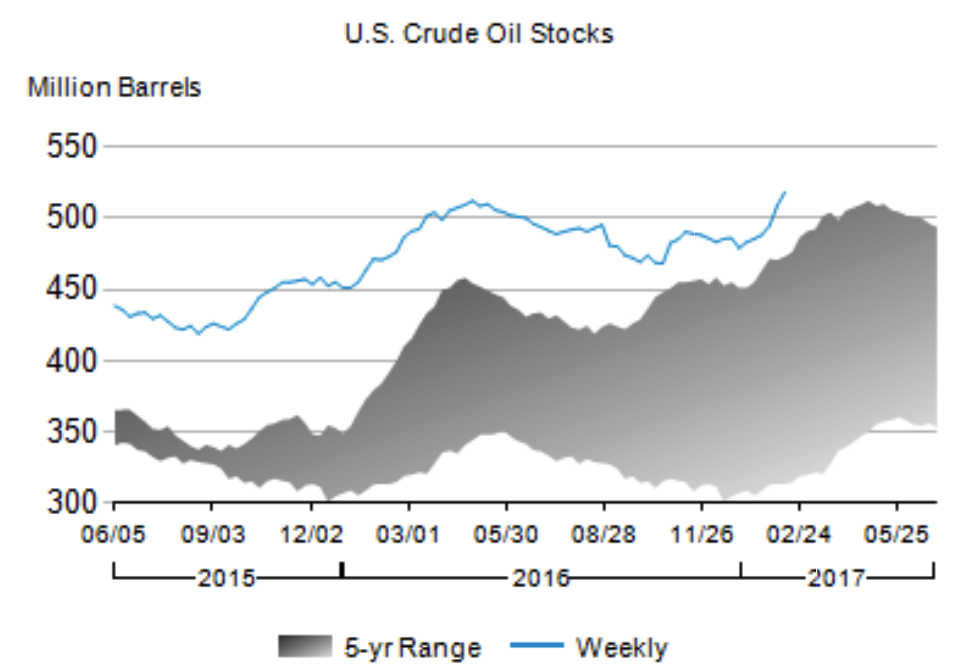

Oil stocks are surging on the view that market conditions are starting to improve. While it's true that many states are preparing to reopen their economies, which should boost oil demand, the industry has a massive glut of it in storage that will take months to burn off.

Full Answer

Why are oil prices so high?

In the near term, however, the market fundamentals point that supply is lagging behind the rebound in demand, pushing oil prices higher, together with the threat of a possible disruption in the Russian oil supply due to the Ukraine crisis.

Are oil stocks going up?

When crude oil prices rise, oil stock prices tend to go up, too. When crude oil prices tumble, so will the prices of most oil and gas stocks. The reasoning behind this is pretty simple. The costs...

What did crude oil close at Yesterday?

W&T Offshore Inc. (WTI) is priced at $4.30 after the most recent trading session. At the very opening of the session, the stock price was $4.28 and reached a high price of $4.36, prior to closing the session it reached the value of $4.46. The stock touched ...

When will oil stocks rise?

as a potential war could send oil prices over $100 a barrel, analysts have warned. Read: What a Russian invasion of Ukraine would mean for the stock market, oil and other assets U.S. markets will be closed Monday in observance of Presidents Day.

Why has oil price increased today?

The price of oil bottomed out in spring 2020 during the Covid-19 crash, but today a barrel of oil fetches almost $130 in the U.S., with higher prices a direct result of Russia's invasion of Ukraine—aided by strong consumer demand as the world moves on from Covid-19 and weak supply as the leading oil-producing nations ...

Will oil prices go down in 2022?

Oil, gasoline prices to pare gains but remain high through 2022, 2023: EIA.

Are oil stocks going up?

The S & P 500 energy sector is up nearly 59% year to date, compared to a decline of 14% for the broad stock index. The huge move has come as oil prices surged. U.S. benchmark West Texas Intermediate crude is up about 60% this year. International benchmark Brent crude is up slightly more than that.

What is oil doing on the market today?

WTI Crude109.6-6.83%Brent Crude113.1-5.58%Murban Crude112.5-5.62%Natural Gas6.944-6.97%Gasoline •2 days3.793-4.12%3 more rows

How much will gas cost in 2023?

EIA predicted the US retail gasoline price to fall to average $3.66/gal in 2023.

