What was the original price of Amazon stock?

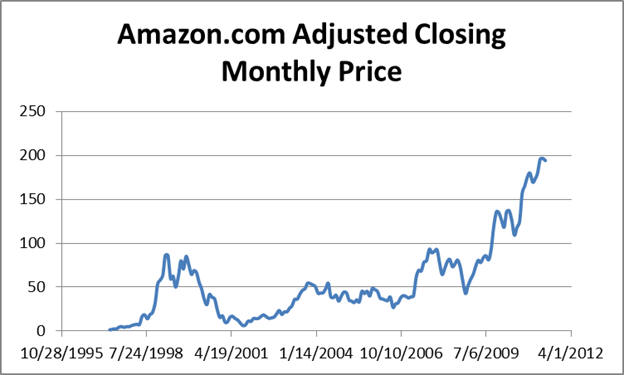

Overview of Amazon’s history Amazon’s meteoric rise, both as a company and on the stock market, did not kick in until the start of the last decade. The business went public on the Nasdaq stock exchange in March 1997, with a starting price of $18 per share. Three stock splits were carried out in the first two years of listing.

What price did Amazon stock start at?

The stock soared from a split-adjusted IPO price of $1.50 per share to $106.69 per share on Dec. 10, 1999. From there, it proceeded to fall 96% until it bottomed on Sept. 28, 2001, at $5.97 per share.

How much does Amazon stock cost?

On the 20th anniversary of the IPO Amazon stock closed at $961.35, giving the company a market value of about $466.2 billion. That's 490 times its split-adjusted stock price.

How much does Amazon share cost?

How to earn more as a self-published author on amazon

- Publish more books. Not only does having more books increase your revenue because there are more products being sold, but the Amazon algorithm favors accounts that publish regularly, pushing ...

- Offer your book in multiple formats. Even with a single book, you can have more “products” available by offering your book in multiple formats.

- Write a series. ...

How much did Amazon lose in 1999?

Why did Amazon make $39 million in inventory?

About this website

What caused market crash in 2000?

The 2000 stock market crash was a direct result of the bursting of the dotcom bubble. It popped when a majority of the technology startups that raised money and went public folded when capital went dry.

What was Amazon stock price in 2000?

The closing price for Amazon (AMZN) in 2000 was $15.56, on December 29, 2000.

What caused Amazon stock drop?

This leads us to the next reason why Amazon's stock is stumbling today: Investors are getting increasingly anxious about the economy. Inflation is still at a nearly 40-year high, and the Federal Reserve has committed itself to raising the federal funds rate to get it back down.

How many times has Amazon stock split since 2000?

This is the fourth time Amazon has declared a stock split since it went public in 1997, but the first in more than two decades. The other three splits were all within 15 months in the heart of the internet bubble period: 2-for-1 in June 1998, 3-for-1 in January 1999, and 2-for-1 in September 1999.

What was Amazon's lowest stock price in 2001?

$5.97 per shareThe stock soared from a split-adjusted IPO price of $1.50 per share to $106.69 per share on Dec. 10, 1999. From there, it proceeded to fall 96% until it bottomed on Sept. 28, 2001, at $5.97 per share.

What happens if you buy Amazon stock in 1997?

As our chart illustrates, an initial investment of $1,000, enough to buy 55 shares at a price of $18 in May 1997, would now be worth more than $2 million.

What is wrong with Amazon stock?

Highly Speculative Valuation. The valuation of Amazon shares poses investment risk. At nearly $3,000 a share as of July 2020, Amazon is a highly speculative investment with a market cap over $1 trillion and a trailing P/E ratio of 138x earnings.

When did Amazon split its stock?

Today marked the first trading day following Amazon's (AMZN) 20-for-1 stock split that the company announced on March 9. Amazon shares were revalued to $120 per share, after trading well above $2000 per share prior to the stock split.

Does Amazon pay a dividend?

Amazon's lack of a dividend certainly has not hurt investors to this point, as Amazon has been a premier growth stock. Over the past 10 years, Amazon stock generated returns above 30% per year. But for income investors, Amazon may not be an attractive option due to the lack of a dividend payment.

What stocks will split in 2022?

Upcoming stock splits in 2022CompanyStock Split RatioPayable DateAmazon (NASDAQ:AMZN)20-for-1June 3, 2022Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)20-for-1July 15, 2022Shopify (NYSE:SHOP)10-for-1June 28, 2022DexCom (NASDAQ:DXCM)4-for-1June 10, 20221 more row•Jun 8, 2022

What would 1000 in Amazon be worth today?

If you had invested $1,000 in Amazon.com you would have approximately $218,793.08 today.

What was Amazon stock price in 2003?

