Employers have long recognized the benefit of giving employees a stake in the business they belong to. Share ownership schemes help incentivize employees to hit targets and generate profits for the company, aligning their own interests as stock holders with their performance on a day-to-day basis.

Can an employee own stock in a company?

Employees can buy stock directly, be given it as a bonus, can receive stock options, or obtain stock through a profit sharing plan. Some employees become owners through worker cooperatives where everyone has an equal vote. But by far the most common form of employee ownership in the U.S. is the ESOP, or employee stock ownership plan.

What are the benefits of stock ownership plans?

Most corporations use stock ownership plans as a form of an employee benefit. Plans in public companies generally limit the total number or the percentage of the company's stock that may be acquired by employees under a plan.

What is an all-employee stock ownership plan?

All-employee plans offer participation to all employees (subject to certain qualifying conditions such as a minimum length of service). Most corporations use stock ownership plans as a form of an employee benefit.

How do employees become owners of a company?

Some employees become owners through worker cooperatives where everyone has an equal vote. But by far the most common form of employee ownership in the U.S. is the ESOP, or employee stock ownership plan.

Can employees own stock?

An employee stock ownership plan (ESOP) gives workers ownership interest in the company. An ESOP is usually formed to allow employees the opportunity to buy stock in a closely held company to facilitate succession planning.

Why do companies give stock to employees?

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

What is it called when employees own the company?

When a company is employee-owned, it means they have an Employee Stock Ownership Program, or ESOP.

Why an owner benefits from an employee-owned company?

Employee-owners experience financial advantages on four levels: Equal or better pay and benefits. Asset building through profit sharing, retirement savings and shared business ownership. Enhanced job security and stability.

Why do companies give stocks instead of salary?

There are several reasons why employers offer stock options: To preserve cash — options don't require out-of-pocket cash, like salaries do. As an incentive to attract new employees. As a performance incentive for existing employees (a higher stock price results in higher option payouts)

Should you give employees stock?

Even during a tight economy, small business owners look for ways to attract and retain high quality employees. One common way to do this, especially in start-up companies that don't have huge payrolls, is to give company stock to employees. There are many benefits of offering this type of perk or incentive.

How does employee-owned stock work?

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Is an ESOP good for employees?

ESOPs are a long-term benefit for employees. Like a good healthcare plan or competitive paid time off, ESOPs can be an enticing aspect of an employee benefit package and help attract top talent to the company. ESOPs can help team members build significant wealth as shares appreciate over time.

What happens to ESOP when you leave?

If Raj leaves the company after completing four years, his stock options would already be vested at the time of leaving the company. He has the opportunity to benefit from his ESOPs by exercising them. Typically, vested stocks have two categories: non-qualified stock options (NQSOs) and incentive stock options (ISOs).

What is a 100% employee-owned company?

What does it mean when a company is 100% employee owned? Some employee-owned companies are only partly employee owned. Where companies are 100% employee owned, workers own the entire company. Employees hold all the shares, and they're responsible for all the decisions.

What are the pros and cons of an ESOP?

It's worth internalizing these pros and cons if you're considering an employee stock ownership plan for your closely-held company.PRO: Sellers are Paid Fair Market Value (FMV) ... CON: ESOPs Cannot Offer More than FMV. ... PRO: An Employee Trust is a Known Buyer. ... CON: An ESOP Transaction Process is Highly Structured.More items...

What are the disadvantages of employee-owned companies?

List of the Cons of Employee-Owned CompaniesIt eliminates the benefits of strategic buying. ... Financing may be difficult to obtain for some ESOPs. ... There are fees which must be paid. ... It requires broad shareholder ownership. ... ESOPs can also create a cash-flow drain. ... There are distribution restrictions to consider.

How do employees become owners of stock?

Employees can buy stock directly, be given it as a bonus, can receive stock options, or obtain stock through a profit sharing plan . Some employees become owners through worker cooperatives where everyone has an equal vote. But by far the most common form of employee ownership in ...

What happens when employees leave a company?

When employees leave the company, they receive their stock, which the company must buy back from them at its fair market value (unless there is a public market for the shares). Private companies must have an annual outside valuation to determine the price of their shares.

What is an ESOP plan?

ESOP Rules. An ESOP is a kind of employee benefit plan, similar in some ways to a profit-sharing plan. In an ESOP, a company sets up a trust fund, into which it contributes new shares of its own stock or cash to buy existing shares. Alternatively, the ESOP can borrow money to buy new or existing shares, with the company making cash contributions ...

Is ESOP a pro rata share?

Note, however, that the ESOP still must get a pro-rata share of any distributions the company makes to owners. Dividends are tax-deductible: Reasonable dividends used to repay an ESOP loan, passed through to employees, or reinvested by employees in company stock are tax-deductible. Employees pay no tax on the contributions to the ESOP, ...

