Stock prices go down because of company revenues, business outlook, analyst downgrades and simple market corrections. Sometimes wonderful news about a company triggers a sell-off, which is most frustrating for an investor. To understand why stock prices fluctuate, consider that their prices are a reflection of human action and reaction.

What to do if your stocks are all falling?

Dec 04, 2021 · The largest single-day decrease in the history of the Nasdaq Composite Index took place on March 16, 2020. The market "lost" (traded down) 970.28 points, over 12% of its value. This move is...

Why is the NASDAQ still falling on Monday?

Nov 21, 2021 · “Stocks are on their last legs,” he declares, predicting that the market will plummet 80%. Indeed, in the first two to three months of 2022, it will drop more than 50%, Dent, a …

Why do stocks keep going up?

Jul 28, 2021 · First, let’s start by outlining why stocks go down in the first place. Stock market prices go up and down every day because of market forces. The share prices end up changing due to supply and demand. When the company is doing well, more people want to buy the stock instead of selling it. If the company starts to do worse, then more people stock selling it, and …

Why is the market falling right now?

Jan 20, 2022 · Blame surging inflation, an out-of-step Federal Reserve or a nagging pandemic. But whatever boogeyman market participants identify, there are clear signs that the market is experiencing signs of ...

What is supply and demand in a market economy?

In a market economy, any price movement can be explained by a temporary difference between what providers are supplying and what consumers are demanding. This is why economists say that markets tend towards equilibrium , where supply equals demand. This is how it works with stocks;

Why are interest rates important?

First, interest rates affect how much investors, banks, businesses, and governments are willing to borrow, therefore affecting how much money is spent in the economy.

Who is Mary Hall?

Mary Hall is a freelance editor for Investopedia's Advisor Insights, in addition to being the editor of several books and doctoral papers. Mary received her bachelor's in English from Kent State University with a business minor and writing concentration.

Is the stock market a living entity?

"The market," so to speak, is not a living entity. Instead, it is just shorthand for the collective values of individual companies.

What happens at the end of each quarter?

Typically, at the end of each quarter, they sell their outperforming assets and buy the under-performing ones to bring those percentages back in line.

When will the third quarter of 2020 end?

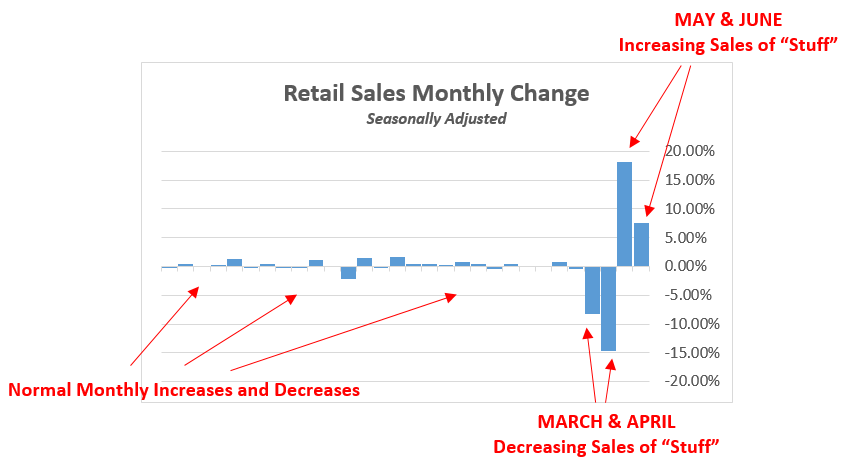

The third quarter of 2020 will end in a few days, and the S&P 500 was up over sixteen percent from the close at the end of June to its high at the beginning of this month. That means a lot of those multi-billion- or even multi-trillion-dollar funds will be selling a lot of stocks to rebalance going into Q4.

Where did Martin Tillier work?

Martin Tillier spent years working in the Foreign Exchange market, which required an in-depth understanding of both the world’s markets and psychology and techniques of traders. In 2002, Martin left the markets, moved to the U.S., and opened a successful wine store, but the lure of the financial world proved too strong, leading Martin to join a major firm as financial advisor.

Will Donald Trump accept the results of the election if he loses?

Donald Trump has suggested on several occasions that he won’t accept the results if he loses, bringing legitimate fears of a constitutional crisis. If he wins, Democrats will look at the polls leading up to the vote and conclude that either he, the GOP in general, or Russia stole the election from them.

Why do stocks go down?

First, let’s start by outlining why stocks go down in the first place. Stock market prices go up and down every day because of market forces. The share prices end up changing due to supply and demand. When the company is doing well, more people want to buy the stock instead of selling it.

What should you do with your portfolio if stocks go down?

Of course, if you had your choice, your stocks would always be in demand. However, that isn’t always how it works. If your stocks start to take a hit, here’s what you should do.

Just breathe

When you are ready to panic, pack up, and leave, take a deep breath, and realize that a dip in stocks is all part of the process. If you haven’t diversified already, you need to get on it to spread the wealth and lower the overall risk. You should consider buying when there is a dip but don’t go crazy looking for one.

Why Shouldn’T I Panic?

Understand Your Risk Tolerance

- Investors can probably remember their first experience with a market downturn. For inexperienced investors, a rapid decline in the value of their portfolios is unsettling, to say the least. That is why it is very important to understand your risk tolerance beforehand when you are in the process of setting up your portfolio, and not when the market is in the throes of a sell-off. Your risk toleranc…

Prepare for—and Limit—Your Losses

- To invest with a clear mind, you must grasp how the stock market works. This permits you to analyze unexpected downturns and decide whether you should sell or buy more. Ultimately, you should be ready for the worst and have a solid strategy in place to hedge against your losses. Investing exclusively in stocks may cause you to lose a significant amount of money if the mark…

Focus on The Long Term

- Reams of research prove that though stock market returns can be quite volatile in the short term, stocks outperform almost every other asset class over the long term. Over a sufficiently lengthy period, even the biggest drops look like mere blips in the market's long-term upward trend. This point needs to be borne in mind especially during volatile periods when the market is in a substa…