The drop was most likely due to competitor Nike disclosing that it's having supply chain issues that will affect it in the coming months, and investor fears that the same issues will plague Under Armour in the short term.Golfer wearing Under Armour clothing. Image source: Under Armour.Under Armour has been undergoing challenges for several years.

Full Answer

Why did Under Armour stock fall on April 11?

Why Did Under Armour Stock Fall on April 11? Under Armour (UA) has a market cap of $9.5 billion. UA fell by 5.5% to close at $41.15 per share on April 11, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -48.6%, -45.8%, and -46.0%, respectively, on the same day.

What drove Under Armour’s 28% drop in 2016?

Shares of sports apparel specialist Under Armour (NYSE:UAA) (NYSE:UA) declined 28% in 2016, according to data provided by S&P Global Market Intelligence. UAA data by YCharts. Shareholders at one point in the year were up more than 15%, but those gains gave way to minor losses, which then spiraled into a significant calendar-year decline.

Is Under Armour’s soft outlook a threat to the business?

That soft outlook is no threat to the wider investing thesis for the business since executives believe supply chain issues will ease beginning in mid-2022. However, investors were hoping that Under Armour could avoid significant inventory challenges, which now appear set to have a meaningful (if temporary) impact on growth this year.

Is Under Armour the Dow's single worst performer in 2016?

Like rival Nike ( NKE -1.75%), which was the Dow's single worst performer in 2016, Under Armour's business was hurt by a slowdown in the core U.S. market that forced price cuts. The company's gross profit still beats Nike's, but it is now below 48% of sales for its lowest result yet as a public company.

Why has Under Armour stock fallen?

However, supply chain disruptions and rising costs have weighed on profitability in recent quarters. Shares plunged earlier this month after Under Armour reported an unexpected loss for the period ending on March 31.

When did Under Armour stock split?

UA's 5th split took place on June 20, 2016. When a company such as Under Armour splits its shares, the market capitalization before and after the split takes place remains stable, meaning the shareholder now owns more shares but each are valued at a lower price per share.

Is Under Armour stock undervalued?

Athleisure apparel and footwear maker Under Armour (NYSE: UAA) stock has been falling within the proximity of revisiting its pandemic lows. Athleisure apparel and footwear maker Under Armour (NYSE: UAA) stock has been falling within the proximity of revisiting its pandemic lows.