Is ESOP interest deductible?

The company then makes tax-deductible contributions to the ESOP to repay the loan, meaning both principal and interest are deductible. To create an additional employee benefit: A company can simply issue new or treasury shares to an ESOP, deducting their value (for up to 25% of covered pay) from taxable income.

Can an ESOP borrow money?

Alternatively, the ESOP can borrow money to buy new or existing shares, with the company making cash contributions to the plan to enable it to repay the loan. Regardless of how the plan acquires stock, company contributions to the trust are tax-deductible, within certain limits. The 2017 tax bill limits net interest deductions for businesses ...

Is a company's contribution to ESOP deductible?

Cash contributions are deductible: A company can contribute cash on a discretionary basis year-to-year and take a tax deduction for it, whether the contribution is used to buy shares from current owners or to build up a cash reserve in the ESOP for future use.

Why do companies offer stock options?

There are benefits for employers as well. Offering stock options helps companies recruit better-qualified candidates, and motivates current employees to perform at the top of their game. Employers who offer stock options also find less turnover and better morale among their work forces, according to a 2000 report by the National Commission on Entrepreneurship.

What happens if you invest heavily in stock?

By investing heavily in company stock and depending on the same company for your salary and benefits, you're essentially staking your financial security on a single firm. Should the company hit a shaky spot, your financial future can start to tremble as well.

How much of a 401(k) is tied to stock?

by the Employee Benefit Research Institute found that about 8% of employees have more than 80% of their 401 (k) assets tied up in company stock, and 19% of employees over 60 have more than half their assets in company stock.

Is it bad to invest in stock?

Purchasing your company's stock can have benefits for both you and your employer, but investing too heavily can have negative consequences. That's why it's important to understand the pros and cons of investing in your company's stock -- and to find the right balance in your 401 (k) assets.

Do new hires feel less secure in their companies?

According to the Employee Benefit Research Institute report, new and recent hires, perhaps feeling less secure in their companies, are opting for balanced funds like

Can you buy and sell stock in 401(k)?

In addition, some companies place limitations on how much stock you can buy and sell, which limits your ability to freely manage your assets, especially if the stock should start to slide. (However, federal legislation passed in the wake of the Enron debacle mandates that companies that match employee contributions with company stock must allow employees with three or more years of service to transfer the company stock's value into other investments.) Other companies have placed a cap on how much company stock employees can hold through their 401 (k)s.

Why are employee owned companies successful?

As an article published by the Employee Ownership Foundation explains, "Employee-owners have a different attitude about their company, their job, and their responsibilities that make them work more effectively and increases the likelihood that their company will be successful.

What are some examples of employee owned companies?

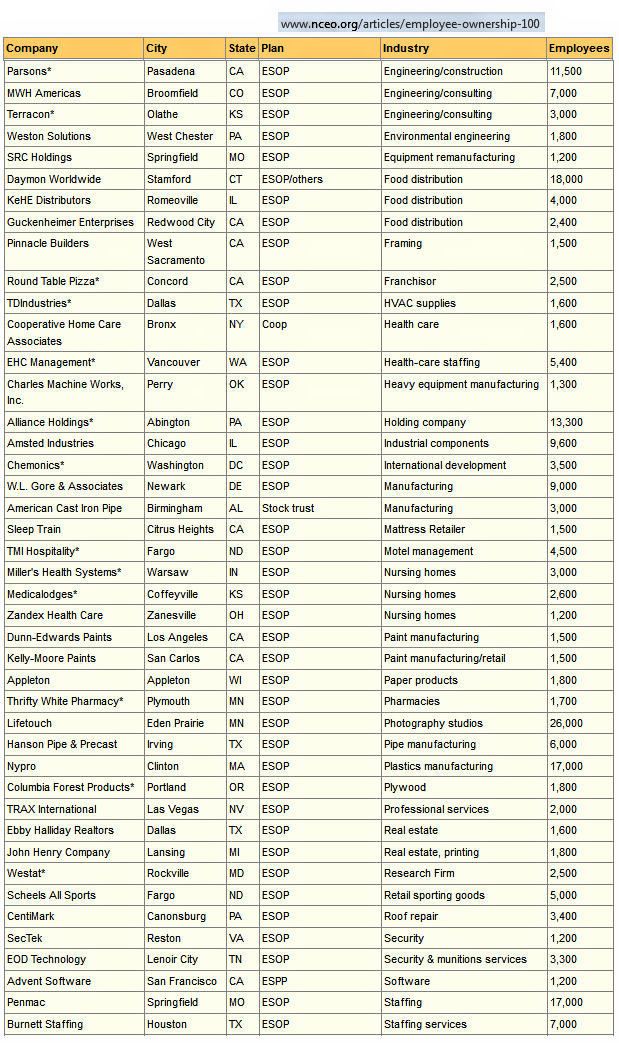

Other notable examples of employee-owned companies include Penmac Staffing, WinCo Foods, and Brookshire Brothers. It's believed ESOP programs motivate employees to take more accountability over their work and improve their performance because they have a stake in the company.

