What kinds of things affect the stock market?

Things Affecting the Stock Market

- Economy. The conditions in a regional economy have the potential to affect the stock market. ...

- Expectations. Corporate profits are among the factors that affect stock market performance. ...

- Confidence. The level of investors' confidence has an effect on the level of participation in the stock market, according to a Santa Clara University study.

- Social Media. ...

What factors influence the stock market?

Macroeconomic Impact on the Market

- Gross Domestic Product. GDP or Gross Domestic Product is a critical economic indicator that is considered a barometer of a country’s economy and a statement on its well being.

- Inflation. ...

- Industrial production and sales. ...

- Unemployment rate. ...

What is the most basic factor that affects stock price?

While many forces affect the market price of any stock, the most basic is supply and demand, according to the New York Stock Exchange. If more investors want to buy a particular stock than there are investors willing to sell their stock, the market price of that stock will increase.

How does the news affect the stock market?

As the world watches to see whether Russia invades Ukraine, the question arises –how would this affect the stock market? Pete Holloway, senior vice president at Hazlett Burt and Watson summed it up in two words: Remain calm. Holloway said the market goes ...

Does the stock market affect everybody?

For all the obsession over the ups and downs of the stock market, for the majority of Americans, the stock market has absolutely no impact on their life.

Does the stock market influence the economy?

The increase and decrease in stock prices can influence numerous factors in the economy such as consumer and business confidence which can, in turn, have a positive or negative impact on the economy as a whole. Alternatively, different economic conditions can affect the stock market as well.

What role does the stock market play?

It allows companies to raise money by offering stock shares and corporate bonds. It lets common investors participate in the financial achievements of the companies, make profits through capital gains, and earn money through dividends—although losses are also possible.

Who watches over the stock market?

The stock market is overseen by both the U.S. Securities and Exchange Commission and its own self-regulatory organizations.

How does falling stock price affect a company?

When a company's stock price falls, the likelihood of a takeover increases, mainly due to the fact that the company's market value is cheaper. Shares in publicly traded companies are typically owned by wide swaths of investors.

How does the stock market benefit society?

The prices determined by trading in the stock market serve as signals that help allocate society's scarce savings to the most promising new investment projects and help discipline managers to make the best use of the productive capacity already under their control.

What would happen if there was no stock market?

Without markets for stocks and bonds, business owners would have fewer options to bring their ideas to life or to expand their businesses; they would have to save up enough cash to re-invest. With healthy capital markets, business owners can obtain the needed financial capital to build successful companies.

What would happen if stock market crashes?

