Nike shares are falling on Friday, after the company reported mixed earnings report and confirmed it was laying off employees. The athletic apparel retailer is struggling with backlogged ports in North America and sluggish brick-and-mortar sales in other parts of the globe.

Full Answer

Is Nike still a winning apparel stock?

· The analyst cut his price target on Nike stock by nearly $20 a share this morning, to $173. ... Down More Than 23%, This Year's 2 Worst-Performing Dow Stocks Look Like Monster Buys Right Now.

When did Nike last split?

· Nike Stock Falls Amid Worries About Supply Chain Problems Shares of Nike found themselves under pressure after the company released its quarterly results. Nike reported revenue of $12.25 billion...

How much is Nike stock dividend?

· The analyst thinks supply chain snarls that hurt consumer goods stocks in 2021 will continue into 2022, and Nike is not "out of the woods" on that yet. Additionally, currency exchange rates have...

Why is Nike stock falling?

· To put it mildly, Wednesday was not the best day for a stock to be hit with a price target cut. But that was the situation with top athletic apparel maker Nike (NYSE: NKE), whose shares closed 5.6 ...

See more

· NIKE temporarily suspended share-repurchase activities in March 2020 to preserve liquidity amid the pandemic. Prior to the suspension, it …

Why has Nike stock gone down?

In an industry pressured by soaring inflation, Nike Inc. is suffering more than most as its exposure to the fallout from the war in Ukraine and supply-chain issues put its shares on track for their worst quarter since 2008.

Is Nike stock a good buy now?

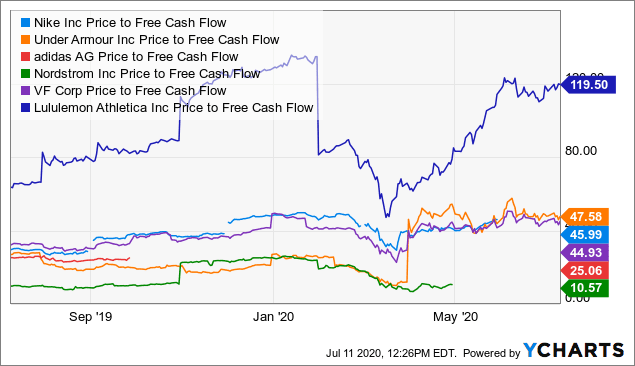

Nike is trading at 35 times earnings today, below the company's five-year average price-to-earnings (P/E) multiple of 43. It was trading above its historical average at the start of the year, but the P/E has quickly contracted, which leads me to believe that now is a good time to buy shares.

Is Nike a good stock to buy 2022?

Nike (NKE 2.93%) is having a rough start to 2022. The stock is down 21% through the first two months, and the company is hampered with output disruptions due to the pandemic and its myriad consequences. Fortunately, consumer demand for its products is resilient.

Why is Nike stock going up?

Shares of Nike gained strong upside momentum after the company released its fiscal third quarter earnings report. The company reported revenue of $10.9 billion and GAAP earnings of $0.87 per share, beating analyst estimates on both earnings and revenue.

Should I sell my Nike stock?

There are currently 1 sell rating, 3 hold ratings and 25 buy ratings for the stock. The consensus among Wall Street analysts is that investors should "buy" NIKE stock. View analyst ratings for NIKE or view top-rated stocks.

Is Nike a safe stock?

The company is also highly profitable, with gross margins over the last decade that have registered in the mid-40s. Unfortunately, while the multiple positives associated with an investment in Nike mean the stock is a relatively safe long term investment, these truths are generally known by savvy investors.

Which is the best stocks to buy now?

Fabindia IPO.EBIX Cash IPO.Vikram Solar IPO.Joyalukkas IPO.Biba IPO.Gujarat Polysol IPO.Hemani IPO.Corrtech IPO.More items...

Why is Nike stock dropping 2022?

Bloomberg also reported that Bank of America Securities analyst Lorraine Hutchinson has dropped Nikes earnings per share estimates for fiscal 2022 and 2023 as a result of the troubles in eastern Europe and Chinas ongoing Covid-19 dilemma.

