Why did Opendoor stock drop?

Opendoor stock plunges as losses soar along with revenue The selloff was widely attributed to a drop in Opendoor's contribution margin, a key profitability metric that factors in the costs of carrying and selling home inventory. It declined to 4 percent in the fourth quarter from 13 percent a year ago.Feb 25, 2022

Is Opendoor a good stock to buy?

Opendoor is still unproven enough that it is best kept to a small, speculative part of a well-diversified portfolio. But for those interested in buying in and seeing how the business develops, Friday's job provides an opportunity to acquire shares at near a 52-week low.Feb 25, 2022

Why is Opendoor tanking?

The Real Estate Firm Is 'Misunderstood. ' Opendoor Technologies stock dropped Friday as poor quarterly results overshadowed financial forecasts that were more positive than expected.Feb 25, 2022

What happened to Opendoor?

For the year, Opendoor reported a net loss of $662 million, more than double the $253 million loss reported in 2020. The higher loss was primarily driven by stock-based compensation, which ballooned to $536 million compared to $38 million in 2020.Feb 25, 2022

Is Opendoor a buy or sell?

Despite the risks, Opendoor trades extremely cheaply for a monopoly business with sky-high growth potential. This combination doesn't come often. Opendoor is a Strong Buy.Jan 8, 2022

Is Opendoor losing money?

Fast forward to Thursday, and Opendoor reported losing $662 million in 2021. That exceeds Zillow's $528 million loss for the year. It also surpasses by 161% Opendoor's 2020 loss of $253 million. Opendoor's losses came after iBuyer Offerpad announced it made $6 million in net income for 2021.Feb 24, 2022

Why is Zillow stock down?

The closure of the company's Zillow Offers program sent shares falling after its third-quarter earnings. The homebuying business lost $381 million in the third quarter, according to its adjusted third-quarter Ebitda. As of Thursday's close, Zillow stock was down about 60% year to date.Dec 3, 2021

What is Opendoor company?

Opendoor is a leading digital platform for residential real estate. In 2014, we set out to reinvent life's most important transaction with a new, radically simple way to buy and sell your home. We have rebuilt the entire consumer real estate experience and have made buying and selling possible on a mobile device.

How is Opendoor different from Zillow?

While Opendoor's median buy-to-list premium is higher than Zillow's, the magic is in the distribution curve. Opendoor has a wide distribution of premiums that skews higher, leading to higher gross profits. The finesse of Opendoor's pricing curve has been refined and improved over the past month.Dec 16, 2021

Is Opendoor a profitable company?

Opendoor experienced a dramatic rise in price thanks to its surge in revenue, but in 2022 the market continues to punish the company for a lack of underlying profitability. Opendoor's impressive revenue growth does not make up for the numerous pitfalls it will face as it tries to scale up its iBuying business.Jan 7, 2022

Is Zillow losing money?

The full company, which includes Zillow's profitable home-listing and advertising business, posted a consolidated net loss of $528 million in 2021, mostly because of its home-flipping business, Zillow Offers.Feb 10, 2022

What happened

Shares of Opendoor Technologies ( NASDAQ:OPEN) dropped 16.4% in July, according to data from S&P Global Market Intelligence. There wasn't much in the way of business-specific news driving the sell-off, but macroeconomic concerns prompted a significant pullback for the company's stock price.

So what

July was a month of volatile trading for many small- and mid-cap tech stocks. Concerns related to faster-than-anticipated inflation and a surge of new confirmed coronavirus cases prompted investors to seek out stocks with lower risk profiles. Data released by the U.S.

Now what

Opendoor Technologies stock has continued to lose ground early in August's trading. The company's share price is down 2.8% in the month so far.

When did Opendoor publish its quarterly results?

Opendoor published its quarterly results on March 4, with sales topping expectations but earnings falling far short of Wall Street's target. The company's sales fell 80% year over year to land at $248.9 million, beating the average analyst sales target by roughly $5.5 million.

Is Opendoor a public company?

