What drove naked brand’s stock price down 41% on November 20?

Jan 06, 2022 · NAKD. Ford Motor Company. F. $16.65 (-1.54%) $0.26 *Average returns of all recommendations since inception. Cost basis and return based on previous market day close. ... Why Nvidia Stock Dropped ...

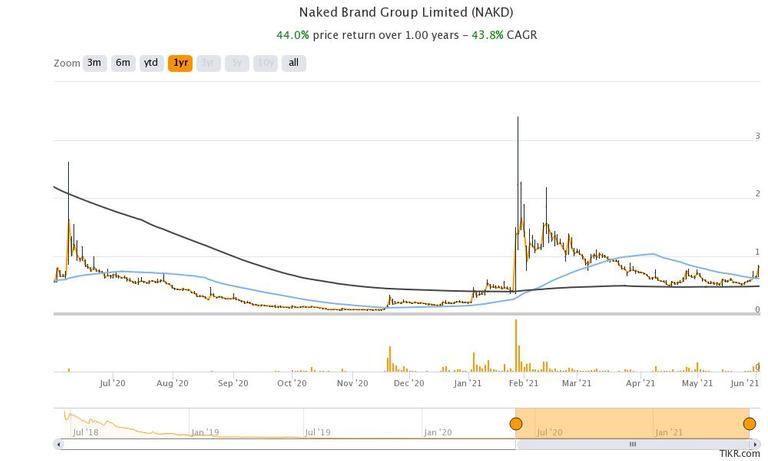

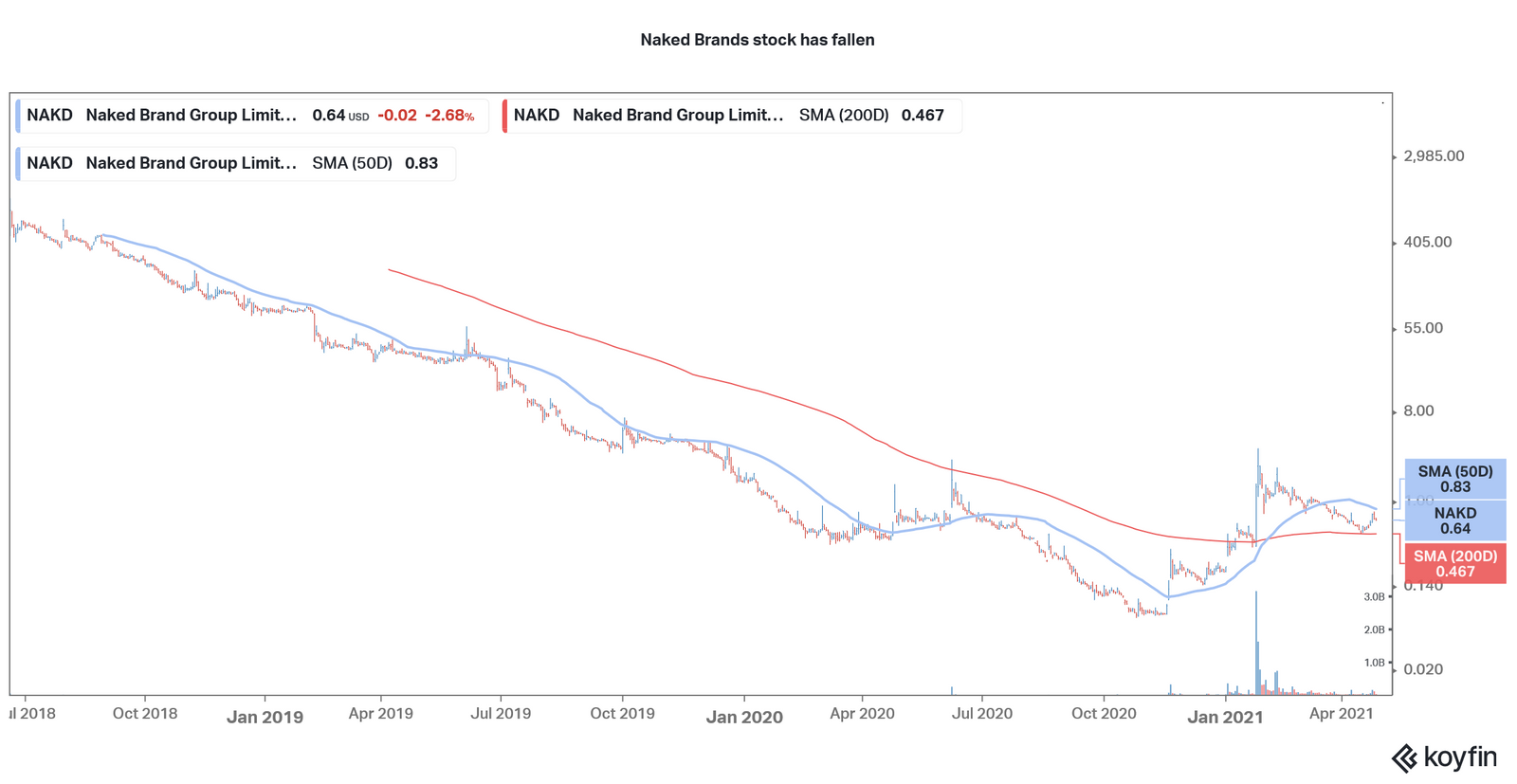

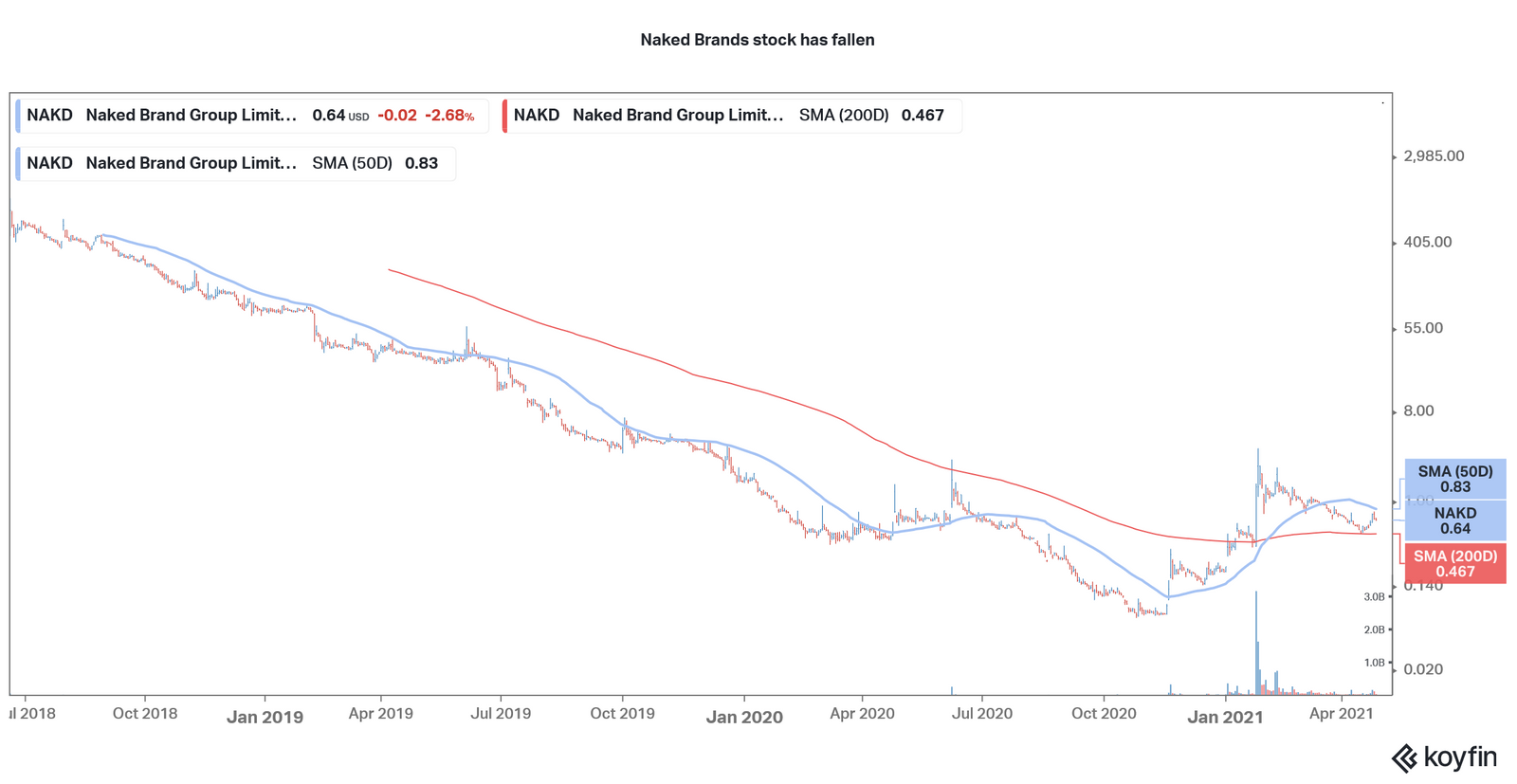

Is Nakd stock down 98% over the last 12 months?

Dec 22, 2021 · Naked Brand Group Ltd (NASDAQ: NAKD) is lower after adjusting for a 1-for-15 reverse stock split today. Shareholders approved the reverse split at an extraordinary meeting on December 20. Shares ...

Can Naked brand groups (Nakd) stock succeed?

Jan 28, 2020 · NAKD stock has dropped 98.6% in value over the past 12 months, and over 26% already in 2020. With the latest slide — to $1.15 — it has closed at yet another all-time low.

Is naked brands a penny stock to buy?

Apr 06, 2021 · Shares of Naked Brand Group Limited ( NAKD) stock were down today in the Pre-Market trading session.NAKD stock price was down by 2.14% to drop at $0.68 a share as of this writing. It seems that NAKD is not performing well in recent times as it was down by 2.10% at the previous closing.

