Between the two of them, Visa has a cheaper share price that provides higher dividend yields. Its only downside is smaller growth potential in the event Mastercard manages to chip away at its market. Otherwise, Visa seems to be the more economical choice.

Full Answer

Is MasterCard a better buy than visa?

Mastercard’s net margin for the last 3 years averaged 39% vs 46% for Visa. So far, Visa looks better given that you’ll pay less money for better margins. But that’s not all.

Which is more popular visa or MasterCard?

The 22 countries where Mastercard is the most popular credit card company

- Australia

- Brazil

- Canada

- Chile

- Côte d’Ivoire

- Czech Republic

- Denmark

- Estonia

- Finland

- Greenland

Is visa bigger than MasterCard?

While Visa is larger in terms of transactions, purchase volume, and cards in circulation, Visa and Mastercard have nearly identical global merchant acceptance footprints. Mastercard Overview

What makes Discover Card better than visa or MasterCard?

- May require a higher credit score and annual income.

- Some products are charge cards, so you must pay off your entire balance each month.

- No card with rotating cashback categories.

- No student or secured credit card.

- Not as widely accepted globally as Visa or Mastercard.

See more

:max_bytes(150000):strip_icc()/thinkstockphotos-71051415-5bfc34a046e0fb00511b5fee.jpg)

Whats a better stock Visa or Mastercard?

Summary. Visa has higher revenues, profitability, and valuation than Mastercard, but the latter has a higher revenue per share, higher EPS, and higher YoY revenue per share growth. Both companies are expected to be bullish and offer solid returns in the future.

Is Visa and Mastercard good stock to buy?

Visa is a top Barron's stock pick for 2022. It's now up about 3% on the year, compared with a loss of 8% for the S&P 500 SPX +2.39% . Mastercard isn't far behind with a 2.8% gain on the year. While it's still early to call a winner, Visa may be starting to pull ahead.

Is Mastercard a good stock to buy now?

Mastercard is a great stock to protect investors who are concerned about inflation. COVID-19 could pose challenges to the global economy this year, but the world is better equipped to deal with such obstacles. Mastercard looks set to turn out a great year of both business and stock performance.

Is Visa a good stock to buy 2021?

Bottom line: Visa stock is not a buy, as it is in a months-long consolidation with a 252.77 buy point. Keep an eye on the Dow Jones card giant, as it compares favorably with many top-rated large-cap stocks to buy or watch.

Does Warren Buffett own Visa stock?

Warren Buffett's Berkshire Hathaway has sold a combined $3.1 billion worth of shares in Visa and Mastercard and bought a $1 billion stake in Brazilian digital lender Nubank. In SEC filings, Berkshire Hathaway reveals that is has sold Visa shares worth $1.8 billion and Mastercard shares worth $1.3 billion.

Is Visa a good stock to buy 2022?

Is Visa Stock a good buy in 2022, according to Wall Street analysts? The consensus among 15 Wall Street analysts covering (NYSE: V) stock is to Strong Buy V stock.

Is Mastercard a long term buy?

Over the past 10 years, even with COVID-19 impacting part of 2021, Mastercard has had a 10-year CAGR of 10.9% in revenues and 16.2% in EPS. Longer-term, COVID-19 will likely be little more than a temporary blip for Mastercard, or indeed a positive in accelerating electronic payments.

Will Mastercard stock go up?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Mastercard Inc have a median target of 440.00, with a high estimate of 480.00 and a low estimate of 357.00. The median estimate represents a +22.98% increase from the last price of 357.78.

Is Mastercard A Buy Sell or Hold?

Mastercard has received a consensus rating of Buy. The company's average rating score is 2.81, and is based on 14 buy ratings, 1 hold rating, and 1 sell rating.

Is Visa still a buy?

Stacked up against its potential for high-teens percentage annual earnings growth, this is a reasonable valuation for a stock of Visa's quality. The 0.7% dividend yield is also a bit higher than its 0.6% 13-year median yield, which also supports the idea that Visa is a solid buy right now.

Is Visa a buy sell or hold?

Visa has received a consensus rating of Buy. The company's average rating score is 2.79, and is based on 19 buy ratings, 5 hold ratings, and no sell ratings.

Why should I invest in Visa?

Visa favors buybacks over dividends. It pays a $1.50 annual dividend, which provides a yield of 0.7% at the current stock price. It aims to pay out 20% to 25% of its earnings in dividends, with most of the rest going to repurchases. It lifted its dividend by 17% in late 2021.

