Will Barrick's stock fall if gold prices fall?

In the short-term, Barrick's stock may continue to face some pressure if gold prices weaken, although any lower earnings due to gold should be partially offset by higher copper prices (Barrick owns and operates four copper mines).

What drove Barrick Gold's 11% drop in September?

The shares of Barrick Gold ( NYSE:GOLD), one of the largest gold miners in the world, fell a little more than 11% in September, according to data provided by S&P Global Market Intelligence. That was well more than peer Newmont Goldcorp, which only dropped 5%.

Why did Barrick and Newmont Mining stock drop last month?

The common problem that Barrick and Newmont faced last month was a drop in the spot price of gold. As miners, these two companies don't control the value of the product they sell. Copper, which is another key commodity for Barrick, was also weak. So, some of Barrick's price drop is inherently related to the prices of the commodities it sells.

Did Berkshire Hathaway just cut its entire stake in Barrick Gold?

It was recently reported in Berkshire Hathaway's latest 13F filing that the Buffett-owned conglomerate has shed its entire stake in Barrick Gold ( GOLD ); Berkshire previously took a $564 million stake in the gold/copper miner in August 2020.

Is Barrick Gold stock a good investment?

GOLD boasts a Value Style Score of B and VGM Score of B, and holds a Zacks Rank #3 (Hold) rating. Shares of Barrick Gold are trading at a forward earnings multiple of 20X, as well as a PEG Ratio of 10, a Price/Cash Flow ratio of 10.1X, and a Price/Sales ratio of 3.5X.

Why is Barrick stock so low?

Declining profitability, expectations or weaker long-term commodities prices, dwindling reserves may all play a role in weighing down the performance of commodities producers. There are some factors at play that can justify the decline in Barrick's stock value relative to the price of gold.

Why did gold stock drop today?

Gold edges lower as Treasury yields rise; faces weekly drop Gold prices slipped on Friday, pressured by strength in U.S. Treasury yields, and were headed for their first weekly fall in three. Spot gold was down 0.1% at $1,950.01 per ounce, as of 0049 GMT.

Will Barrick Gold stock go up?

The 20 analysts offering 12-month price forecasts for Barrick Gold Corp have a median target of 28.00, with a high estimate of 32.05 and a low estimate of 21.50. The median estimate represents a +39.93% increase from the last price of 20.01.

Is Barrick Gold undervalued?

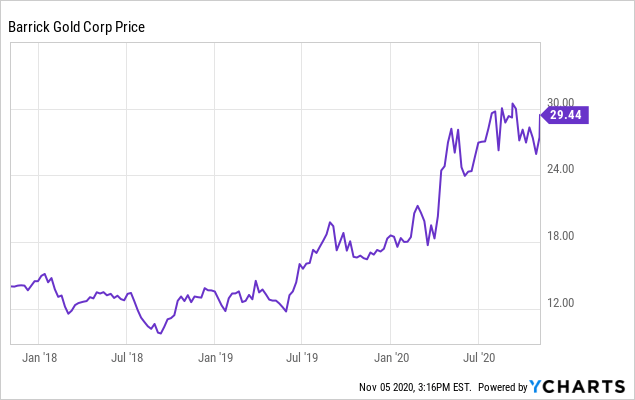

Despite rising more than 56% from its March 2020 lows, at the current price of $25 per share, Barrick Gold stock is still undervalued and seems like a good bet at the present time.

What is the best gold company to invest in?

Best Gold Stocks to BuyBarrick Gold Corp (NYSE: GOLD) ... Newmont (NYSE: NEM) ... Kirkland Lake Gold (NYSE: KL) ... Franco-Nevada Gold (NYSE: FNV) ... Agnico Eagle Mines (NYSE: AEM) ... Kinross Gold (NYSE: KGC) ... Sibanye-Stillwater (NYSE: SBSW) ... Wheaton Precious Metals (NYSE: WPM)More items...

Will the gold rise tomorrow?

Gold Rate Forecast for Tomorrow is Rs. 4760 for 22 Carat & Rs. 5194 for 24 Carat segment. Expected change is very low i.e. -0.248% & -0.247% for 22 Carat & 24 Carat respectively.

Is gold high or low right now?

Live Gold PriceGold Price Last WeekCurrent Price$59,513.36Week High$60,248.09Week Low$58,791.66Week Change-$86.09 (0.14%)Jun 1, 2022

Does Barrick Gold pay a dividend?

First Quarter 2022 Results Toronto — Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) today announced a $0.20 per share quarterly dividend, the first to include a $0.10 per share performance component in line with its new dividend policy.

What is the price target for Barrick Gold?

Stock Price Target GOLDHigh$32.05Median$28.00Low$21.50Average$28.05Current Price$20.03

How much gold was produced in the third quarter?

What is Zacks research?

Total gold production amounted to around 1.16 million ounces in the third quarter, down 11.6% year over year from 1.3 million ounces. Average realized price of gold was $1,926 per ounce in the quarter, up 30.5% year over year.

The shares of the giant miner had more than one headwind to deal with

Zacks. Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank.

