What is happening to Altria’s stock price?

Altria Group, Inc. Technical Assessment: Neutral in the Intermediate-Term The stock market continues to be battered and we have finally reached the white-knuckle point of the decline, …

Does Altria have headroom for price increase?

Apr 17, 2022 · Altria Group, Inc. (NYSE:MO) Expected to Post Earnings of $1.09 Per Share americanbankingnews.com - April 18 at 2:16 AM: Big Tobacco Will Feel the Burn From Pricier Gas finance.yahoo.com - April 15 at 9:00 PM: Altria to Host Webcast of 2022 First-Quarter Results finance.yahoo.com - April 14 at 1:53 PM: Is Altria Stock Undervalued Or Overvalued?

What is Altria’s biggest investment in E-vaping?

May 21, 2020 · Well, of course there is a reason – it’s earnings, profits earned after all the expenses and taxes. Turns out Altria’s earnings margins (profits as a % of revenue) steadily dropped over the last...

How does Altria’s valuation compare to Philip Morris’?

Sep 30, 2021 · Altria was down 5.72% at $45.95 and Philip Morris was down 3.76% at $95.75 at time of publication. ... shareholders lost ground to the market on Wednesday as the stock fell 11% by 1:15 p.m. ET ...

Why did Altria stock go down?

MO, -1.77% slipped 0.2% in premarket trading Thursday, after the cigarette and heated tobacco seller reported third-quarter profit that missed expectations while revenue fell but beat forecasts. Net losses widened to $2.7 billion, or $1.48 a share, from $952 million, or 51 cents a share, in the year-ago period.Oct 28, 2021

Is Altria stock a buy now?

MO stock is no longer a buy, as it is just extended from the consolidation pattern. IBD recommends investors focus on stocks that are closer to their highs and that have Composite Ratings of 90 or higher. Earnings growth for MO stock might tick higher this year.5 days ago

Is MO a buy sell or hold?

The median P/B ratio for stocks in the S&P is just over 3....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.93%2Buy18.44%3Hold9.99%4Sell5.61%2 more rows

Is Altria a safe stock?

The Altria stock dividend appears safe. It consumes only a portion of the company's free cash flow. And that cash is supported by a consistent and proven business model. Also, Altria projects slow but profitable growth during the next 1-3 years.

What is the future for Altria?

Altria's Vision by 2030 is to responsibly lead the transition of adult smokers to a smoke-free future. We are developing and investing in potentially reduced harm alternatives that smokers will want to transition to. Our companies have a long history of leading the industry.

What is the best tobacco stock?

Best Value Tobacco StocksPrice ($)12-Month Trailing P/E RatioImperial Brands PLC (IMBBY)20.144.9Vector Group Ltd. (VGR)10.137.1Japan Tobacco Inc. (JAPAY)8.538.4

Does Altria have a lot of debt?

What Is Altria Group's Debt? As you can see below, Altria Group had US$29.7b of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$5.79b in cash offsetting this, leading to net debt of about US$23.9b.Jul 19, 2021

What is Zacks rating on Mo?

MO 54.91 +0.46(0.47%)

Does Altria own Philip Morris?

Altria is the parent company of Philip Morris USA (producer of Marlboro cigarettes), John Middleton, Inc., U.S. Smokeless Tobacco Company, Inc., and Philip Morris Capital Corporation.

Will Altria raise its dividend in 2021?

(Altria) (NYSE: MO) today announced that its Board of Directors declared a regular quarterly dividend of $0.90 per share, payable on January 10, 2022 to shareholders of record as of December 23, 2021. The ex-dividend date is December 22, 2021.Dec 8, 2021

Will Altria raise dividends in 2021?

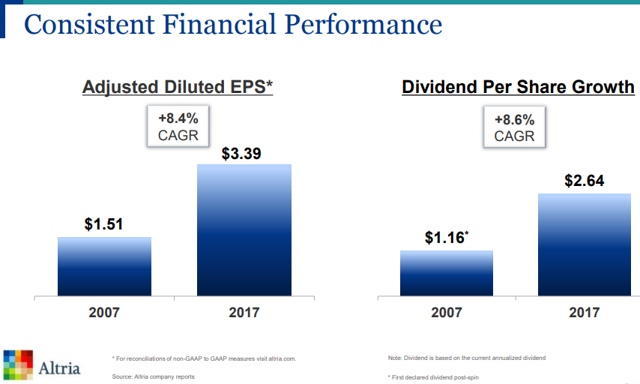

(Altria) (NYSE: MO) today announced that its Board of Directors voted to increase Altria's regular quarterly dividend by 4.7% to $0.90 per share versus the previous rate of $0.86 per share. The quarterly dividend is payable on October 12, 2021 to shareholders of record as of September 15, 2021.Aug 26, 2021

Is Altria a good dividend?

