What will Avid Technology's stock price reach in the next year?

On average, they expect Avid Technology's stock price to reach $45.00 in the next year. This suggests a possible upside of 52.0% from the stock's current price.

What is the upside for Avid Technology (AVID)?

On average, they expect Avid Technology's share price to reach $9.1667 in the next twelve months. This suggests a possible upside of 43.5% from the stock's current price. View Analyst Price Targets for Avid Technology.

What companies are related to avid?

Some companies that are related to Avid Technology include Apple (AAPL), Dell Technologies (DELL), HP (HPQ), NCR (NCR), 3D Systems (DDD), Stratasys (SSYS), Diebold Nixdorf (DBD) and Kopin (KOPN). View all of AVID's competitors.

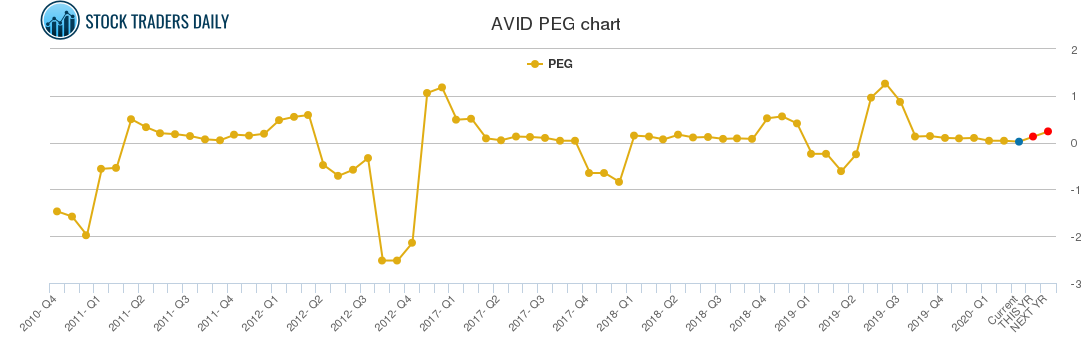

What does Avid Technology's P/E ratio mean?

The P/E ratio of Avid Technology is 40.56, which means that it is trading at a more expensive P/E ratio than the market average P/E ratio of about 14.79. The P/E ratio of Avid Technology is 40.56, which means that it is trading at a less expensive P/E ratio than the Computer and Technology sector average P/E ratio of about 66.17.

Will Avid stock go up?

Avid Technology Inc (NASDAQ:AVID) The 4 analysts offering 12-month price forecasts for Avid Technology Inc have a median target of 43.50, with a high estimate of 53.00 and a low estimate of 30.00. The median estimate represents a +70.86% increase from the last price of 25.46.

Is Avid a good stock to buy?

Avid Technology has received a consensus rating of Buy. The company's average rating score is 3.00, and is based on 3 buy ratings, no hold ratings, and no sell ratings.

Is Avid publicly traded?

Stock Quote (U.S.: Nasdaq) | MarketWatch....$ 27.64.CloseChgChg %$27.641.947.55%

When did Avid Technology go public?

This industry-standard file format permitted the exchange of digital media among different platforms and applications. Meanwhile, Media Suite Pro 2.0 was scheduled to ship in the fall of 1993. From 1989 to 1993, when the company went public, Avid's revenue jumped from $1 million to $112 million.

What do you know about Avid?

AVID, which stands for Advancement Via Individual Determination, is a nonprofit college-readiness program designed to help students develop the skills they need to be successful in college. The program places special emphasis on growing writing, critical thinking, teamwork, organization and reading skills.

What does avid stand for in high school?

Advancement Via Individual DeterminationAdvancement Via Individual Determination (AVID) is an in-school academic support program for grades seven through twelve. The purpose of the program is to prepare students for college eligibility and success.

Is AVID stock a buy right now?

3 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Avid Technology in the last twelve months. There are currently 3 buy ratin...

Will Avid Technology's stock price go up in 2022?

3 Wall Street research analysts have issued 12-month target prices for Avid Technology's stock. Their forecasts range from $30.00 to $53.00. On ave...

How has Avid Technology's stock performed in 2022?

Avid Technology's stock was trading at $32.57 at the start of the year. Since then, AVID shares have decreased by 12.9% and is now trading at $28.3...

When is Avid Technology's next earnings date?

