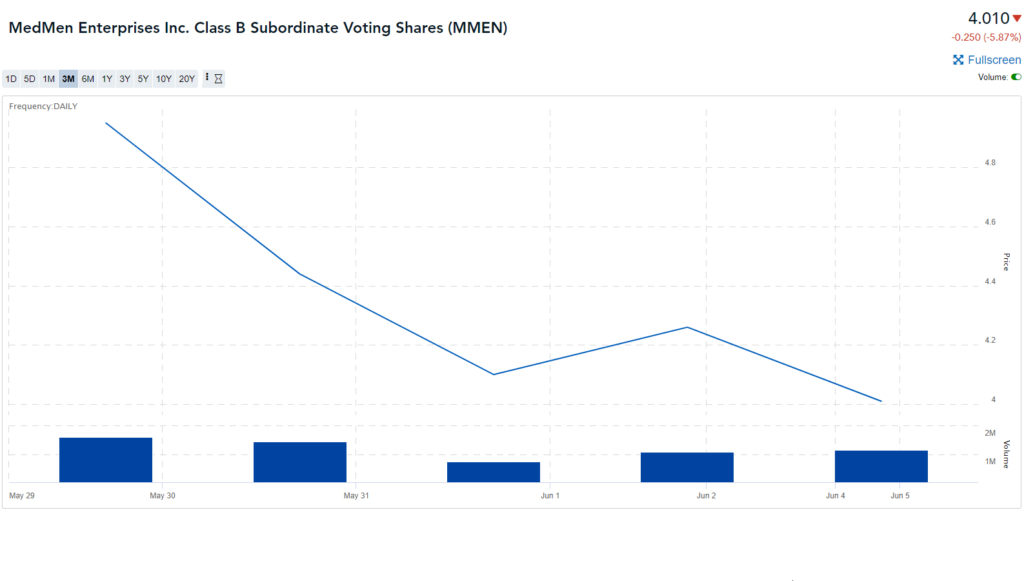

MedMen stock plummeted through 2019, as the company abruptly killed a merger with PharmaCann, laid off staff and curbed its expansion plans. Bierman and Modlin slashed their salaries after months of criticism that they were too high. The CFO spot became a revolving door.

Full Answer

Why is MedMen’s stock down in 2019?

One reason why MedMen is performing dismally so far in 2019 is that the company has been embroiled in controversy. MedMen was kicked out of the New York Medical Cannabis Industry Association in February.

Is MedMen Enterprises (MEDM) stock a buy or sell?

MedMen Enterprises has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on no buy ratings, 1 hold rating, and no sell ratings. According to analysts' consensus price target of $0.25, MedMen Enterprises has a forecasted upside of 110.8% from its current price of $0.12.

What happened to MedMen?

MedMen was kicked out of the New York Medical Cannabis Industry Association in February. This action came after the company's former CFO, James Parker, alleged in a lawsuit that MedMen executives created an environment that tolerated "racial, homophobic, and misogynistic epithets and slurs," as well as abuse of drugs and alcohol.

Will MedMen Enterprises (MMNFF) outperform or underperform the S&P 500?

MarketBeat's community ratings are surveys of what our community members think about MedMen Enterprises and other stocks. Vote “Outperform” if you believe MMNFF will outperform the S&P 500 over the long term. Vote “Underperform” if you believe MMNFF will underperform the S&P 500 over the long term.

Whats going on with MedMen?

Summary. MedMen has been in restructuring mode since 2019, and the company has fired its co-founders, slashed corporate costs, and divested licenses. However, MedMen's business remains unprofitable and cash burn is estimated at ~$25M per quarter.

Did MedMen go out of business?

The company is still in business, though a shell of its former self. Canadian cannabis company Tilray bought up a chunk of its debt in August and MedMen has a new interim CEO in Michael Serruya, its third since Bierman was forced out in early 2020.

Is there any hope for MedMen?

The key investor takeaway is that MedMen is still a major gamble. The MSO has more hope of surviving and thriving, but the stock has a lot more risk than other MSO stocks that are currently beaten down....About MMNFF.SymbolLast Price% ChgMMNFF0.08-2.46%Sep 26, 2021

Is Mmnff stock a good buy?

Medmen Enterprises Inc (OTCQX International:MMNFF) The 1 analysts offering 12-month price forecasts for Medmen Enterprises Inc have a median target of 0.28, with a high estimate of 0.28 and a low estimate of 0.28. The median estimate represents a +294.28% increase from the last price of 0.07.

Who bought MedMen?

TilrayCannabis company Tilray acquires stake Medmen notes in bet on U.S. legalization. Tilray stock jumped nearly 5% in extended trading on Tuesday after announcing an investment in American cannabis retailer Medmen.

Can I invest in MedMen?

No, but MedMen stock can be purchased through a brokerage firm, including online brokerage services.

Is MedMen making money?

