Full Answer

How to recover after loss in the stock market?

Market Watch ... Tata Steel with a stop loss of Rs 1,126 and a target of Rs 1,080. Shares of speciality pharma manufacturer Ajanta Pharma rose as much as 5 percent Friday after falling for three consecutive sessions. The stock action came after the ...

What causes stock market drop?

Why Do Stock Prices Drop?

- Earnings Reports. Public companies release earnings reports four times a year (quarterly). ...

- Negative Corporate News. Negative corporate news ranges from product recalls to violations in accounting practices. ...

- Implicit Value. ...

- Explicit Value. ...

- Supply and Demand. ...

Is money in the stock market lost?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock.

Is the stock market losing momentum?

The stock market may be rising, but the momentum is waning, creating a negative divergence that implies a correction lies ahead, Louise Yamada Technical Research Advisors of New York warned ...

Who gets lost money in the stock market?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock.

Is everyone losing in the stock market?

All isn't lost. It's been a rough start to 2022 from an investing perspective. While stocks happened to rally late last week, many investors are still seeing losses in their portfolios. Now if you haven't sold off investments since the start of the recent downturn, you may only be looking at losses on screen.

Does the average person lose in the stock market?

According to popular estimates, as much as 90% of people lose their money in stock markets, and this includes both new and seasoned investors.

Do most people lost money in the stock market?

If you read articles around stock market investment, you would have definitely come across the statement - 90% of the people lose money in the stock market. It is 100% true.

Will the market crash again in 2021?

Nope! They're more concerned about what will happen five, 10 or even 20 years from now. And that helps them stay cool when everyone else is panicking like it's Y2K all over again. Savvy investors see that over the past 12 months (from May 2021 to May 2022), the S&P 500 is only down about 5%.

Should I invest now or wait 2022?

If you're ready to invest and don't need the money for at least five years, then yes, jump in. Even when the market has lows — and 2022 has been full of them — if you're invested for the long term, you'll have time to recover losses.

Who is the most successful day trader?

6 Best (and Successful) Traders In The WorldJames Simmons.George Soros.Bill Gross.Ken Griffin.Ray Dalio.Steve Cohen.

Why do 99 traders lose money?

Risk Reward Ratio is defined as the the impact of risk one takes for a particular desired profit. In other words, how much money you are willing to lose to get the desired gains. Not knowing the proper risk reward is the reason why most of the traders tend to lose money in stock market as a beginner.

Do you owe money if stock goes down?

Do I owe money if a stock goes down? If a stock drops in price, you won't necessarily owe money. The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money.

Should I pull my money out of stock market?

In the case of cash, taking your money out of the stock market requires that you compare the growth of your cash portfolio, which will be negative over the long term as inflation erodes your purchasing power, against the potential gains in the stock market. Historically, the stock market has been the better bet.

How do you make money when the market is falling?

Bear market investing: how to make money when prices fallShort-selling.Dealing short ETFs.Trading safe-haven assets.Trading currencies.Going long on defensive stocks.Choosing high-yielding dividend shares.Trading options.Buying at the bottom.

Do people lose on Bitcoin?

There are three main ways to lose all you money with bitcoin: The value plummets and you sell: crypto is volatile with its price determined by sentiment. Though technically you only lose money if you sell an investment for less than you bought it for. This is known as “crystallising your losses”.

Stock Market Loss Stories – People Who Lost Their Money In the Stock Market!

Jesse Lauriston Livermore definitely is one of the most fascinating traders of all times. He made and lost millions of dollars several times during his trading career. The stories about his trading losses were as spectacular as the stories about the fortunes he made in the market. And with a lot of personal problems, he ended up committing suicide.

Common Mistakes that Lead to Losses In the Stock Market

Retail investors, especially the ones who are new to the market, tend to make some avoidable mistakes that could make irreparable damage to their trading account.

Why You Need to Think Long Term

Thinking long term is key if you want to be successful in the markets. The reasons why that is, are many. Let’s have a look at some of them!

How to Recover From Your Losses and Become a Winner

There is no doubt that losing a large portion of your investment capital can have an effect on your trading confidence. But almost all successful investors have had to deal with losses at some point in their investing journey. The following tips can help you rise above your losses and become the winner you desire to be.

Conclusion

The stock market is a great place to invest and build wealth over a long period. There are countless stories of people who have made good fortunes from the market, but a great majority of traders and investors lose money. If you don’t play your game well, you can lose everything and even more.

Why is it called a capital loss?

This kind of loss is referred to as a capital loss because the price at which you sold a capital asset was less than the cost of purchasing it.

What happens when you watch a stock fall back?

This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock. You might feel that the money you could have made is lost money—money you would have had if you had just sold at the top.

What happens when a stock goes nowhere?

You've experienced an opportunity loss when a stock goes nowhere or doesn’t even match the lower-risk return of a bond. You've given up the chance to have made more money by putting your money in a different investment. It's basically a trade-off that caused you to lose out on the other opportunity.

What to say if you don't sell stock?

You can tell yourself, “If I don’t sell, I haven’t lost anything, ” or "Your loss is only a paper loss.". While it's only a loss on paper and not in your pocket (yet), the reality is that you should decide what to do about it if your investment in a stock has taken a major hit.

Why are my losses not as apparent?

In other cases, your losses aren’t as apparent because they’re more subtle and they take place over a longer period of time. Losses in the stock market come in different forms, and each of these types of losses can be painful, but you can mitigate the sting with the right mindset and a willingness to learn from the situation.

What is it called when you tie up $10,000 of your money for a year?

This is known as an opportunity loss or opportunity cost.

Can you use a capital loss to offset a capital gain?

