What is the journal entry for issuing common stock?

To sum up, the journal entry for issuing common stock varies depending on each type of issuance. This includes the common stock issued at par value, at no par value, at the stated value, and finally the common stock issued for noncash assets.

What is an example of a common stock journal?

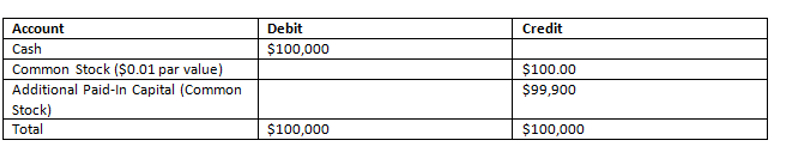

Common Stock Journal Example. In the following example, ABC Advertising sells 10,000 shares of its common stock at $10 per share. The sale is recorded as follows: When the sale has been recorded, both total columns should match. The common stock row shows the total par value of the stock that is sold.

What is the journal entry for reacquired stock?

In this case, the company needs to account for the reacquired stock as the treasury stock with proper journal entry if it does not have the intention to retire the stock. In accounting, the company needs to account for the treasury stock under the cost method.

How do you calculate the capital stock of a company?

For example, if a company has issued 1,000 shares and a shareholder owns 100 shares then they own 100 / 1000 = 10% of the capital stock of the company entitling them to 10% of the retained earnings of the business. Companies can issue different types of capital stock each of which carries different rights mainly relating to dividends, and voting.

What is the journal entry for capital stock?

When an investor pays a company for shares of its stock, the typical journal entry is for the company to debit the cash account for the amount of cash received and to credit the contributed capital account.

Where is capital stock recorded?

shareholders' equityCapital stock is the amount of common and preferred shares that a company is authorized to issue—recorded on the balance sheet under shareholders' equity.

How do you record a capital share?

As stated earlier, the total par value of all issued shares is generally the legal capital of the corporation. Keep in mind your journal entry must always balance (total debits must equal total credits)....Stock issuances.Paid-in capital:Paid-in capital in excess of par value—common20,000Total paid-in capital$ 220,0002 more rows

Is capital stock a debit or credit?

Account TypesAccountTypeDebitCAPITAL STOCKEquityDecreaseCASHAssetIncreaseCASH OVERRevenueDecreaseCASH SHORTExpenseIncrease90 more rows

Is capital stock a liability or asset?

You might think they should be a “capital” asset since the two share the word, but this is not the case. Capital stock as an asset are highly liquid and can be easily converted to cash within one year without losing value, so they're simply current assets.

Is capital stock the same as owner's equity?

Equity represents the total amount of money a business owner or shareholder would receive if they liquidated all their assets and paid off the company's debt. Capital refers only to a company's financial assets that are available to spend.

Why is capital credited in journal entry?

A debit to a capital account means the business doesn't owe so much to its owners (i.e. reduces the business's capital), and a credit to a capital account means the business owes more to its owners (i.e. increases the business's capital).

How do you post capital in accounting?

When you record the journal, you enter the capital introduced as a credit and post the opposite debit entry to the nominal ledger account you want to affect.

Why is capital stock credited?

Since there is an increase in a credit account of the capital stock, the accounting should record a credit to the capital-stock account. Thus, an increase in capital stock is a credit.

Is capital stock considered revenue?

Although capital stock is not shown on the income statement, earnings are indirectly affected, because dividends must be shown as a reduction of earnings. Since dividend payments are not an expense coming directly from the company's operations, though, they are not shown on the income statement.

What is journal entry for stock investment?

The company can make the journal entry for purchase of stock investment by debiting the stock investments account and crediting the cash account. Stock investments account is an asset account on the balance sheet, in which its normal balance is on the debit side.

Why do companies need to make journal entries for stock purchases?

Likewise, the company needs to make the journal entry for the purchase of stock investment when it decides to purchase it as an investment asset. Purchase of stock investment provides two main benefits to the company, in which the first one is that it can earn the dividend revenue from the investment. And another one is that it can enjoy the ...

What is stock investment account?

Stock investments account is an asset account on the balance sheet, in which its normal balance is on the debit side. Likewise, in this journal entry, there is no impact on the total assets of the balance sheet as it results in the increase of one asset (stock investment) and the decrease of another asset (cash).

Is journal entry for stock purchase similar to debt investment?

It is useful to note that even though the journal entry for the purchase of stock investment is similar to the purchase of debt investments, it may be different from one investment to another when it comes to the recognition of revenue and dividend from the stock investments. This will depend on how much ownership the company has in other companies.

