What happens with CCIV stock?

As a result of the merger, Churchill Capital and Lucid Motors will be renamed Lucid Group. In addition to this, shares of CCIV stock will switch over to the LCID stock ticker.Jul 23, 2021

Is CCIV stock a good buy?

I personally would rate CCIV a hold for most, and a potential buy for those with some appetite for risk who are looking for an investment with a strong return outlook in a bullish scenario.May 17, 2021

Is Lucid merger with CCIV?

Lucid Group, the company formed after Lucid Motors' July 23 merger with Churchill Capital Corp IV (CCIV), has become a publicly listed company.Jul 27, 2021

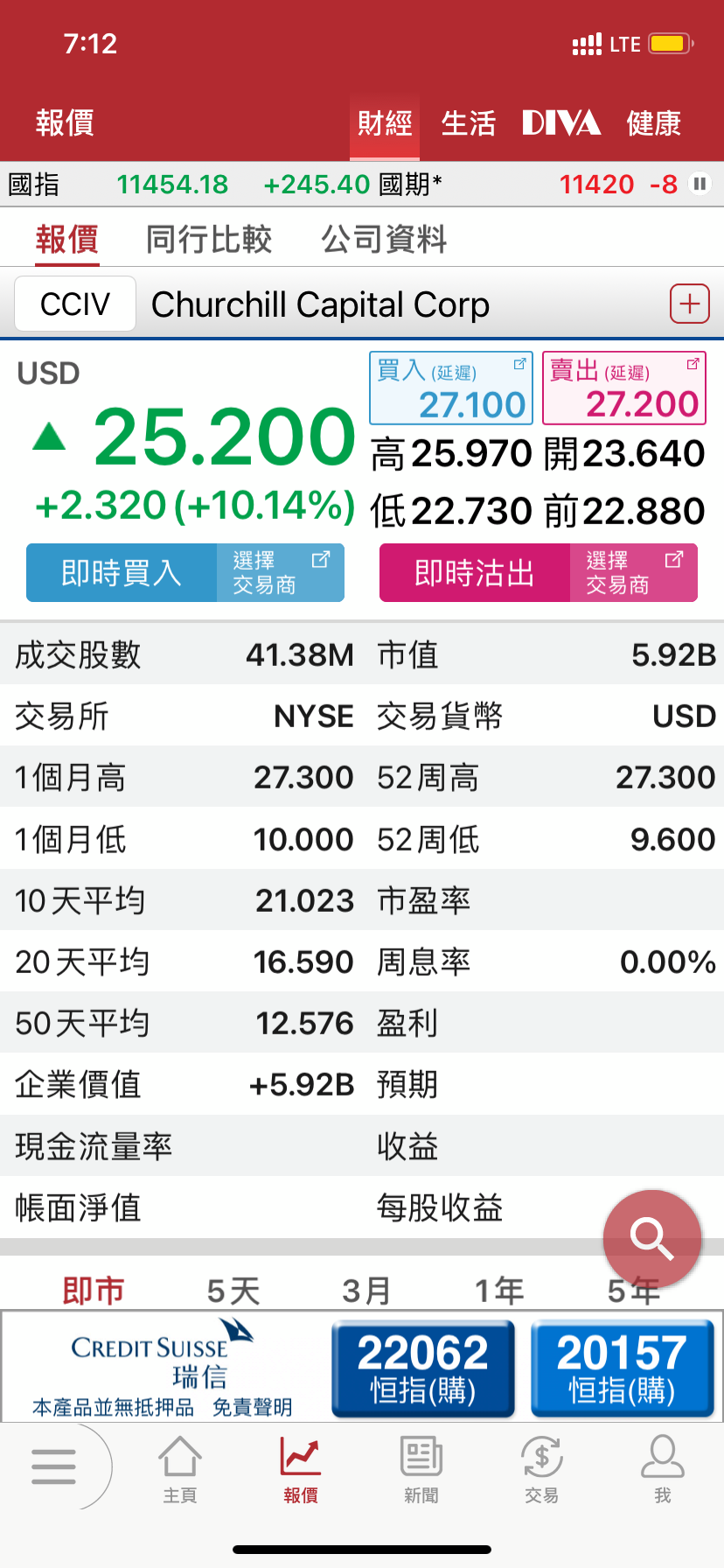

What is CCIV stock worth today?

