What is the ticker symbol for SuperValu?

Mar 27, 2022 · Only 1.70% of the stock of Supervalu is held by insiders. Percentage Held by Institutions. 92.00% of the stock of Supervalu is held by institutions. High institutional ownership can be a signal of strong market trust in this company. Previous Next

What is SuperValu's (SVU) stock price?

Discover historical prices for SVU stock on Yahoo Finance. View daily, weekly or monthly format back to when SUPERVALU INC. stock was issued. ... Why Russia’s military is …

Is Supervalu owned by insiders?

Jan 10, 2018 · Image source: Supervalu. So what. Supervalu said net sales increased 31% to $3.94 billion, but that was boosted by its acquisition of Unified Grocers last year, and was short of estimates at $3.99 ...

Does SuperValu stock have a dividend growth track record?

SUPERVALU Inc. Shares of the supermarket operator and supplier fell after the company turned in a disappointing earnings report. What happened Shares of SUPERVALU Inc ( SVU ) …

What happened to my Supervalu stock?

United Natural Foods completed its $2.9 billion acquisition of Supervalu on Monday. United Natural Foods Inc. closed its $2.9 billion purchase of Supervalu Inc. on Monday, with Supervalu shares disappearing from the New York Stock Exchange as the first sign of the completed takeover.Oct 22, 2018

How much is Supervalu stock?

32.49Key Turning Points52-Week High32.50Last Price32.49Fibonacci 61.8%25.28Fibonacci 50%23.05Fibonacci 38.2%20.821 more row•Oct 19, 2018

Did Supervalu get bought out?

On July 26, 2018, United Natural Foods, Inc. (NASDAQ: UNFI) and SUPERVALU Inc. (NYSE: SVU) announced that they have entered into a definitive agreement under which UNFI will acquire SUPERVALU for $32.50 per share in cash, or approximately $2.9 billion, including the assumption of outstanding debt and liabilities.

Who is Supervalu owned by?

United Natural FoodsUnited Natural Foods, or UNFI, said it would acquire Supervalu for $2.9 billion.Jul 26, 2018

Is Supervalu still in business?

UNFI reported Wednesday that third-quarter net sales increased to $5.96 billion in the third quarter of 2019, an increase of $3.3 billion or 125% from a year ago. Of that increase, $3.24 billion came from Supervalu, which UNFI acquired in October.Jun 6, 2019

Does Amazon own UNFI?

United Natural Foods Inc. (UNFI) and Whole Foods Market, a wholly owned subsidiary of Amazon, have extended their current primary wholesale grocery distribution agreement, the term of which now runs until Sept. 27, 2027.Mar 4, 2021

When did UNFI buy Supervalu?

2018United Natural Foods Inc., the company that bought Supervalu Inc. in 2018, has sold off another big piece of Supervalu's retail supermarket holdings.Dec 6, 2019

Does Tesco own SuperValu?

Their main competitors are Dunnes Stores and Tesco Ireland....SuperValu (Ireland)TypeSubsidiaryOwnerMusgrave GroupNumber of employees14,500 (2015)WebsiteSuperValu.ie9 more rows

Is SuperValu owned by musgraves?

SuperValu is part of the Musgrave Group, Ireland's largest grocery and food distributor. With 223 stores throughout Ireland, SuperValu has served the people of Ireland for over 30 years and has become a well established landmark across Irish communities.

What brands does SuperValu own?

SuperValu brands include:Arctic Shores.Baby Basics.Carlita.Culinary Circle.Equaline.Essential Everyday.Farm Fresh.Farm Stand.More items...

How were Supervalu's earnings last quarter?

Supervalu Inc. (NYSE:SVU) issued its quarterly earnings data on Wednesday, October, 17th. The company reported ($0.23) earnings per share for the q...

When did Supervalu's stock split? How did Supervalu's stock split work?

Supervalu's stock reverse split before market open on Wednesday, August 2nd 2017. The 1-7 reverse split was announced on Thursday, July 20th 2017....

Who are Supervalu's key executives?

Supervalu's management team includes the following people: Mr. Mark Gross , Pres & Director (Age 55) Mr. Rob N. Woseth , Exec. VP & CFO (Age 4...

Who are some of Supervalu's key competitors?

Some companies that are related to Supervalu include Kroger (KR) , Casey's General Stores (CASY) , Weis Markets (WMK) , Ingles Markets (IMKTA)...

What other stocks do shareholders of Supervalu own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Supervalu investors own include Tronox (TROX) , Intelsat...

What is Supervalu's stock symbol?

Supervalu trades on the New York Stock Exchange (NYSE) under the ticker symbol "SVU."

What is Supervalu's stock price today?

One share of SVU stock can currently be purchased for approximately $32.49.

What is Supervalu's official website?

The official website for Supervalu is www.supervalu.com .

Where are Supervalu's headquarters?

Supervalu is headquartered at 11840 VALLEY VIEW ROAD, EDEN PRAIRIE MN, 55344 .

