Did the 1929 stock market crash signal trouble ahead?

Hindsight is 20/20, but the stock market threw signals back in the summer of 1929 that trouble lay ahead.

Who predicted the market crash 90 years ago?

90 Years Ago Roger Babson Predicted The Market Crash. What Would He Say Today? 90 Years Ago Roger Babson Predicted The Market Crash. What Would He Say Today? Opinions expressed by Forbes Contributors are their own. A problem occurred. Try refreshing the page. This article is more than 2 years old.

What are the best books about the stock market crash of 1929?

The Day America Crashed: A Narrative Account of the Great Stock Market Crash of October 24, 1929. New York: G.P. Putnam. ISBN 0399116133. Thomas, Gordon and Morgan-Witts, Max (1979). The Day the Bubble Burst: A Social History of the Wall Street Crash of 1929.

Did Babson predict the stock market crash in 1929?

^ " Babson Predicts Crash in Stocks Sooner or Later ". The Owensboro Messenger (Owensboro, Kentucky). September 8, 1929. p. 2. "I repeat what I said at this time last year, and the year before, that sooner or later a crash is coming which will take the leading stocks and cause a decline of from sixty to eighty points in the Dow-Jones Borometer.

Who predicted Wall Street crash?

The falling commodity and industrial production may have dented even American self-confidence, and the stock market peaked on September 3 at 381.17 just after Labor Day, then started to falter after Roger Babson issued his prescient "market crash" forecast.

Did people know the stock market would crash in 1929?

In 1929, popular prognosticators like the Yale economist Irving Fisher swore that if a correction came, it would look like a harmless slump, while others predicted a jagged cliff. But nobody, absolutely nobody, could have foreseen the stock-market slaughter that happened in late October.

Did Irving Fisher predict the stock market crash?

He famously predicted, nine days before the crash, that stock prices had "reached what looks like a permanently high plateau." Irving Fisher stated on October 21 that the market was "only shaking out of the lunatic fringe" and went on to explain why he felt the prices still had not caught up with their real value and ...

Who was blamed for the stock market crash and for causing the Great Depression?

As the Depression worsened in the 1930s, many blamed President Herbert Hoover...

Who started the stock market crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.

Who made money during the Great Depression?

Not everyone, however, lost money during the worst economic downturn in American history. Business titans such as William Boeing and Walter Chrysler actually grew their fortunes during the Great Depression.

What is Fisher's theory?

The Fisher Effect is an economic theory created by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. The Fisher Effect states that the real interest rate equals the nominal interest rate minus the expected inflation rate.

What did Irving Fisher do?

Irving Fisher, (born February 27, 1867, Saugerties, New York, U.S.—died April 29, 1947, New Haven, Connecticut), American economist best known for his work in the field of capital theory. He also contributed to the development of modern monetary theory. Fisher was educated at Yale University (B.A., 1888; Ph.

What is Irving Fisher theory of money?

Fisher's Quantity Theory of Money The value of money or price level is also determined by the demand and the supply of money. Supply of money consists of a quantity of money in existence (M). It is multiplied by the number of times this money changes hands which is the velocity of money (V).

What president is blamed for the Great Depression?

By the summer of 1932, the Great Depression had begun to show signs of improvement, but many people in the United States still blamed President Hoover.

What did Herbert Hoover do?

He was influential in the development of air travel and radio. He led the federal response to the Great Mississippi Flood of 1927. Hoover won the Republican nomination in the 1928 presidential election, and defeated Democratic candidate Al Smith in a landslide.

What caused the stock market crash of 1929 for dummies?

By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What percent of Americans were investing in the stock market prior to the crash?

The crash affected many more than the relatively few Americans who invested in the stock market. While only 10 percent of households had investments, over 90 percent of all banks had invested in the stock market. Many banks failed due to their dwindling cash reserves.

What led to the stock market crash of 1929?

By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

Does the article say that the Wall Street crash caused the depression explain your answer?