$52.62The closing price for Amazon (AMZN) in 2003 was $52.62, on December 31, 2003. It was up 174.2% for the year.

When did Amazon go public?

The business went public on the Nasdaq stock exchange in March 1997, with a starting price of $18 per share. Three stock splits were carried out in the first two years of listing. Amazon stock performance for the period was not remarkable, and so were the company’s fortunes for the first few years after the firm went public.

What is Amazon's name?

Amazon (AMZN) is an American multinational technology company founded by Jeff Bezos in 1994. Bezos at the time decided to change his life and made up his mind to move to Seattle to start a bookselling business, which he did, sometimes sleeping in his car with all he owned in the world. In the company’s early years, ...

What is Amazon marketplace?

Over the years, Amazon has transformed itself from a bookselling online store to an online marketplace where any item that could be put to use in everyday life can be purchased. Electronics, video games, books, gadgets, furniture, food, software are just some of the products that are found on the website.

When did Amazon start cloud computing?

Amazon pioneered cloud computing in 2006, but it took some years for the product’s earning potential to kick in and this is now one of the company’s biggest revenue earners; Expansion of its customer base to include large businesses and government (CIA chose Amazon over IBM for its $600m cloud computing project).

Did Amazon survive the dot com bubble?

Amazon ran into significant headwinds created by the dot-com bubble of 1999/2000. However, it was able to survive this storm because it had a product, a revenue model and clients who were already patronising its products, unlike many of the dot-com companies of that age. Up until 2001, Amazon did not make any profit.

What happened in the mid 2000s?

The mid-2000s brought a period of both skepticism and immense growth for Amazon. As the company recovered from the brutal dot-com crash, it rarely returned money to investors or made a profit. But Amazon was aggressively reinvesting its revenue. The company continued to expand its customer base and its retail offerings.

When did Jeff Bezos start Amazon?

In the early 1990s, Jeff Bezos walked away from a Wall Street career with an outlandish idea to sell books on the World Wide Web. In 1994, he launched Amazon.com. “I found this fact on a website that the web was growing at 2,300 percent per year,” Bezos told CNBC in a 2001 interview about his early foray into book selling.

What is Amazon Echo powered by?

It released the Echo powered by virtual personal assistant Alexa as well as a successful line of tablets.

When did dot com companies become all the rage on Wall Street?

In the late 1990s , dot-com companies became all the rage on Wall Street. Amazon’s customer growth and savvy capital fundraising combined to help it rapidly expand its offerings. Soon books became just one part of an expansive online retailer connecting customers with everything from power tools to Pokemon cards.

Who told Bezos he would crush Amazon?

At an early meeting between Barnes & Noble Chairman Leonard Riggio and Bezos, Riggio reportedly told Bezos he would “crush” Amazon. Barnes & Noble dwarfed the young start-up. The traditional bookseller had hundreds of stores and more than $2 billion in revenue.

Is Amazon's growth rate a ceiling?

Others say Amazon’s growth rate has hit a ceiling as the company enters maturity. Only time will tell who has their finger on the pulse. But either way, for those who invested early on and held their nose through some of Amazon’s most difficult times, the long bet has paid off with handsome gains.

What happened

Shares of Amazon.com ( AMZN -3.58% ) fell 20.2% lower in October of 2018, according to data from S&P Global Market Intelligence. On the heels of the e-commerce veteran's solid third-quarter earnings report, investors were rattled by modest guidance for the all-important holiday season and shaky trading across the tech sector in general.

So what

Amazon's stock dropped as much as 10.1% lower on Oct. 26, the day after publication of the company's earnings report. Sales grew 30% year over year, while earnings multiplied 11-fold, exceeding Wall Street's bottom-line estimates by 83%.

Now what

Amazon's year-over-year sales growth has inevitably landed above 20% in recent years, with the exception of a 15% gain at the end of 2015. Even then, the company was fighting a significant headwind from negative currency-exchange trends. That's not the case this time.

NASDAQ: AMZN

That doesn't take away from Amazon's value as a long-term investment, especially if the fourth-quarter forecast turns out to have been overly humble. Either way, the fourth-quarter report is likely to turn heads and move stock prices early next year. We just don't know yet in which direction.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

How much did Amazon lose in 1999?

For all of 1999, Amazon posted a loss of $390 million, or $1.19 per share, before one-time items, on revenue of $1.64 billion. That compares to a net loss of $74 million, or 25 cents per share, on revenue of $610 million in 1998.

Why did Amazon make $39 million in inventory?

Amazon had to make about $39 million of inventory-related charges and write-downs in the fourth quarter because it overstocked its warehouses with items from its new business lines, such as toys and electronics. Over the past 18 months Amazon has diversified beyond books to a wide range of consumer products.