Avid Technology is scheduled to release its next quarterly earnings announcement on Tuesday, August 2nd 2022. View our earnings forecast for Avid...

How were Avid Technology's earnings last quarter?

Avid Technology, Inc. (NASDAQ:AVID) announced its quarterly earnings results on Wednesday, May, 4th. The technology company reported $0.27 EPS for...

What guidance has Avid Technology issued on next quarter's earnings?

Avid Technology issued an update on its second quarter 2022 earnings guidance on Monday, May, 16th. The company provided earnings per share guidanc...

Who are Avid Technology's key executives?

Avid Technology's management team includes the following people: Mr. Jeff Rosica , Pres, CEO & Director (Age 60, Pay $1.25M) Mr. Kenneth L. Gayr...

Who are some of Avid Technology's key competitors?

Some companies that are related to Avid Technology include Apple (AAPL) , HP (HPQ) , Dell Technologies (DELL) , NCR (NCR) , 3D Systems (DDD) ,...

What other stocks do shareholders of Avid Technology own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Avid Technology investors own include NVIDIA (NVDA) , Adv...

When will Avid Technology release its earnings?

How much does Avid Technology make?

Avid Technology is scheduled to release its next quarterly earnings announcement on Monday, August 2nd 2021. View our earnings forecast for Avid Technology.

While revenue took a tumble, the bottom line soared thanks to cost cuts

Avid Technology has a market capitalization of $1.74 billion and generates $360.47 million in revenue each year. The technology company earns $11.06 million in net income (profit) each year or $0.46 on an earnings per share basis.

What happened

Tim writes about technology and consumer goods stocks for The Motley Fool. He's a value investor at heart, doing his best to avoid hyped-up nonsense. Follow him on Twitter: Follow @TMFBargainBin

So what

Shares of Avid Technology ( NASDAQ:AVID) jumped on Tuesday after the technology provider for the media and entertainment industry reported its second-quarter results. While revenue declined, the company beat analyst expectations across the board. The stock was up about 9.8% at 1:20 p.m. EDT.

Now what

Avid reported second-quarter revenue of $79.3 million, down 19.7% year over year but about $1.9 million higher than the average analyst estimate. Subscription revenue soared 68.3% to $16.4 million, driven by an increase of 24,000 paid subscriptions to around 242,000.

How many Emmys does Avid have?

"We are adjusting our strategy and our investments to respond to the changes in the market which are informed by ongoing discussions with customers across the media industry, placing greater focus on the products and solutions that we believe will drive profitable growth as we emerge in the post-COVID environment," said Avid CEO and president Jeff Rosica..

What is the difference between Avid and Sibelius?

Avid has actually won 16 Emmy awards, one Grammy, and two Oscars for technical innovation. The company sells a variety of tools such as its Pro Tools audio software, which is popular for professional music production. The Media Composer product is used to edit video for TV, commercials, and feature films, while Sibelius is a software used ...

What is ad technology?

The Media Composer product is used to edit video for TV, commercials, and feature films, while Sibelius is a software used to create musical scores and is widely used to teach music composition. Avid's software has historically been offered as a licensed software but is now also available as a recurring subscription.

Is Avid a technology company?

Avid Technology provides software and integrated hardware used in video and audio production. The company's products can be found on the sets of Hollywood films and television programming, in addition to live events venues. Avid has actually won 16 Emmy awards, one Grammy, and two Oscars for technical innovation.

The company announced disappointing results from two clinical studies

As a technology company focused on supplying the film and music production industry, Avid Technology ( NASDAQ:AVID) has faced significant headwinds from the cancellation of these live events. In early August, the company released its second-quarter earnings report, which revealed the extent of the pandemic's financial impact on the business.

Key Points

Keith began writing for the Fool in 2012 and focuses primarily on healthcare investing topics. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. Follow @keithspeights

What happened

Allokos said that lirentelimab failed to meet co-primary endpoints in two clinical studies.

So what

Shares of Allakos ( NASDAQ:ALLK) are crashing 88% lower as of 10:17 a.m ET on Wednesday. The huge decline came after the company announced results from its phase 3 Enigma 2 and its phase 2/3 Kryptos clinical studies evaluating lirentelimab.

Now what

The biotech stock plunged so much because the co-primary endpoint misses weren't even close. That's especially problematic because lirentelimab is Allokos' only pipeline candidate in clinical development.