How to find good dividend stocks to invest in?

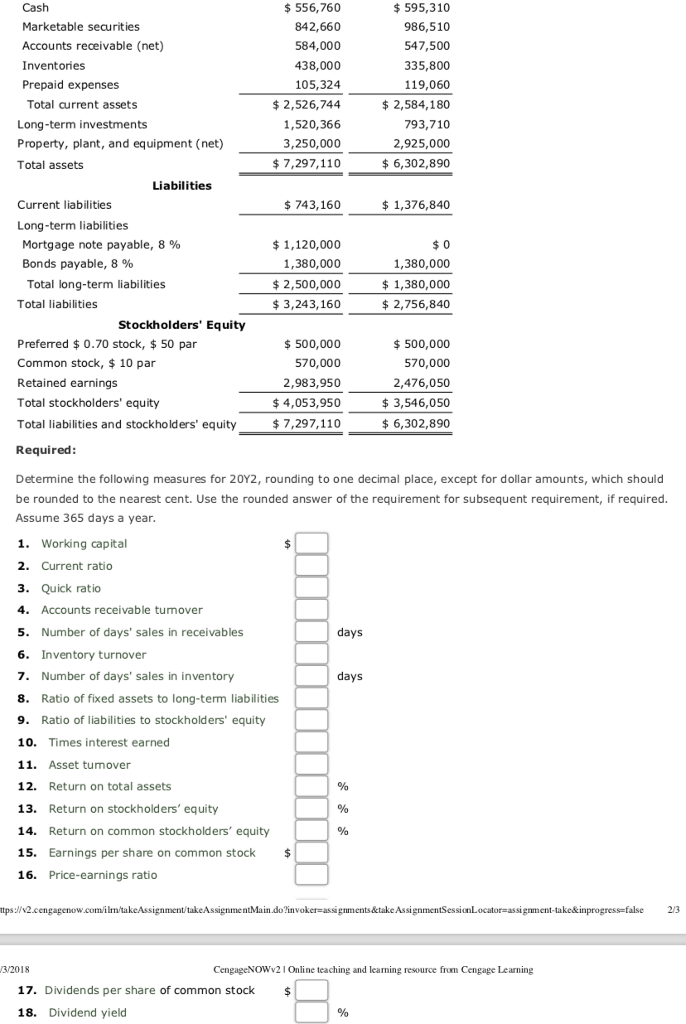

- Consider including a Payout Ratio criteria less than 100%. ...

- Price/Earnings greater than 0 (showing company has positive earnings). ...

- Operating Margin, over 10% (the company can likely pay its bills).

- Earnings per share are stable or rising over the last 5 years. ...

How do you calculate preferred dividends per share?

To estimate the dividend per share:

- The net income of this company is $10,000,000.

- The number of shares outstanding is 10,000,000 issued – 3,000,000 in the treasury = 7,000,000 shares outstanding.

- $10,000,000 / 7,000,000 = $1.4286 net income per share.

- The company historically paid out 45% of its earnings as dividends.

- 0.45 x $1.4286 = $0.6429 dividend per share.

What is the formula for preferred dividends?

1, 2021. The board also declared a dividend of $375 on each of the Series G preferred stock (equivalent to $0.375 per depository share) payable on Nov. 15, 2021, to Series G preferred stock shareholders of record at the close of business on Nov. 1 ...

How do I calculate preferred dividend?

What is Dividend Formula?

- Examples of Dividend Formula (With Excel Template) Let’s take an example to understand the calculation in a better manner. ...

- Explanation. Step 1: Firstly, determine the net income of the company which is easily available as one of the major line items in the income statement.

- Relevance and Uses. ...

- Calculator

- Recommended Articles. ...

What is preferred stock dividends on income statement?

Preferred dividends refer to the cash dividends that a company pays out to its preferred shareholders. One benefit of preferred stock is that it typically pays higher dividend rates than common stock of the same company.

