What happens to the stock market after an election?

Bottom Line on the Stock Market. The stock market is surging after Election Day 2020 because Democrats didn’t flip the Senate, and therefore, the prospect of sweeping anti-business reform is ...

Will the stock market go up or down if the President wins?

Nov 05, 2020 · Why Is the Stock Market Up as Election Results Come In? Technology stocks led major indexes higher, while banks and other growth-sensitive areas struggled.

What's going on with the stock market?

Jan 15, 2021 · Bond markets provided similar results, with returns of around 6.5 percent in the year leading up to a presidential election, compared with their more typical 7.5 percent in any given 12-month period. Stock market performance after elections. There are a few different variables that can affect the stock market performance.

Why is the stock market so bullish right now?

Nov 09, 2016 · Nov. 8, 2016. After a sharp sell-off overnight in Asia, markets staged a recovery on Wednesday as investors shook off the shock of a Donald J. Trump presidency and began to focus on whether his ...

Why did stock market go up?

What events cause stock prices up?

Is the stock market rigged to go up?

What goes up when market crashes?

Why do stocks go up and down after hours?

Who changes the stock price?

Can a stock be manipulated?

Why do CEOS buy their own stock?

What would happen if the stock market didn't exist?

Will the market recover in 2022?

Should I buy stocks when they are low or high?

How do you hedge against inflation?

- Gold. Gold has often been considered a hedge against inflation. ...

- Commodities. ...

- A 60/40 Stock/Bond Portfolio. ...

- Real Estate Investment Trusts (REITs) ...

- The S&P 500. ...

- Real Estate Income. ...

- The Bloomberg Aggregate Bond Index. ...

- Leveraged Loans.

What happens to the stock market after the election?

After an election, stock market returns tend to be slightly lower for the following year, while bonds tend to outperform slightly after the election. It doesn’t seem to make much difference which party takes office, but it does matter whether control of the White House changes hands.

How much did the stock market gain in the year leading up to the election?

In any given 12-month period, the analysts saw equities generally providing gains of about 8.5 percent — but in the year leading up to a presidential election, gains averaged less than 6 percent. Bond markets provided similar results, with returns of around 6.5 percent in the year leading up to a presidential election, compared with their more typical 7.5 percent in any given 12-month period.

What does Hainlin suggest after the election?

After an election is over, Hainlin suggests reevaluating how the policies that are championed by newly elected officials could affect the global economy.

What is the best rule of thumb for investing in election years?

Although a few investment opportunities may arise through an understanding of volatility and performance patterns in election years, Haworth says the best rule of thumb may simply be to stay invested and make sure your portfolio is rebalanced when necessary.

What percentage of stock market gains are made when a new party comes into power?

When a new party comes into power, the analysts found that stock market gains averaged 5 percent.

Why are equity and bond market trends consistent over time?

These equity and bond market trends were consistent over time unless there was a dramatic disruption. Rob Haworth, senior investment strategy director at U.S. Bank, believes the reason for this consistency is fairly straightforward: Markets do not like uncertainty. “Every four years in the U.S., we have more uncertainty,” he says, “and so the data is very explainable.”

When will the S&P 500 return?

In the period since Joe Biden’s win in the 2020 election, the S&P 500 returned about 25 percent through end of May 2021. The election occurred during a period when the market was already enjoying a strong rally coming off the dramatic COVID-19 bear market of late February/early March 2020.

What happened to the stock market in 2016?

The night of the 2016 election, as more states began reporting and a Trump victory became increasingly likely, stock market futures sank rapidly . The S&P 500 fell more than 5% in premarket trading, triggering a circuit breaker to halt trading. By the time the market closed the day after the election, the index was up over 1%.

What percentage of the stock market was positive in 1989?

But since 1989, emerging market equities [2] were only positive 50% of the time under a Democratic administration, versus 100% of the time with Republican leadership. Like the U.S. stock market, returns of global stocks depend on multiple factors, many of which are outside the control of any administration.

What does it mean to get too hung up on what ifs?

Getting too hung up on what-ifs over the next four years means losing sight of the big picture. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

What are the factors that affect the returns of global stocks?

stock market, returns of global stocks depend on multiple factors, many of which are outside the control of any administration. Natural disasters, terrorism, political scandal or turmoil within a country, geopolitical tensions, trade policy, international relations, and the relative strength of the dollar are just a few factors .

What is the highest partisan control combination for the S&P 500?

Since 1933, the highest returning partisan control combination for the S&P 500 has been a Democratic Senate, Republican House, and Democratic President where returns averaged 13.6% per year. In 2020, this would require a reversal for all three.

How much is the S&P 500 up in 2020?

As of market close on August 17 th 2020, the S&P 500 was up 4.68% year to date (total return) and Bloomberg Barclays US Aggregate Bond Index was positive 6.94% on the year.

Who won the election in the recession?

