Who makes money in the stock market?

- One option is to listen to the big financial gurus on TV or in the news telling you to buy this or that stock. ...

- Another option is you copy what your friend has done. See the stocks they picked, and hopefully, you don’t get burned by a bad stock pick.

- Look around your house and find products that you use and believe will continue to do better. ...

Who wins in the stock market?

Winners are determined on the percentage return above or below S&P 500 growth. The team comprised of Madison Guth, Gracie Spearman, ReAnna Edwards, Abigail Dunn, Hunter Walton, and James Vick outperformed the S&P by 22.8 percent.

What percentage of Americans own stocks?

- Of the top 10% of income earners, 92.3% own stock (vs 94.7% in 2016).

- Of the 80-89.9% percentile of income, 86.3% own stock (vs 83.3% in 2016).

- Of the 60-79.9% percentile of income, 71.0% own stock (vs 73.6% in 2016).

- Of the 40-59.9% percentile of income, 55.8% own stock (vs 51.8% in 2016).

Who owns 'St. Roch Market'?

- St. Roch pewter medal

- 24" stainless steel chain

- Patron saint of plaques, the sick, dogs and surgeons

- Seek his intercession for your health and wellness

Who overlooks the stock market?

In the United States, financial markets get general regulatory oversight from two government bodies: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Is the stock market owned by the government?

The federal government regulates much of the stock market's activity to protect investors and ensure the fair exchange of corporate ownership on the open markets.

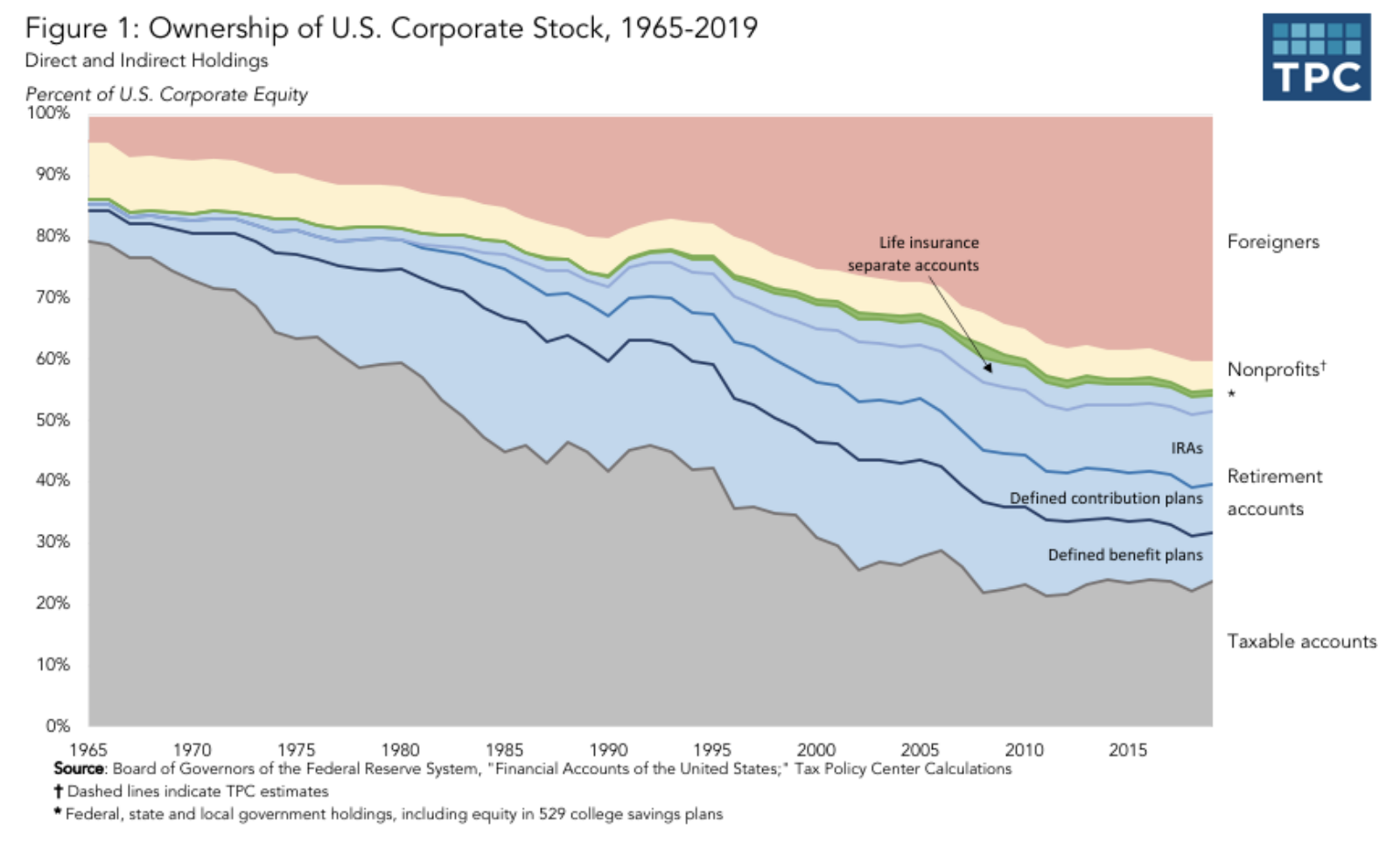

How much of the stock market is owned by institutional investors?