Key Turning Points52-Week High64.86Fibonacci 50%37.23Fibonacci 38.2%30.71Last Price24.2552-Week Low9.601 more row

Is CCIV undervalued?

CCIV Stock Is Almost 20% Undervalued Ahead of Lucid Motors Merger.Mar 31, 2021

Is CCIV a good long-term stock?

If you are looking at CCIV stock as a long-term investment, there will probably be a more attractive entry point. This could happen between now and the completion of the deal. It is certainly a top EV stock to watch from now on, but not quite the price that investors are paying right now.Feb 23, 2021

Is CCIV delisted?

This will have CCIV shares being delisted from the New York Stock Exchange and LCID stock start trading on the Nasdaq Exchange at the start of trading on Monday. Peter Rawlinson, as well as the rest of the executive team at Lucid Motors, will continue to lead the post-merger company.

When did CCIV become LCID?

Should the merger be approved by investors (which it likely will be), CCIV will cease to trade, and shares will be converted to LCID, which will trade on the NYSE starting July 23.Jul 19, 2021

When did NIO go public?

The stock has gained 234.5% from the September 2018 initial public offering price of $6.26 a share. The stock plunged to a low of $1.19 in late 2019, before a state-led capital injection in early 2020 helped shares soar by more than 1,100% that year.Feb 28, 2022

Why is CCIV stock going up today?

CCIV stock is getting a boost as investors salivate at the potential valuation of a special purpose acquisition company (SPAC) merger with electric vehicle (EV) maker Lucid Motors.Jun 2, 2021

Who is CCIV stock?

Churchill Capital Corp IV(CCIV)

Who is John Rosevear?

John Rosevear is the senior auto specialist for Fool.com. John has been writing about the auto business and investing for over 20 years, and for The Motley Fool since 2007. Follow @john__rosevear

Is Churchill going to merge with Lucid?

So what. Shares of Churchill have surged more than 200% since Bloomberg reported on Jan. 11 that the SPAC was close to a deal to merge with Lucid, a start-up manufacturer of luxury EVs that is close to beginning production of its first model. It's easy to see why auto investors might be excited about such a deal.

Why CCIV stock is dropping

CCIV stock is trading more than 60 percent down from its 52-week high. The stock peaked in February before its merger with Lucid Motors was announced. Soon after the merger became official, the stock started dropping, which is slightly unusual. Most SPAC stocks rise on the announcement of merger targets.

Will CCIV SPAC stock recover?

While CCIV has fallen nearly 60 percent from its peak, it's still trading at a hefty 125 percent premium to its IPO price. The very exuberance that sent the stock soaring in the first place was misplaced.

Forecast for CCIV stock

CCIV's stock forecast depends on Lucid Motors. Looking at CCIV’s current stock price, markets are still valuing Lucid Motors at a premium to its peers. A case can be made that the stock falls even more.

Volkswagen versus Lucid Motors

Among legacy carmakers, Volkswagen has the most solid EV case. Recently, the company held a “Power Day,” similar to Tesla’s Battery Day, to make its EV intentions clearer to the market. The company intends to bring down its battery production costs to below $100 per kilowatt-hour. Volkswagen aims to become the global EV market leader by 2025.

CCIV stock looks expensive and isn't a buy

While Lucid Motors’ vision and technology are quite strong, its stock has run up to price in most of these positives. Even after the recent plunge, it still looks expensive. Therefore, it's best avoided at the current prices.

Who is John Rosevear?

John Rosevear is the senior auto specialist for Fool.com. John has been writing about the auto business and investing for over 20 years, and for The Motley Fool since 2007. Follow @john__rosevear

Where is Tesla made?

Led by Peter Rawlinson, who previously was the chief engineer of Tesla ( NASDAQ:TSLA) groundbreaking Model S, the company has a nearly completed factory in Arizona, more than 400 patents on its next-generation EV technology, and plenty of reservations for its first model, the Air luxury sedan.