Why we were wrong about micron stock price?

The share price had its 52-week low at $42.25, which suggests the last value was 45.55% up since then. When we look at Micron Technology Inc.’s average trading volume, we note the 10-day average is 21.73 million shares, with the 3-month average coming to 19.35 million. Get the hottest stocks to trade every day before the market opens 100% free.

Why is Micron Technology undervalued?

Micron stock appears undervalued in comparison to its peers, considering the enterprise-value-to-revenue metric. The chipmaker has an EV-to-revenue ratio of 2.36x for the upcoming fiscal year.

Should you buy Micron Technology stock?

One of the reasons why MediaTek dominates the smartphone processor market is because of its 5G chips, which is a positive sign for Micron. All of this indicates that Micron could keep benefiting from the 5G smartphone market in the long run, and that could help it remain a top growth stock for a long time to come.

Why is nano dropping so much?

Nano Dimension Ltd. (the “Company”) announces that Itzchak Shrem, the co-Chairman of its Board of Directors has notified the Company that he is taking a leave of absence from his role as co-Chairman until further clarity on the police investigation referenced in the Company’s report on Form 6-K dated May 16, 2018.

See more

Is Micron stock a buy right now?

Micron stock is not a buy right now.

Will Micron Technology stock go up?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Micron Technology Inc have a median target of 100.00, with a high estimate of 165.00 and a low estimate of 56.00. The median estimate represents a +70.94% increase from the last price of 58.50.

Is Micron a buy sell or hold?

Micron Technology has received a consensus rating of Moderate Buy. The company's average rating score is 2.84, and is based on 20 buy ratings, 3 hold ratings, and 1 sell rating.

Is Micron a strong buy?

Analysts expect Micron's adjusted earnings to grow a whopping 51% this year and increase another 35% in fiscal 2023. Over the next five years, they expect its annual earnings to grow at an average rate of about 25% -- which gives it a low PEG ratio of 0.9.

Is Micron undervalued?

If you are looking for an undervalued growth company that is a bet on digital, then Micron is a company we recommend that you consider in your portfolio.

Is MU a good buy now?

Consensus estimates also rate MU as a strong buy now, given its strong market position in the DRAM segment. The stock is also trading attractively at $76.18, down 22% from its 52 weeks high of $98.45.

Is Micron a good company?

Overall, Micron is a good company. They compensate well and have great benefits. US manufacturing operations continue to transfer overseas, which isn't great. If you are in a manufacturing supporting role, you can expect a lot of evening meetings and late nights.

What is the price target for Micron stock?

Stock Price TargetHigh$165.00Low$83.00Average$111.45Current Price$73.32

Who are Micron technical customers?

Apple is one of Micron's biggest customers. Any weakness in iPhone sales will affect Micron, as Micron supplies memory for iPhones and other mobile devices. It's clear that Micron Technology is vulnerable on several fronts.

Why is Micron stock so cheap?

Micron's stock is cheap due to market volatility and simultaneously incredibly undervalued in contrast to its potential.

Who are Micron's competitors?

Micron Technology competitors include MediaTek, Intel Corporation, SanDisk, Western Digital Corporation and Seagate Technology.

Is Micron a chip maker?

SAN FRANCISCO, May 12 (Reuters) - Chipmaker Micron Technology Inc (MU. O) on Thursday announced it was experimenting with a new pricing model for its chips called forward pricing agreements that would aim to stabilize the steep price fluctuations that plague the industry.

How many 5G phones will be sold in 2021?

Strategy Analytics estimates that 5G smartphone shipments could hit 624 million units this year from just 269 million in 2020. There were almost 136 million 5G smartphones shipped in the first quarter of 2021, according to the research firm, and sales are likely to get stronger as the year progresses.

Is Micron Technology a boom and bust?

Micron Technology (NASDAQ:MU) stock is a boom-and-bust play that’s booming again. Since bottoming Oct. 13 below $67, MU stock has been on fire. It trades today at a little above $85.InvestorPlace - Stock Market News, Stock Advice & Trading Tips They are still up just 10% on the year, against the average S&P gain of 25%, but they could catch the average by year-end. What’s driving Micron is the shortage of other chips, and the possibility of it ending. Micron makes memory, where demand is mostly

Does UMC pay Micron?

UMC will make a onetime payment to Micron of an undisclosed amount, the pair also said in separate statements on Thursday, without elaborating on reasons for their withdrawal agreement. Micron had accused UMC of misappropriating trade secrets and passing them to a Chinese state-backed firm. UMC had alleged patent infringement by two of Micron's China-based subsidiaries.

How much is Micron's Q1 2021?

Even that would be a 14% improvement over Micron's performance in last year's Q4, but it's only a 4% sequential improvement over Q3's $5.4 billion. Moreover, Zinsner says fiscal Q1 2021 should be in the $5.4 billion range as well -- versus the $5.8 billion in revenue that Wall Street wants to see.

Who is the CFO of Micron Technology?

Speaking at the Future of Technology virtual conference hosted by KeyBanc Capital Markets today, Micron Technology ( NASDAQ:MU) CFO David Zinsner laid out a conservative forecast for revenue over the next few quarters.

Does Rich Smith have a position in Motley Fool?

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Prev. 1. 2.

What happened

Shares of Micron Technology (NASDAQ: MU) fell as much as 11.1% lower on Thursday morning, following a few negative analyst reports. The memory chip maker's stock recorded these lows near 11 a.m. EDT. An hour later, Micron shares had recovered slightly to an 8.8% drop.

So what

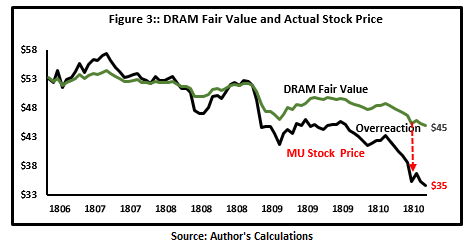

Analyst firm Baird no longer calls Micron a "top idea," lowering its price target from $100 to $75 per share. That's still more than 40% above Micron's current prices, and Baird analyst Tristan Gerra still holds an "Outperform" rating on the stock, but he sees the positive market cycle for both DRAM and NAND memory chips peaking right about now.

Now what

Micron is currently trading at 5 times trailing earnings or 4.3 times forward earnings estimates, lending support to Deutsche Bank's optimistic attitude. At the same time, we Micron shareholders never like to see unit prices dropping amid an imbalance between chip supply and market demand.

What happens when the market figures out M?

When the market figures out 'M' is for Micron, the stock will catch up and launch into triple digits.

Which semiconductor company is growing faster than most of the industry?

But the one missing from the investor conversation is Micron, the company in the semiconductor sector growing faster than most of the industry.

Is Disney stock flat in 2021?

Disney stock slipped 3% in the first half of 2021, and so far in July it is flat. We noted in June that Disney stock would be a winner if the economy reopened sooner than expected. Its film "Black Widow" had a strong opening earlier this month, with a good showing on the Disney+ streaming platform.

Is Micron stock going up in 2021?

Micron stock hasn't kept pace with the market so far in 2021. It rose 13% in the first half, and so far in July, Micron stock has slipped 10.6%. By comparison, the S&P 500 index rose 14.4% in the first half, and has gained 2.7% so far in July.