What is the journal entry for issuing common stock?

To sum up, the journal entry for issuing common stock varies depending on each type of issuance. This includes the common stock issued at par value, at no par value, at the stated value, and finally the common stock issued for noncash assets.

What is common stock?

Common stock is a type of stock that gives the right to the common stockholders to have an equal right to vote at the meeting and receive the same dividend. Theoretically, common stock can be issued at par value, no par value, at stated value, or for non-cash assets.

What does it mean when a corporation issues common stock at par value?

When a corporation issues common stock at par value, the amount of cash or non-cash assets received equal to the value of the common stock. This means that the outstanding value of common stock and the asset received are at the same value.

Why is par value stock issued at a discount?

When par value stock is issued at a discount, the assets received both cash or noncash assets is lower than the value of the common stock. In practice, the discount on the stock is prohibited in most jurisdictions. This is because the regulators want to protect the creditors of the company who issues the common stock. When issuing at discount, the company is putting its creditors at risk of not being able to repay the debts to creditors. This is because there might not be enough assets to recover the debt owed to creditors in case of default.

What happens when a corporation issues a par value stock?

When a corporation issues par value of the common stock, it can be issued at par, at a premium, or a discount. Each of these cases can be exchanged for either cash or non-cash assets depending on the agreed approach.

What is par value stock?

When par value stock is issued at a premium, the assets received both cash or noncash assets are higher than the value of the common stock. For example, a cash receipt of $12 per share for common stock of $10 par value. The excess of $2 ($12 minus $10) is called a premium or capital contribution in excess of par value.

What is the most common scenario for selling common stock?

Selling common stock for cash is the most common scenario. It is recorded with a credit in the common stock account with the par value listed for each share. Another entry is made in the cash account for the amount of cash received. There is also an entry for additional paid-in capital, which is a credit for the amounts in excess ...

What is common stock?

When a company issues just one type of stock it is called common stock, and it includes the equity shares that the owners of a company receive. Common stockholders in a company usually receive returns on their investment in the form of dividends, they usually receive a portion of the assets at the time of sale, ...

What are the different types of stock transactions?

There are three major types of stock transactions including repurchasing common stock, selling common stock, and exchanging stock for non-cash assets and services. The accounting for each type of transaction is different. The cash sale of stock depends on the par value, or the capital per stock share.

How much is a stock liable for if it is redeemed at its par value?

For instance, if the company’s par value of a stock is at $8 per share, but the price of the stock falls to $4 per share, the shareholders are liable for $4 per share if the stocks are redeemed at their par value.

Does ABC issue common stock?

If ABC Advertising wants to issue common stock for non-cash assets, it can assign a particular value to its common stock shares based on their market value or on the value of the non-cash services or assets that are being received.

Overview

Selling the common stock is one of the funding sources that the company may use to operate or expend the business. Likewise, the company needs to make the sale of common stock journal entry when such transactions occur.

Sale of common stock journal entry

If the company sells the common stock at the price of its par value or stated value, it can make the journal entry by debiting the cash account and crediting the common stock account.

Sale of common stock example

For example, on January 01, the company ABC sells 10,000 shares of its common stock at the price of 10$ per share. The common stock has a par value of $1 per share.

What is capital stock?

Capital stock is the amount of common and preferred shares that a company is authorized to issue—recorded on the balance sheet under shareholders' equity. The amount of capital stock is the maximum amount of shares that a company can ever have outstanding. Issuing capital stock allows a company to raise money without incurring debt.

What is authorized stock?

Authorized stock refers to the maximum number of shares a firm is allowed to issue based on the board of directors' approval. Those shares can be either common or preferred stock shares. A business can issue shares over time, so long as the total number of shares does not exceed the authorized amount. Authorizing a number of shares is an exercise ...

How is the common stock balance calculated?

The common stock balance is calculated as the nominal or par value of the common stock multiplied by the number of common stock shares outstanding. The nominal value of a company's stock is an arbitrary value assigned for balance sheet purposes when the company is issuing shares—and is generally $1 or less. It has no relation to the market price.

What are the drawbacks of issuing capital stock?

The drawbacks of issuing capital stock are that the company relinquishes more control and dilutes the value of outstanding shares. 1:25.

Why is it important to authorize a large number of shares?

Authorizing a number of shares is an exercise that incurs legal cost, and authorizing a large number of shares that can be issued over time is a way to optimize this cost. Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, ...

Can you buy issued shares?