You can use a capital loss to offset a capital gain (a profit from selling a capital asset) for tax purposes. A capital loss or gain is characterized as short-term if you owned the asset for one year or less. The loss is considered to be long-term if you owned the asset for more than one year. 1.

Why do people lose money in the stock market?

People lose money in the stock market because they think and assume investing is their ticket to getting rich quick. If you’ve done research online about investing, you certainly have come across the wealthy day traders or penny stock traders.

What happens when things turn red?

But as soon as things turn red, you can wipe out all returns and potentially more. It’s why people mix in funds like stocks, bonds, REITs, cash, real estate, commodities, gold, silver, etc. Ultimately what you choose to invest in is based on your goals and horizon, but always diversify .

Why is diversification important in investing?

By creating an investment portfolio with diversification, you help weather against stock market corrections, rough economies, or a bear market. The goal with a diversified portfolio is to include various industries and categories that react differently from each other. This way it helps reduce risk, especially long-term.

Is day trading a long term investment?

To me, that really refers to people day trading without real knowledge, not long-term investing for the future. Regardless of how accurate that is or not, many people do make costly mistakes when it comes to investing in the stock market. Many of the reasons may be obvious, but are also easy to overlook or forget, ...

Can you use robo investing?

Another way for people who don’t have the time or care to manually invest, can use Robo-investing that does more of the work for you. At a high level, the process of robo-investing is to ensure you have the most hands-off approach to your money, but are maximizing results.

Can you lose sight of the big picture?

It’s easy to lose sight of the big investing picture and make mistakes. But like most areas in personal finance, you can overcome and correct your ways. Start to identify with the above reasons, stick to your money gameplan, and protect yourself during rough stock market years. As you get older your investments and strategy will change, ...

What is the term for the market where money disappears?

Before we get to how money disappears, it is important to understand that regardless of whether the market is rising–called a bull market –or falling–called a bear market – supply and demand drive the price of stocks. And it's the fluctuations in stock prices that determines whether you make money or lose it.

What happens if you buy a stock for $10 and sell it for $5?

If you purchase a stock for $10 and sell it for only $5, you will lose $5 per share. It may feel like that money must go to someone else, but that isn't exactly true. It doesn't go to the person who buys the stock from you.

What happens when a stock tumbles?

When a stock tumbles and an investor loses money, the money doesn't get redistributed to someone else. Essentially, it has disappeared into thin air, reflecting dwindling investor interest and a decline in investor perception of the stock. That's because stock prices are determined by supply and demand and investor perception of value and viability.

What is implicit value in stocks?

Depending on investors' perceptions and expectations for the stock, implicit value is based on revenues and earnings forecasts. If the implicit value undergoes a change—which, really, is generated by abstract things like faith and emotion—the stock price follows.

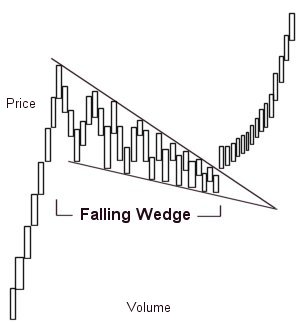

What is short selling?

Short Selling. There are investors who place trades with a broker to sell a stock at a perceived high price with the expectation that it'll decline. These are called short-selling trades. If the stock price falls, the short seller profits by buying the stock at the lower price–closing out the trade.

What happens when investors perceive a stock?

When investor perception of a stock diminishes, so does the demand for the stock, and, in turn, the price. So faith and expectations can translate into cold hard cash, but only because of something very real: the capacity of a company to create something, whether it is a product people can use or a service people need.

What does it mean when a company is in a bull market?

In a bull market, there is an overall positive perception of the market's ability to keep producing and creating.

How to recover from losing money in the stock market?

The best way to recover after losing money in the stock market is to invest again, but better. Instead of investing everything at once, wade in gradually by investing a set dollar amount or percentage of your savings each month or quarter. (Getty Images)

How long does it take to recover from a stock market loss?

Most of the 3,000 respondents didn't recover from their setback until three to five years later. "This isn't surprising given that on average, based on 90 years of history, it takes up to 70 weeks for markets ...

What happens when you sell an investment at a loss?

As a result, they end up losing money on every cycle of trades.

Do you own the same number of shares of each investment when the market declines?

You still own the same number of shares of each investment when the market declines; if and when those shares move higher, you'll be able to participate in the recovery.". Unless your falling investment is a legitimately bad apple. In this case, it may be best to throw it out before it sours the whole bushel.

Capital Losses

Opportunity Losses

- Another type of loss is somewhat less painful and harder to quantify, but still very real. You might have bought $10,000 of a hot growth stock, and the stock is very close to what you paid for it one year later, after some ups and downs. You might be tempted to tell yourself, "Well, at least I didn’t lose anything." But that's not true. You tied up $10,000 of your money for a year and you receive…

Missed Profit Losses

- This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock. You might feel that the money you could have made is lost money—money you would have had if you had just sold at the top. Man…

Paper Losses

- You can tell yourself, “If I don’t sell, I haven’t lost anything,” or "Your loss is only a paper loss." While it's only a loss on paper and not in your pocket (yet), the reality is that you should decide what to do about it if your investment in a stock has taken a major hit. It might be a fine time to add to your holdings if you believe that the company’s long-term prospects are still good and yo…

How to Deal with Your Losses

- No one wants to suffer a loss of any kind, but the best course of action is often to cut your losses and move on to the next trade. Turn it into a learning experience that can help you going forward: 1. Analyze your choices. Review the decisions you made with new eyes after some time has passed. What would you have done differently in hindsight, and why? Would you have lost less o…