What is a good start up stock to buy?

Summary: Best Stocks To Buy For BeginnersNameSymbolRevenue GrowthAmazonNASDAQ:AMZN13.99%AlphabetNASDAQ:GOOG37.45%AppleNASDAQ:AAPL18.63%CostcoNASDAQ:COST17.69%11 more rows•Jan 7, 2022

Is nikes market demand increasing?

Revenue in North America, Nike 's (ticker: NKE) biggest market, climbed 12%, representing the highest growth of all geographies. Greater consumer demand, especially for online merchandise, helped boost results, the company said in an earnings call Monday evening.

How much money does Nike make?

about 44.54 billion U.S. dollarsNike's revenue worldwide 2005-2021 In 2021, Nike's global revenue amounted to about 44.54 billion U.S. dollars. Nike, Inc., founded in January 1964, is a sportswear and equipment supplier based in the United States. The company's headquarters are located near Beaverton, Oregon.

An HSBC analyst sounds the alarm on Nike's still-too-high stock price

I like things that go "boom." Sonic or otherwise, that means I tend to gravitate towards defense and aerospace stocks. But to tell the truth, over the course of a dozen years writing for The Motley Fool, I have covered -- and continue to cover -- everything from retailers to consumer goods stocks, and from tech to banks to insurers as well.

What happened

Shares of sportswear icon Nike ( NYSE:NKE) are crashing 4% as of 11 a.m. ET on Monday -- and yes, I suppose that with the S&P 500 down 1.9%, you could say the whole stock market is in the red today.

So what

As The Fly reports today, an analyst at investment bank HSBC just cut his rating on Nike stock from buy to hold. Analyst Erwan Rambourg also trimmed the stock's price target to $182.

Now what

The analyst thinks supply chain snarls that hurt consumer goods stocks in 2021 will continue into 2022, and Nike is not "out of the woods" on that yet. Additionally, currency exchange rates have "turned against the [consumer goods] sector," warns Rambourg.

Why did Nike suspend its stock purchase?

NIKE temporarily suspended share-repurchase activities in March 2020 to preserve liquidity amid the pandemic. Prior to the suspension, it repurchased 45.2 million shares for nearly $4 billion. Consequently, it had a share-repurchasing capacity of $11 billion remaining under the current program. It expects to resume its existing share-repurchase program in fourth-quarter fiscal 2021.

How did Nike's revenue decline?

Within the NIKE Brand, revenues in North America declined 10% on a reported basis and 11% on a currency-neutral basis . As already mentioned, North America revenues were impacted by wholesale shipment delays caused by global container shortages and port congestions in the West Coast of the United States. This increased the transit time and pushed back wholesale shipments by more than three weeks in the quarter, which resulted in the lack of available inventory at partner stores. This was, however, partly offset by 15% growth in NIKE Direct in the region, with more than 50% digital growth. Moreover, the company expects to capture revenues from the delayed inventory in the fiscal fourth quarter. Also, it notes that the digital momentum has continued into March.

How much money did Nike invest in 2021?

NIKE ended third-quarter fiscal 2021 with cash and short-term investments of $12.5 billion, up $9.3 billion from the last year. These included proceeds from the corporate bonds issued in fourth-quarter fiscal 2020 and strong free cash flow.

Has the fresh estimate trended downward?

It turns out, fresh estimates have trended downward during the past month.

How much did Nike stock go up in 1995?

The stock continued to perform well into the 1990s. By the end of 1994, the stock hit $2.33 and by December 1995, the stock had gone as high as $4.35. In just one year’s time, the stock’s value had increased by 87%. Growth was a constant.

What was the stock price of Nike on November 15th?

On November 15th, Nike stock price closed at a price of $56.63. This represents an increase of over 11% compared to the low on October 13th and a year over year increase of almost 13%.

How many times has Nike split?

Nike`s stock has split two for one six times. In November 2015 Nike announced it was increasing its dividend by 14%, and that its board had also approved a $12 billion share repurchase program and a two-for-one stock split. Nike stock price rocketed on the news. In 2017, the stock performed reasonably well.