Revenue 1: Net revenue across MedMen's continuing operations in California, Nevada, Illinois, Arizona and Florida was $145.1 millionfor fiscal year 2021, down 6.6% from the prior year, reflecting the impact of COVID-19, particularly during the first half of the fiscal year and in the Las Vegas and California markets.

Is Tilray buying MedMen?

(“ MedMen ”) (CSE: MMEN) (OTCQX: MMNFF), a premier American cannabis retailer, today announced that Tilray has acquired the majority of the outstanding senior secured convertible notes (the “Notes”) of MedMen that were originally held by certain funds affiliated with Gotham Green Partners, LLC and other funds ( ...

How much debt is MedMen?

MedMen fights to keep NY marijuana permit, meet $114 million debt deadline. Marijuana multistate operator MedMen Enterprises is scrambling to keep its potentially lucrative New York operation while debt coming due in six months is forcing the company to try to sell additional assets.

Is MedMen a buy now?

MedMen Enterprises has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on no buy ratings, 1 hold rating, and no sell ratings.

Is MedMen Enterprises a buy right now?

1 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for MedMen Enterprises in the last twelve months. There are...

When is MedMen Enterprises' next earnings date?

MedMen Enterprises is scheduled to release its next quarterly earnings announcement on Monday, May 30th 2022. View our earnings forecast for MedMe...

How were MedMen Enterprises' earnings last quarter?

MedMen Enterprises Inc. (OTCMKTS:MMNFF) announced its earnings results on Monday, February, 15th. The company reported ($0.11) earnings per share (...

What price target have analysts set for MMNFF?

1 equities research analysts have issued 12 month price targets for MedMen Enterprises' stock. Their forecasts range from $0.25 to $0.25. On averag...

Who are MedMen Enterprises' key executives?

MedMen Enterprises' management team includes the following people: Mr. Michael Serruya , Exec. Chairman & CEO (Age 58) Ms. Ana Bowman , Chief F...

Who are some of MedMen Enterprises' key competitors?

Some companies that are related to MedMen Enterprises include Abacus Health Products (ABAHF) , Acreage (ACRGF) , Alliance Growers (ACGWF) , Alt...

What is MedMen Enterprises' stock symbol?

MedMen Enterprises trades on the OTCMKTS under the ticker symbol "MMNFF."

How do I buy shares of MedMen Enterprises?

Shares of MMNFF can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBu...

What is MedMen Enterprises' stock price today?

One share of MMNFF stock can currently be purchased for approximately $0.08.

MedMen Announces Resignation of Chief Revenue Officer

LOS ANGELES, February 12, 2022--MedMen Announces Resignation of Chief Revenue Officer

MedMen wins six month grace period on debt

Cannabis company MedMen Enterprises Inc. on Wednesday announced a six month grace period for a $114.3 million commercial loan agreement issued on Oct. 1, 2018. MedMen CEO Michael Serruya said the company will use the time to "realize fair value for significant assets that are no longer core to our market strategy," according to a statement.

Regulations Cited In MedMen-PharmaCann Termination

MedMen cited several reasons for the decision to scrap the $682 million all-stock deal for Chicago-based PharmaCann, announced last year.

Focus On California

In announcing the deal's termination, MedMen also said that over the past six months, it has decided to focus more on California — a massive pot market whose growth has been stifled by regulations and community resistance. But the cannabis retailer said that resistance represented "upside," as more areas allow recreational sales.

MedMen Stock Skids

MedMen stock finished 14% lower over the counter on the stock market today. Among other U.S. marijuana stocks, Acreage Holdings ( ACRGF) lost 4.3%. Curaleaf ( CURLF) gave up 1.7%.

Other Marijuana Stocks Fall

Among Canadian stocks on U.S. exchanges, Canopy Growth ( CGC) rebounded 2.2% after trading lower earlier in the day. Aurora Cannabis ( ACB) added 1%. Aphria ( APHA) fell 1.6%. Tilray ( TLRY) slipped 1.3%.

Regulatory Issues Elsewhere

MedMen and PharmaCann, in March, both received requests for additional information from the Justice Department's antitrust division. Both companies "declared substantial compliance" with the requests on Aug. 9, MedMen said at that time.

CFO Turmoil

New CFO Zeeshan Hyder previously served as MedMen's chief corporate development officer.

3.0 Analyst's Opinion

MedMen Enterprises has received a consensus rating of Hold. The company's average rating score is 2.00, and is based on no buy ratings, 1 hold rating, and no sell ratings.

Is MedMen Enterprises a buy right now?

1 Wall Street analysts have issued "buy," "hold," and "sell" ratings for MedMen Enterprises in the last year. There are currently 1 hold rating for the stock. The consensus among Wall Street analysts is that investors should "hold" MedMen Enterprises stock.

How has MedMen Enterprises' stock price been impacted by Coronavirus (COVID-19)?

