Why did the Dow Jones drop below 30000?

U.S. stocks tumbled Thursday, sending the Dow Jones Industrial Average below 30000 for the first time since January 2021 as volatility continued to rock the market.

What happened to the Dow after the Fed raised rates?

The Dow had rallied on Wednesday after the Fed raised rates by the most since 1994, but reversed those gains and then some on Thursday, tumbling to the lowest level since January 2021.

Why did stocks drop on Monday?

Stocks dropped on Monday, continuing declines from last week as fears loomed large over inflation and whether Federal Reserve policy to tame it will cause a recession.

What happened to the Dow and S&P 500?

The S&P 500 fell 123.22 points, or 3.3%, to 3666.77. The Dow industrials dropped 741.46 points, or 2.4%, to 29927.07. Both indexes ended at their lowest closing levels since December 2020. The technology-focused Nasdaq Composite slumped 453.06 points, or 4.1%, to 10646.10, its lowest close since September 2020.

Is DOW chemical stock a good buy?

DOW is currently sporting a Zacks Rank of #2 (Buy), as well as an A grade for Value. The stock holds a P/E ratio of 8.51, while its industry has an average P/E of 11.13. Over the past year, DOW's Forward P/E has been as high as 12.32 and as low as 6.35, with a median of 8.87.

What is causing the DOW to drop?

Stock markets plummet; Dow on pace for biggest single-day drop since 2020. The Dow Jones Industrial Average posted its biggest loss since 2020 on Wednesday after another major retailer warned of rising cost pressures, confirming investors' worst fears over rising inflation and rekindling the brutal 2022 sell-off.

What happened to DOW chemical stock?

On April 1, 2019, we completed the separation of the materials science business through the spin-off of Dow Inc. (“Dow”) and our stockholders received one (1) share of Dow stock for every three (3) shares of DowDuPont common stock held on that date. This is what we refer to as the Dow Distribution.

Why did the stock market drop so suddenly?

U.S. stocks fell sharply on Friday to suffer their biggest one-day drop since 2020, as investors continued to weigh hawkish comments on interest rates a day earlier by Federal Reserve Chairman Jerome Powell, as well as a fresh batch of corporate earnings that largely disappointed.

Why is the Dow tumbling?

Up big one day, down hard the next. Stocks tumbled Thursday, giving back the gains from a spectacular rally touched off by Fed Chairman Jerome Powell after the central bank settled on a half-point rate hike and a timeline for shrinking its balance sheet. China and its economic concerns were a drag on the market, too.

Why are the stocks tanking?

With the stock market falling for the last six weeks in a row amid growing concerns about an economic slowdown and the Federal Reserve raising interest rates to combat inflation, an increasing number of Wall Street experts are warning of now “uncomfortably high” recession risks, with rising odds of a downturn within ...

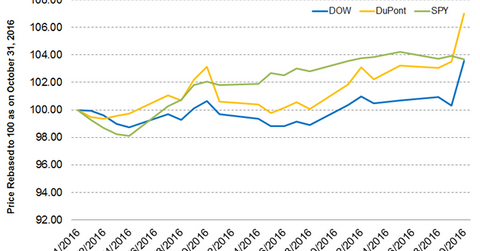

Is Dow Chemical now DuPont?

- September 01, 2017 - DowDuPont™ (NYSE:DWDP) today announced the successful completion of the merger of equals between The Dow Chemical Company (“Dow”) and E.I. du Pont de Nemours & Company (“DuPont”), effective Aug. 31, 2017.

Are Dow Chemical and DuPont the same company?

The DowDuPont era has come to an end. Corteva Agriscience has separated from DowDuPont, and the remaining entity is being recast as DuPont. Corteva combines the crop protection chemical and seed businesses of Dow Chemical and DuPont, which merged in 2017 to form DowDuPont.

What is Dow Chemical stock worth today?

Key Data PointsMarket Cap:$45BCurrent Price:$58.68Day's Range:$57.97 - $60.5852wk Range:$52.07 - $71.86Volume:8,509,2522 more rows

Should I pull money out of the stock market?

If pulling your money out of the market is a risky move, what should you do instead? The answer is simpler than you might think: do nothing. While it may sound counterintuitive, simply holding your investments and waiting it out is often the best way to survive periods of volatility without losing money.

Where will stock be in 2022?

Stocks in 2022 are off to a terrible start, with the S&P 500 down close to 20% since the start of the year as of May 23. Investors in Big Tech are growing more concerned about the economic growth outlook and are pulling back from risky parts of the market that are sensitive to inflation and rising interest rates.

What goes up when the stock market crashes?

Gold, silver and bonds are the classics that traditionally stay stable or rise when the markets crash. We'll look at gold and silver first. In theory, gold and silver hold their value over time. This makes them attractive when the stock market is volatile, and the increased demand drives the prices up.

NYSE: DOW

Dow Chemical, despite its history of steady returns, is being overlooked

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Its fiscal responsibility is paying off

Dow Inc. ( DOW 1.69% ) is down more than 8% over the past three months. That isn't likely to last because the company's improving financials and steady dividend, coupled with its declining share price, make it appear to be a good value play.

Dow has solid revenue and free cash flow momentum

The company has done a solid job of paying down debt, which had been weighing down the stock's price. It cut its debt by $1.1 billion last quarter, and over the past year, it has trimmed long-term debt from $16.5 billion to a little more than $14 billion, it said in its third-quarter report.

Dow stock appears to be a better deal than its competitors

Dow is benefiting greatly as the country opens up again as the COVID-19 pandemic ebbs. For the past five quarters, it has grown revenue, and in four of the past five quarters, it has improved net operating free cash flow. That's something that investors are likely to notice and should help drive up the stock's price.

Premium Investing Services

Diversified chemical companies, like many industrial companies, should do better as the globe's economy opens up. Dow had three consecutive quarters of declining revenue when the COVID-19 pandemic began, but since then, has had five consecutive quarters of rising revenue.

Dow Chemical (DOW-N Merged)

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Dow Chemical (DOW-N Merged)

One of the world's largest chemical producers. It is very highly cyclical. He thinks we will get through this. It had a nice bounce. Management has said they don't intend to trim that nice dividend. You need a year and a half to two years as an investment horizon. It could go down in the short term. It is a great way to play a cyclical recovery.

Dow Chemical (DOW-N Merged)

This will move with oil prices, up or down. Look elsewhere. Not a good time in the cycle to buy this.

Dow Chemical (DOW-N Merged)

Dow is the chemical side, which is very cyclical. Worries of a recession in Germany and the Chinese trade drove stock prices down in August, but has since recovered nicely. A good buy on weakness. Not one of his core holdings.

Dow Chemical (DOW-N Merged)

It is split up into Dow and Dupont again. Dupont is a petro-chemical company going through difficult times. DOW is a bit more specialized. It has a 5%+ dividend. They are both defensive stocks over 10 years.

Dow Chemical (DOW-N Merged)

A defensive stock. Expects surprising growth. (Analysts’ price target is $60.45)

Dow Chemical (DOW-N Merged)

One of the themes that is starting to play out is materials, and chemicals would be included in this. This company has lots of opportunity. The economy is growing nicely and their business is improving. You get a very nice 3% dividend. If the US economy continues to perform, the stock is going to do well.