What is PayPal's partnership with Visa?

In particular, the partnership will enable consumers and small-medium enterprises to move their money faster through PayPal and Visa Direct Capabilities. Also, the rapid shift to e-commerce also brings significant value to Visa.

How much did MA stock gain in 2020?

It’s worth pointing out that MA stock gained 19% in 2020, a decent performance by any measure. It outperformed the S&P 500, which rose 16%. As the pandemic eases and the economy recovers in 2021, Mastercard could be looking at a strong year ahead.

Is Mastercard a crypto?

This made it the first native crypto platform to issue Mastercard payment cards. Meanwhile, Mastercard also has a broad range of market-leading services, from insights and analytics to cybersecurity tools. This allows the company to support its partners’ evolving needs in a rapidly changing world. In June, Mastercard announced an agreement ...

Does Mastercard have Finicity?

In June, Mastercard announced an agreement to acquire Finicity, a leading provider of real-time access to financial data and insights, to bolster its open banking platform. By incorporating this into Mastercard’s operations, the company expects to further enhance and grow its banking reach and capabilities.

Is Mastercard a global company?

Payment processor Mastercard has a strong presence globally with a coverage of more than 210 countries. The company’s stock was trading higher Thursday after the company posted earnings that beat Wall Street’s estimates in its fourth quarterly earnings.

Is Mastercard cashless?

The company has invested heavily in cashless payments. It has almost doubled its fees on card payments over the past two years. As the COVID-19 pandemic speeds the transition to cashless payment solutions, the company expects to earn higher revenue from the increase in fees. With analysts expecting most Asian and European countries to go cashless by 2030, Mastercard seems to be in the right position. Also, Mastercard has also accelerated its Crypto Card Partner Program and has granted Wirex a principal membership license. This made it the first native crypto platform to issue Mastercard payment cards.

When did Mastercard go public?

For its part, Mastercard Inc. has been around since 1966, and its initial public offering came in 2006. Mastercard makes its corporate home in, appropriately enough, Purchase, N.Y. What’s really exciting about Mastercard from a shareholder’s standpoint is that it’s been investing in entirely new technologies.

Where is Visa headquartered?

Visa Inc., which went public in 2008, was founded in 1958, and it’s headquartered in Foster City, Calif. Visa represents an attractive investment opportunity because it’s actively pursuing growth opportunities right now.

Is a credit card safe?

When you’re out on the town, a credit card is a safe and reliable way to pay for items. Similarly, when you’re looking to invest in stocks, a credit card company has the potential to be a way to grow your wealth. When you hear the term “credit card,” two names might instantly leap to mind: Mastercard ( NYSE: MA) and Visa ( NYSE: V).

Is Visa stock growing?

Yes. No. This reliance on innovation is important, particularly over the long haul. After all, the companies that tend to last the longest and keep growing over time are those that diversify and evolve. It may be a key reason why Visa’s stock growth rate has recently surpassed that of Visa.

Do people use credit cards when shopping online?

What’s more, when people shop online, they use credit cards more than any other method of payment. Plus, this type of commerce is projected to keep growing over the next several years, if not longer, especially since more and more people will start purchasing their groceries via the internet.

Is Visa Europe a separate company?