Shares of the supermarket operator and supplier fell after the company turned in a disappointing earnings report

Fool since 2011. I write about consumer goods, the big picture, and whatever else piques my interest. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. Follow @tmfbowman

What happened

Shares of SUPERVALU Inc ( NYSE:SVU) were heading lower again today after the diversified supermarket company posted weak results in its third-quarter report out this morning and lowered its outlook. As a result, shares were trading down 14.1% as of 11:03 a.m. EST this morning, continuing a slide from last year.

So what

Supervalu said net sales increased 31% to $3.94 billion, but that was boosted by its acquisition of Unified Grocers last year, and was short of estimates at $3.99 billion. That growth was driven by a 52% increase in wholesale revenue to $2.89 billion, primarily due to the Unified Grocers acquisition.

Now what

Looking ahead, Supervalu sees diminished net income for the year, calling for -$20 million to $2 million in profit, which includes $35 to $45 million in non-cash charges. That compares to a previous forecast of $31 to $50 million.

What happened

Shares of SUPERVALU Inc.

So what

Supervalu got off on the wrong foot in January as the stock fell 12% over a two-day period -- the company posted weaker results than expected in its third-quarter earnings report. Adjusted for a reverse split later in the year, it turned in an adjusted earnings per share of $0.35, short of estimates at $0.93.

Now what

Supervalu's bets on wholesale with the acquisition of AG of Florida and Unified Grocers earlier in the year makes sense as the company's retail division continues to struggle with comparable sales falling 3.5% in its most recent quarter.

Shares of the integrated grocery company tumbled last year on underwhelming results and increased competition

Fool since 2011. I write about consumer goods, the big picture, and whatever else piques my interest. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. Follow @tmfbowman

What happened

Shares of SUPERVALU Inc.

So what

Supervalu got off on the wrong foot in January as the stock fell 12% over a two-day period -- the company posted weaker results than expected in its third-quarter earnings report. Adjusted for a reverse split later in the year, it turned in an adjusted earnings per share of $0.35, short of estimates at $0.93.

Now what

Supervalu's bets on wholesale with the acquisition of AG of Florida and Unified Grocers earlier in the year makes sense as the company's retail division continues to struggle with comparable sales falling 3.5% in its most recent quarter.

What happened

Shares of SUPERVALU INC. (NYSE: SVU) were getting hammered last month after the diversified supermarket chain posted weak guidance in its second-quarter earnings report as it struggles with broader shifts in the industry. According to data from S&P Global Market Intelligence, the stock finished October down 25%.

So what

In its second-quarter earnings report, the company's retail division continued to suffer as comparable sales fell 3.5% and overall retail revenue slipped 1.1% to $1.02 billion. Total revenue, including wholesale, jumped 35% to $3.8 billion, helped by its acquisition of Unified Grocers earlier in the year. That beat estimates at $3.75 billion.

Now what

Despite the seemingly strong performance in the quarter, Supervalu lowered its full-year guidance for net earnings of $31 million to $50 million, down from $51 million to $70 million.

Shares of the supermarket operator and food supplier soared after it agreed to be acquired

Fool since 2011. I write about consumer goods, the big picture, and whatever else piques my interest. Follow me on Twitter to see my latest articles, and for commentary on hot topics in retail and the broad market. Follow @tmfbowman

What happened

Shares of SUPERVALU Inc. ( NYSE:SVU) surged today on news that the food supplier and supermarket operator would be acquired by United Natural Foods Inc. ( NYSE:UNFI) for $1.3 billion. Shares of SUPERVALU were up 64.2% on the news as of 12:47 p.m. EDT, while United Natural Foods tumbled 14.2%.