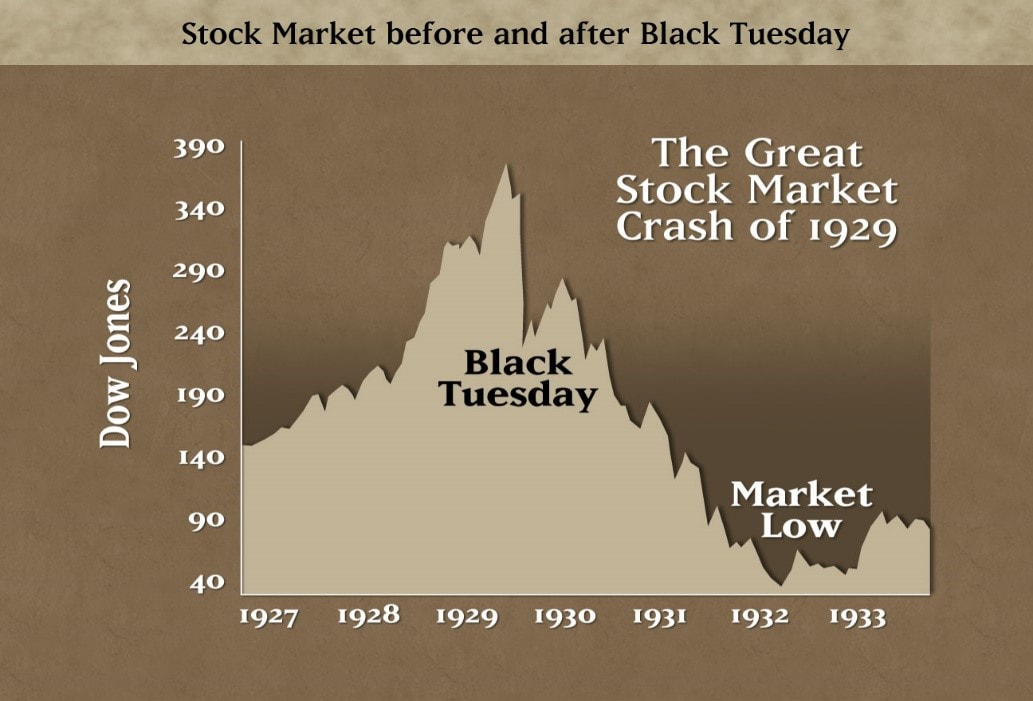

Stock market crashes wipe out equity-investment values and are most harmful to those who rely on investment returns for retirement. Although the collapse of equity prices can occur over a day or a year, crashes are often followed by a recession or depression.

Who owns the stock market?

Intercontinental ExchangeNew York Stock ExchangeOwnerIntercontinental ExchangeKey peopleSharon Bowen (Chair) Lynn Martin (President)CurrencyUnited States dollarNo. of listings2,400Market capUS$26.2 trillion (2021)8 more rows

Who controls the stock price?

Generally speaking, the prices in the stock market are driven by supply and demand. This makes the stock market similar to other economic markets. When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price.

How does the stock market make you money?

Collecting dividends—Many stocks pay dividends, a distribution of the company's profits per share. Typically issued each quarter, they're an extra reward for shareholders, usually paid in cash but sometimes in additional shares of stock.

Who started stock market?

The Dutch East India Company (founded in 1602) was the first joint-stock company to get a fixed capital stock and as a result, continuous trade in company stock occurred on the Amsterdam Exchange. Soon thereafter, a lively trade in various derivatives, among which options and repos, emerged on the Amsterdam market.

What happens if pensions fall too much?

This means that future pension payouts will be lower. If share prices fall too much, pension funds can struggle to meet their promises. The important thing is the long-term movements in the share prices. If share prices fall for a long time, then it will definitely affect pension funds and future payouts.

Why are shares falling in 2020?

The fall in share prices since the start of the year primarily reflect concern and uncertainty over the global spread of Coronavirus. Share prices have fallen 15% and could fall further. There are good reasons to believe these share price falls do reflect a real economic shock and could be the precursor to a recession in 2020. The share price falls reflect – not market adjustment – but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment.

What would happen if the stock market fell?

A substantial and prolonged fall in the stock market could lead to a fall in the value of their pension fund, and it could lead to lower pension payouts when they retire. Similarly, if the stock market does well, the value of pension funds could increase.

What does the fall in share price reflect?

The share price falls reflect – not market adjustment – but an awareness of disruption of supply chains, a disruption to the free movement of people and goods, and a shock to aggregate demand as consumers and business cut back on consumption and investment.

What is CC-SA-BY 3.0?

CC-SA-BY 3.0. For example, the stock market crash of 1987, didn’t cause any economic damage in the real economy. (though it did influence monetary policy). The UK cut interest rates in fear the stock market crash would cause a recession. Instead, low-interest rates caused an economic boom with rapid rates of economic growth.

How does wealth affect people?

Wealth effect. The first impact is that people with shares will see a fall in their wealth. If the fall is significant, it will affect their financial outlook. If they are losing money on shares they will be more hesitant to spend money; this can contribute to a fall in consumer spending.

Can pension funds be affected by stock market?

Anybody with a private pension or investment trust will be affected by the stock market, at least indirectly. Pension funds invest a significant part of their funds in the stock market. Therefore, if there is a serious and prolonged fall in share prices, it reduces the value of pension funds.

