Is Callon Petroleum Company (CPE) a good investment?

It focuses on unconventional oil and natural gas reserves in the Permian Basin. The company was founded by Sim C. Callon and John S. Callon in 1950 and is headquartered in Houston, TX. Have Callon Petroleum Company (NYSE:CPE) Insiders Been Selling Their Stock? Callon Petroleum has received a consensus rating of Hold.

Is CPE stock headed to bankruptcy?

But somehow CPE stock continues to draw the attention of investors. But after an ill-timed acquisition, the company has a multitude of problems. And ultimately, the answer may be bankruptcy. I’m probably becoming loathed by Robinhood investors. However, in fairness, they’re making it very easy.

Where can I buy shares of CPE?

Shares of CPE can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Will CPE stock recover?

quote is equal to 39.490 USD at 2022-06-30. Based on our forecasts, a long-term increase is expected, the "CPE" stock price prognosis for 2027-06-25 is 132.457 USD. With a 5-year investment, the revenue is expected to be around +235.42%. Your current $100 investment may be up to $335.42 in 2027.

Will CPE go up?

The 12 analysts offering 12-month price forecasts for Callon Petroleum Co have a median target of 72.50, with a high estimate of 145.00 and a low estimate of 40.00. The median estimate represents a +93.85% increase from the last price of 37.40.

Is CPE stock a good buy?

Out of 6 analysts, 2 (33.33%) are recommending CPE as a Strong Buy, 1 (16.67%) are recommending CPE as a Buy, 2 (33.33%) are recommending CPE as a Hold, 0 (0%) are recommending CPE as a Sell, and 1 (16.67%) are recommending CPE as a Strong Sell. What is CPE's earnings growth forecast for 2022-2024?

Should I sell Callon Petroleum?

Considering the 90-day investment horizon and your complete indifference towards market risk, our recommendation regarding Callon Petroleum is 'Strong Buy'.

Does CPE stock pay dividends?

Callon Petroleum Co (NYSE: CPE) does not pay a dividend.

How much debt does Callon Petroleum have?

Callon is now expected to generate $758 million in positive cash flow in 2022. This would allow it to reduce its net debt to $1.955 billion at the end of 2022, or around 1.15x its 2022 EBITDAX....$ Million.$ MillionCash Interest$160Operational Capital Expenditures$775Total Expenses$1,5764 more rows•May 3, 2022

When did CPE go public?

1994: Callon Petroleum merges with partners and goes public.

How many employees does Callon Petroleum have?

Compare CPE With Other StocksCallon Petroleum Annual Number of Employees20203032019475201821820171699 more rows

Should I buy or sell Callon Petroleum stock right now?

8 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Callon Petroleum in the last year. There are currently 1 sell rating, 4 ho...

What is Callon Petroleum's stock price forecast for 2022?

8 Wall Street analysts have issued 1-year price objectives for Callon Petroleum's shares. Their forecasts range from $45.00 to $101.00. On average,...

How has Callon Petroleum's stock price performed in 2022?

Callon Petroleum's stock was trading at $47.25 at the start of the year. Since then, CPE stock has increased by 26.8% and is now trading at $59.93....

When is Callon Petroleum's next earnings date?

Callon Petroleum is scheduled to release its next quarterly earnings announcement on Wednesday, August 3rd 2022. View our earnings forecast for Ca...

How were Callon Petroleum's earnings last quarter?

Callon Petroleum (NYSE:CPE) released its quarterly earnings data on Wednesday, May, 4th. The oil and natural gas company reported $3.43 EPS for the...

Who are Callon Petroleum's key executives?

Callon Petroleum's management team includes the following people: Mr. Joseph C. Gatto Jr. , Pres, CEO & Director (Age 51, Pay $3.62M) Mr. Kevin...

What is Fred L. Callon's approval rating as Callon Petroleum's CEO?

2 employees have rated Callon Petroleum CEO Fred L. Callon on Glassdoor.com . Fred L. Callon has an approval rating of 73% among Callon Petroleum'...

Who are some of Callon Petroleum's key competitors?

Some companies that are related to Callon Petroleum include ConocoPhillips (COP) , EOG Resources (EOG) , Pioneer Natural Resources (PXD) , Devo...

What other stocks do shareholders of Callon Petroleum own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Callon Petroleum investors own include Oasis Petroleum (OA...

How much is Callon Petroleum stock worth in 2021?

The Callon Petroleum Company stock price gained 5.18% on the last trading day (Friday, 9th Jul 2021), rising from $51.76 to $54.44. During the day the stock fluctuated 5.71% from a day low at $51.54 to a day high of $54.48. The price has been going up and down for this period, and there has been a -7.34% loss for the last 2 weeks. Volume fell on the last day by -792 thousand shares and in total, 1 million shares were bought and sold for approximately $68.87 million. You should take into consideration that falling volume on higher prices causes divergence and may be an early warning about possible changes over the next couple of days.

Is Callon Petroleum a negative stock?

The Callon Petroleum Company stock holds several negative signals and despite the positive trend, we believe Callon Petroleum Company will perform weakly in the next couple of days or weeks. Therefore, we hold a negative evaluation of this stock. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Buy to a Strong Sell candidate.