Institutional investors own about 80% of equity market capitalization. 12 As the size and importance of institutions continue to grow, so do their relative holdings and influence on the financial markets.

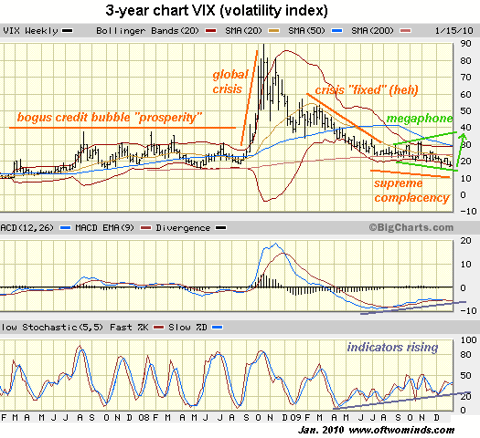

What drives the stock market today?

Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up.

Who owns the most stock in the world?

The natural stock pick held by the world's wealthiest person is Microsoft (NASDAQ:MSFT), the giant tech company Bill Gates co-founded with Paul Allen in 1975. Gates still owns almost 103 million shares of the company worth $15.4 billion.

Who owns the most stock in the US?

One of either Blackrock, Vanguard, or State Street is the largest shareholder in 88% of S&P 500 companies. They are the three largest owners of most DOW 30 companies. Overall, institutional investors (which may offer both active and passive funds) own 80% of all stock in the S&P 500.

How much of the stock market is owned by pension funds?

Public pension funds had a median 61% of their assets in stocks as of Dec. 31, up from 54% 10 years ago, according to Wilshire Trust Universe Comparison Service.

Who owns the most S&P 500?

The Big Five, also known as GAFAM, dominated the S&P 500 Index as of April 22, 2022. After a brief period where Microsoft overtook Apple to become the largest company, Apple retook the lead with a market capitalization of over 2.7 trillion U.S. dollars....CharacteristicMarket cap in billion U.S. dollars--12 more rows•Apr 22, 2022

Is stock market only for the rich?

2. The Stock Market Is an Exclusive Club for Brokers and Rich People. Many market advisors claim to be able to call the markets' every turn. However, almost every study done on this topic has proven that these claims are false.

What happens if no one sells a stock?

When there are no buyers, you can't sell your shares—you'll be stuck with them until there is some buying interest from other investors. A buyer could pop in a few seconds, or it could take minutes, days, or even weeks in the case of very thinly traded stocks.

What are the 4 major market forces?

These factors are government, international transactions, speculation and expectation, and supply and demand.

Why do stock prices change every second?

Stock prices change every second according to market activity. Buyers and sellers cause prices to change and therefore prices change as a result of supply and demand. And these fluctuations, supply, and demand decide between its buyers and sellers how much each share is worth.

Our Data Sources

A great source of this information is the Federal Reserve’s Survey of Consumer Finances (SCF). The most recent SCF dataset was released for 2019. We use this data when we looked at how millionaires made their money – it contains a lot of juicy information you can’t find (reliably) anywhere else.

Where Do People Put Their Money?

If so few people own stock, and those that do own stock mostly hold it in retirement accounts, where do people keep their money?

Conclusions

Building wealth is difficult but it’s made harder given the financial scenario many young people are in. The SCF also discusses other areas of American’s financial lives and one such area is debt and debt burden. Overall debt obligations decreased from 2013 to 2016 with one exception – education debt (yes, student loans). That remains high.

What age group has the highest stock ownership?

Families with a head of household aged 45 to 54 had the highest rate of stock ownership in 2019, with 58% of families in the stock market in some form. That said, the difference in ownership rates between age groups is not large.

What is the lowest stock ownership rate in 2019?

People 75 or older had the lowest ownership rate in 2019, at 47%, followed by those under 35, at 48%. The value of stock owned, however, is much higher for older Americans, who have had more time to accumulate their investments.

Do wealthy people have more money in stock?

Wealthier Americans also tend to have more money in stock. Families in the top 10% of income earners accounted for 70% of the dollar value of all stock holdings in 2019, with a median of $432,000 worth of stock per invested household. Meanwhile, the bottom 60% of income earners owned only 7% of all stock that year.

Can you buy stock on your own?

People who buy stock on their own become direct owners. But people can invest in other ways, including actively managed mutual funds or passive versions like index funds, as well as through retirement plans that put their money in the stock market. Those avenues result in indirect ownership.

Do people with higher incomes own stock?

Investing requires money, so it follows that families with higher incomes and net worth own stock more often and purchase more of it. But there are also differences in how they own the stock, with wealthier families much more likely to have directly purchased stock as part of their portfolio compared to those with lower incomes.