Why is the stock market important?

The stock market is important for a variety of reasons. It enables traders and investors the opportunity to profit from its moves and generate personal wealth, can provide a benchmark of a country’s commercial and industrial health, and gives businesses an opportunity to scale and prosper, benefiting the wider economy.

Why is company ownership important?

Company Ownership can Enable Impressive Returns. While representing a risk to capital, investing in stocks and major stock indices is a potential way for individual investors – not just venture capitalists – to take an ownership in successful enterprises and accumulate wealth.

How does investing in the stock market help the economy?

Stock Market Investment can Spark Economic Growth. The money that investors put into companies allows enterprises to invest in growth. When a business starts out, it may have to bootstrap, or survive on little capital.

How does the stock market affect the economy?

Three ways the stock market impacts the economy. The stock market and economy relationship can be broadly characterized by investment fueling economic growth, the enabling of company ownership that increases personal wealth, and equities providing a measure of economic health . We’ll explore these three factors below.

How much money did Facebook make in 2012?

In 2012, Facebook’s global revenue was already some $5 billion, with around 5,000 employees on the payroll. However, the company’s IPO that year raised in excess of $16 billion, which helped build the company to a market cap of $630 billion by January 2020, with 2018 figures showing some $55 billion in global revenue and more than 40,000 employees ...

What happens to stock market after a downturn?

A stock market crash can devastate the economy. When a downturn in the business cycle happens, significant amounts of value can be erased from share prices. In turn, this means lower returns and dividends for individual investors, a smaller market capitalization for businesses, less wealth for pension funds, and less funding for companies in ...

Is a sharp downturn in equities a recession?

A sharp downturn in equities does not necessarily mean the onset of recession, just as a long bull run does not necessarily represent continued economic strength. The former may be caused by an isolated fundamental factor for example, while the latter may mean stocks are becoming overvalued due to excess speculation.

How does low oil prices affect gas prices?

As a result, prices per oil barrel drop, and gas prices decline.

Why did the government raise interest rates during the Great Recession?

In a down market, such as during the 2007-08 Great Recession, the government lowered taxes and the cost of borrowing money in hopes of sparking economic activity. Now that the U.S. market has recovered, the government has decided to raise interest rates to entice investors and bring in a higher cash flow.

Is the stock market a good indicator of the economy?

As FiveThirtyEight's Nate Silver has written, the stock market is a good indicator of the nation's economic mood, even if millions of Americans do not own stock.

Why do people invest in the stock market?

The rule of thumb is that stock prices increase 7% a year on average after taking inflation into account. 1 That's enough to compensate most investors for the additional risk of owning stocks rather than bonds (or keeping the money in a savings account).

Why do stock prices rise?

Stock prices rise in the expansion phase of the business cycle. 2 Since the stock market is a vote of confidence, a crash can devastate economic growth. Lower stock prices mean less wealth for businesses, pension funds, and individual investors. Companies can't get as much funding for operations and expansion.

How much do stocks increase in a year?

The rule of thumb is that stock prices increase 7% a year on average after taking inflation into account. 1 That's enough to compensate most investors for the additional risk of owning stocks rather than bonds (or keeping the money in a savings account).

What makes the stock market attractive?

What Makes the U.S. Stock Market Attractive. U.S. financial markets are very sophisticated and make it easier to take a company public than in other countries. Information on companies is also easy to obtain. That raises the trust of investors from around the world.

What happens if you don't invest in the stock market?

Even if you don't invest, the stock market's health affects you. Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

What is the drawback of IPO?

The drawback is that the founders no longer own the company; the stockholders do. Founders can retain a controlling interest in the company if they own 51% of the shares. Stocks indicate how valuable investors think a company is.

How does a stock market crash affect GDP?

A stock market crash will adversely affect the nation’s gross domestic product as personal consumption and business investment are some of the major components of GDP. If stock prices stay depressed long enough, new businesses can't get funds to grow.