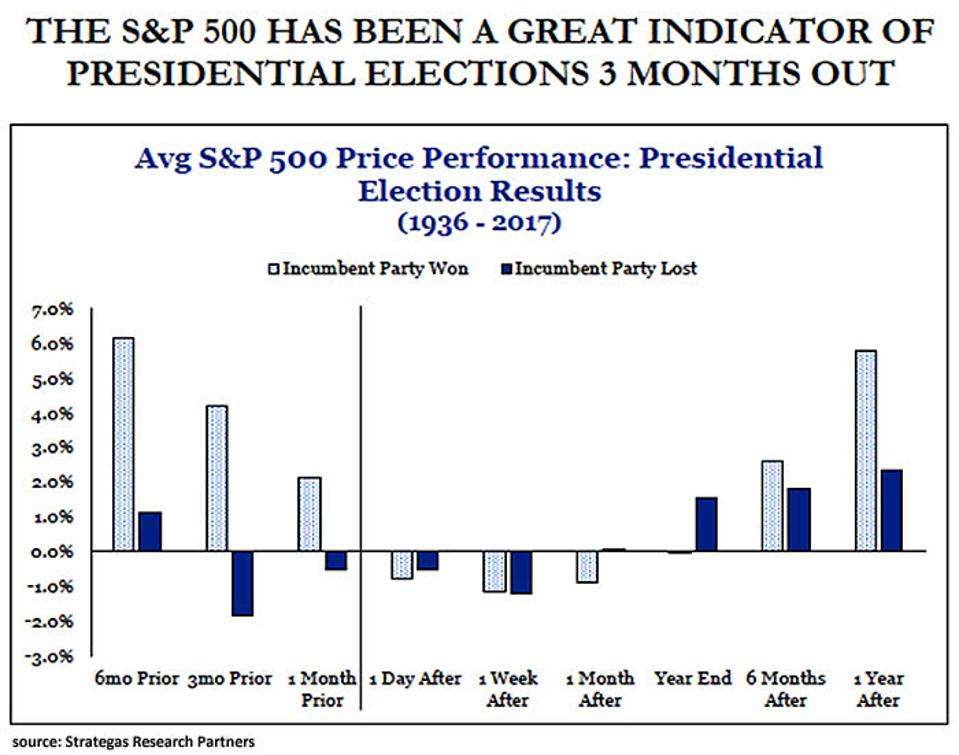

Only one, Calvin Coolidge, went on to win reelection when there was a recession in the two years leading up to the election. His research also shows how stock market performance leading up to an election has also been a major indicator of the outcome.

How does the stock market affect people?

How the stock market does matters to a lot of people. A little over half of all Americans report owning stocks, including in their retirement or pension plans. And during the pandemic, plenty of people got into day trading, for better and for worse. But some groups have much higher stakes in the market than others. More than 80 percent of stocks are owned by the wealthiest 10 percent of Americans, meaning when markets go up, they’re the ones who reap the most gains. White people are also the overwhelming majority of market beneficiaries — by Palladino’s estimates, 92 percent of corporate equity and mutual fund value is owned by white households, compared to less than 2 percent each by Black and Hispanic households.

When did the S&P 500 bottom out?

The S&P 500 bottomed out on March 23, just a week into New York’s shutdown, and after that, it made a remarkably strong recovery, month after month. Most analysts and experts point to the Fed as the most important factor in supporting market confidence.

What happened in March 2020?

The market was temporarily shaken in March 2020, as stocks plunged for about a month at the outset of the Covid-19 outbreak , but then something strange happened. Even as hundreds of thousands of lives were lost, millions of people were laid off and businesses shuttered, protests against police violence erupted across the nation in the wake ...

What is the mantra of shareholder primacy?

Companies have been ruled by the mantra of shareholder primacy, where maximizing profits for investors is the end-all, be-all, for decades. Worker pay has severely lagged gains in productivity. Those trends were unlikely to change during a pandemic.

Why did the Federal Reserve take extraordinary measures?

The Federal Reserve took extraordinary measures to support financial markets and reassure investors it wouldn’t let major corporations fall apart. Congress did its part as well, pumping trillions of dollars into the economy across multiple relief bills. Turns out giving people money is good for markets, too.

What percentage of mutual funds are owned by white people?

White people are also the overwhelming majority of market beneficiaries — by Palladino’s estimates, 92 percent of corporate equity and mutual fund value is owned by white households, compared to less than 2 percent each by Black and Hispanic households.

Is the market measure meaningless?

Beyond policy fixes, there’s also just the reality that the market measures very one specific thing — how investors think (rightly or wrongly) corporate profits are going to be in the future. And for many people, that measure is meaningless. “If you can assess that the economy is good when we’re in one of the worst economic moments of American history, then it’s a useless measure,” said Maurice BP-Weeks, co-executive director of the Action Center on Race and the Economy.