What lies ahead for Dillard’s stock after surging 80% in 3 months?

Dillard's (DDS) closed the most recent trading day at $303.28, moving -1.1% from the previous trading session. Zacks Ulta Beauty (ULTA) Looks Promising: Stock Up 15% in 6 Months

Can Dillard's sustain or increase its dividend?

Mar 16, 2021 · Dillard’s Inc. DDS has been witnessing momentum from robust quarterly results on improved margins and lower expenses. Notably, the company’s aggressive measures to lower excess inventory ...

How do I buy shares of Dillard's?

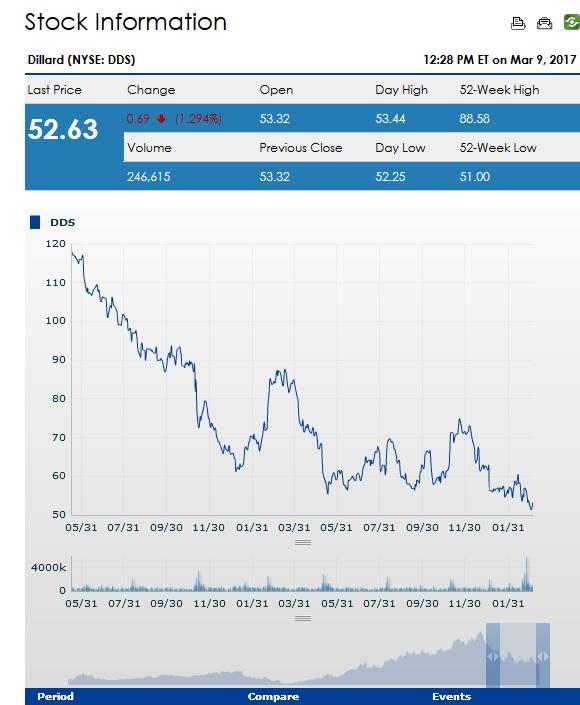

Mar 27, 2022 · Dillard's' stock was trading at $43.76 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organization (WHO). Since then, DDS shares have increased by 540.0% and is now trading at $280.06. View which stocks have been most impacted by COVID-19.

Should you invest in Dillard's (DDS) stock?

Dillard's (DDS) closed the most recent trading day at $303.28, moving -1.1% from the previous trading session. Zacks Ulta Beauty (ULTA) Looks Promising: Stock Up 15% in 6 Months

Why is Dillards stock climbing?

In recent quarters, the retailer has posted record profits. This shocking turnaround (along with an aggressive share repurchase program and periodic short squeezes) caused Dillard's stock to soar over the past year.Feb 17, 2022

Is Dillards overvalued?

Dillard's share price became overvalued with a special dividend but has since returned to reasonable levels. I see a current fair market value of $272.32 and a six-month target price of $352.26.Jan 6, 2022

Is Dillards stock a good buy?

The Dillard stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average.

Why did DDS stock go up?

Dillard's stock soared Thursday after the department store chain's third-quarter earnings and sales blew past analysts' expectations. Dillard's (ticker: DDS ) reported an adjusted profit of $9.81 a share, topping forecasts of $5.52, on total net sales of $1.48 billion, beating expectations for $1.44 billion.Nov 11, 2021

Is Dillards in financial trouble?

Before the COVID-19 pandemic, Dillard's ( DDS -11.61% ) was struggling with stagnant sales and steadily eroding margins. In fiscal 2019, the regional department store chain recorded revenue of $6.3 billion and a woeful adjusted pre-tax margin of 1.8%. That translated to adjusted earnings per share (EPS) of just $3.56.Nov 16, 2021

Is Dillards financially sound?

Dillard's is now worth roughly $7 billion, a massive run-up compared with the $1 billion value it carried a year ago. That means the company's size rivals that of companies like Alaska Air Group Inc. and Western Union Co.Nov 11, 2021

What happened with DDS?

Recently, John Danaher announced on Instagram that the famed Danaher Death Squad was splitting up due to “a combination of factors revolving around disagreements in physical location of a future school, personality conflicts, conflicting values and an inevitable tension between brand and the growing individual brands ...Jul 30, 2021

How is Dillard's doing financially?

Comparable retail sales increased 8% compared to fiscal year 2019. Net income of $862.5 million compared to a net loss of $71.7 million. Net income of $41.88 per share compared to a net loss of $3.16 per share. Retail gross margin of 42.9% of sales compared to 29.4% of sales.Feb 22, 2022

Is Dillard's a buy right now?

2 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Dillard's in the last twelve months. There are currently...

How has Dillard's' stock been impacted by Coronavirus (COVID-19)?

Dillard's' stock was trading at $43.76 on March 11th, 2020 when Coronavirus (COVID-19) reached pandemic status according to the World Health Organi...

Are investors shorting Dillard's?

Dillard's saw a increase in short interest in the month of February. As of February 28th, there was short interest totaling 2,030,000 shares, an in...

When is Dillard's' next earnings date?

Dillard's is scheduled to release its next quarterly earnings announcement on Thursday, May 12th 2022. View our earnings forecast for Dillard's .

How were Dillard's' earnings last quarter?

Dillard's, Inc. (NYSE:DDS) announced its quarterly earnings results on Monday, February, 21st. The company reported $16.61 EPS for the quarter, bea...

How often does Dillard's pay dividends? What is the dividend yield for Dillard's?

Dillard's announced a quarterly dividend on Thursday, February 24th. Stockholders of record on Thursday, March 31st will be paid a dividend of $0.2...