What is an ESOP trust fund?

An ESOP is usually a trust fund set up by an employer that owns shares in the business for the benefit of its employees. 2 Below, we will take a look at six companies that are significantly owned by their past and present employees.

Why do employees use ESOP?

It's believed ESOP programs motivate employees to take more accountability over their work and improve their performance because they have a stake in the company.

Is Recology a 100% employee owned company?

Recology is a 100% employee-owned company and began its ESOP program in 1986. 14 Their plan offers employees a 401 (k) plan plus a supplemental retirement plan.

Why did Mozilo unload his stock?

Mozilo unloaded $140 million of his Countrywide stock when the company was doing well, because he knew that the mortgage company was about to go under and be acquired by Bank of America. Rather than risk prison, Mozilo agreed to pay a fine of $67.5 million.

Why was Michael Brown fired?

He was fired for insider trading based on his company’s definition of the act, which is buying Facebook stock on the secondary market. Facebook is a private company. Brown not only broke his company’s insider trading policy, he might have broken federal law by buying $100,000 worth of Facebook shares in the knowledge that Goldman Sachs planned to invest $50 billion four months later, according to Business Insider. Whether or not Brown knew about the Goldman Sachs deal, he lost his job because of the accusation anyway.

Can an employee be accused of insider trading?

An employee can be accused of insider trading not only for buying stock based on private information, but also for selling stock based on private knowledge. That is what happened to Angelo Mozilo, CEO of Countrywide.

Is Facebook a private company?

Facebook is a private company. Brown not only broke his company’s insider trading policy, he might have broken federal law by buying $100,000 worth of Facebook shares in the knowledge that Goldman Sachs planned to invest $50 billion four months later, according to Business Insider.

Why is it more likely that the investor who owns a heavy stake in the company also owns additional shares in?

Moreover, because company stock ownership is much heavier among larger-cap stocks than smaller ones , it's much more likely that the investor who owns a heavy stake in the company also owns additional shares in that same company through any mutual funds in the portfolio.

Why do you liquidate a company's stock?

In addition, the rules regarding net unrealized appreciation are another reason why investors might take a deliberate approach to liquidating company stock. Blanchett says investors who hold company stock in their 401 (k)s will have to weigh the potential tax savings of being able to take advantage of the NUA rules against the loss of diversification that accompanies holding a substantial stake in company stock. A tax advisor can provide guidance for the best course of action; the longer your time horizon to liquidation, the greater the risk of a high allocation to employer stock.

Why is Blanchett's allocation to company stock zero?

Because of portfolio-diversification and human-capital considerations, Blanchett notes that the optimal allocation to company stock, from a "pure research perspective," is zero. Such a Draconian approach might not be practical for some investors, however. Blanchett notes that 10% of total portfolio assets is a reasonable upper limit for company-stock ownership.

Why do stock shares sink?

And then there are human-capital considerations: Employees who invest heavily in company stock have both their human capital and financial capital riding on the fortunes of a single company; difficulties at their employer could cause their stock shares to sink at the same time they suffer job loss or an income reduction.

Is employee stock ownership bad?

Blanchett concedes that employee-stock ownership, while less than ideal, is “less bad” in a small handful of situations, such as when one's company is especially large and well-diversified. In that case, however, it’s also more likely that the stock would appear elsewhere in the investor’s portfolio. Company stock is also less dangerous if the employee is able to purchase it at a discount, as is the case with some 401 (k) plans, or if the employee's portfolio is already extremely large and well diversified. The flip side is that company-stock ownership can cause the greatest harm to investors who can least afford it: those with small and relatively undiversified portfolios.

Is company stock on 401(k) plan?

Whereas nearly half of employers offered company stock in their 401 (k) plans a decade ago, either as part of the 401 (k)-plan menu or as part of an employee stock-ownership plan, that figure had dropped to less than 40% as of 2019 , according to the Callan Institute.

Do you have to stick around if you earn match in company shares?

Even if you earn your match in company shares, it doesn't mean you have to stick around.

What is the goal of a company executive?

Shareholders usually want a steady stream of increasing dividends from the company. And one of the goals of company executives is to maximize shareholder wealth. However, company executives must balance appeasing shareholders with staying nimble if the economy dips into a recession .

Why do companies repurchase their common shares?

Since companies raise equity capital through the sale of common and preferred shares, it may seem counter-intuitive that a business might choose to give that money back. However, there are numerous reasons why it may be beneficial to a company to repurchase its shares, including ownership consolidation, undervaluation, and boosting its key financial ratios.

What is a stock buyback?

