Should you buy CCIV stock after its recent drop?

Even after CCIV’s recent drop, its $34 billion valuation is hard to justify. This is especially true given the fact that it hasn’t delivered a single vehicle yet and isn't expected to generate any revenues in 2021. Investors should wait to buy CCIV stock.

Should you buy Lucid Motors (CCIV) stock?

While Lucid Motors’ vision and technology are strong, its stock has run up to price in most of these positives. Even after the recent plunge, it still looks expensive and it isn't expected to recover significantly anytime soon. Since the merger with Lucid Motors hasn't materialized, CCIV doesn’t have any analysts covering it.

How does CCIV compare to NIO and Xpeng?

CCIV’s pro forma market capitalization is close to $36 billion. NIO has a market capitalization of $59 billion. Meanwhile, XPeng (XPEV) has a market cap of nearly $24 billion. Xpeng is an established Chinese EV-maker that's already delivering vehicles.

What are the chances of the stock going up?

The stock lies in the middle of a very wide and strong rising trend in the short term and a further rise within the trend is signaled. Given the current short-term trend, the stock is expected to rise 18.05% during the next 3 months and, with a 90% probability hold a price between $25.87 and $36.60 at the end of this 3-month period.

Can you buy CCIV stock?

The first step to buying shares of CCIV is to pick a brokerage. Very few brokers still charge commissions for trades, so you should be able to buy shares of CCIV with no additional fees.

What happened to CCIV shares?

Now that work is finally done as the two companies have completed the merger. As a result of the merger, Churchill Capital and Lucid Motors will be renamed Lucid Group. In addition to this, shares of CCIV stock will switch over to the LCID stock ticker.

Does CCIV stock become Lucid?

After days of both sides rallying stockholders to exercise their vote, the SPAC merger between Lucid Motors and Churchill Capital Corp IV (CCIV) has been approved.

Did CCIV change to LCID?

CCIV is now officially LCID as the Lucid Motors transaction has closed and begins trading under its new ticker today. All 7 SPAC merger votes are at prices that make more big redemptions possible.

Is CCIV merger completed?

The merger was approved this past July, resulting in the companies joining the Nasdaq under the ticker symbol $LCID and combining for a pro-forma equity value of $24 billion. Lucid's SPAC merger with CCIV joined a growing number of other EV companies that took a similar approach.

Did CCIV merger go through?

Lucid Group, the company formed after Lucid Motors' July 23 merger with Churchill Capital Corp IV (CCIV), has become a publicly listed company....Lucid Group trades under the "LCID" ticker symbol.CategoryIndustryBody StyleSedan1 more row•Jul 27, 2021

Why did Lucid and CCIV merge?

Merger with CCIV would allow Lucid to raise capital like a public company, bolstering the development and marketing of Lucid's first luxury electrical vehicle, Lucid Air.

Should I buy CCIV before merger?

The company has a strong and experienced team that could turn the projections and goals into a reality but I would recommend investors to wait for the merger to complete before investing in CCIV stock.

How many Lucid shares does CCIV have?

Moreover, the PIPE investors, who are bringing in $2.5 billion in crucial liquidity, also need to be issued new shares, to the tune of 166.66 million. Assuming no redemptions, 1.595 billion Lucid Group common shares will have to be issued in total upon the close of the merger agreement.

When did CCIV become lucid?

Lucid completed the previously announced merger with Churchill Capital Corp IV on July 23, 2021. The combined company will now operate as Lucid Group, Inc. Lucid will be ringing the opening bell at Nasdaq on July 26 to celebrate the company's public listing.

What is the CCIV new symbol?

Churchill Capital Corp IV (CCIV) will change its name, trading symbol, and CUSIP to Lucid Group, Inc. (LCID), CUSIP 549498103 effective July 26, 2021. As a result, option symbol CCIV will also change to LCID effective at the opening of business on July 26, 2021. Strike prices and all other option terms will not change.

When did CCIV become LCID?

Shares of common stock and warrants of the post-combination company, renamed Lucid Group, Inc. ("Lucid"), will be listed on The Nasdaq Stock Market LLC ("Nasdaq") beginning on July 26, 2021 under the ticker symbols "LCID" and "LCIDW," respectively. Units will no longer trade separately.