What is the prediction for oil prices?

Prices. The Brent crude oil spot price averaged $113 per barrel (b) in May. We expect the Brent price will average $108/b in the second half of 2022 (2H22) and then fall to $97/b in 2023.

Is oil still a good buy?

Is oil still a good investment in 2021 and beyond? Since 2020, crude oil prices have experienced a tremendous rebound. In February 2021, oil prices hit pre-pandemic prices of $60 a barrel. Similarly, natural gas prices, which bottomed out in April 2020, have rebounded.

Is now a good time to buy oil stocks?

In fact, since hitting lows of under $20 per barrel in 2020, oil has increased in value by over 1,000%. As such, now could be a great time to gain exposure to leading oil companies. In this guide, we discuss the 10 best oil stocks to buy right now and how to complete your investment at a commission-free broker.

Is oil stock a good buy?

Oil and gas stocks can produce significant capital gains from share price appreciation and attractive dividend income during periods of high oil and gas prices. As crude oil prices rise, oil companies tend to generate gushers of cash.

What is oil per barrel today?

Live interactive chart of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel. The current price of WTI crude oil as of June 17, 2022 is 108.93 per barrel.

How much is oil a barrel right now?

WTI Oil Prices In US DollarWTI OilUS DollarUS Dollar1 Barrel108.1 USD1 USD2 Barrel216.2 USD2 USD5 Barrel540.6 USD5 USD10 Barrel1081.1 USD10 USD5 more rows

Will oil prices continue to rise?

"We expect oil demand to improve further, benefiting from the reopening of China, summer travel in the northern hemisphere and the weather getting warmer in the Middle East. With supply growth lagging demand growth over the coming months, we continue to expect higher oil prices," he said.

When will oil hit $100?

Expectations that strong demand recovery would outpace supply in coming months could lead to oil prices briefly hitting $100 per barrel in 2022, BofA Global Research said in a note…

What has boosted the price of the WTI crude?

Rising oil demand in the United States and flat domestic production in recent months have boosted the price of the U.S. oil benchmark WTI Crude, which has significantly narrowed the…

Why is it important to invest in oil stocks?

The most important thing to remember about investing in oil stocks is that your investment is fundamentally driven by supply and demand. Simply put when demand for crude oil is high, prices go up. Conversely when demand decreases, so do prices.

Why is oil so expensive?

Oil is expensive to bring to market. It’s more than just the cost of extracting it from the ground. Oil has to be transported, stored, and in many cases refined into gasoline or other products. And those costs are usually fixed.

What is an ETF in oil?

Some investors will also choose to invest in an exchange-traded fund (ETF) that is tied to the price of oil or includes a basket of companies with exposure to the oil sector. However, a more indirect (and slightly less risky) way to play the oil market is to buy oil stocks.

What are downstream companies?

Downstream companies – These companies refine oil into other products such as gasoline and petrochemicals. In many cases, these companies are also part of selling this refined product to consumers. Two examples of downstream companies are gas station operators and refinery operators.

When a barrel of oil sells for more than the sum of all these costs, does it turn a profit

When a barrel of oil sells for more than the sum of all these costs, oil companies turn a profit. And stocks of oil companies will go up as well. However, the opposite is also true. When oil sells for less than, many of these companies will lose money. During these times, stocks of oil companies will go down.

Is oil a no brainer?

For a long time having exposure to oil was a no-brainer for any investor. From air travel and commuting to heating our homes and powering factories, oil truly powered the world.

The Demand Component of Higher Oil Prices

When the Covid Recession hit the U.S. nearly two years ago, oil prices tanked along with the stock market. As the novel coronavirus spread around the globe, governments rapidly imposed lockdowns in an attempt to protect their citizens. Lockdowns drove unprecedented economic disruptions, resulting in less energy demand and falling oil prices.

The Supply Side of Higher Oil Prices

In April 2020, a spat between Russia and Saudi Arabia over proposed output cuts in response to the new Covid-19 pandemic spooked investors, causing the price of oil to fall to historic lows in April 2020.

Russia, Ukraine and the Price of Oil

And then there’s the outbreak of war between Russia, the world’s third largest oil producer, and Ukraine. The threat of a Russian invasion turned into reality in late February, causing crude oil prices to rise briefly above $100 a barrel.