MedMen Enterprises' stock was trading at $0.1539 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization (WHO). Since then, MMNFF shares have decreased by 19.1% and is now trading at $0.1245. View which stocks have been most impacted by COVID-19.

How were MedMen Enterprises' earnings last quarter?

MedMen Enterprises Inc. (OTCMKTS:MMNFF) issued its quarterly earnings data on Monday, February, 15th. The company reported ($0.11) EPS for the quarter, missing analysts' consensus estimates of ($0.08) by $0.03. View MedMen Enterprises' earnings history.

What price target have analysts set for MMNFF?

1 equities research analysts have issued 12-month price targets for MedMen Enterprises' shares. Their forecasts range from $0.25 to $0.25. On average, they anticipate MedMen Enterprises' share price to reach $0.25 in the next twelve months.

Who are some of MedMen Enterprises' key competitors?

Some companies that are related to MedMen Enterprises include Abacus Health Products (ABAHF), Acreage (ACRGF), Alliance Growers (ACG), Althea Group (AGH), Applied Biosciences (APPB), AusCann Group (AC8), Ayr Strategies (AYRSF), Bio-Rad Laboratories (BIO), Blueberries Medical (BBM), Can B (CANB), Cannara Biotech (LOVE), CannPal Animal Therapeutics (CP1), Cansortium (CNTMF), Chalice Brands (GLDFF) and Charlotte's Web (CWBHF). View all of MMNFF's competitors..

What is MedMen Enterprises' stock symbol?

MedMen Enterprises trades on the OTCMKTS under the ticker symbol "MMNFF."

What goes up must come down. But is the opposite true for this top U.S. marijuana stock?

Keith began writing for the Fool in 2012 and focuses primarily on healthcare investing topics. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. Follow @keithspeights

Controversies

One reason why MedMen is performing dismally so far in 2019 is that the company has been embroiled in controversy. MedMen was kicked out of the New York Medical Cannabis Industry Association in February.

The dilution solution

Don't think that these controversies are the only factors behind MedMen's share price hovering near its all-time low. The biggest reason for MedMen's poor stock performance is illustrated in the following chart.

Time for a comeback?

Despite the distractions, some remain optimistic about MedMen's prospects. Analysts even think that MedMen's share price could double within the next 12 months.

MedMen Stock

MedMen is a United States based company that went public on the Canadian Stock Exchange via a reverse takeover (RTO) on May 29, 2018. The stock is traded under the ticker CNSX: MMEN.

MedMen Dispensaries

Med Men is among the largest cannabis businesses in the US. This company is headquartered in California in Culver City in California. To date they have 29 physical dispensaries spread across the US, both medicinal and recreational. They have marijuana dispensaries in the following locations:

MedMen Deals and Discounts

It’s quite easy to get deals and discounts at any of the MedMen dispensary locations. Some of the deals that you may be able to get at MedMen dispensaries include:

MedMen Careers & Reviews

MedMen periodically posts jobs on the MedMen Careers page on their website. Employees at MedMen receive the following benefits apart from a good pay package:

MedMen Glassdoor Reviews

Unfortunately the reviews for this company on Glassdoor are anything but encouraging. It appears that former employees have several complaints and do not think highly about this company as an employer. Generally the company has a rating of 2/5.

Weed College Online

Want to open your own dispensary? Want to learn how to grow marijuana? Looking for a marijuana job? Want to open your own legal cannabis business? Learn it all online at the leading weed college online. Start your cannabis career training at the premier cannabis college, Cannabis Training University.

Why did Medmen stock drop?

MedMen stock plummeted through 2019, as the company abruptly killed a merger with PharmaCann, laid off staff and curbed its expansion plans. Bierman and Modlin slashed their salaries after months of criticism that they were too high. The CFO spot became a revolving door.

How much did Medmen stock jump?

MedMen stock jumped 6.7% to 44 cents over the counter. Other U.S. and Canadian marijuana stocks fell. MedMen's board named Ryan Lissack, the company's chief operating officer and chief technology officer, as interim CEO. Bierman, who co-founded MedMen, will stay on the company's board for now. He will still hold millions ...

When did Medmen CEO step down?

California-based cannabis retailer MedMen ( MMNFF) on Friday said that Adam Bierman would step down as CEO on Feb. 1, after months of concerns about the company's culture, finances and expansion strategy.

Who sued Medmen?

One former CFO, James Parker, sued the company, alleging wrongful termination and other excesses — including using company money to pay for a Cadillac Escalade and a Tesla SUV for the two founders. Based on an analysis by Marijuana Business Daily last month, MedMen had only a few months' worth of cash coverage.

Does Medmen pay its suppliers?

MarketWatch confirmed that MedMen was offering to pay its suppliers in company stock, after the issue was first raised on social media. Marijuana stocks have fallen as anxieties sharpen over how much money North America's weed company's actually have in the bank.