What happened

Reuben Gregg Brewer believes dividends are a window into a company's soul. He tries to invest in good souls.

So what

The shares of Barrick Gold ( NYSE:GOLD), one of the largest gold miners in the world, fell a little more than 11% in September, according to data provided by S&P Global Market Intelligence. That was well more than peer Newmont Goldcorp, which only dropped 5%.

Now what

The common problem that Barrick and Newmont faced last month was a drop in the spot price of gold. As miners, these two companies don't control the value of the product they sell. Copper, which is another key commodity for Barrick, was also weak. So, some of Barrick's price drop is inherently related to the prices of the commodities it sells.

Barrick Gold stock analysis: Major price drivers

Although the merger news and gold prices were notable issues in September, neither was really out of the ordinary for Barrick. So investors shouldn't read too much into this single month. That said, it is worth keeping an eye on efforts to integrate Acacia.

Barrick Gold stock fundamental analysis: Earnings beat estimates

Barrick Gold's shares are traded on the Toronto Stock Exchange (TVX) under the symbol ABX and on the New York Stock Exchange (NYSE) under the ticker symbol GOLD.

Barrick Gold stock news: 2022 guidance and share buyback

On 16 February, the miner reported fourth-quarter earnings that beat analysts' estimates for eight consecutive quarters since the second quarter in 2020, according to data compiled by MarketBeat.

Barrick Gold stock price prediction: Analyst sentiment and price target

In 2022, the company expects to produce 4.2m to 4.6m ounces on the back of stable performance on its portfolio of six mines classified as "Tier One Gold Assets”. Barrick defines a Tier One mine as an asset producing more than 500,000 ounces of gold per annum and having a mine life of at least ten years.

Barrick Gold stock forecast: Targets for 2022, 2025 and 2027

Mikhail Karkhalev, analyst at Capital.com, said that Barrick Gold shares are on the rise and there are plenty of reasons for that:

How much did Berkshire Hathaway stake in Barrick Gold?

Algorithm-based forecasting services also provided mixed price targets for Barrick stock, as of 23 February.

When did Barrick get upgraded to Baa1?

It was recently reported in Berkshire Hathaway's latest 13F filing that the Buffett-owned conglomerate has shed its entire stake in Barrick Gold ( GOLD ); Berkshire previously took a $564 million stake in the gold/copper miner in August 2020.

How much is Barrick Crushes Q3 2020?

The improving balance sheet resulted in a credit rating upgrade on October 2020, when Moody’s upgraded Barrick’s senior unsecured ratings to Baa1 from Baa2 while maintaining a stable outlook. The rating could get upgraded again since Barrick is now cash positive and has seen improvements in its finances since October.

Is Barrick Gold stock cheap?

Previous coverage: Barrick Crushes Q3 2020 Earnings Estimates. Most notably, Barrick produced $6.4 billion in cash flow and $3.4 billion in free cash flow in 2020, with an average realized gold price of $1,778 and copper price of $2.92.

When did gold hit $800?

Barrick Gold: Final Thoughts. Barrick's stock, along with other similar gold miners, may more pressure in the short-term if gold prices continue to flounder, but the stock's valu ation is dirt-cheap and the miner is able to turn a profit even if gold fell by another $500-$600 (which is highly unlikely).

Is Barrick Gold a cash positive company?

When interest rates go up, it seems to go down, but when you get hyperinflation and super high interest rates, it seems to hold its value. Gold hit $800 in 1980 and has never hit that level again when adjusted for inflation, which today would be about $2500.

Barrick's Earnings and Sales Beat Estimates in Q3

- Barrack recorded net earnings (on a reported basis) of $882 million or 50 cents per share in third-quarter 2020, down from $2,277 million or $1.30 in the year-ago quarter. Barring one-time items, adjusted earnings per share surged 173.3% year over year to 41 cents. The figure also beat the Zacks Consensus Estimate of 32 cents. Barrick recorded tota...

Operational Highlights

- Total gold production amounted to around 1.16 million ounces in the third quarter, down 11.6% year over year from 1.3 million ounces. Average realized price of gold was $1,926 per ounce in the quarter, up 30.5% year over year. Cost of sales remained unchanged year over year at $1,065 per ounce. All-in sustaining costs fell 1.8% year over year to $966 per ounce in the quarter. Copper p…

Financial Position

- At the end of the third quarter, Barrick had cash and cash equivalents of $4,744 million, up 97.3% year over year. The company’s long-term debt was $5,140 million at the end of the quarter, down 6.4% year over year. Net cash provided by operating activities surged 85.2% year over year to $1,859 million. The company’s board also raised its quarterly dividend payout by 12.5% to 9 cent…

Guidance

- For 2020, Barrick retained its annual production guidance. It continues to anticipate attributable gold production in the range of 4.6-5 million ounces. AISC is expected in the range of $920-$970 per ounce, unchanged from the prior view. Cost of sales is expected in the range of $980-$1,030 per ounce, unchanged from the previous guidance. The company continues to expect copper pr…