Should you buy Berkshire grey stock?

3 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Berkshire Grey in the last year. There are currently 1 hold rating and 2 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" Berkshire Grey stock.

How much did Berkshire grey increase its total orders to-date?

Total Orders to-Date Increase to $184 Million, Reinforcing the Company's Ongoing Revenue Momentum and Growth Trajectory Total Orders to-Date Increase to $184 Million, Reinforcing the Company's Ongoing R... Berkshire Grey Announces the Robotic Shuttle Product Sortation (BG RSPS) Solution to Accelerate Order Fulfillment and...

Who are Berkshire Grey’s investors?

Founded in 2013, Massachusetts startup Berkshire Grey has taken in $263 million in disclosed funding from investors that include SoftBank and Khosla.

What is Berkshire Grey’s new reverse merger all about?

They’re doing a reverse merger with a SPAC called Revolution Acceleration Acquisition ( RAAC ). We’ve looked at plenty of robots working in warehouses but never came across Berkshire Grey before because they were flying under the radar.

Will Berkshire GREY stock go up?

The 4 analysts offering 12-month price forecasts for Berkshire Grey Inc have a median target of 5.50, with a high estimate of 8.00 and a low estimate of 2.45. The median estimate represents a +109.52% increase from the last price of 2.63.

Is Berkshire GREY stock a buy?

Berkshire Grey has received a consensus rating of Buy. The company's average rating score is 2.67, and is based on 2 buy ratings, 1 hold rating, and no sell ratings.

Who uses Berkshire GREY?

Berkshire Grey's robotic sortation solutions are widely used by businesses within the ecommerce, retail, grocery, 3PL, and package handling logistics industries. The solutions are also used to support local nonprofits like Greater Boston Food Bank, City Harvest, and United Way.

Is BGRY a buy?

Analyst Price Target on BGRY Based on 3 Wall Street analysts offering 12 month price targets for Berkshire Grey in the last 3 months. The average price target is $8.67 with a high forecast of $10.00 and a low forecast of $8.00. The average price target represents a 222.30% change from the last price of $2.69.

What does Berkshire GREY do?

Berkshire Grey, Inc. is an American technology company based in Bedford Massachusetts that develops integrated artificial intelligence (“AI") and robotic solutions for e-commerce, retail replenishment, and logistics. The company's systems automate pick, pack and sort operations.

Where is Berkshire GREY located?

Bedford, MAHeadquarters – Bedford, MA.

Is Berkshire Grey a buy right now?

3 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Berkshire Grey in the last year. There are currently 1 hold ratin...

When is Berkshire Grey's next earnings date?

Berkshire Grey is scheduled to release its next quarterly earnings announcement on Thursday, August 11th 2022. View our earnings forecast for Berk...

How were Berkshire Grey's earnings last quarter?

Berkshire Grey, Inc. (NASDAQ:BGRY) announced its quarterly earnings results on Tuesday, March, 29th. The company reported ($0.16) earnings per shar...

What guidance has Berkshire Grey issued on next quarter's earnings?

Berkshire Grey updated its FY 2022 earnings guidance on Thursday, May, 26th. The company provided earnings per share (EPS) guidance of for the peri...

What price target have analysts set for BGRY?

3 analysts have issued 12 month price targets for Berkshire Grey's stock. Their forecasts range from $8.00 to $12.00. On average, they expect Berks...

Who are Berkshire Grey's key executives?

Berkshire Grey's management team includes the following people: Dr. Thomas Wagner Ph.D. , Founder, CEO, Treasurer, Sec. & Director (Age 55, Pay...

Who are some of Berkshire Grey's key competitors?

Some companies that are related to Berkshire Grey include Sarcos Technology and Robotics (STRC) , Ouster (OUST) , Velodyne Lidar (VLDR) , Clean...

What is Berkshire Grey's stock symbol?

Berkshire Grey trades on the NASDAQ under the ticker symbol "BGRY."

Who are Berkshire Grey's major shareholders?

Berkshire Grey's stock is owned by a number of retail and institutional investors. Top institutional investors include Vanguard Group Inc. (0.87%),...

Somerville's RightHand Robotics picks SoftBank as investor

What Kind Of Shareholders Own Berkshire Grey, Inc. (NASDAQ:BGRY)?

RightHand Robotics Inc., a Somerville-based robotics startup with 75 employees in the Bay State, has closed a new $66 million round.