Why is NAKD stock dropping?

A reverse split factors in. Shares of NAKD are down 6.15% on the split-adjusted basis as investors digest the big share count reset. Last month, the privately-held company that Naked is combining with, Cenntro Automotive, said it received an order for 2,000 electric vehicles.Dec 22, 2021

Is NAKD going out of business?

Pending shareholder approval at a special meeting on Dec. 21, Naked Brands will merge with Cenntro Automotic Group, an electric vehicle (EV) technology firm. The new company will go forward under the Cenntro name, albeit with the NAKD stock symbol. Upon finalization, Naked Brands will cease to exist.Dec 10, 2021

What happened NAKD stock?

NAKD Stock Down on Closing of EV-Related Acquisition Today, Naked Brand announced the closing of its acquisition of EV startup Cenntro Automotive. This deal leaves the combined company with $250 million in cash on the balance sheet, and provides a strong growth runway for those bullish on the EV sector.Dec 31, 2021

Will NAKD stock recover?

NAKD stock became a hit with the Reddit trading crowd and has done well to fortify its balance sheet. It's now debt-free and has evolved into a pure-play e-commerce business. Unfortunately, there are several loopholes in its turnaround strategy, so it is unlikely things will change significantly for the company.Sep 16, 2021

Why is NAKD brand stock going up?

A 1-for-15 reverse stock split is to blame for NAKD stock's seemingly outlandish returns today. The reverse split became effective as of this morning, which means that for every 15 shares of NAKD stock investors owned as of yesterday's close, they now own 1 share. Consequently, the price of the stock increased by 15X.Dec 22, 2021

Did Naked Brand get bought out?

Upon finalization, Naked Brands will cease to exist. Under the terms of the merger, Naked shareholders will receive seven shares in the new entity for every three existing NAKD shares they own. The combined company will have a market capitalization of nearly $2 billion.Dec 10, 2021

Is NAKD stock a good buy?

It has been an extraordinary year, and to be fair, still a profitable one: NAKD stock has still gained 74% so far in 2021. 2022 should be quieter, at least on a relative basis, as Naked becomes Cenntro Automotive.Dec 29, 2021

Why did NAKD reverse split?

That reverse stock split saw the company consolidate 15 shares of NAKD stock down to one share. The goal of the split is to get its share price up to where it needs to be for the Cenntro Automotive merger. A recent shareholder meeting saw investors in NAKD stock vote in favor of the split and the merger.Dec 22, 2021

What will happen to NAKD stock after merger?

Per the terms of the merger, existing NAKD shareholders will own 30% of the combined company. Cenntro's existing investors will hold the other 70%.Dec 17, 2021

Is NAKD a good stock to buy Reddit?

NAKD stock is a high-risk play with no chances of growth. It is best to avoid the stock for now. Investor interest is low and the company needs to fix several aspects and mitigate risks to elevate the online business. It may have managed to raise funds but the risks are too many.May 4, 2021

Naked Brand Groups Announces It is Selling Naked Brand

On Jan.21, Naked Brand Group announced it is selling its Naked brand. That makes for just about the most confusing headline ever. Here’s a little background to help make sense of it.

Going All-In on Bendon

As part of the announcement it was selling the Naked brand, NAKD assured investors that it was going all in on its Bendon brand. The company plans to “… build Bendon as our master brand globally, leveraging its storied 72-year history.”

Bottom Line on NAKD Stock

NAKD stock has dropped 98.6% in value over the past 12 months, and over 26% already in 2020. With the latest slide — to $1.15 — it has closed at yet another all-time low.

Business Development

On March 29, 2021, Naked stock announced that it had completed multiple strategic capital financing that resulted in the net proceeds of $270 million and weaned itself from debt obligations. Moreover, NAKD is in the final stages of getting shareholder approval for divestiture of its brick-and-mortar operations.

Conclusion

Things are gloomy for NAKD stock as far as market sentiment is concerned. The good part is that NAKD stock is free from debt and has sufficient capital for the growth of its eCommerce business.

Early Morning Vibes: Check Out These 4 hot Stocks Right Now

On January 11, American stock markets closed in the red. The S & P500 index fell 0.66% to 3800 points, the Dow Jones lost 0.29%,

No News Is Bad News

Admittedly, this is a company that should not have been here. NAKD’s inability to grow sales for several years meant it was all but headed for Chapter 11. However, Redditors gave it a new lease on life. And now it has the capital to fight for another day.

E-Commerce Strategy Is a Silver Lining

Despite the negatives, the pivot to an e-commerce strategy is a great move. Brick-and-mortar businesses have suffered for quite a while. And the pandemic exacerbated the shift to online purchases. In this brave new world, the writing is on the wall. Digital sales are the future.

NAKD Stock Remains Overvalued

Considering the steep drop in the stock’s price, many might be tempted to give NAKD stock a chance. However, as Mark Hake points out, there is a sizeable difference between the valuation and fundamentals. This means we have to wait for it to drop a bit more before you can even think of it becoming a viable investment.