Why is Berkshire Hathaway stock outperforming the market?

And a big reason Berkshire stock is beating the market is due to strong performances from its consumer staple stocks, financial stocks, energy stocks, and industrial and material stocks that make up a big portion of its portfolio . Berkshire Hathaway gets a lot of attention for the stocks it owns.

How much would it cost to invest in Berkshire Hathaway today?

In fact, investing just $100 in Berkshire Hathaway in its first year would have made you a millionaire today, as that would now be worth roughly $2.7 million. In addition to that track record, Berkshire Hathaway is run by Warren Buffett, generally regarded as the greatest investor in history.

Why is Berkshire Hathaway’s book value falling?

The book value of Berkshire Hathaway ( NYSE: BRK.A ) (NYSE: BRK.B) is in the process of falling by a scary amount. That will become apparent in about a month when it reports second quarter earnings. There are a few underlying reasons but very few companies have the unusual degree of exposure to a huge downward reset of valuations.

Is Berkshire Hathaway B’S Stock underperforming the S&P 500?

A month has gone by since the last earnings report for Berkshire Hathaway B (BRK.B). Shares have lost about 1.2% in that time frame, underperforming the S&P 500.

Why is Berkshire stock dropping?

B -0.18% first-quarter earnings fell as turbulence across financial markets weighed on its giant stock portfolio and rising claims costs hurt its insurance-underwriting business. Warren Buffett's company reported net income of $5.46 billion, or $3,702 a Class A share equivalent.

Is Berkshire Hathaway stock a good buy?

Buffett has Berkshire Hathaway well-positioned to ride out the market volatility and continue to produce long-term returns. It is a great investment, but with a stock price of $325 per share, it may be too expensive for some investors to buy multiple shares.

What is happening with Berkshire Hathaway?

Buffett's Berkshire posts record annual profit, extends but slows buybacks. Berkshire also signaled renewed confidence in its own stock, repurchasing $6.9 billion in the quarter, and boosting total buybacks in 2021 to a record $27 billion.

Is BRK BA a buy or sell?

For example, a stock trading at $35 with earnings of $3 would have an earnings yield of 0.0857 or 8.57%. A yield of 8.57% also means 8.57 cents of earnings for $1 of investment....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy25.08%2Buy18.56%3Hold10.15%4Sell5.79%2 more rows

Is Berkshire Hathaway stock undervalued?

“We still find Berkshire undervalued, but less so than in past years given the stock is up more than 50% since year-end 2020,” says Chris Bloomstran, chief investment officer of Semper Augustus Investments, a St. Louis investment firm that holds Berkshire.

Is Berkshire Hathaway doing well?

The resurgence of value stocks Between 1965 and 2021, Berkshire Hathaway produced an annual gain of 20.1% compared to the S&P 500 (with dividends) gain of 10.5%. Put another way, one dollar invested in the S&P 500 in 1964 would have turned into $30,209 by the end of 2021.

Why did Warren Buffett buy Berkshire Hathaway?

In explaining why he bought it, Buffett was quoted at the time as saying “we bought Berkshire Hathaway at a good price”. My research has uncovered that this “good price” did not involve a low price to trailing earnings multiple. Instead, it refers to a good price in relation to the value of the assets.

Who owns the most Berkshire Hathaway stock?

The top shareholders of Berkshire Hathaway class B shares are Warren E. Buffett, Ronald L. Olson, Meryl B. Witmer, Vanguard Group Inc., BlackRock Inc.

How much cash does Berkshire Hathaway have 2022?

Berkshire Hathaway cash on hand for the quarter ending March 31, 2022 was $39.113B, a 34.87% decline year-over-year.

Will Berkshire B stock go up?

Based on our forecasts, a long-term increase is expected, the "BRK. B" stock price prognosis for 2027-06-11 is 637.500 USD. With a 5-year investment, the revenue is expected to be around +137.8%. Your current $100 investment may be up to $237.8 in 2027.

Is BRK A better than BRK B?

Class A shares will typically grant more voting rights than other classes. This difference is often only pertinent for shareholders who take an active role in the company. Nevertheless, because of the voting rights, A-shares are often more valuable than B shares.

Does BRK B pay a dividend?

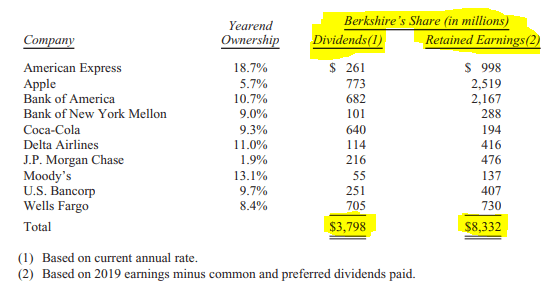

Berkshire Hathaway (BRK.B) famously doesn't pay dividends – it has better things to do with its shareholders' cash – but Chairman and CEO Warren Buffett sure loves collecting them. In 2018 alone, Berkshire raked in $3.8 billion in dividends – “a sum that will increase in 2019,” Buffett said in the annual letter.