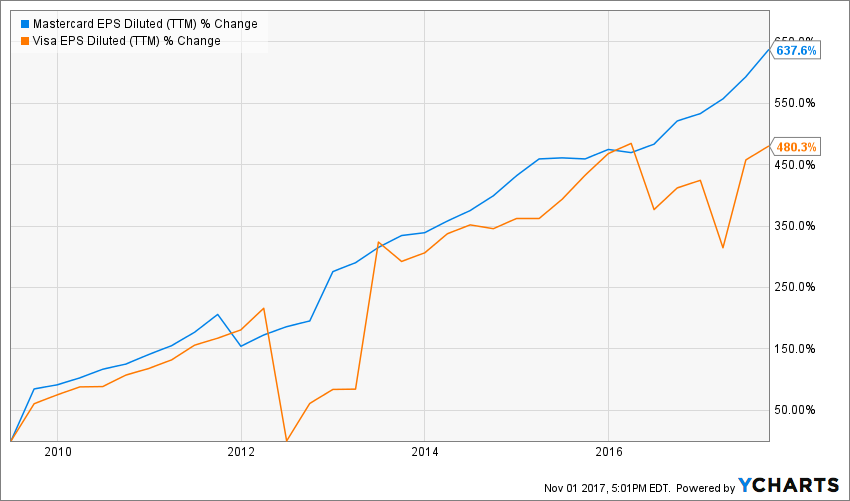

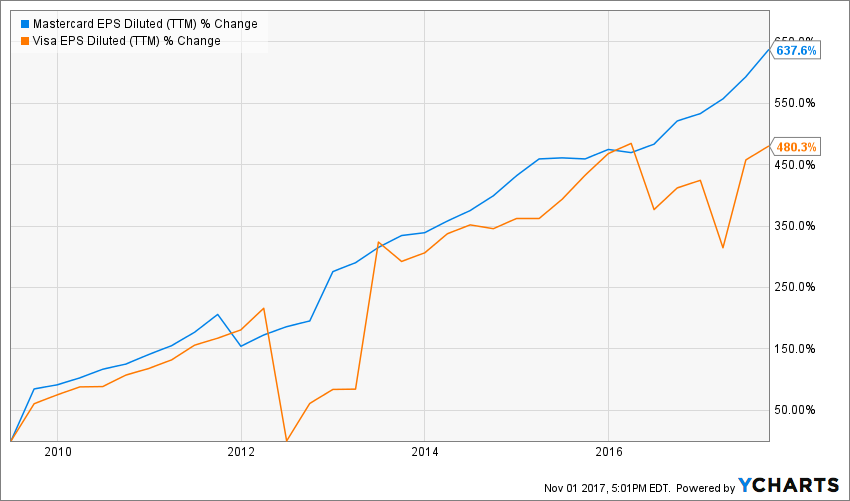

Visa Europe had previously been a separate company that only licensed the Visa name. On the (somewhat) negative side, Mastercard is currently outpacing Visa in terms of growth. From the end of third quarter 2017 to the end of third quarter 2018, Mastercard shares rose 41 percent while Visa’s went up by just 27 percent.

Is MasterCard a market leader?

Mastercard is in second place to Visa, but it’s still a market leader. It’s also not standing by to let Visa take all its shine; it spent $3.19 billion to acquire Nets Holding A/S, a Danish payments company.

Is Mastercard the same as Visa?

Mastercard faces many of the same problems as Visa, which includes growing pressure from competition and regulators. The digital payments space is getting more competitive, and there’s no guarantee a fintech startup won’t find a way to take some of their market share. This risk gets even greater as the economy heads towards recession.

Transparency is our policy. Learn how it impacts everything we do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we make money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we use your personal data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

How we approach editorial content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

What are the differences between Visa and Mastercard?

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

Visa vs. Mastercard Benefits

Within each network, there are some differences in the basic benefits that come with certain types of cards. Visa and Mastercard both have three levels of cards, each with different perks. It's here that you'll find the main differences between Visa and Mastercard, but even so, these differences are relatively small.

Visa Card Options

There are the three main types of Visa cards, each with specific features: 1

Mastercard Options

There are also differences in the benefits offered by the three types of Mastercards: 2

Choosing the Best Card For You

Unless you have a strong preference for the benefits of one of these cards over another, it's better to focus more on the terms and rewards that the card issuer offers. That's where cards usually differ the most.

Where is Mastercard accepted vs Visa?

Mastercard is accepted at more than 70 million merchant locations in over 210 countries. Visa is also accepted at more than 70 million merchant locations in over 200 countries.

How many levels of credit card benefits are there?

There are three levels of Visa credit card benefits: Traditional, Signature and Infinite. Mastercard has three tiers of benefits, too. Some cards offer one level of benefits to all users. Others give better perks to people approved for a certain credit limit – $5,000+, for example. Visa Traditional Benefits.

What is the largest card network in the world?

Feb 25, 2020. Visa and Mastercard are the two largest card networks in the world, accepted in more than 200 countries and territories worldwide. As card networks, Visa and Mastercard control where credit cards and debit cards can be used, as well as what secondary perks they offer – from $0 fraud liability guarantees to rental car insurance.

Does Visa issue Mastercard?

Neither Visa nor Mastercard actually issues credit cards, unlike the two other leading card networks: American Express and Discover. That’s why you should only worry about whether to get a Visa or Mastercard credit card if you’re torn between two offers.

Is Chase a Visa or Mastercard?

Chase can be Visa or Mastercard, depending on which Chase credit card you have. Most Chase credit cards are on the Visa network, though there are also a few Chase cards on the Mastercard network, such as the Chase Freedom Flex.