The Wall Street Crash wasn't the cause of the Great Depression, but it did mark the beginning of it. It was the equivalent of a heart attack being suffered by someone with high blood pressure. The economy had a pre-existing condition, an underlying weakness.

What led to the stock market crash of 1929 for kids?

Major Causes of the Crash Wild speculation - The market had grown too fast and stocks were overvalued. The stocks were worth much more than the real value of the companies they represented. The economy - The economy had slowed down considerably and the stock market didn't reflect it.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

How did the stock market crash of 1929 affect the world?

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the extent of the crisis that ensued, it soon became clear that the world's economies were more interconnected than ever. The effects of the disruption to the global system of financing, trade, and production and the subsequent meltdown of the American economy were soon felt throughout Europe.

How many points did the Dow Jones Industrial Average recover from the 1929 crash?

The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day. The trading floor of the New York Stock Exchange Building in 1930, six months after the crash of 1929.

What was the prediction of the Great Bull Market?

The optimism and the financial gains of the great bull market were shaken after a well-publicized early September prediction from financial expert Roger Babson that "a crash is coming, and it may be terrific". The initial September decline was thus called the "Babson Break" in the press.

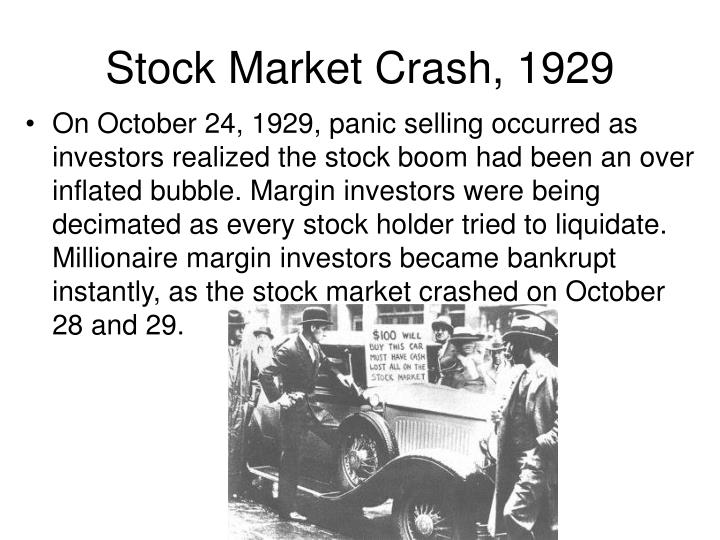

What was the biggest stock crash in 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

Why did wheat prices fall in August?

In August, the wheat price fell when France and Italy were bragging about a magnificent harvest, and the situation in Australia improved. That sent a shiver through Wall Street and stock prices quickly dropped, but word of cheap stocks brought a fresh rush of "stags", amateur speculators, and investors.

What happened to the stock market in 1929?

On September 20, 1929, the London Stock Exchange crashed when top British investor Clarence Hatry and many of his associates were jailed for fraud and forgery. The London crash greatly weakened the optimism of American investment in markets overseas: in the days leading up to the crash, the market was severely unstable.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the Great Depression?

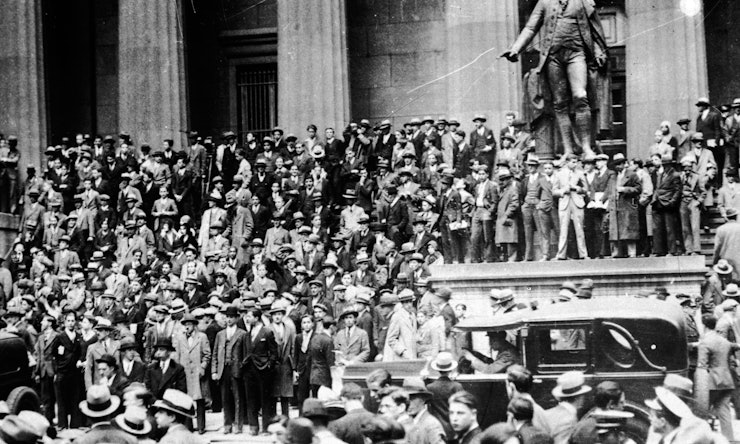

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What happened to the stock market in 1929?

