The company's most recent earnings report showed weakness in most divisions. The decline in share price has brought the valuation more in line with the stock's historical average. One benefit to this sell-off is 3M now offers an accidentally high yield. Few companies can match 3M's dividend growth history.

Full Answer

Is 3M stock a buy during the market sell-off?

Market Sell-Off: Is 3M Stock a Buy Now? T he market sell-off has created buying opportunities in many stocks, but is industrial giant 3M (NYSE: MMM) one of them? The stock is down 16% on the year at writing, and the stock currently yields a dividend of 3.9%.

Is 3m a good buy at current levels?

3M Company’s stock price has declined ~16% since the beginning of this year. While there are some near-term headwinds, the stock has become too attractive to ignore trading at ~14.5x forward P/E with a ~3.96% dividend yield. I believe the stock is a good buy at the current levels for long-term investors.

Is 3M stock a dividend King now?

3M stock, though, is now trading at prices not seen in nearly six years despite a growing top line and robust cash flows, pushing its dividend yield to 4%. That might tempt some, particularly income investors, to pay attention to this Dividend King now.

What are 3M’s key end markets?

The automotive original equipment manufacturer (OEM) is a major end market for 3M across its safety & industrial, and transportation & electronics segments. For example, 3M manufactures tapes, adhesives, advanced materials, and electrical products used in the automotive industry.

Is 3M stock a good buy?

MMM has a C grade for Value, which is in sync with its 5.20x forward P/B, which is 105.5% higher than the 2.53x industry average. MMM is ranked #48 out of 78 stocks in the B-rated Industrial - Machinery industry. Click here to access MMM's Growth, Momentum, Stability, Sentiment, and quality ratings.

Is 3M undervalued?

An Intrinsic Calculation For 3M Company (NYSE:MMM) Suggests It's 46% Undervalued. Today we'll do a simple run through of a valuation method used to estimate the attractiveness of 3M Company (NYSE:MMM) as an investment opportunity by projecting its future cash flows and then discounting them to today's value.

What's going on with 3M stock?

3M Company (NYSE:MMM) has seen a ~16.37% decline in its stock price since the beginning of this year. The stock is currently trading at ~14.46x FY2022 earnings and has a ~3.96% dividend yield which looks attractive.

Is 3M a good long term investment?

3M Co's trailing 12-month revenue is $35.3 billion with a 15.8% profit margin. Year-over-year quarterly sales growth most recently was -0.2%. Analysts expect adjusted earnings to reach $10.772 per share for the current fiscal year. 3M Co currently has a 4.6% dividend yield.

Is 3M a buy hold or sell?

3M has received a consensus rating of Hold. The company's average rating score is 1.73, and is based on 1 buy rating, 9 hold ratings, and 5 sell ratings.

Is 3M a good stock to buy 2022?

3M's current payout ratio is 58%. This means it paid out 58% of its trailing 12-month EPS as dividend. MMM is expecting earnings to expand this fiscal year as well. The Zacks Consensus Estimate for 2022 is $10.26 per share, which represents a year-over-year growth rate of 1.38%.

Why is 3M stock struggling?

As unimpressive as that outlook was, something else that 3M said didn't go down well with the market: Guidance included "an anticipated decline in COVID-19-related disposable respirator demand in 2022," which is expected to hit its organic sales growth by 2% and earnings by $0.45 per share.

Will 3M stock go up?

The 17 analysts offering 12-month price forecasts for 3M Co have a median target of 151.00, with a high estimate of 194.00 and a low estimate of 118.00. The median estimate represents a +17.07% increase from the last price of 128.98.

How is 3M doing financially?

The company's operating cash flow was $2.0 billion with adjusted free cash flow of $1.5 billion contributing to adjusted free cash flow conversion of 110 percent. 3M returned $1.8 billion to shareholders in the fourth quarter of 2021, including $848 million in cash dividends and $938 million of gross share repurchases.

What is the future of 3M?

3M Provides Strong 2022 Financial Guidance 1% to 4% total sales growth. 2% to 5% organic sales growth. Earnings per share of $10.15 to $10.65. Operating cash flow of $7.3 to $7.9 billion contributing to 90% to 100% free cash flow conversion.

Is 3M a dividend aristocrat?

Not only is 3M a Dividend Aristocrat, it is also a Dividend King. 3M is not recession-proof, but the company has proven itself to be resilient during the difficult times in the economic cycle. A big reason for its long-term growth is innovation, a major competitive advantage.

Is MMM a cyclical stock?

For one thing, cyclical firms are not sitting on the sidelines as well. This is evident from consumer discretionary names such as General Motors (NYSE: GM) to industrial players like 3M (NYSE: MMM).

Is 3M increasing its R&D?