How much did Nike make in 1981?

In 1981, its revenues reached almost $458 million. For comparison, back in 1972 Nike’s annual revenue was $2 million. From 1972 to 1981, NIKE Inc.’s net income grew at a pace of almost 100% per year. On IPO day Nike stock price closed at $0.18 on the first day of trade.

What is the dividend payout ratio of Nike?

NIKE does not yet have a strong track record of dividend growth. The dividend payout ratio of NIKE is 30.90%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, NIKE will have a dividend payout ratio of 22.04% next year.

When did Nike split?

NIKE shares split on the morning of Thursday, December 24th 2015. The 2-1 split was announced on Thursday, November 19th 2015. The newly minted shares were payable to shareholders after the market closes on Wednesday, December 23rd 2015. An investor that had 100 shares of NIKE stock prior to the split would have 200 shares after the split.

Where is Nike located?

NIKE is headquartered at ONE BOWERMAN DRIVE, BEAVERTON OR, 97005.

What is the NKE symbol?

NIKE trades on the New York Stock Exchange (NYSE) under the ticker symbol "NKE."

What is the peg ratio of Nike?

NIKE has a PEG Ratio of 3.22. PEG Ratios above 1 indicate that a company could be overvalued.

What is Nike shoes?

NIKE, Inc., together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories worldwide. The company offers NIKE brand products in six categories, including running, NIKE basketball, the Jordan brand, football, training, and sportswear. It also markets products designed for kids, as well as for other athletic and recreational uses, such as American football, baseball, cricket, golf, lacrosse, skateboarding, tennis, volleyball, walking, wrestling, and other outdoor activities; and apparel with licensed college and professional team and league logos, as well as sells sports apparel. In addition, the company sells a line of performance equipment and accessories comprising bags, socks, sport balls, eyewear, timepieces, digital devices, bats, gloves, protective equipment, and other equipment for sports activities; and various plastic products to other manufacturers. Further, it provides athletic and casual footwear, apparel, and accessories under the Jumpman trademark; casual sneakers, apparel, and accessories under the Converse, Chuck Taylor, All Star, One Star, Star Chevron, and Jack Purcell trademarks; and action sports and youth lifestyle apparel and accessories under the Hurley trademark. Additionally, the company licenses agreements that permit unaffiliated parties to manufacture and sell apparel, digital devices, and applications and other equipment for sports activities under NIKE-owned trademarks. It sells its products to footwear stores; sporting goods stores; athletic specialty stores; department stores; skate, tennis, and golf shops; and other retail accounts through NIKE-owned retail stores, digital platforms, independent distributors, licensees, and sales representatives. The company was formerly known as Blue Ribbon Sports, Inc. and changed its name to NIKE, Inc. in 1971. NIKE, Inc. was founded in 1964 and is headquartered in Beaverton, Oregon.

When did the 2-1 split happen?

The 2-1 split was announced on Thursday, November 19th 2015. The newly minted shares were distributed to shareholders after the closing bell on Wednesday, December 23rd 2015. An investor that had 100 shares of NIKE stock prior to the split would have 200 shares after the split.

Operating Segments

The NIKE Brand revenues were $10,816 million, up 1% year over year on a reported basis. Revenues for the brand were flat on a constant-dollar basis as growth in the NIKE Direct business was offset by lower Wholesale revenues. Within the NIKE Brand, revenues in North America advanced 12% on both reported and currency-neutral basis to $4,477 million.

Costs & Margins

The gross profit advanced 8% year over year to $5,213 million, while the gross margin expanded 280 basis points (bps) to 45.9%.

Balance Sheet & Shareholder-Friendly Moves

NIKE ended second-quarter fiscal 2022 with cash and short-term investments of $15,103 million, up $3.3 billion from the last year. These included strong free cash flow generation, partly offset by cash dividends and share repurchases.

Outlook

NIKE expects the operating environment to remain volatile due to business disruptions caused by the COVID-variants. The company’s fiscal 2022 outlook assumes inventory supply significantly lagging consumer demand across NIKE’s portfolio of brands.