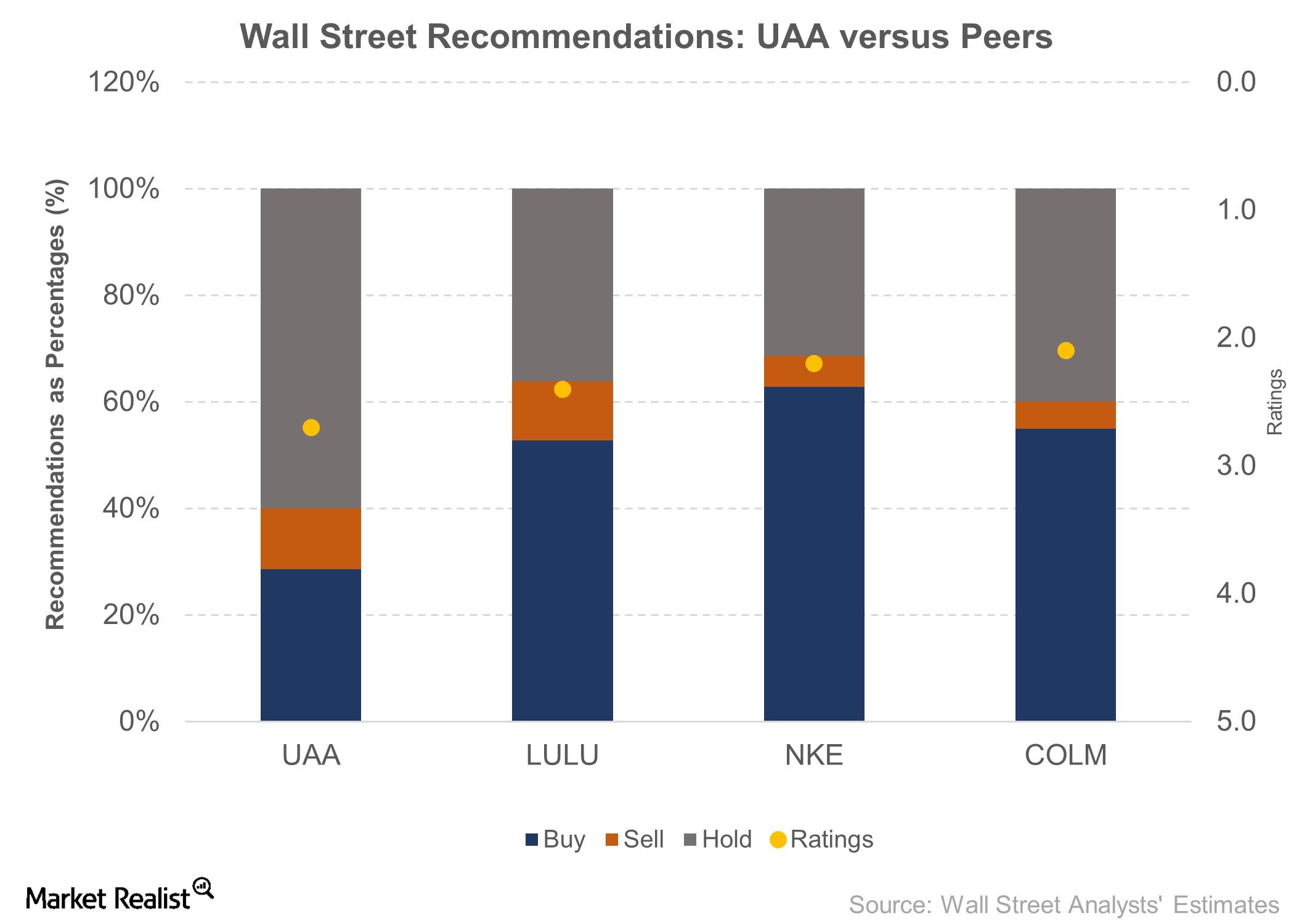

Is Under Armour a buy or sell?

Under Armour has received a consensus rating of Moderate Buy. The company's average rating score is 2.75, and is based on 3 buy ratings, 1 hold rating, and no sell ratings.

Will under Armour ever pay a dividend?

Does Under Armour pay a dividend? At the present time we do not pay a dividend on our common stock.

What's the difference between under Armour stock UA and UAA?

The main distinction between UA and UAA shares comes down to voting rights. UA stock, formerly trading under the UA. C symbol, stands for Class C shares, which garner no voting rights. UAA stock, formerly trading under the symbol UA, stands for Class A shares, which confer one vote per share to the owner.

Is it a good time to buy under Armour stock?

Under Armour / UAA Analysts estimate that it will earn 79 cents a share in calendar 2022 after last year's 77 cents, on a 6% increase in sales, to $6 billion. The consensus calls for 2022 sales to rise about 9% and 22% at Nike and Lululemon, respectively.

Should I invest in UAA?

UAA is a #2 (Buy) on the Zacks Rank, with a VGM Score of B. Additionally, the company could be a top pick for growth investors. UAA has a Growth Style Score of A, forecasting year-over-year earnings growth of 307.7% for the current fiscal year.

Should I buy Adidas stock?

Adidas AG - Sell Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of ADDYY, demonstrate its potential to outperform the market. It currently has a Growth Score of A.

Who bought Under Armour?

Francisco PartnersGlobal fitness giant Under Armour announced this morning that it will be selling MyFitnessPal to investment firm Francisco Partners for $345 million, five and a half years after acquiring it for $475 million.

Is Nike a buy or sell?

NIKE has received a consensus rating of Moderate Buy. The company's average rating score is 2.75, and is based on 21 buy ratings, 7 hold ratings, and no sell ratings.

Does UAA stock pay dividends?

UNDER ARMOUR Dividends FAQ UNDER ARMOUR (NYSE: UAA) does not pay a dividend.

Jordan Spieth lost, and Under Armour fell

Under Armour fell 5.5% after Jordan Spieth lost the Masters Golf Tournament. Spieth has signed a ten-year agreement to wear the company’s golf shoes and other clothes.

Performance of Under Armour in 4Q15 and 2015

Under Armour (UA) reported fiscal 4Q15 net revenues of $1.2 billion, a rise of 30.8% compared to net revenues of $895.2 million in fiscal 4Q14. Revenues from licensing and connected fitness rose by 43.1% and 220.8%, respectively, in fiscal 4Q15 compared to fiscal 4Q14.

Fiscal 2015 results

In fiscal 2015, UA reported net revenues of $4.0 billion, a rise of 28.5% year-over-year. The number of factory house and brand house door counts rose to 161 and 30, respectively, in fiscal 2015.

What happened

The stock of Under Armour ( UAA -2.36% ) ( UA -1.52% ) lost ground to the market on Friday, dropping 9% by 12:30 p.m. ET today, compared to a 0.3% decline in the S&P 500. The decline was sparked by news that the retailer is struggling with supply chain challenges.

So what

Revenue for the holiday period that ended in late December was up 8% after accounting for currency exchange swings. That result was just above most investors' hopes.

Now what

Instead of that good news, investors focused on management's cautious outlook for the next several months. For the current quarter, sales will rise in the mid-single-digit range, executives said.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.