As you can see below, 3M has been increasing its R&D expenditures in the last decade on an absolute and relative basis.

Does 3M have R&D?

3M has long prided itself on its ability to use research and development (R&D) in order to create differentiated products. In plain English, this means 3M's solutions aren't commodity-type offerings and therefore tend to have some pricing power. So, 3M should be able to grow revenue through increasing price without suffering significant drop-offs in volume while maintaining strong margin.

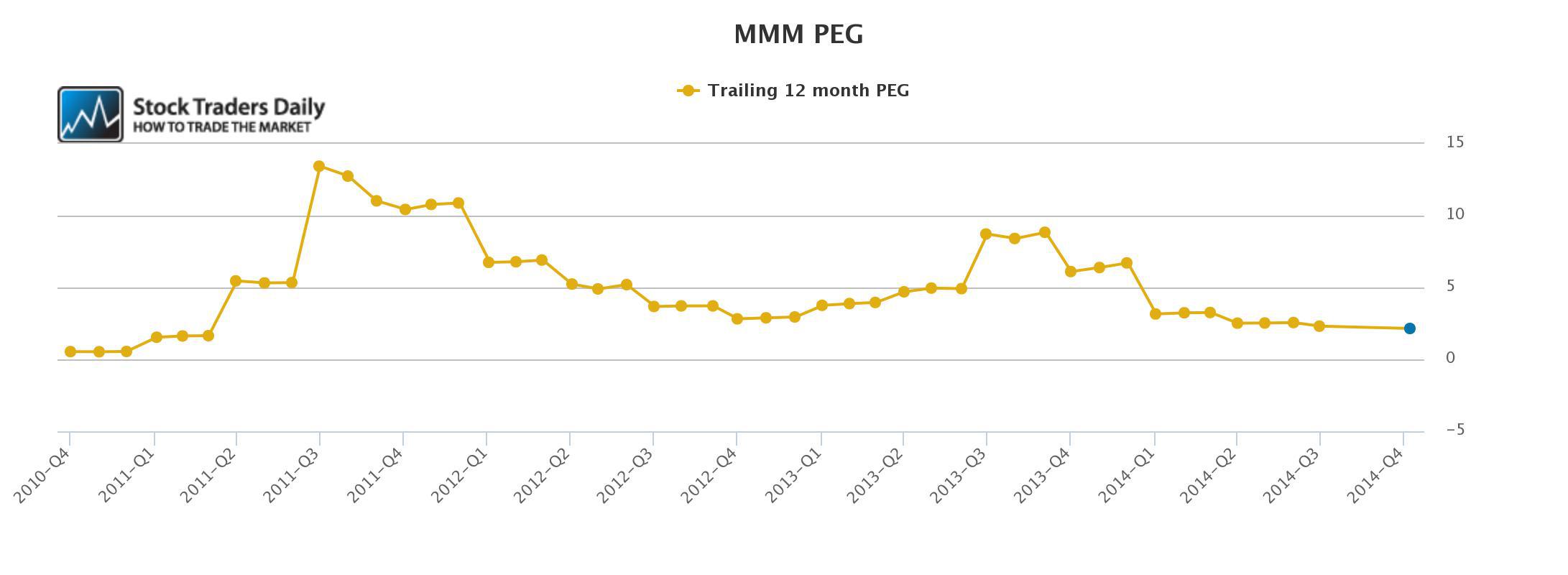

Introduction

On January 30th, I published an article titled "How far could 3M fall?". Since that time, I've published over 20 articles examining how far other large-cap stocks in the industrial sector and the service sector could fall if there was a bear market or a recession.

The Price I'll Start Buying

As part of my analysis in January, I noted that the number of significant sell-offs 3M stock had experienced over the past five decades really surprised me. In fact, 3M has had fewer deep sell-offs than any of the 26 stocks I've covered in the "How far could they fall?" series of articles this year.

Current Owners

If I was a current owner of 3M and didn't need access to the funds invested in the stock for the next five years, I would probably hold on in order to see if this is a premature prediction of a market downturn. I've seen this a lot with cyclical stocks.

Potential Buyers

I'm in this category, and since I think there are two equally likely downside scenarios - one that includes a bear market without a recession and one that includes a bear market with a recession - I'm going to have two equally weighted entry points for the stock.

Investors Who Rotated Into JNJ

I think if I were a JNJ holder, I would wait to get closer to that 30% spread between the two stocks I originally thought could happen, and I probably wouldn't even get interested in rotating back into 3M until I saw a 20% spread open up between the two stocks.

Conclusion

It's hard to write bearish articles on quality companies when they are trading at all-time highs like 3M was in January, but the fact is sometimes quality businesses get overvalued by the market and it's a good idea to sell and rotate into more defensive positions, especially if we appear to be entering the later stages of the business cycle.