How many lucid shares does CCIV have?

Moreover, the PIPE investors, who are bringing in $2.5 billion in crucial liquidity, also need to be issued new shares, to the tune of 166.66 million. Assuming no redemptions, 1.595 billion Lucid Group common shares will have to be issued in total upon the close of the merger agreement.

Why did CCIV drop in February?

The stock price fell after it was confirmed that a merger deal was confirmed with Lucid Motors to take the California-based electric vehicle company public. CCIV's stock price drop comes off as a surprise reversal as it was surging through February based on speculation that a deal was imminent.

Why is lucid stock suspended?

The exercise of non-qualified stock options, however, is suspended. Since the date that we received a letter of intent to enter into a SPAC merger, we have been unable to confirm the fair market value of Atieva, Inc.

Why did lucid stock go down?

Summary. Lucid stock fell over -30% year-to-date in 2022; its Q4 2021 revenue and 2022 production guidance didn't meet market expectations, and investors seem to prefer established automakers over startups now.

How many EVs will be sold in 2021?

Volkswagen aims to become the global EV market leader by 2025. It's targeting a sale of 1 million EVs in 2021. Tesla has a lead in the EV market.

Will CCIV SPAC stock recover?

At nearly a $47 billion valuation, Lucid Motors is almost as highly valued as a legacy stalwart like Ford, which itself has strong EV ambitions and the financial muscle to back it up. In contrast, Lucid hasn't delivered its first vehicle yet. Many EV makers stumbled before they could deliver anything significant like Detroit Electric and Dyson. Fundamentally, the stock could fall even more, let alone increase.

CCIV SPAC History

Churchill Capital Corp IV, or CCIV Stock, is a special purpose acquisition company or better known as a SPAC.

CCIV Stock Forecast

Having mentioned that CCIV Stock, or Churchill Capital IV, has a lawsuit against them and that Lucid Motors is not prepared to deliver the number of vehicles expected; it is pretty clear that CCIV is not in a positive light.

CCIV Stock Charts

I personally use Webull for all of my trading. If you want to create a similar setup to mine pictured above I wrote an entire article on how to change your settings to Webull Dark Mode and include the necessary indicators.

CCIV Stock News

When it comes to investing based on the news related to company risk factors I pull my CCIV Stock news from three places.

What Was CCIV Stock?

CCIV stock referred to a company known as Churchill Capital Corp IV. The company was known as a special purpose acquisition company and it was publicly traded. On July 23rd, 2021, the company completed a merger with Lucid Motors. As such, the Churchill Capital company ceased to exist in the same manner that it had previously existed.

What Does This Mean for Stockholders?

In short, it means that the stock is no longer valid. In fact, the company was delisted from the New York Stock Exchange on the 26th of July, 2021, just three days after the announcement that the merger had been completed. Of course, that doesn’t necessarily mean that people who had CCIV stock are completely out of luck.

Moving Forward

For those individuals who are still holding on to stock, it will now be traded on NASDAQ under the ticker LCID. The company has also changed its name. As a matter of fact, both companies made legal changes to their names, although Lucid Motors remained largely unchanged for practical purposes. The new company is now known as Lucid Group.

Potential Success

Considering the two companies that are involved, there is always the potential for success in this merger. That said, there is perhaps an even greater potential for failure.

The Weakness of EV Stocks

Driven largely by euphoria about the move to EVs, along with exceptionally low interest rates, many EV names, including CCIV stock, reached irrationally high levels before the recent correction.

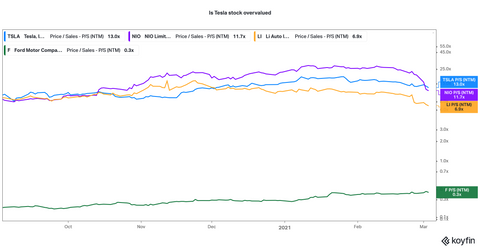

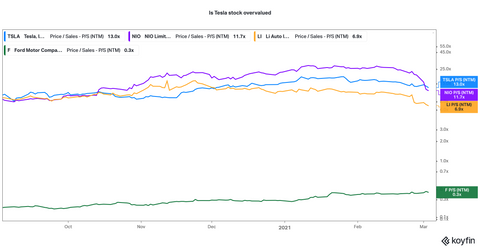

The Still-Huge Valuation of CCIV Stock

Even after Churchill Capital plunged on Feb. 23, Lucid reportedly was still valued at a gigantic $52 billion. That means that, even if Lucid is very successful and generates $1 billion of revenue in three years, CCIV stock is still changing hands for 52 times its 2024 revenue. By any measure, that’s a sky-high valuation.