Stock buybacks refer to the repurchasing of shares of stock by the company that issued them. A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors .

Why are buybacks favored over dividends?

Why are buybacks favored over dividends? If the economy slows or falls into recession, the bank might be forced to cut its dividend to preserve cash. The result would undoubtedly lead to a sell-off in the stock. However, if the bank decided to buy back fewer shares, achieving the same preservation of capital as a dividend cut, the stock price would likely take less of a hit. Committing to dividend payouts with steady increases will certainly drive a company's stock higher, but the dividend strategy can be a double-edged sword for a company. In the event of a recession, share buybacks can be decreased more easily than dividends, with a far less negative impact on the stock price.

Why do companies do buybacks?

Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive. The downside to buybacks is they are typically financed with debt, which can strain cash flow. Stock buybacks can have a mildly positive effect on the economy overall.

How much does a company's EPS increase if it repurchases 10,000 shares?

If it repurchases 10,000 of those shares, reducing its total outstanding shares to 90,000, its EPS increases to $111.11 without any actual increase in earnings. Also, short-term investors often look to make quick money by investing in a company leading up to a scheduled buyback.

How many shares did Bank of America buy back in 2017?

However, as of the end of 2017, Bank of America had bought back nearly 300 million shares over the prior 12-month period. 2 Although the dividend has increased over the same period, the bank's executive management has consistently allocated more cash to share repurchases rather than dividends.

Why do companies buy back shares?

First, buying back shares can be a way to counter the potential undervaluing of the company’s stock. If a stock’s share price falls, then the company can send the market a positive signal by investing its capital in buying back shares. This can help restore confidence in the stock.

What happens when there are fewer shares to be traded on the open market?

Additionally, when there are fewer shares to be traded on the open market, your overall ownership stake in the company increases. That means you could potentially benefit from a higher dividend payout going forward, since you’re entitled to a larger share of the company’s earnings.

How does a buyback affect a company's balance sheet?

Buybacks reduce the amount of assets on a company’s balance sheet, which increases both return on equityand return on assets. Both are beneficial in terms of how the market views the financial stability of the company and its stock. A buyback can also result in a higher earnings per shareratio.

How does a stock buyback work?

The other way a stock buyback can be executed is open market trading. In this scenario, the company buys its own shares on the market, the same as any other investor would, paying market price for each share. It may sound complicated, but essentially, the company is investing in itself.

What is a stock buyback?

In terms of mechanics, a stock buyback involves a company that wants to purchase back its own shares and a purchasing agent who completes the transaction. David Russell, vice president at TradeStation, says companies typically hire an investment bankto buy a certain amount of stock back. The company’s board is responsible for authorizing a buyback and determining how much of the company’s capital to allocate to the purchase.

Can shareholders ask for a percentage of their shares?

A company can ask shareholders to return a percentage of their shares voluntarily to the company. Investors decide how much of their shares, if any, they want to sell back and at what price, based on a range determined by the company.

Overview

Employee stock ownership, or employee share ownership, is where a company's employees own shares in that company (or in the parent company of a group of companies). US Employees typically acquire shares through a share option plan. In the UK, Employee Share Purchase Plans are common, wherein deductions are made from an employee's salary to purchase shares over time. In Australia it i…

Types of plan

To facilitate employee stock ownership, companies may allocate their employees with stock, which may be at no upfront cost to the employee, enable the employee to purchase stock, which may be at a discount, or grant employees stock options. Shares allocated to employees may have a holding period before the employee takes ownership of the shares (known as vesting). The vesting of shares and the exercise of a stock option may be subject to individual or business per…

Employee ownership

Employee ownership is a way of running a business that can work for different sized businesses in diverse sectors.

Employee ownership requires employees to own a significant and meaningful stake in their company. The size of the shareholding must be significant. This is accepted as meaning where 25 percent or more of the ownership of the company is broadly held by all or most employees (or o…

By country

The Baltic states do not provide detailed rules on employee financial participation except for some supported schemes. However, comparisons across the national regulations on employee financial participation schemes showed little density. In other words, there were few laws related mostly to employee ownership plans and no special legislation on profit sharing. The Baltic states use the same type of employee ownership plans. In practice, several employee ownership plans are offe…

See also

• Center on Business and Poverty

• Co-determination

• Cooperative

• Worker cooperative

• Economics of participation

Further reading

• Joseph Blasi, Douglas Kruse; Bernstein, Aaron (2003), In the company of owners: The Truth about Stock Options (and why Every Employee Should Have Them), New York, NY: Basic Books, ISBN 9780465007004, OCLC 50479205

• Rosen, Corey; Case, John; Staubus, Martin (2005), Equity: Why Employee Ownership is Good for Business, Boston, Mass.: Harvard Business School Press, ISBN 9781591393313, OCLC 57557579