Callon Petroleum Company Price, Consensus and EPS Surprise

Callon Petroleum Company price-consensus-eps-surprise-chart | Callon Petroleum Company Quote

Production

For the quarter, net production volumes averaged 88,981 Boe/d, significantly down from the year-ago period’s 108,664 Boe/d. Production volumes decreased in both Permian Basin and Eagle Ford. Of the total second-quarter production, 63% was oil.

Price Realizations (Without the Impact of Cash-Settled Derivatives)

The average realized price per barrel of oil equivalent was $48.68. The figure increased from the year-ago quarter’s $15.90 a barrel. Average realized price for oil was $65.36 per barrel compared with $20.41 a year ago.

Total Expenses

Total operating expenses of $234.3 million declined from the year-ago level of $1,518.9 million. The year-ago figure includes an impairment charge of $1,276.5 million.

Capital Expenditure & Balance Sheet

Capital expenditure for the reported quarter was $149.7 million. It generated adjusted free cash flow of $6.9 million, down from $18 million a year ago.

Guidance

For the third quarter, it expects production within 95.5-97.5 MBoe/d, of which 64% will likely be crude oil. Operational capital spending will likely be in the range of $120-$130 million.

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #3 (Hold). Some better-ranked stocks from the energy space include Range Resources Corporation RRC, Hess Corporation HES and Summit Midstream Partners, LP SMLP, each having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What is the CPE symbol?

Callon Petroleum trades on the New York Stock Exchange (NYSE) under the ticker symbol "CPE."

When will Callon Petroleum release its earnings?

Callon Petroleum is scheduled to release its next quarterly earnings announcement on Tuesday, August 3rd 2021. View our earnings forecast for Callon Petroleum.

What is the P/B ratio of Callon Petroleum?

Callon Petroleum has a P/B Ratio of 3.17. P/B Ratios above 3 indicate that a company could be overvalued with respect to its assets and liabilities.

What is Callon Petroleum's rating?

Callon Petroleum has received a consensus rating of Hold. The company's average rating score is 2.20, and is based on 2 buy ratings, 8 hold ratings, and no sell ratings.

Does Callon Petroleum pay dividends?

Callon Petroleum does not currently pay a dividend.

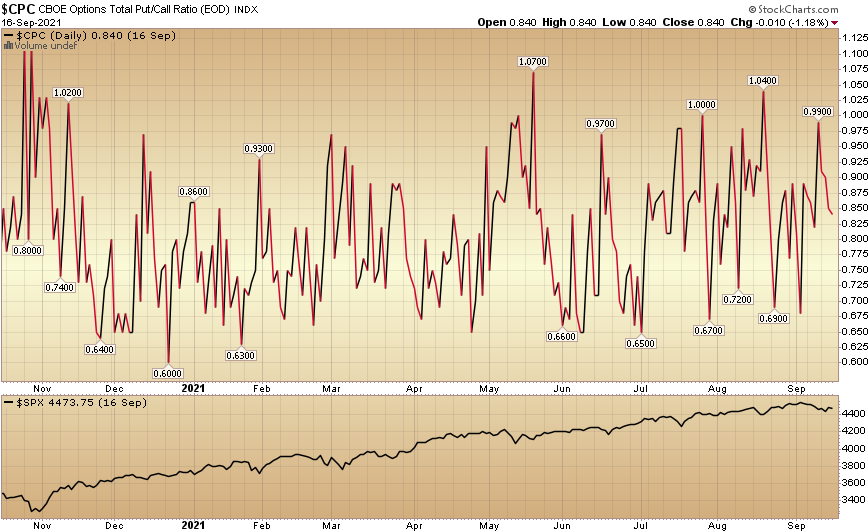

What does increasing volume mean in stocks?

Increasing volume can mean a trend is getting stronger, while decreasing volume can mean a trend is nearing a conclusion. For stocks that have options, our system also considers the balance between calls, which are often bets that the price will go up, and puts, which are frequently bets that the price will fall.

What is sentiment in stock?

Sentiment is how investors, or the market, feels about a stock. There are lots of ways to measure sentiment. At the core, sentiment is pretty easy to understand. If a stock is going up, investors must be bullish, while if it is going down, sentiment is bearish.

CPE Stock Is Loved by Robinhood Investors

I’m probably becoming loathed by Robinhood investors. However, in fairness, they’re making it very easy. In early March, only 4,000 accounts were holding its stock. As of this writing over 76,000 Robinhood members are seeking to be the smartest guy in the room.

Callon Has Serious Problems

For starters, Callon is heavily invested in shale production. That’s a very expensive way to extract oil. And they’ve shut in a good bit of their production. So even if oil prices go up significantly, they’re going to be late getting to that party.

How much debt did Callon pay for Carrizo?

Oil was still up over $50/barrel then and thus Callon paid too high a price for Carrizo Oil and Gas. That deal brought Callon’s overall debt load to more than $3 billion.

Does shale oil need more demand?

The answer to that probably depends on whether or not the coronavirus continues picking up steam or not. Shale oil producers need more demand — more cars on the road, more jets in the air, and so on. In a world with a glut of oil, independent shale producers like Callon are not in a great position.

Is Callon stock speculative?

There’s some merit to the speculative case for Callon stock. Ironically, the company’s size is both a strength and a weakness here. Many oil stocks trading at a dollar per share are on the brink of bankruptcy. It’d take a miracle for them to survive.