Positive Attributes and Very Tough Competition

Lucid’s EVs appear to have some compelling features. For example, the Dream edition of the company’s Air Sedan, its initial EV, will reportedly be able to drive more than 500 miles on a single charge. Conversely, Tesla’s luxury Model Y EV has a range of just 326 miles.

The Bottom Line

In the current environment, Churchill Capital looks poised to drop further. And even in the longer term, Lucid may have trouble justifying the SPAC’s current stock price.

CCIV Stock Is a Play on Infrastructure

President Joe Biden’s infrastructure spending plan addressed the need for job creation to boost the U.S. market share of plug-in electric vehicles. Biden is proposing a $174 billion investment to win the EV market. From domestic battery and parts supply, the U.S. will give consumers sales rebates and tax incentives to buy American-made EVs.

Impressive Specifications

Lucid’s luxury EV has a maximum horsepower of 1,080 and a range of 500 miles per charge. It can go from zero to 60 mph in just 2.5 seconds. With that acceleration, the EV is comparable to a supercar.

Opportunity

Just as investors lack a financial model to assign a fair value on Tesla stock, the same applies to CCIV shares. Readers should look at Lucid’s investor presentation that was posted in February as a starting point.

Product Roadmap

In 2023, Lucid’s Project Gravity will result in an SUV launch. When it gets there, it will already have Lucid Electric Advanced Platform. So, it may build on its existing powertrain while adding more features and performance standards to the EV SUV. For 2030, it will have other planned sedans and SUVs.

Your Takeaway

Churchill shares fell enough to wipe out the euphoria. At current levels, the stock is approaching buy levels. The infrastructure spending in the U.S. may lift all boats. Tesla will very likely rebound first because it is a widely held stock.

Why CCIV stock is dropping

CCIV stock was surging ahead of its merger announcement with Lucid Motors. In fact, it hit a peak of $58.05 in February right before its merger with Lucid Motors was announced. Usually, SPACs rise after a merger target is announced. However, CCIV followed a completely opposite path.

Will CCIV stock recover?

After the sell-off in EV names, the rebound has started happening gradually. The stocks with good fundamentals are expected to recover more. While Lucid Motors’ vision and technology are strong, its stock has run up to price in most of these positives.

CCIV target price

Since the merger with Lucid Motors hasn't materialized, CCIV doesn’t have any analysts covering it. CCIV’s pro forma market capitalization is close to $36 billion. NIO has a market capitalization of $59 billion. Meanwhile, XPeng (XPEV) has a market cap of nearly $24 billion.

Investors should wait to buy CCIV stock

Even after the recent crash, CCIV stock is still trading at a premium of nearly 100 percent to its listing price. The stock might have fallen from the peak, but the peak value wasn't justified or warranted.

What Was CCIV Stock?

What Does This Mean For Stockholders?

- In short, it means that the stock is no longer valid. In fact, the company was delisted from the New York Stock Exchange on the 26th of July, 2021, just three days after the announcement that the mergerhad been completed. Of course, that doesn’t necessarily mean that people who had CCIV stock are completely out of luck. In fact, quite the opposite ...

Moving Forward

- For those individuals who are still holding on to stock, it will now betraded on NASDAQ under the ticker LCID. The company has also changed its name. As a matter of fact, both companies made legal changes to their names, although Lucid Motors remained largely unchanged for practical purposes. The new company is now known as Lucid Group. It is believed that the financial back…

Potential Success

- Considering the two companies that are involved, there is always the potential for success in this merger. That said, there is perhaps an even greater potential for failure. The problem is that it has traditionally been increasingly difficult to manufacture electric vehicles with any real financial success, largely because the public doesn’t seem interested in trading in their traditional interna…