IBIO stock shot up 24% on April 27 when the company announced that it could manufacture nearly 500 million of Covid-19 vaccines at its Texas site. Source: Shutterstock In fact, iBio has joined a group of stocks that already at least doubled so far this year as investors bet on treatments for the novel coronavirus.

Full Answer

How much is IBio stock up since the start of the year?

That’s an impressive increase over its daily average trading volume of 8.6 million shares. IBIO stock was up 18.8% as of Friday morning and is up 33.1% since the start of the year. Investors looking for more coronavirus news need look no further.

How did IBio's stock react to the intellectual property settlement?

By the close of trading, iBio's stock price was up 14.7% after rising as much as 32.6% earlier in the day. The settlement confirmed iBio's ownership of key intellectual property related to its plant-based biopharmaceutical-production system.

How did IBio's stock react to the Fraunhofer deal?

By the close of trading, iBio's stock price was up 14.7% after rising as much as 32.6% earlier in the day. The settlement confirmed iBio's ownership of key intellectual property related to its plant-based biopharmaceutical-production system. The agreement will also see iBio grant Fraunhofer USA a license to use its protein-manufacturing technology.

What is IBio’s pipeline?

IBio Inc (NYSE: IBIO) has added three anti-cancer targets to its pipeline of therapeutic candidates. The Company seeks to change the drug development paradigm with the FastPharming Protein Expression System by reducing the time and cost to move from the initial concept to the clinic.

What is the Ibio 202 subunit?

iBio Inc (NYSE: IBIO) has provided an update on its IBIO-201 program and reported its progress in developing a second-generation subunit vaccine candidate, IBIO-202, being designed for the prevention of SARS-CoV-2 infection. IBIO-201 combines antigens derived from the spike protein ("S protein") fused with iBio's patented LicKM booster molecule It recently completed IND-enabling toxicology studies. No adverse effects at low or high doses were identified. The Company also reported on the development of IBIO-202, a subunit vaccine candidate that targets the nucleocapsid protein ("N protein") of SARS-CoV-2. "In light of the successful global roll-out of COVID-19 vaccines targeting the S protein and the emergence of variant strains of the disease, we decided to focus our efforts on the continued development of IBIO-202 as a differentiated vaccine candidate," said Tom Isett, Chairman, and CEO. iBio has expressed N protein antigens and initiated intramuscular and intranasal preclinical studies to identify favorable antigen-adjuvant combinations using its plant-based FastPharming System. Results are expected in early Q1 FY2022. Price Action: IBIO shares are 30.4% at $1.80 during premarket trading on the last check Friday. See more from BenzingaClick here for options trades from BenzingaCorcept Stops Phase 2 NASH Study With Miricorilant Due To Elevated Liver Enzymes In PatientsCigna's Strong Performance Across Businesses Drive Q1 Earnings Beat; Raises 2021 Guidance© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How much is the psychedelic market worth in 2027?

The Aspen Brain Institute says the psychedelic drug market is potentially a $100 billion market opportunity and may grow at more than 16% annually and reach $6.85 billion by 2027.

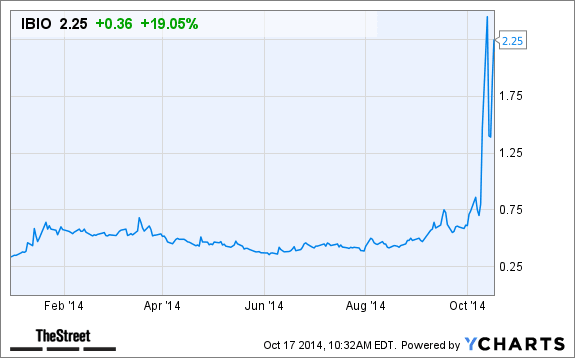

IBIO Stock Is Benefitting From MRNA News

As mentioned above, iBio is making a run for the top in the market this morning, regardless of the fact that the company hasn’t issued any press releases or SEC filings. While no news has been released, there’s good reason for the gains.

Final Thoughts

The bottom line here is simple. Moderna essentially proved today that the development of a viable vaccine is indeed possible. Now, there’s even more of a reason to be excited about the work that IBIO is doing as the company will likely be one of the leaders in the space in the long run.

iBio stock analysis

With sales of roughly $2 million per year during the past two fiscal years it is quite difficult to understand how this company has managed to reach – and hold – a market capitalisation of around $300m, especially now that getting a vaccine approved by the FDA seems as difficult and complex as ever.

iBio stock forecast 2021

iBio’s stock price is currently submerged in a strong downtrend that started back on February 10, only a few days before the company reported its financial results for the fourth quarter of 2020.

iBio stock: buy or sell?

Only two analysts seem to be covering iBio’s stock at the moment – Cantor Fitzgerald and Alliance Global Partners.

Bottom line

Even though iBio has stepped outside penny territory for now, there are arguably no signs that the business has become one with a justifiable $300m valuation.