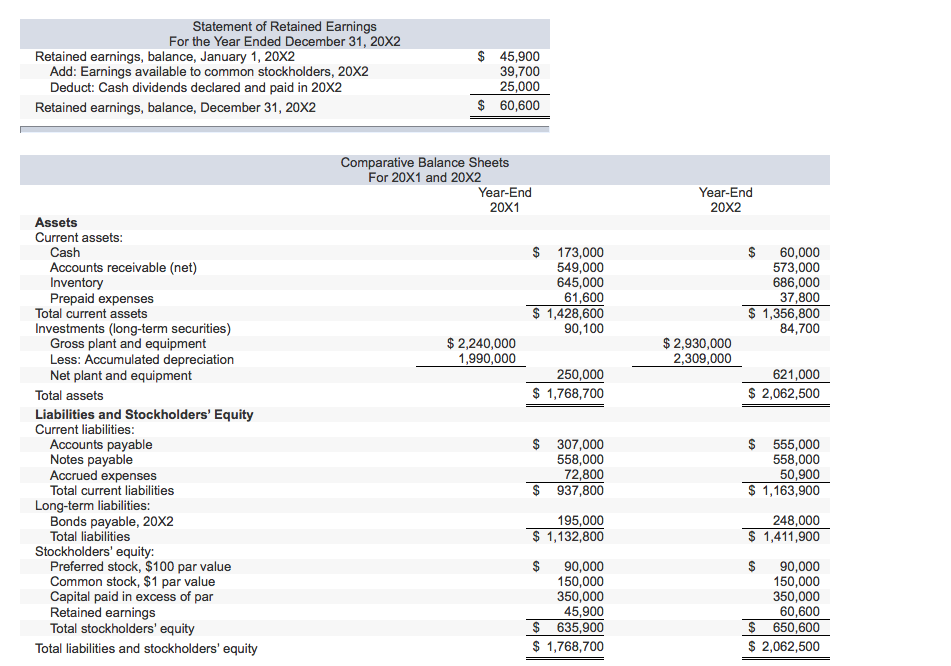

Where are preferred shares on financial statements?

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during liquidation.

How do you find preferred stock on a balance sheet?

0:216:10Preferred Stock on the Balance Sheet - YouTubeYouTubeStart of suggested clipEnd of suggested clipTelling. You on the balance sheet the preferred stock is a type of ownership in a corporation. WhichMoreTelling. You on the balance sheet the preferred stock is a type of ownership in a corporation. Which has a higher claim on the company's assets.

How do you calculate preferred dividends from balance sheet and income statement?

Multiply the amount stated by the number of shares issued and outstanding to calculate preferred stock dividends due. For example, if the amount is $4, which means the amount the company pays per share, and there are 50,000 preferred shares issued and outstanding, multiply $4 times 50,000 shares.

How do you account for dividends on preference shares?

To determine the accounting treatment of preference shares and dividend on such shares, first you have to identify if preference shares are redeemable or irredeemable. If preference shares are redeemable then shares are reported as liability in statement of financial position.

Does dividends go on the balance sheet?

Cash dividends affect two areas on the balance sheet: the cash and shareholders' equity accounts. Investors will not find a separate balance sheet account for dividends that have been paid.

Are preferred dividends in retained earnings?

Home » Accounting Dictionary » What are Preferred Dividends? Definition: Preferred Dividends are cash distributions that are paid to the owners of a company's preferred shares. In other words, this is the amount of money preferred shareholders receive from the company's retained earnings each year.

Are dividends on the balance sheet or income statement?

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Stock and cash dividends do not affect a company's net income or profit. Instead, dividends impact the shareholders' equity section of the balance sheet.

What is preferred dividend?

Preferred stock dividends are every bit as real of an expense as payroll or taxes.

What is preferred stock?

In essence, preferred stock acts like a mixture of a stock and a bond. Each preferred share is normally paid a guaranteed, fairly high dividend. If the company ever goes bankrupt or is liquidated, preferred stock is ranked higher in the capital structure to receive any leftover distributions. It's behind the bondholders and certain other creditors. 1 2

Why are preferred stock dividends deducted from income?