In December, Opendoor was taken public through a merger with Social Capital Hedosophia II, a special purpose acquisition company led by venture capitalist Chamath Palihapitiya. The deal valued Opendoor at about $4.8 billion, but the combined company's market cap skyrocketed following its new public listing -- reaching $18 billion. The stock has now fallen nearly 30% since market close on the day of its initial public offering late last year, but the deal has still been a huge success.

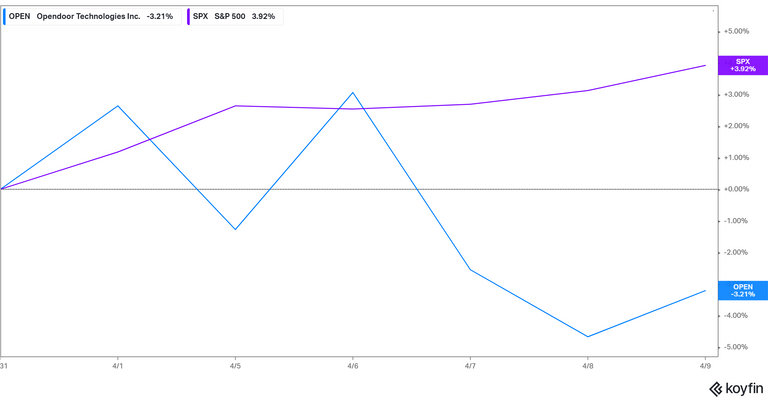

NASDAQ: OPEN

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

What happened

Shares of Opendoor Technologies ( OPEN -28.70% ) fell 20% on Friday morning after the real estate company reported a worse-than-expected loss. There was a lot to like in the report, but investors haven't shown much patience with young, unprofitable companies so far this earnings season, and Opendoor is proving to be no exception.

So what

Opendoor, a residential real estate iBuyer that acquires houses directly from sellers and then resells them, lost $0.31 per share in the quarter on revenue of $3.82 billion. The earnings missed Wall Street's expectation for a $0.18-per-share loss, though revenue did come in ahead of the $3.17 billion estimate.

Now what

Stock-based compensation matters, and the loss was worse than expected, but the sell-off appears to be an overreaction. It's possible some of today's sell-off is just blowback from yesterday, when investors bid Opendoor up 18% prior to earnings, but the stock is still down more than 25% for the week.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

How much is Opendoor revenue in 2021?

Opendoor's revenue in the average quarter in 2019 was nearly $1.2 billion and the high end of first-quarter 2021 guidance is for $625 million, so it's not difficult to see why investors might be concerned.

What is the gross margin of Opendoor?

In addition, Opendoor's gross margin improved to 8.5% for 2020 from 6.4% in 2019, which is certainly an encouraging sign for future potential. However, until the company can really build its inventory back up, revenue is likely to remain somewhat depressed.

How much cash does Opendoor have in 2020?

To be sure, the news isn't all bad. Opendoor ended 2020 with nearly $1.5 billion in cash and recently raised another $860 million in an equity offering, so it has tons of growth capital. And the company anticipates doubling its geographic footprint to 42 markets in 2021.

What is Opendoor technology?

Opendoor Technologies (NASDAQ:OPEN) runs a digital platform for residential real estate. It is also on a massive home-buying spree. Eventually, that will lead to much higher cash flow, as I pointed out in my previous article on OPEN stock last month.

Is a forward-looking statement a forward-looking statement?

The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

How does Opendoor make money?

Opendoor makes money in two ways: from the service fees it charges, and from any difference between what it buys for houses and what it sells them for. Right now, the company isn’t profitable and doesn’t expect to break even until 2023. Adjusted EBITDA declined last year to 3.8% from 4.6% in 2019.

What is Opendoor cash offer?

Opendoor’s cash offer is based on comparable home sales. In a slow market, more sellers are willing to accept less for the certainty of a quick sale.

What does Instant Buyer do?

Instant buyers use proprietary online home value assessment tools to determine what your home is worth. They make fast cash offers and then resell homes. OPEN claims that internet-based real estate transactions represented 1.3 million of the total 5.6 million home transactions closed in 2020.

Does Opendoor offer fair market prices?

Opendoor claims to offer “fair market prices.”. But it’s not clear whether customers are getting the best price for their home . In fact, according to many reviews, the firm preys on home sellers in need of quick cash.