Opinions expressed by Forbes Contributors are their own. In September 1929, Roger Babson, a so-called statistician, warned investors that the stock market was about to collapse so they should pay off their debts, according to the New York Times. On October 29, 1929 stocks plunged 12% and by 1932 they had lost 89% of their value, ...

How much did stocks lose in 1929?

On October 29, 1929 stocks plunged 12% and by 1932 they had lost 89% of their value, according to ZeroHedge. Along the way, “thousands of banks and lending institutions went belly-up. 13 million jobs disappeared,” it noted.

Who assured Americans that the market was sound?

Even President Herbert Hoover assured Americans that the market was sound,” noted Zero Hedge. According to John Kenneth Galbraith’s book, The Great Crash, Barron’s wrote a mocking editorial about Babson on September 9 noting his past “notorious inaccuracies.”. Irving Fisher was then the right wing version of today’s Paul Krugman.

Why was Babson reviled?

Babson was reviled at the time for his prediction and after the Great Depression was blamed for causing it, according to Zero Hedge. Indeed, the Times was quick to add a story which quoted Irving Fisher, a then highly-respected Yale professor, who said that there would not be a crash.

Why did the stock market crash in 1929?

Richardson says that Americans displayed a uniquely bad tendency for creating boom/bust markets long before the stock market crash of 1929. It stemmed from a commercial banking system in which money tended to pool in a handful of economic centers like New York City and Chicago. When a market got hot, whether it was railroad bonds or equity stocks, these banks would loan money to brokers so that investors could buy shares at steep margins. Investors would put down 10 percent of the share price and borrow the rest, using the stock or bond itself as collateral.

What was the message of the stock market in 1929?

Back in 1929, the message was “Stop loaning money to investors, ” says Richardson. “This is creating a problem.”. Recommended for you.

Why did the Federal Reserve start?

One of the reasons Congress created the Federal Reserve in 1914 was to stem this kind of credit-fueled market speculation. Starting in 1928, the Fed launched a very public campaign to slow down runaway stock prices by cutting off easy credit to investors, Richardson says.

What was the first warning sign of a looming market correction?

He says that the first warning sign of a looming market correction was a general consensus that the blistering pace at which stock prices were rising in the late 1920s was unsustainable. “People could see in 1928 and 1929 that if stock prices kept going up at the current rate, in a few decades they’d be astronomic,” says Richardson.

When did Babson say that stock prices were going to be high?

That was on October 15, 1929, less than two weeks before Black Monday.

What was the rallying of the economy in 1929?

economy was riding high on the decade-long winning spree called the Roaring Twenties, but the Fed was raising interest rates to slow a booming market and an increasingly vocal minority of economists and bankers were beginning to wonder how long the party could possibly last.

When did the stock market throw signals back?

Hindsight is 20/20, but the stock market threw signals back in the summer of 1929 that trouble lay ahead. In the spring and summer of 1929, the U.S. economy was riding high on the decade-long winning spree called the Roaring Twenties, but the Fed was raising interest rates to slow a booming market and an increasingly vocal minority ...

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

Who published a monetary history of the United States in 1963?

Consensus coalesced around the time of the publication of Milton Friedman and Anna Schwartz’ s A Monetary History of the United States in 1963.

When did the Dow Jones Industrial Average increase?

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

When did Wall Street collapse?

Front pages of American newspapers dedicated to the collapse of Wall Street in October 1929. DEA Picture Library/Getty Images. Contrary to popular lore, there was no epidemic of suicides—let alone window-jumpings—in the wake of the Stock Market Crash of 1929.

When was the surveyor walking back and forth in New York City?

Down below, however, October 24, 1929 , was no ordinary day.

Who shot himself on Black Tuesday?