Preferred stock dividends are deducted on the income statement. The reason is that preferred stockholders have a higher claim to dividends than common stockholders. Many companies include preferred stock dividends on the income statement; then, they report another net income figure known as "net income applicable to common.".

What is income statement?

An income statement is a type of financial statement . Income statements include a company's revenues, expenses, gains and losses, and net income. Net income is the total after-tax profit made for the period. This is done before deducting the required dividends paid on the outstanding preferred stock.

Is preferred stock deducted from income statement?

This is due to the nature of preferred stock and preferred stock dividends. Regular cash dividends paid on common stock are not deducted from the income statement. For instance, let's say a company made $10 million in profit and paid $9 million in dividends. The income statement would show $10 million; the balance sheet would show $1 million.

Is participating preferred stock comparable to common stock?

That's unless it is a special type, known as participating preferred stock. Even then, it won't be comparable to common stock. Rather, in a highly successful enterprise, as long as things go well year after year, you collect your preferred dividends. But the common stockholders earn significantly more.

Do dividends have to be deducted from net income?

So, before finding the "true" net income, dividends from all of these shares need to be deducted from net income on the income statement. That is because, in nearly every instance, corporation bylaws forbid the payment of any dividend on the common stock.

How to calculate preferred dividend per share?

Once you know how to calculate the preferred dividend per share, you would just need to multiply the number of shares with the preferred dividend per share. And you would know how much you would get each year.

What is preferred dividend?

Preferred Dividends is a fixed dividend received from Preferred stocks. It means that if you’re a preferred shareholder, you will get a fixed percentage of dividends every year. And the most beneficial part of the preferred stock is that the preferred shareholders get a higher rate of dividend.

What is non-cumulative preferred stock?

Non-cumulative Preferred Stocks Non-cumulative preference shares are the stocks which allow the investors to receive a fixed dividend at the pre-determined dividend rate every year. However, if any year's dividend remains unpaid, the preference shareholders are not liable to receive it in the future. read more.

What is dividends in arrears?

Dividends In Arrears Dividends in Arrears is the cumulative dividend amount that has not been paid to the cumulative preferred stockholders by the presumed date.

How much preferred dividend does Urusula get?

Urusula has invested in preferred stocks of a firm. As the prospectus says, she will get a preferred dividend of 8% of the par value of shares. The par value of each share is $100. Urusual has bought 1000 preferred stocks.

Why is preferred stock perpetuity?

The preferred stock pays a fixed percentage of dividends. That’s why we can call it perpetuity because the dividend payment is equal and paid for an infinite period . However, a firm can choose to skip the equal payment of preferred dividends to preferred shareholders. And the firm can choose to pay the dividends in arrears#N#Dividends In Arrears Dividends in Arrears is the cumulative dividend amount that has not been paid to the cumulative preferred stockholders by the presumed date. It might be due to the business having insufficient cash balance for dividend payment or any other reason. read more#N#.

What does it mean when a firm pays dividends?

It means that a firm won’t pay a dividend each year. Rather the due amount of dividend would accumulate over the period. And then the firm will pay the accumulated preferred dividends to the preferred shareholders. This feature of arrear payment is only available with the cumulative preferred stock.

What is dividend 2021?

April 10, 2021. / Steven Bragg. A dividend is a distribution made to shareholders that is proportional to the number of shares owned. A dividend is not an expense to the paying company, but rather a distribution of its retained earnings. There are four components of the financial statements.

Is dividend an expense?

Dividends have no impact here, since they are not an expense. Statement of cash flows. Reported as a use of cash in the Cash Flow from Financing Activities section. Statement of retained earnings*. Reported as a reduction in retained earnings.

Does dividend pay affect balance sheet?

Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount of retained earnings stated in the balance sheet. Simply reserving cash for a future dividend payment has no net impact on the financial statements.