Kalos Management, Inc. Buys Vale SA, Sells Consensus Cloud Solutions Inc, Intuitive Surgical ..

A look at the shareholders of Berkshire Grey, Inc. ( NASDAQ:BGRY ) can tell us which group is most powerful...

Berkshire Grey flips the switch on returns and reverse logistics

Investment company Kalos Management, Inc. (Current Portfolio) buys Vale SA, sells Consensus Cloud Solutions Inc, Intuitive Surgical Inc, Amarin Corp PLC, Catalyst Biosciences Inc, Paratek Pharmaceuticals Inc during the 3-months ended 2021Q4, according to the most recent filings of the investment company, Kalos Management, Inc..

Berkshire Grey to Present at the Needham Growth Conference

UPS said this week that it expects to handle 60 million returned packages through Jan. 22, a 10% increase over last year, with 25% of Americans expected to make at least one return. That delivery strain...

Berkshire Grey Introduces Next Generation Robotic Product Sortation (BG RPS) Solution for Scalable, Touchless Order F..

BEDFORD, Mass., Jan. 11, 2022 (GLOBE NEWSWIRE) -- Berkshire Grey Inc. (Nasdaq: BGRY), the leader in AI-enabled robotic solutions that automate supply chain processes, today announced that management is ...

Berkshire Grey struggles in first quarter as public company

BG RPS systems autonomously pick, sort, and pack millions of items per month with higher speed and throughput while increasing fulfillment by up to 2X without adding labor BG RPS systems autonomously pi...

Bealls, Inc. Selects Berkshire Grey's Advanced Robotic Solutions to Automate and Accelerate Fulfillment Operations

AI-powered robotics and supply chain automation company Berkshire Grey reported its first earnings as a publicly traded company Thursday morning before the bell, revealing some early struggles for the b...

Berkshire Grey Reports Third Quarter 2021 Results

Innovative Retailer with over 525 stores chooses Berkshire Grey's robotic automation to speed up store replenishment for growth merchandise categories Innovative Retailer with over 525 stores chooses Be...

Berkshire Grey Announces the Robotic Shuttle Product Sortation (BG RSPS) Solution to Accelerate Order Fulfillment and..

Total Orders to-Date Increase to $184 Million, Reinforcing the Company's Ongoing Revenue Momentum and Growth Trajectory Total Orders to-Date Increase to $184 Million, Reinforcing the Company's Ongoing R...

About Berkshire Grey

Following successful customer adoption, Berkshire Grey offers RSPS to global retailers, grocers and 3PLs to efficiently put the right inventory in the right places at the right times Following successfu...

To Buy or Not to Buy

We’ve looked at plenty of robots working in warehouses but never came across Berkshire Grey before because they were flying under the radar. Founded in 2013, Massachusetts startup Berkshire Grey has taken in $263 million in disclosed funding from investors that include SoftBank and Khosla.

Conclusion

It’s important to understand what we’re investing in here – warehouse automation. This involves a mix of technologies including artificial intelligence, robotics, and eventually 5G so that your entire warehouse can become a digital twin. The thesis was boosted when The Rona hit and warehouses were being closed because workers were falling ill.

What happened

It’s always important to spell out the thesis you’re investing in so you can see what opportunities exist. If you’re risk averse like us, you’ll go with the option that allows for greater diversification and lower risk. The opportunity pretty much sells itself, so you won’t find a whole lot of value in the Berkshire Grey investment deck.