So what

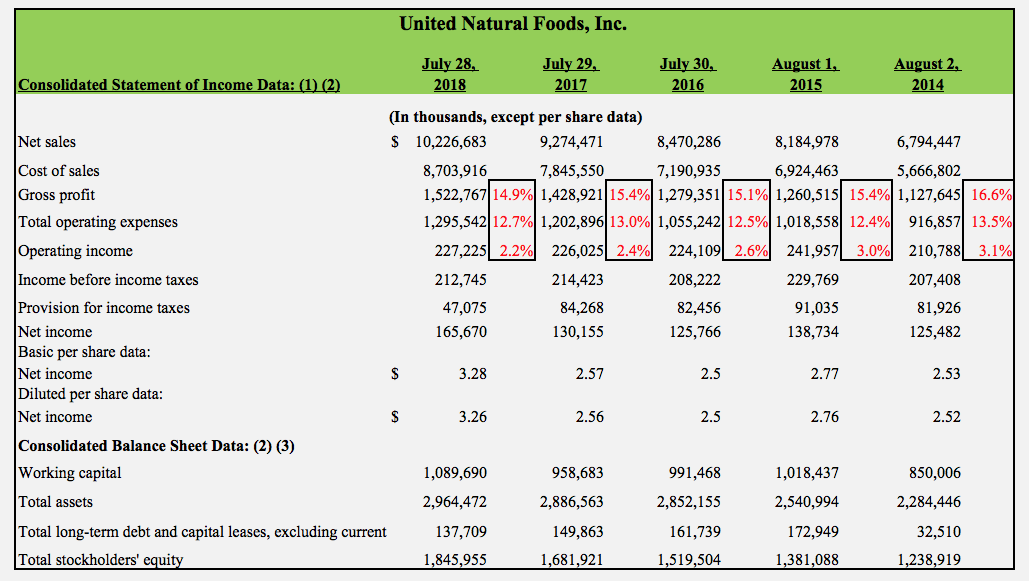

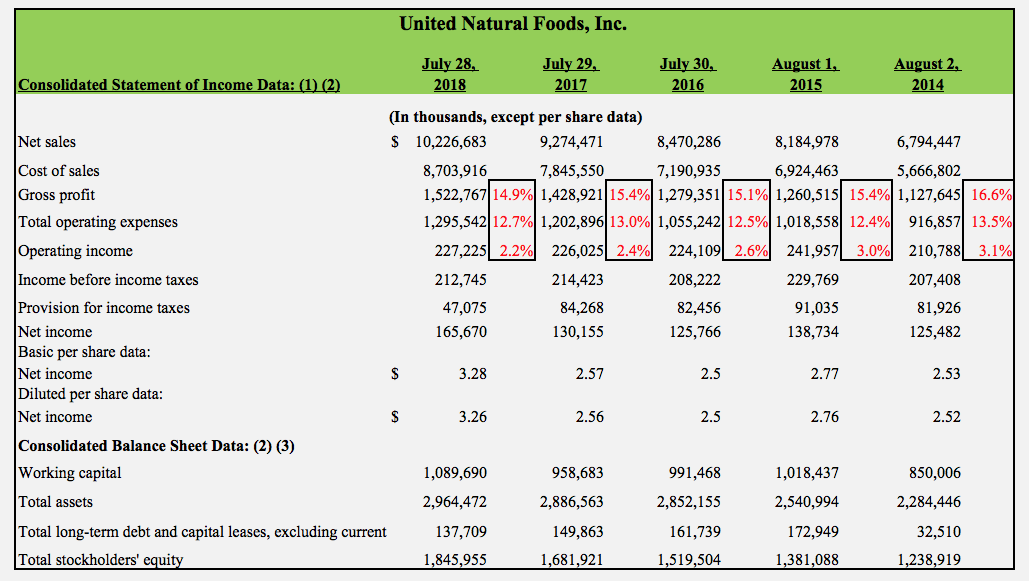

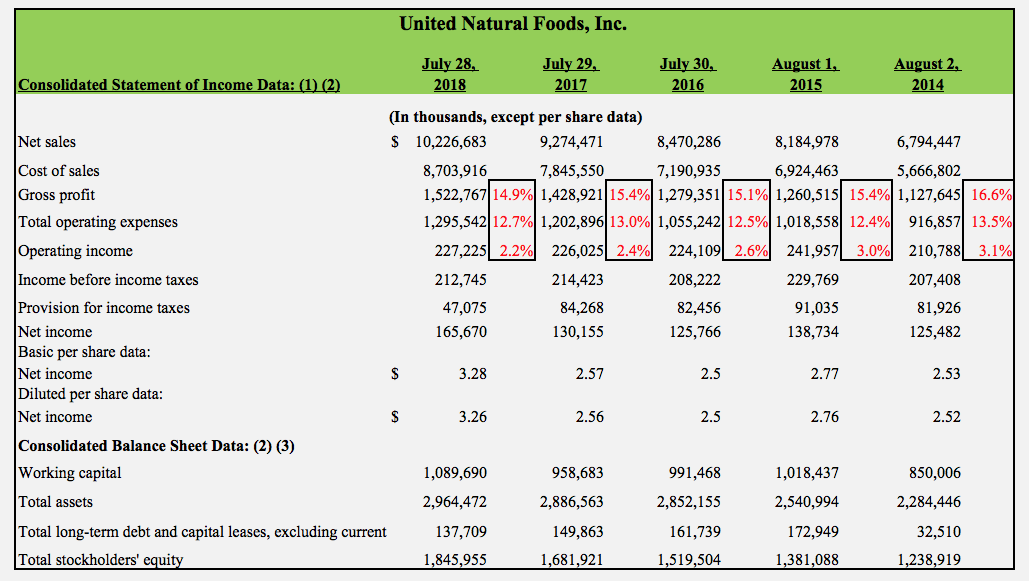

United Natural Foods (UNFI), a key supplier of chains like Whole Foods, said it would pay $32.50 a share for SUPERVALU, which has gradually converted itself from a supermarket operator to a food supplier through acquisitions and divestitures in recent years. The deal is valued at $2.9 billion, including SUPERVALU's debt.

Now what

SUPERVALU had struggled for years to build a sustainable, profitable business in the midst of an increasingly competitive supermarket landscape, and the deal no doubt looks like a win for the company, as it commanded a steep premium in the sale.