Shares of online textbook company Chegg ( CHGG) are crashing amid declining enrollments at American colleges and universities. The sudden slowdown in the higher education sector pushed shares down by 48.82% on Tuesday.

What happened to Chegg’s stock?

Chegg’s stock is down 48% to around $32 per share on Tuesday, shaving over $4 billion off the company’s market value, which stood at more than $9 billion a day earlier. The company on Monday afternoon reported third-quarter revenue of $171.9 million—up 12% from a year ago but slightly below analyst expectations of $174.5 million.

Who is the founder of Chegg?

The company was founded by Osman Rashid and Aayush Phumbhra on July 29, 2005 and is headquartered in Santa Clara, CA. Chegg has received a consensus rating of Hold. The company's average rating score is 2.38, and is based on 5 buy ratings, 8 hold ratings, and no sell ratings.

What is the ticker symbol for Chegg?

Chegg trades on the New York Stock Exchange (NYSE) under the ticker symbol "CHGG." Who are Chegg's major shareholders? Chegg's stock is owned by a number of retail and institutional investors.

How much is a share of Chegg worth?

One share of CHGG stock can currently be purchased for approximately $34.32. How much money does Chegg make? Chegg has a market capitalization of $4.63 billion and generates $776.27 million in revenue each year. The technology company earns $-1.46 million in net income (profit) each year or ($0.09) on an earnings per share basis.

Is Chegg a good stock to buy now?

The stock market rewarded Chegg with a dramatic rise in the value of its shares. On the news that fourth-quarter 2021 earnings were better than forecast, Chegg rose from a 52-week low of $23.50 in late January to $33 in early February. As of April 27, 2022, the stock price was $25.56.

Will Chegg go back up?

Chegg expects revenue to rise 1% to 3% year over year in the first quarter of 2022, and 7% to 9% for the full year.

What happened to Chegg?

Chegg Stock Collapses as More Students Give Up School and Head to Work. Chegg shares lost nearly half their value after the company provided an earnings outlook that raised concern about the health of its business and the overall online education market.

Is Chegg losing money?

Summary. Chegg shares collapsed under the weight of a major earnings surprise. A sudden plunge in college enrollments and lower consumption of education goods reduced guidance for Q4 revenues and earnings, and also forced Chegg to delay issuing guidance for 2022.

What is the future of Chegg?

Chegg Services ended 2020 with 6.6 million annual subscribers, compared to 3.9 million subscribers in 2019 and 3.1 million subscribers in 2018....Benefiting from pandemic-related tailwinds.Revenue Growth (YOY)FY 2019FY 2020Chegg Services31%57%Required Materials17%56%Total28%57%Nov 4, 2021

What is the future of Chegg stock?

Stock Price Forecast The 10 analysts offering 12-month price forecasts for Chegg Inc have a median target of 21.50, with a high estimate of 30.00 and a low estimate of 13.00. The median estimate represents a +11.11% increase from the last price of 19.35.

Will Chegg be shut down?

In late 2020, Chegg announced that Chegg Tutors would be discontinued in 2021. The last day for lessons was announced as January 15, with the last payments to tutors to be made on January 22, and the site to cease operations on January 31.

What company owns Chegg?

Chegg, Inc., is an American education technology company based in Santa Clara, California....Chegg.Type of businessPublicFoundedJuly 2005HeadquartersSanta Clara, California, U.S.Founder(s)Aayush Phumbhra Osman Rashid Josh CarlsonKey peopleDan Rosensweig, Chairman, president and CEO13 more rows

Is Chegg a profitable company?

Profitability Story Contrary to other e-learning and tech companies, Chegg is very focused on its profitability. It is constantly improving its operating margins, reaching a 23% EBITDA margin in 2021.

What did Chegg highlight?

Chegg highlighted that with fewer enrollments and lighter course loads as students returned to school postpandemic, demand for online education services reset faster than expected.

How much does Chegg cost?

Chegg charges $14.95 for what it claims is online study help. But a Forbes investigation earlier this year found that most students use Chegg to cheat on exams, quizzes and homework. Now that students are back in the classroom, they can’t easily use Chegg to cheat.

Who is the CEO of Chegg?

Here's what Chegg CEO Dan Rosensweig had to say on the cause:

Who is the Motley Fool?

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community. Reaching millions of people each month through its website, books, newspaper column, radio show, television appearances, and subscription newsletter services, The Motley Fool champions shareholder values and advocates tirelessly for the individual investor. The company's name was taken from Shakespeare, whose wise fools both instructed and amused, and could speak the truth to the king -- without getting their heads lopped off.

Did Chegg buy back shares?

Chegg's board of directors authorized the company to buy back an additional $500 million worth of shares , perhaps in anticipation of the markets' negative response.

What is the ticker symbol for Chegg?

Chegg trades on the New York Stock Exchange (NYSE) under the ticker symbol "CHGG."

When is Chegg earnings call?

How can I listen to Chegg's earnings call? Chegg will be holding an earnings conference call on Monday, August 9th at 4:30 PM Eastern. Interested parties can register for or listen to the call using this link or dial in at 412-317-6671 with passcode "13721450".

What is the P/E ratio of Chegg?

The P/E ratio of Chegg is -416.43, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

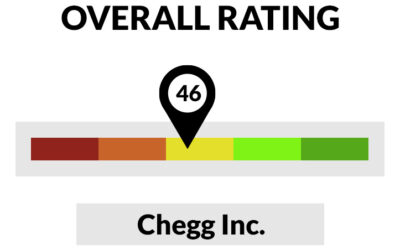

What is Chegg's rating?

Chegg has received a consensus rating of Hold. The company's average rating score is 2.33, and is based on 5 buy ratings, 10 hold ratings, and no sell ratings.

What is Chegg's FY 2021 earnings?

The company provided EPS guidance of - for the period. The company issued revenue guidance of $790 million-$800 million, compared to the consensus revenue estimate of $790.46 million.

What hedge funds are in stay at home stocks?

Big hedge funds like Viking, Coatue and RenTech jumped into these stay-at-home stocks just before they crashed — possibly as a hedge against the virus-prone winter months. - Markets Insider

Does Chegg pay dividends?

Chegg does not currently pay a dividend.

CHGG Stock at a Glance

Before diving into recent news with Chegg, I’ll give you a brief overview of the company, in case you have only a faint familiarity with it. Based in Santa Clara, CA, the company got its start as a textbook leasing service. In recent years, however, its Chegg Study platform has become its main business.

The Verdict on CHGG Stock

Put simply, Chegg is a busted growth story. Last year, you could make the argument that the digitalization of education meant many more years ahead for the company to expand at an above-average clip.