Do dividend notes have to be included in financial statements?

A brief narrative description of a dividend issuance may also be included in the notes that accompany the financial statements, though these notes may not be included if the statements are only issued for internal use. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount ...

What is preferred dividend?

A preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. If a company is unable to pay all dividends, claims to preferred dividends take precedence over claims to dividends that are paid on common shares .

Why are preferred stocks paid out before dividends?

This is because the fixed payment is based on a real rate of interest and is typically unadjusted for inflation. The dividends for preferred stocks are by definition determined in advance and paid out before any dividend for the company's common stock is determined.

Why do dividends in arrears have to be paid?

Dividends in Arrears. A business may elect to forgo payment of dividends. Because preferred stockholders have priority over common stockholders in regards to dividends, these forgone dividends accumulate and must eventually be paid to preferred shareholders. Therefore, preferred stock dividends in arrears are legal obligations to be paid ...

What is preferred dividend coverage ratio?

The preferred dividend coverage ratio is a measure of a company's ability to pay the required amount that will be due to the owners of its preferred stock shares. Preferred stock shares come with a dividend that is set in advance and cannot be changed.

What is the purpose of dividends?

The dividend is a reward to stockholders. It represents their share of the company's profits and is an incentive for them to hold onto the stock for the long term.

Do preferred dividends have to be paid out of net income?

A company declares all of its future preferred dividend obligations in advance, and so must allocate funds for that purpose where they accumulate in arrears. Preferred dividends must be paid out of net income before any common share dividend is considered. 1:13.

Do preferred dividends accumulate?

Preferred dividends accumulate and must be reported in a company’s financial statement. Noncumulative preferred stock does not have this feature, and all preferred dividends in arrears may be disregarded.

How does preferred stock differ from common stock?

Preferred stock differs from common stock in a few significant areas . Payment of dividends is a potentially major difference because preferred stock comes with a stated dividend rate. Common stock dividends carry no such provision and are declared after year-end by a Board of Directors.

Why do you examine the market fluctuations of a company's preferred stock?

Examine the market fluctuations of a company's preferred stock, because its trends and/or volatility displays how the "market" feels about the organization and its outstanding share values.

What does "cumulative" mean in dividends?

Cumulative means that if the company pays the calculated preferred dividend this year, it must also pay any previous year's dividends it was unable to pay.

Is a common preferred dividend guaranteed?

Although dividends, common or preferred, are never guaranteed, cumulative preferred dividends ensure shareholders that, when dividends are paid, they will receive all that are contractually due, including prior years' dividends that previously went unpaid. Advertisement.

Why is preferred stock called preferred stock?

It sports the name “preferred” because its owners receive dividends before the owners of common stock. On a classified balance sheet, a company separates accounts into classifications, or subsections, within the main sections. Preferred stock is classified as part of capital stock in the stockholders’ equity section.

How does preferred stock value fluctuate?

Because dividends are paid at a fixed percentage, preferred stock’s market value fluctuates based on factors such as changes in market interest rates. When interest rates are higher than the dividend rate on a company’s preferred stock, the market value is usually less than the amount on the balance sheet. When the dividend rate is higher than interest rates, the preferred stock becomes a hot item, and the market value exceeds the balance sheet amount.

What is par value in preferred stock?

If a company sells preferred stock at par value, the par value account is the only preferred stock account on the balance sheet. If it sells preferred stock for a higher price, the extra amount is “additional paid-in capital” and is reported a couple of lines below par value. Using the previous example, assume the company initially sold its ...

When interest rates are higher than dividends, what happens to the market value of a preferred stock?

When the dividend rate is higher than interest rates, the preferred stock becomes a hot item, and the market value exceeds the balance sheet amount. 00:00.

What is stockholders equity?

Stockholders’ Equity Section. Stockholders’ equity is funding that a company doesn’t have to pay back. The stockholders’ equity section of the balance sheet lists two main classifications: capital stock and retained earnings.