billionaire Warren Buffett. He bought the house for $31,500 in 1958 or about $250,000 in today’s dollars; it’s now worth an estimated $652,619.

How did Warren Buffett get rich?

In 1962, Buffett became a millionaire because of his partnerships, which in January 1962 had an excess of $7,178,500, of which over $1,025,000 belonged to Buffett. He merged these partnerships into one. Buffett invested in and eventually took control of a textile manufacturing firm, Berkshire Hathaway.

OVERVIEW

Berkshire Hathaway is known to many for two reasons and those two reasons only, it’s stock price or as I perhaps should say it’s astronomical stock price and for its leadership by Warren Buffett who is arguably considered one of the most successful investors of all time. Buffett serves as the chairman and chief executive of the company.

ANALYSIS

One thing one should note before continuing to read is that, Berkshire trades at the stock market as two share classes. There are the Class A shares (BRK-A) that are currently priced at around $416,000 USD per share and Class B shares (BRK-B) which, on the other hand, only trade at around $279 per share.

CONCLUSION

The main reason why Berkshire Hathaway Class A stock is priced so high is that the company didn’t decide to split its stock. As a result, the price of each share has risen along with the immense growth of the holding company over the past decades and is now the most ‘expensive’ publicly trading stock.