What exactly caused the stock market to crash in 1929?

Apr 13, 2018 · Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a …

Which situation helped cause the stock market crash of 1929?

Nov 22, 2013 · The crash frightened investors and consumers. Men and women lost their life savings, feared for their jobs, and worried whether they could pay their bills. Fear and uncertainty reduced purchases of big ticket items, like automobiles, that people bought with credit.

Which of these factors led to the stock market crash of 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic.

What was the significance of the 1929 stock market crash?

May 07, 2014 · October 29, 1929, when a mass panic caused a crash in the stock market and stockholders divested over sixteen million shares, causing the overall value of the stock market to drop precipitously speculation the practice of investing in risky financial opportunities in the hopes of a fast payout due to market fluctuations

What caused the crash of 1929?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.Apr 17, 2022

What caused the stock market crash of 1929 quizlet?

(1929)The steep fall in the prices of stocks due to widespread financial panic. It was caused by stock brokers who called in the loans they had made to stock investors. This caused stock prices to fall, and many people lost their entire life savings as many financial institutions went bankrupt.

What were 5 causes of the stock market crash?

Equally relevant issues, such as overpriced shares, public panic, rising bank loans, an agriculture crisis, higher interest rates and a cynical press added to the disarray. Many investors and ordinary people lost their entire savings, while numerous banks and companies went bankrupt.Apr 27, 2021

What is the main cause of stock market crashes of 1929 and 1987?

Key Takeaways. The "Black Monday" stock market crash of Oct. 19, 1987, saw U.S. markets fall more than 20% in a single day. It is thought that the cause of the crash was precipitated by computer program-driven trading models that followed a portfolio insurance strategy as well as investor panic.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

What was Section 14 of the Federal Reserve Act?

Section 14 of the act extended those powers and prohibitions to purchases in the open market. 4. These provisions reflected the theory of real bills, which had many adherents among the authors of the Federal Reserve Act in 1913 and leaders of the Federal Reserve System in 1929.

When did the Dow Jones Industrial Average increase?

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the Great Depression?

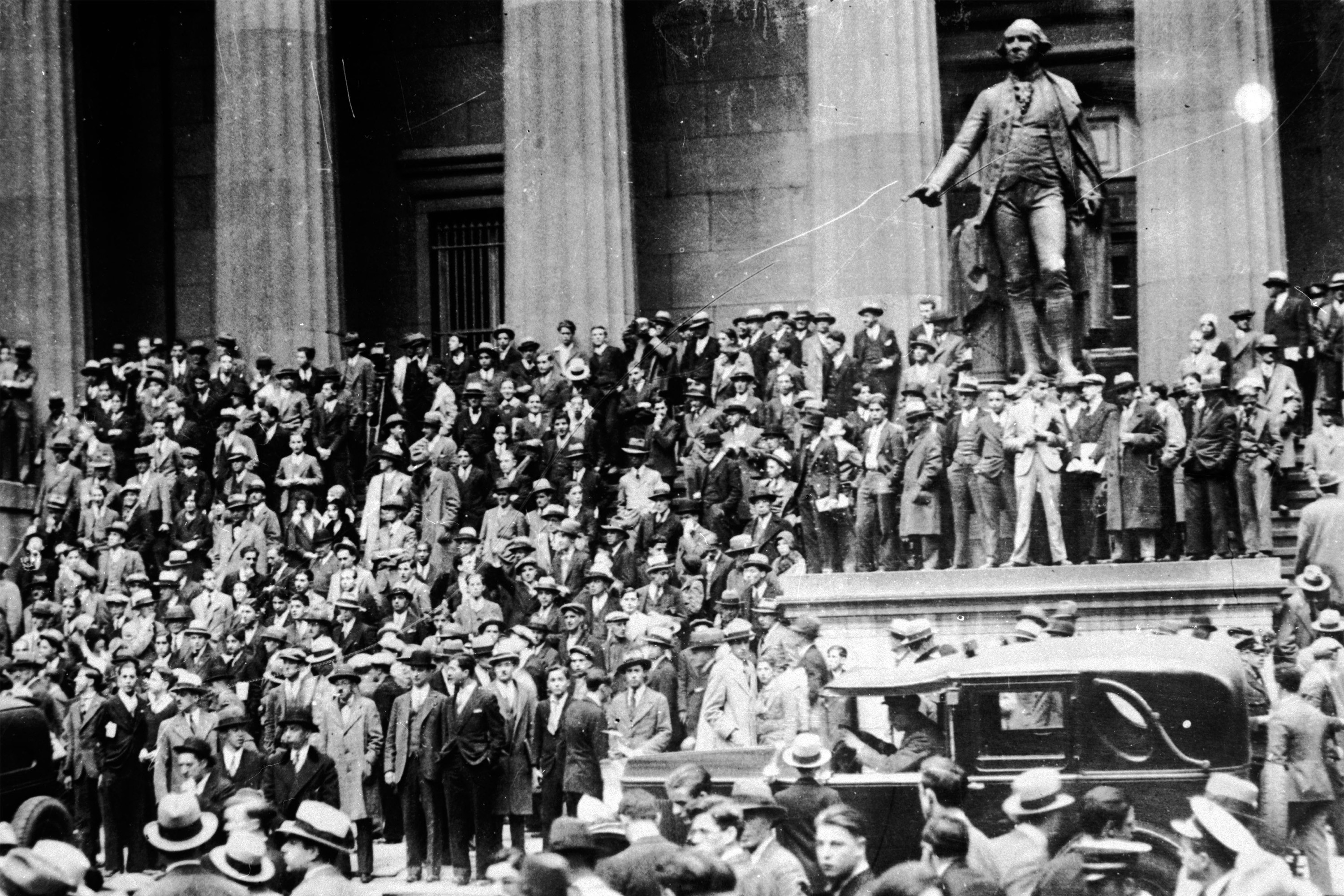

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

How did the stock market crash affect people?

Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

What happened to the stock market on September 20th?

Even the collapse of the London Stock Exchange on September 20 failed to fully curtail the optimism of American investors. However, when the New York Stock Exchange lost 11 percent of its value on October 24—often referred to as “Black Thursday”—key American investors sat up and took notice.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

What were the advertisements selling in the 1920s?

In the 1920s, advertisers were selling opportunity and euphoria, further feeding the notions of many Americans that prosperity would never end. In the decade before the Great Depression, the optimism of the American public was seemingly boundless.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

How did the stock market crash of 1929 affect the world?

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the extent of the crisis that ensued, it soon became clear that the world's economies were more interconnected than ever. The effects of the disruption to the global system of financing, trade, and production and the subsequent meltdown of the American economy were soon felt throughout Europe.

How many points did the Dow Jones Industrial Average recover from the 1929 crash?

The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day. The trading floor of the New York Stock Exchange Building in 1930, six months after the crash of 1929.

What was the prediction of the Great Bull Market?

The optimism and the financial gains of the great bull market were shaken after a well-publicized early September prediction from financial expert Roger Babson that "a crash is coming, and it may be terrific". The initial September decline was thus called the "Babson Break" in the press.

What was the biggest stock crash in 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

Why did the uptick rule fail?

Also, the uptick rule, which allowed short selling only when the last tick in a stock's price was positive, was implemented after the 1929 market crash to prevent short sellers from driving the price of a stock down in a bear raid.

Why did wheat prices fall in August?

In August, the wheat price fell when France and Italy were bragging about a magnificent harvest, and the situation in Australia improved. That sent a shiver through Wall Street and stock prices quickly dropped, but word of cheap stocks brought a fresh rush of "stags", amateur speculators, and investors.