Is Dillard's a good dividend stock?

Dillard's pays an annual dividend of $0.80 per share and currently has a dividend yield of 0.29%. Dillard's has been increasing its dividend for 11...

What price target have analysts set for DDS?

2 Wall Street analysts have issued 1-year price targets for Dillard's' stock. Their forecasts range from $190.00 to $275.00. On average, they antic...

Who are Dillard's' key executives?

Dillard's' management team includes the following people: William Thomas Dillard , Chairman & Chief Executive Officer Alex Dillard , President &...

How much inventory has decreased in 2020?

What is Zacks research?

As of the end of fourth-quarter fiscal 2020, inventory declined about 26% year over year to $1,087.8 million.

How much did payroll expenses fall in 2020?

Zacks. Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank.

About Dillard's

While the company realized cost savings in all expense categories, payroll expenses fell about 30%, in part, due to the company’s reduced store operating hours. In fiscal 2020, payroll expenses declined 33%.

Headlines

Dillard's, Inc. engages in the retail of fashion apparel, cosmetics, and home furnishings, and other consumer goods. It operates through the Retail Operations and Construction segments.

Dillard's (NYSE:DDS) Frequently Asked Questions

DDS: Dillard's vs. Nordstrom: Which Department Store Stock is a Better Buy? - StockNews.com

Which companies are sound enough to meet financial obligations?

3 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Dillard's in the last year. There are currently 1 sell rating and 2 hold ratings for the stock. The consensus among Wall Street research analysts is that investors should "hold" Dillard's stock.

Who is the CEO of Nordstrom?

Companies such as Dillard's (DDS), Target (TGT), Herc (HRI) and Echo Global (ECHO) are sound enough to meet financial obligations.

When did DDS expand its senior secured credit facility?

As Nordstrom kicks off its most important event of the year. CEO Erik Nordstrom chats with Yahoo Finance Live about the luxury department store's outlook. Zacks • 28 days ago.

What is DDS's biggest brand?

On April 29, DDS expanded its $800 million senior secured credit facility with a $200 million expansion option. The company plans to use the proceeds to fund its liquidity requirements, which include working capital and general corporate expenses.

Why did Dillard's close?

In February, DDS’ largest ladies’ exclusive brand, Antonio Melani, launched Born for its ‘Fifth for Antonio Melani’ capsule collection. This product collection marks the first of the three collaborations to be introduced by DDS this year. Also in February, DDS collaborated with American Fashion brand LDT. Under that agreement, LDT’s products are available for sale across the DDS retail chain and online store.

When is Motley Fool 2020?

Dillard's has 285 store locations, and they were all closed by April 9 because of the coronavirus. Because of this, the company discounted merchandise to accelerate e-commerce sales. As a result, inventory is down 14% from last year -- which is good.

Is Dillard's stock up in Q1?

May 15, 2020 at 3:20PM. Author Bio. After spending more than a decade travelling the world exploring different cultures and languages, I'm happy to now be contributing to the Motley Fool's mission to make the world smarter, happier, and richer.

How long has Dillard's been around?

There's really nothing in the Q1 report that would explain the rise in Dillard's stock today, other than investors hoping for a turnaround in coming quarters. Since May 5, the company has started reopening. It has reopened 149 locations with limited hours, and plans to reopen 116 additional stores soon.

Which Russell 2000 stock has the highest short float?

For those less familiar with the mall operator, Dillard’s has been around since 1938. Its stores sprawl across nearly 30 states, with high concentrations in Texas and Florida. Once a ubiquitous anchor in shopping malls, the upscale department store has struggled like many of its other brick-and-mortar retail peers.

How much is Dillard stock worth in 2021?

As Avi Salzman wrote for Barron’s, Dillard’s is one of the Russell 2000 stocks with the highest short float. Because of this fact alone, that means it should be on your radar. If r/WallStreetBets latches on more strongly to DDS stock, it could soar.

Does Dillard have a sell signal?

The Dillard stock price gained 2.19% on the last trading day (Friday, 9th Jul 2021), rising from $179.71 to $183.64. During the day the stock fluctuated 4.73% from a day low at $181.85 to a day high of $190.45. The price has risen in 6 of the last 10 days and is up by 0.41% over the past 2 weeks. Volume fell on the last day by -81 thousand shares and in total, 191 thousand shares were bought and sold for approximately $35.03 million. You should take into consideration that falling volume on higher prices causes divergence and may be an early warning about possible changes over the next couple of days.

The struggling retailer got a big boost from an investor with a big following

The Dillard stock holds a sell signal from the short-term moving average ; at the same time, however, there is a buy signal from the long-term average. Since the short-term average is above the long-term average there is a general buy signal in the stock giving a positive forecast for the stock. On further gains, the stock will meet resistance ...

What happened

Reuben Gregg Brewer believes dividends are a window into a company's soul. He tries to invest in good souls.

So what

Shares of U.S. retailer Dillard's ( NYSE:DDS) rose as much as 46% in early trading on Monday. That massive price increase didn't stick around for long, with the stock up "only" by a third or so at 10:30 a.m. EDT today. Clearly, investor sentiment turned higher here in a big way, a shift that was largely driven by Ted Weschler.

Now what

Don't feel bad if you don't know the name Ted Weschler off the top of your head. But you are highly likely to know his boss, Warren Buffett, and his employer, Berkshire Hathaway. Weschler is one of Buffett's key lieutenants and handles a portion of Berkshire's investments.