So what

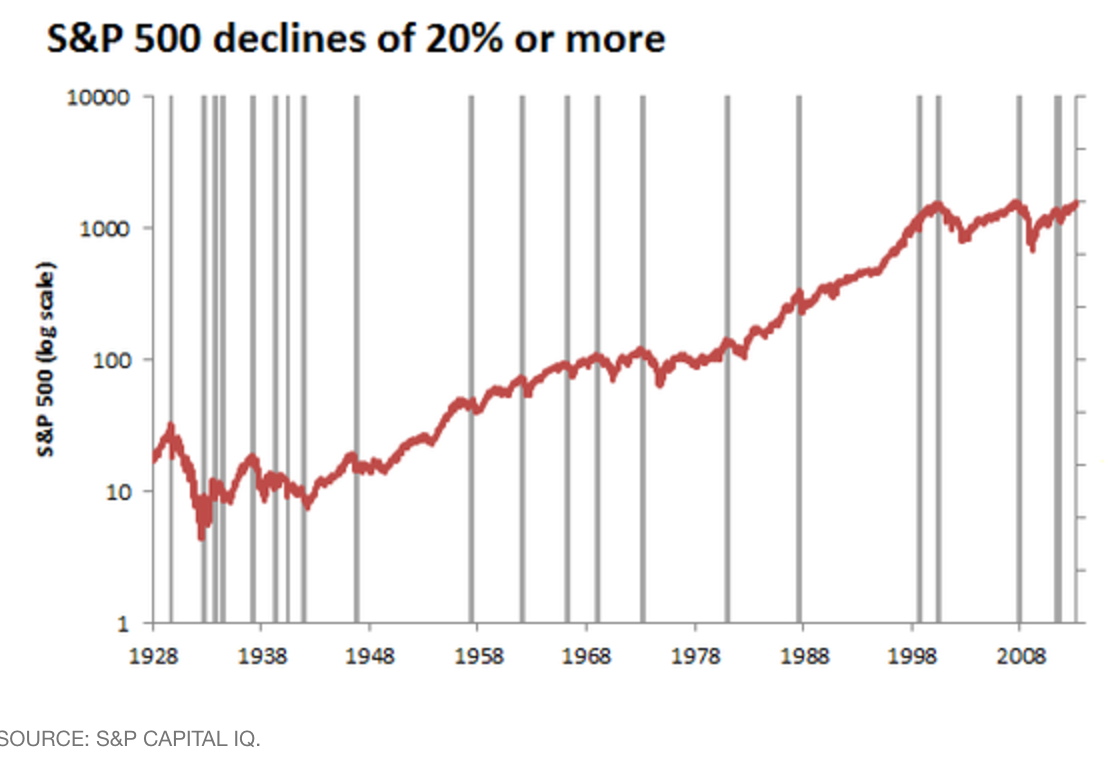

On paper, it would appear the first half of 2020 set up nicely for Warren Buffett, the investor who famously said, "Be greedy when others are fearful, and fearful when others were greedy." Investors were certainly fearful in February and March as the COVID-19 pandemic swept across the globe, with the S&P 500 falling more than 30%.

Now what

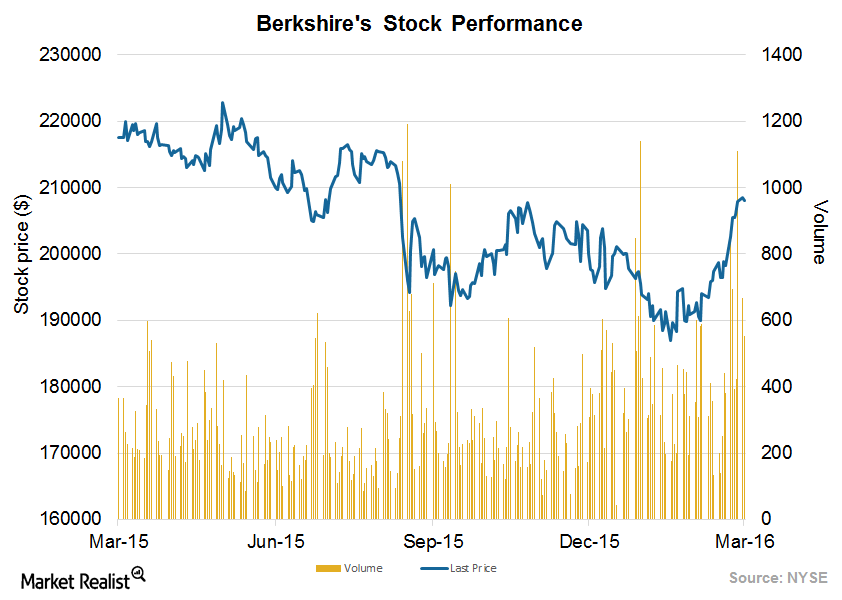

Berkshire has gained a reputation for using downturns to amass large stakes in long-term winners, famously doing a number of deals with large banks during the 2008-2009 downturn that have paid off well.

Premium Investing Services

Many an investor has been left looking like a lower-case fool for questioning the acumen of Warren Buffett over the years, and I'm loath to do it now.