Issued shares can be bought by investors—who seek price appreciation and dividends—or exchanged for assets, such as equipment needed for operations. The number of outstanding shares, which are shares issued to investors, is not necessarily equal to the number of available or authorized shares. Authorized shares are those ...

Introduction

In business, the company may have surplus cash on hand and decide to repurchase the common stock so that it can retire them in order to increase the stock value if it decides to not reissue them to the market.

Journal entry for repurchase of common stock

The company can make the journal entry for repurchase of common stock by debiting the treasury stock account and crediting the cash account.

Journal entry for retirement of common stock

Retirement of common stock means that the company reduces the number of issued shares of common stock that it has. This usually happens when the company wants to increase its share value.

Repurchase and retirement of common stock example

For example, on January 31, the company ABC repurchase 10,000 shares of its common stock from the market. The company ABC originally issued the common stock for $5 per share with the par value of $1 per share.

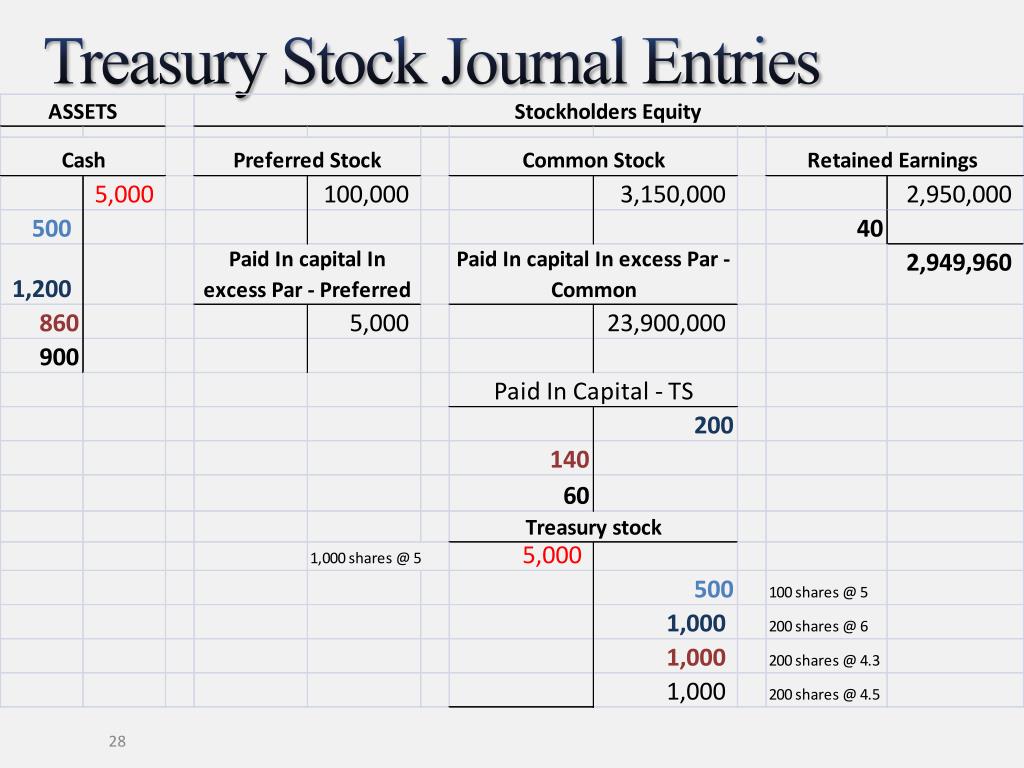

How does a company make a journal entry when it sells treasury stock?

When the company sells the treasury stock, it can make the journal entry by debiting the cash account and crediting the treasury stock account and paid-in capital from the treasury stock.

When does a company need to record the treasury stock?

In other words, the company needs to record the treasury stock at the amount it paid to acquire it back. Later, when the company decides to sell the treasury stock, it needs to record the difference between the cost and sale price of the treasury stock as the paid-in capital from treasury stock.

When will ABC sell treasury stock?

On October 1, 2020, the company ABC sell the 5,000 shares of treasury stock above at the price of $15 per share. What is the journal entry for treasury stock? on June 1, 2020, when the company repurchases 5,000 shares of its common stock back. on October 1, 2020, when the company sells 5,000 shares of the treasury stock.

Does ABC retire repurchased stock?

As the company ABC does not retire the repurchased stock, it can record it as the purchase of the treasury stock and make the journal entry as below: In this journal entry, the $10 par value of the common stock is not used to determine the value of the treasury stock.