Altria Group offers income investors a whopping 7.6% dividend yield that is sustainable. The stock trades at a forward P/E ratio under 10, which makes it tempting as a value stock.Dec 30, 2021

Not even favorable market conditions seemed to help the tobacco giant

What happened

Rich has been a Fool since 1998 and writing for the site since 2004. After 20 years of patrolling the mean streets of suburbia, he hung up his badge and gun to take up a pen full time.

So what

Shares of Altria ( NYSE:MO) were down 16.8% in 2020 despite the coronavirus pandemic forcing everyone to stay at home for large swaths of the year when they theoretically could have smoked more.

Now what

While the COVID-19 outbreak did lead to better industry performance, resulting in Altria revising its full-year forecast for fiscal 2021 to see volumes fall just 1.5% compared to its prior estimate of a 2% to 3.5% decline, it still means the industry is continuing its secular contraction.

Summary

Altria still has significant opportunity before it as consumers who smoke willingly accept price increases on cigarettes, giving it a stable revenue stream. The IQOS continues its national rollout as an FDA-approved e-cig, and even with all of its troubles, Juul remains the market leader, and Altria may one day rule how it's run.

Thesis

Altria's share price is down, but that does not mean the company is running into problems.

Altria's Price Is Down - The Only Issue It Has Experienced

Altria ( MO) has seen its share price decline over the last couple of years, but that was not based on crashing earnings or cash flows. Instead, it was purely driven by valuation. Altria's underlying performance has been solid over the last couple of years, including during the current pandemic.

Altria And The Current Crisis

I recently read an article here on Seeking Alpha that argues that Altria was collapsing. In that report, author Income Generator argues that the company's weak share price performance over the last couple of years was caused by its weak performance, the JUUL investment going south, and problems during the pandemic.

Takeaway

Some bearish investors argue that Altria was running into problems due to the current crisis (pandemic and recession), but I don't think that belief is justified when we look at a couple of relevant factors.

One Last Word

Altria's investment in JUUL seems ill-timed in retrospect, but the cash for that acquisition has been paid a long time ago, and any asset writedowns during 2020 or in the future will be a non-cash item.

What happened

If you found this article interesting or helpful, it would be greatly appreciated if you "Followed" me by clicking the button at the top, or if you "Like this article" below, as this will help me in building an audience and continuing to write on SA. If you want to share your opinion or perspective, you are also very welcome to comment below.

So what

Shares of Altria Group Inc. (NYSE: MO) were down 5.2% as of 3:00 p.m. EDT Wednesday after several analysts downgraded shares of tobacco products giant.

Now what

To justify his downgrade, Spielman argued that e-cigarette maker Juul is "beginning to disrupt the U.S. cigarette industry." As such, when Altria reports earnings next week, he believes it will confirm that industry volumes declined around 6% in the first quarter -- a trend that will mean Altria's valuation remains "depressed."

How much revenue does Altria have?

The bar isn't set particularly high, as investors expect Altria's quarterly sales will climb less than 1% from the same year-ago period, to roughly $4.62 billion. Thanks in part to tight cost controls, though, Altria's earnings per share are expected to simultaneously climb around 26%, to $0.92.

Is Altria going to increase its prices?

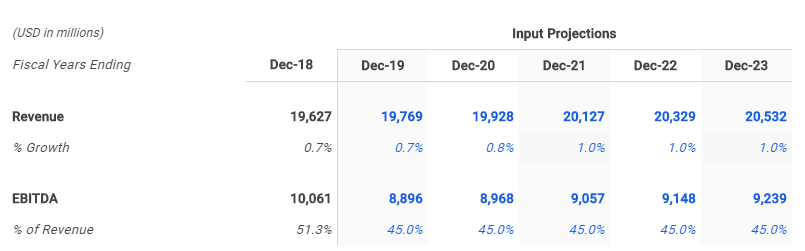

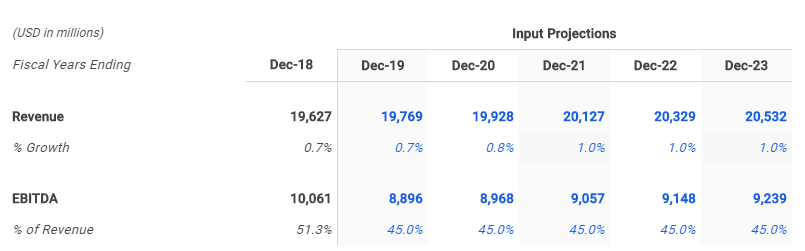

A] Revenue Growth. Altria has seen only a modest rise of $0.5 billion in revenues over the last three years, with net revenue growing from $19.3 billion in 2016 to $19.8 billion in 2019. However, growth is likely to accelerate to $20.2 billion in 2020, led by higher revenue from heated tobacco products, benefiting from JUUL and Cronos acquisitions, ...

Is Juul a crackdown?

However, Altria has resorted to price increases to avoid a sharp decline in revenue. Revenue from the smokeless products division is expected to increase in the near future, driven by higher volume, along with premium pricing and partial phasing out of promotional investments and discounts.