When the market took an even further dive on Black Tuesday, John Schwitzgebel shot himself to death inside a Kansas City club. The stock pages of the newspaper were found covering his body. In the weeks to come, Scranton, Pennsylvania civil engineer Carl Motiska doused himself with gasoline and lit himself on fire.

What is a Stock Market Crash?

A stock market crash is a correction or realignment of the value of stocks. A correction means that the stocks that form the basis of a stock index are deemed to be over-valued, and a sell-off begins. Stock market crashes can be extremely volatile and fall quickly due to psychological fear in the market.

Why Do Stock Markets Crash?

A stock market crashes because stock market investors lose confidence in the value of the equities they own. If you believe that the future earnings potential of stocks you own will be diminished, you will seek to sell the stock before it decreases in price; when many investors start selling simultaneously, this causes a crash.

Why Do Stock Markets Go Up?

If you observe any long-term chart of any major stock index, you will see that it increases in value. There has never been a 20 year period in history when the stock market has not increased in value.

When Did The Stock Market Crash?

There have been six major stock market crashes since 1929. In 1929 the DJIA lost 89% in 3 years, in 1973, the market lost 46% in 2 years, and in 1987 stocks dropped 35% in 4 weeks. More recently, in 2000, the Nasdaq crashed by 83%, and in 2008 the DJIA lost 54% in 16 months.

How Long Until Stock Markets Recover From A Crash?

If we analyze the six major US stock market crashes of the last 100 years, we see that the average peak loss was 57%. Also, the average duration of the recovery is 9.8 years. This can be somewhat misleading, though. The 1929 crash was exceptional in its size and duration.

The Stock Market Crash of 1929

A breakdown in investor confidence caused the 1929 stock market crash. The Dow had risen by over 503% in the previous nine years, led by the general public’s unrestricted access to credit, which they used to buy stocks on margin.

The Stock Market Crash of 1973 (Oil Shock)

In October 1973, OPEC (Organization of Arab Petroleum Exporting Countries) declared an oil embargo on countries supporting Israel during the Arab-Israel Yom Kippur war. This was an attempt to exert political influence on Western nations, who were highly dependent on middle eastern oil. This led to a global economic shock wave.

Overview

Analysis

The crash followed a speculative boom that had taken hold in the late 1920s. During the latter half of the 1920s, steel production, building construction, retail turnover, automobiles registered, and even railway receipts advanced from record to record. The combined net profits of 536 manufacturing and trading companies showed an increase, in the first six months of 1929, of 36.6% over …

Background

The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector.

Crash

Selling intensified in mid-October. On October 24, "Black Thursday", the market lost 11% of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the ticker tape in brokerage offices around the nation was hours late, and so investors had no idea what most stocks were trading for. Several leading Wall Street bankers met to find a solution to the pani…

Aftermath

In 1932, the Pecora Commission was established by the U.S. Senate to study the causes of the crash. The following year, the U.S. Congress passed the Glass–Steagall Act mandating a separation between commercial banks, which take deposits and extend loans, and investment banks, which underwrite, issue, and distribute stocks, bonds, and other securities.

After, stock markets around the world instituted measures to suspend trading in the event of rap…

Effects

Together, the 1929 stock market crash and the Great Depression formed the largest financial crisis of the 20th century. The panic of October 1929 has come to serve as a symbol of the economic contraction that gripped the world during the next decade. The falls in share prices on October 24 and 29, 1929 were practically instantaneous in all financial markets, except Japan.

Academic debate

There is a constant debate among economists and historians as to what role the crash played in subsequent economic, social, and political events. The Economist argued in a 1998 article that the Depression did not start with the stock market crash, nor was it clear at the time of the crash that a depression was starting. They asked, "Can a very serious Stock Exchange collapse produce a serious setback to industry when industrial production is for the most part in a healthy and balan…

See also

• Causes of the Great Depression

• Criticism of the Federal Reserve

• Great Contraction

• List of largest daily changes in the Dow Jones Industrial Average