Behind the Headlines

Revenues increased 12% year over year to $70.6 billion, attributable to higher revenues from Insurance and Other operations as well as Railroad, Utilities and Energy. Costs and expenses increased 11.3% year over year to $63.4 billion, largely due to an increase in costs and expenses in Railroad, Utilities and Energy and Insurance and Other.

Segment Results

Berkshire Hathaway’s Insurance and Other segment revenues increased 11.9% year over year to $57.8 billion in the third quarter of 2021 on the back of higher insurance premiums earned, sales and service revenues, leasing revenues, interest, dividend and other investment income. Railroad, Utilities and Energy operating revenues increased 12.3% year over year to $12.8 billion due to an increase in freight rail transportation revenues, energy operating revenues, service revenues and other income.

Behind the Headlines

Revenues increased 21.6% year over year to $69.1 billion, attributable to higher revenues from Insurance and Other operations as well as Railroad, Utilities and Energy. Costs and expenses decreased 0.5% year over year to $60.9 billion.

Segment Results

Berkshire Hathaway’s Insurance and Other segment revenues increased 20.2% year over year to $57.2 billion in the second quarter of 2021 on the back of higher insurance premiums earned, sales and service revenues, leasing revenues. Railroad, Utilities and Energy operating revenues increased 28.5% year over year to $11.9 billion due to higher freight rail transportation revenues, energy operating revenues, service revenues and other income.

Financial Position

As of Jun 30, 2021, consolidated shareholders’ equity was $470.4 billion, up 6.1% from the level as of Dec 31, 2020.

Buffett's baby has long been a market darling, but it's not right for a lot of investors

Most investors would consider Berkshire Hathaway ( BRK.A 0.34% ) ( BRK.B 0.40% ) a no-brainer stock to own.

NYSE: BRK.A

In addition to that track record, Berkshire Hathaway is run by Warren Buffett, generally regarded as the greatest investor in history.

About that track record

While it's true that Berkshire Hathaway has crushed the S&P 500 over its history, in the recent past, Buffett hasn't kept up. Berkshire, which has historically avoided high-growth stock and tech stocks, performed poorly over the last year, missing out on the broad recovery that most investors enjoyed.

Buffett won't be around forever

Warren Buffett is 90 years old. Berkshire Hathaway's biggest competitive advantage is him, and his partner Charlie Munger, who is 97. They built the company and have guided it through its lifetime. Every year, tens of thousands of shareholders flock to Omaha for Berkshire's annual shareholders' meeting and to see Buffett speak.

What's its economic moat?

Buffett's focus as an investor has been finding profitable businesses with economic moats that are difficult to disrupt. He prefers boring cash-generating companies to riskier high-growth companies. But as technology improves, the pace of innovation and disruption is speeding up, and some of its key subsidiaries are starting to look vulnerable.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

The Resurgence of Value Stocks

- Between 1965 and 2021, Berkshire Hathaway produced an annual gain of 20.1% compared to the S&P 500 (with dividends) gain of 10.5%. Put another way, one dollar invested in the S&P 500 in 1964 would have turned into $30,209 by the end of 2021. But one dollar invested in Berkshire in 1964 would be worth $3.64 million. The problem is that a lot of Berk...

Strong Performances from Other Business Units

- Berkshire Hathaway gets a lot of attention for the stocks it owns. But as of March 24, the value of all of those public equity holdings is just $352.1 billion compared to Berkshire's total market cap of $778.3 billion. The majority of Berkshire Hathaway's value comes from its insurance, manufacturing, railroad, energy, and services businesses, as well as the value of the assets and …

Staying Patient and Keeping A Sizable Cash Position

- In 2021, Berkshire Hathaway retained a massive cash position and bought back a ton of its own stock. In hindsight, it was a brilliant strategy, given Berkshire Hathaway stock is now at its all-time high. The chart below shows how much cash and cash equivalents Berkshire ended 2021 with on its balance sheet -- and that's after buying back $27 billion in stock. Both its cash position and it…

Tying It All Together

- Berkshire Hathaway's performance illustrates the power of a diversified portfolio that can capture upside from different sectors as well as limit downside risk. Apple stock was a bold bet for Buffett, who historically has avoided tech stocks. But the business makes sense, is relatively easy to understand, and isn't overvalued. Today, value stocksand Buffett's other investments are work…